ugurhan

Dear readers,

I’ve been very bullish on Brookfield this year and have published a number of articles on the Brookfield Corporation (NYSE:BN) – most recent article here – and Brookfield Asset Management (NYSE:BAM) – most recent article here.

My bullish thesis for BAM has been based on management’s growth guidance of 15-20% per year which was very attractive, especially combined with a 4% dividend yield likely to grow at the same pace. The stock was priced at a premium valuation, but with this level of growth I felt that the stock deserved a BUY rating, until recently when Blackstone’s (BX) latest results showed an industry-wide slowdown in fundraising, which led me to downgrade the stock to a HOLD. The BUY thesis for BN, which owns 75% of BAM, was based largely on the same logic, in addition to trading at a large discount to the sum of its parts.

As my understanding of Brookfield’s business grew over time, so did my conviction and my position in these two names has become my biggest holding at nearly 10% of my portfolio. That is until yesterday when I sold most of it and moved a substantial part of the proceeds into Apollo Global Management (APO) ahead of their Q3 earnings.

This begs an obvious question. What has changed?

The recent short report on BIP

I came across an article which discusses a recently issued short report on Brookfield Infrastructure Partners (BIP).

The report is very long and extremely dense, but comes from an experienced author who clearly has a deep understanding of Brookfield’s structure of offshore companies and their accounting principles.

The main point of the short report is that Brookfield’s favorite metric – funds from operations (FFO) – which most investors (including myself) relied on, may be overstating true distributable earnings.

The author of the report has found that BIP’s FFO includes the partnership’s share of earnings from its equity-accounted investments, rather than the cash dividends received. This suggests that FFO includes paper (unrealized) gains that BIP doesn’t have access to and cannot use to cover their distribution. And this is a big deal because more than half of BIP’s investments are equity-accounted.

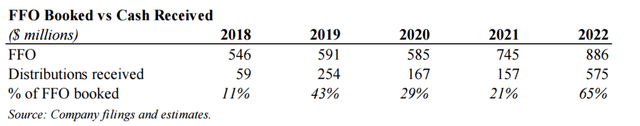

You can see the exact numbers in the table below. The FFO includes the paper gains as discussed above, while Distributions received are pure cash which can be paid out to BIP’s shareholders. In short, since 2018 the company has received just 34% of the reported FFO in cash.

As a result, BIP’s recurring cash flow is not nearly enough to cover its dividends which average a 73% payout ratio. The payout seems to be about 2x the sustainable level. Consequently, BIP has mostly covered the funding gap by issuing new BIP units and taking on recourse debt. (Later you’ll see how this may have helped BAM increase the management fees it gets, as they’re tied to the enterprise value of BIP, which includes recourse debt.)

The report focuses on the negatives and is not very balanced. But it is very well written and it raises some very plausible points, which is why I don’t think it should be taken lightly. I don’t think BIP’s distribution is in imminent danger here, but the report could hurt Brookfield’s credibility and has major implications for the rest of its companies.

Implications for BAM and BN

I was never invested in BIP, but as a major shareholder of BAM and BN, I clearly trusted the management. In the alternative asset management space, reputation is everything and Brookfield has a really good track-record of delivering on their promises. But as a result of the report, their reputation could suffer which could reduce demand from institutional investors. That is unless they can issue a rebuttal and refute the report completely.

BAM is an asset-light business, which means that it doesn’t own anything, but rather it charges a fee for managing the clients’ money. This should make for very predictable and sticky earnings.

But here’s the thing that many investors didn’t realize until recently.

BAM’s management fees are tied to market cap of its investment funds, namely BIP, BEP etc. In the case of BIP, the 1.25% management fee paid to BAM is calculated from BIP’s enterprise value (market cap + debt + preferred stock).

As the market cap of these funds declines, so do total management fees received by BAM, though the drop in fees is less than proportional to the drop in market cap. This is because BIP, as well as BEP, have quite a lot of debt. In particular, Brookfield’s IR has stated that market cap is ~1/5th of enterprise value in BEP’s case and ~1/7th in BIP’s case.

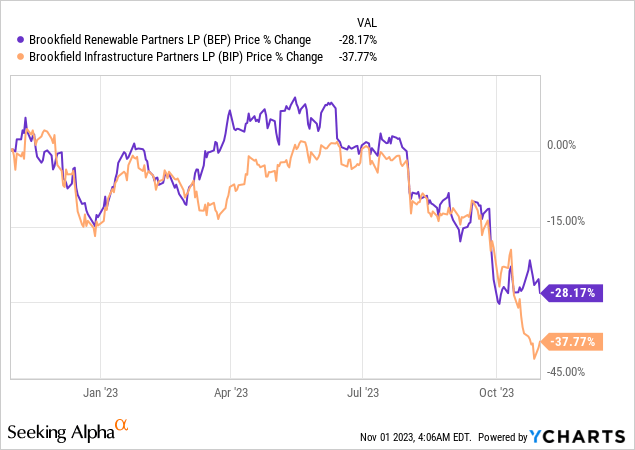

The drop in market cap of BEP and BIP has been massive lately!

As a result, BAM’s base management fees from BIP and BEP will decline meaningfully in Q3 and especially in Q4.

Here’s the math for BIP. The market cap has dropped by 37% year-to-date and because the market cap is 1/7th of enterprise value, base fees will drop by 5.3%. Over the most recent quarter, BIP has generated fee revenues of $106 Million. Therefore, I expect a negative impact from BIP of $5.6 Million. That’s 1.4 cents per share per quarter or $0.06 per share on an annual basis.

For BEP, the math works the same way and I estimate an additional negative impact of $0.03 per share. So combined, we have a negative earnings impact of $0.09 per share. That’s nearly 7% of last 12 months’ earnings.

