European tech is starting to bounce back — and AI is turbocharging the recovery.

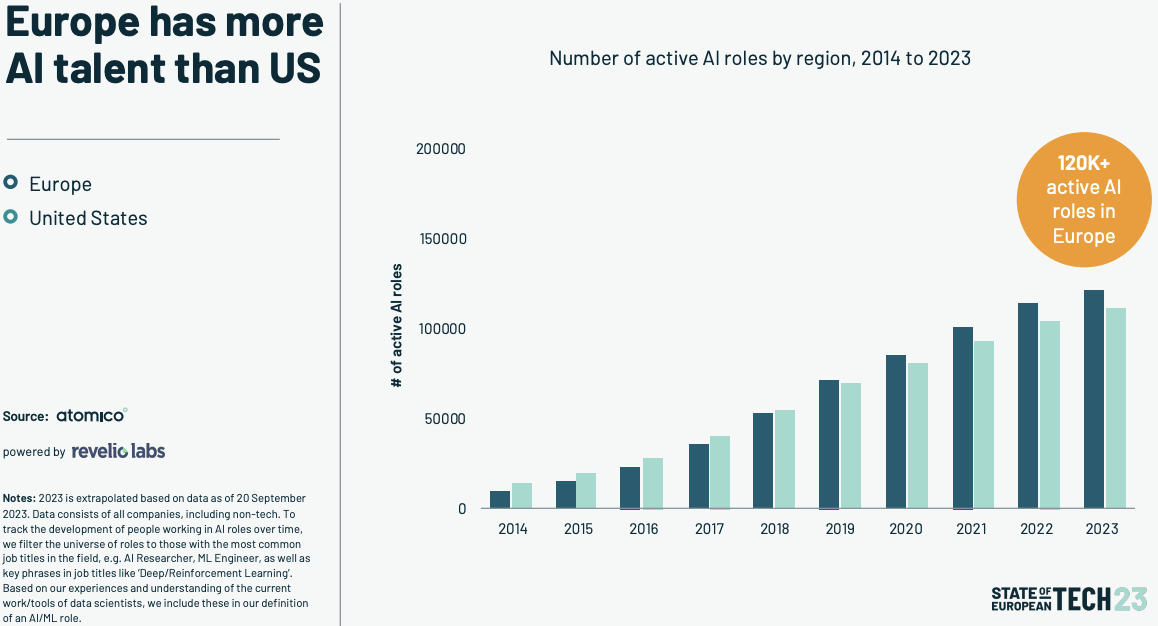

The continent is now home to more highly skilled professionals in the field than the US, according to new research by Atomico, a VC firm headquartered in the UK.

This overtaking follows a decade of rapid progress. Over the past 10 years, the number of people working in artificial intelligence across Europe has increased by a whopping 1,000%.

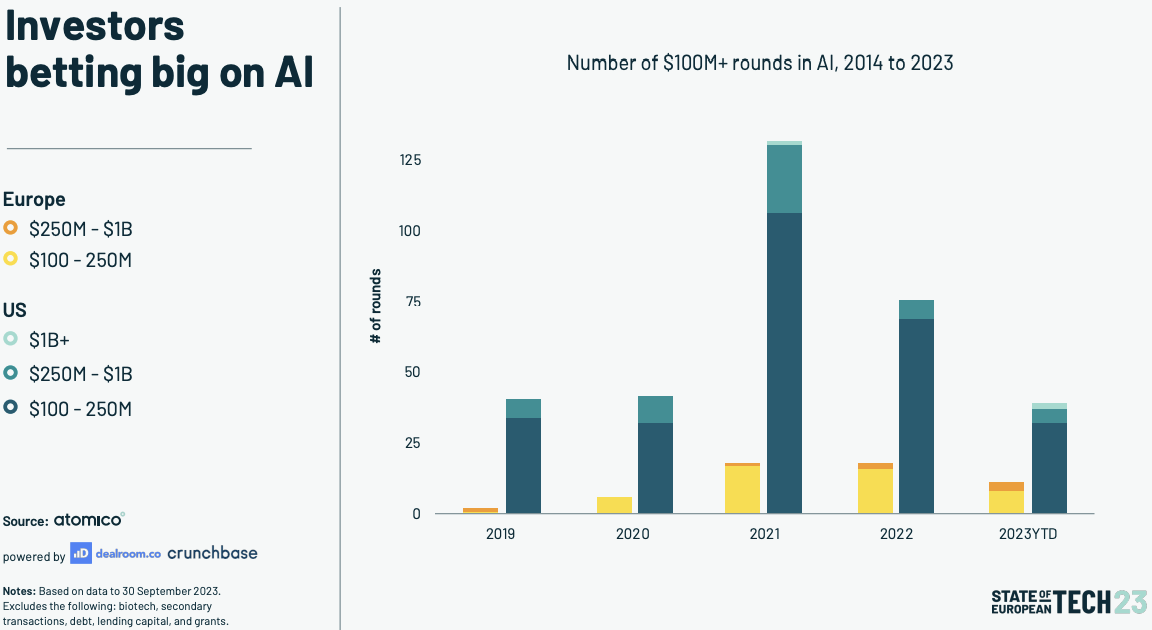

This talent pipeline is now flowing into some impressive startups. In 2023, AI companies raised 11 of Europe’s 36 mega-rounds of $100mn or more. They include France’s Mistral AI, which bagged €105mn in the continent’s largest-ever seed round, and Aleph Alpha, which this month secured €460m in Series B funding.

The pattern extends into the new herd of European unicorns. Of the seven companies to reach a valuation of $1 billion this year, four focus on artificial intelligence: DeepL, Helsing.ai, Synthesia, and Quantexa. Their successes have helped Europe’s ecosystem rebound to a total value of $3 trillion — equalling its 2021 peak.

“The European tech environment today looks more stable than it has at any point since the onset of the pandemic,” Tom Wehmeier, Atomico’s head of intelligence, told TNW. “And that brings with it a greater amount of certainty, predictability, and general confidence throughout the ecosystem.”

AI isn’t the only field with an impressive talent pool. Despite a brutal series of layoffs earlier this year, there’s been a net growth in the number of European tech workers. This means the rate of job creation is more than offsetting the redundancies.

It also continues an impressive recent spell of expansion. In the last five years, Europe’s IT workforce has grown from 750,000 employees to more than 2.3 million today.

One reason for this rise comes from across the Atlantic. According to Atomico’s data, Europe is now a net beneficiary of tech talent from the US.

“There’s always been this myth that Europe sees a big exodus of talent to the US,” Wehmeier said. “But when you look at their data, it shows that the inverse is actually true.”

The tech talent has sparked an explosive growth in new startups. This year, Europe has produced an estimated 14,000 new founders — 1,000 more than in the US.

Unfortunately, the continent’s investor landscape can’t yet match the ambitions of its founders. In the US, startups are 40% more likely to raise VC funding within their first five years. Yet once companies ensure an initial seed investment, the chances of them reaching a billion-dollar valuation are the same in Europe as they are in the US.

It all makes a strong case for better access to institutional investments. As Atomico notes, funding a single company can have a generational effect.

Skype provides a powerful European example. Entrepreneurs from the firm’s alumni network have gone on to launch more than 900 companies across 50 countries. Atomico calls this phenomenon the “flywheel effect.”

“It’s an astonishing reflection of the ability of a single company to advance the needle for the ecosystem,” Wehmeier said. “And given that Europe’s had 111 billion-dollar exits over the past five years, you really get a sense of the extent to which that flywheel is going to keep spinning.”

Nonetheless, the flywheel could certainly do with more greasing from investors.