BAM’s management has previously guided towards 15-20% annual growth in AUM and Fee-related earnings (FRE). Because of this kind of growth the stock has retained one of the highest valuation multiples in the sector of 25x FRE.

But now it seems that growth will be much lower. In particular, deducting the 7% negative impact from the midpoint of management’s guidance gives us a 10% ballpark estimate for growth. Moreover, the fundraising environment outside of private credit and insurance seems to have slowed significantly which presents additional headwinds. I have no doubt that BAM will be able to grow, but at 8-10% annual growth, the company will most likely re-rate to a lower multiple. That’s the risk here.

The corporation owns 75% of BAM so it will be just as impacted by everything we’ve discussed so far. On top of that, it also holds direct stakes in BIP and BEP so as the price of those vehicles declines, BN takes a significant hit as BIP+BEP accounts for about 25% of BN’s value.

The counter argument is that BN already trades at a significant discount to the sum of its parts giving investors a substantial margin of safety. This is true, but I want to point out that the stock almost never trades at a one-to-one valuation with its assets so those counting on the gap closing might be in for a long wait.

Additionally, if BN performs badly, there’s a risk that it could drag BAM down with it. BN’s market cap is already almost equal to that of BAM, which means that if it declines further, BAM might decline in response simply so that its market cap isn’t bigger than that of BN which also owns other assets.

All things considered, recent poor performance of BIP and BEP will hurt Brookfield significantly at the asset management, as well as corporation level. I fully expect BAM to continue growing both its AUM and FRE, but significantly below guidance.

As growth pulls back to 8-10%, the expensive valuation will come under pressure and we could see further downside. Moreover, Blackstone’s recent results reveal that the fundraising environment has slowed significantly in all areas except for private credit and insurance, which is where Brookfield is underexposed.

Why Apollo is a better alternative

That brings me to an alternative – Apollo Global Management.

I wrote an article on APO recently, highlighting their high exposure to private credit and to the insurance business and explaining how this helps them generate superior fees.

Apollo is a combination of a traditional asset-light asset manager and an asset-heavy insurance business. The combination may seem strange at first, but I believe it makes APO the best positioned alternative asset manager at this time.

This is because they focus on two segments that are poised to grow in today’s environment. Their asset management business is almost exclusively focused on private credit, which is extremely profitable in a high interest environment and continues to see high levels of growth as tight credit conditions have driven borrowers to look for alternative beyond traditional banking. And their insurance business focused on annuities is seeing a boom thanks to an ageing population and increased demand from (future) retirees as higher interest rates make annuity products more appealing.

Apollo has released their Q3 earnings today and they have been very good.

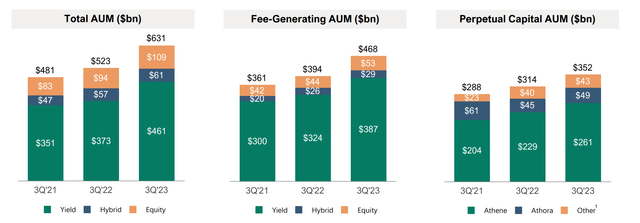

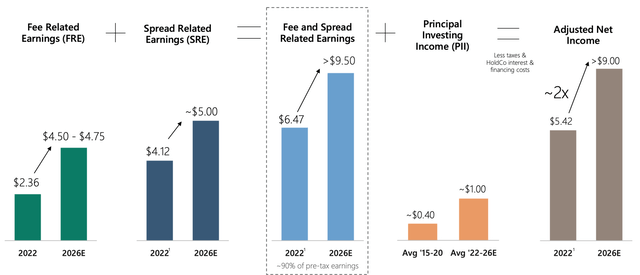

Fee-related earnings generated by the asset management business reached $408 Million ($0.77 per share), up 19% YoY and 4.5% QoQ. The increase was mainly driven by a 21% YoY increase in AUM. All of this was due to their exposure to private credit.

The insurance business posted even more impressive results as Spread-related earnings (SRE) reached $873 Million ($1.43 per share), up 36% YoY and over 9% QoQ. This level of growth, especially over the most recent quarter is exactly why I currently favor APO over BAM or Blackstone. Insurance and Private Credit simply are the places to be right now.

These results, which combined correspond to annualized earnings of $8.8 per share put Apollo well ahead of its 2026 target of FRE + SRE of $9.50 per share.

I expect that Apollo might be able to beat their 2026 targets as the company experiences several tailwinds at the same time. The private credit market, which is mostly perceived as leveraged lending today, provides a $40 Trillion opportunity with IG-equivalent private debt as a replacement for fixed income. Apollo is at the forefront of the industry and is likely to capitalize on substantial growth as private credit assets today accounts for just $1.5 Trillion.

Moreover, Apollo’s insurance business Athene, which has seen their inflows grow by a factor of 16x over the past 8 years is expected to continue growing at 20%+ annually.

Finally, APO has a unique way of driving synergies between their asset management and insurance business. When the insurance business gets money from (future) retirees, the asset management then invests that money into IG loans and keeps a fee. The insurance business keeps whatever is left from the IG loan’s interest, after paying the asset management fee + their own OPEX. Finally, the capital solutions business packages these newly originated loans together and off-leads them to other institutions for yet another fee. This triple fee structure makes Apollo more profitable than most of its peers.

Apollo has demonstrated exceptional growth, despite a tough macroeconomic backdrop and its future growth prospects seem great. Still, the stock trades at a very reasonable valuation today.

I’m going to assume a very conservative multiple of 17.5x FRE for the asset management business, which is considerably below the 22-25x of BAM and BX, despite Apollo demonstrating much better growth.

For the insurance business, I’m going to be very conservative as well and lower my multiple from the previous article further to just 8x SRE.

Still, these multiples yield fair value of $100 per share, which is 30% above today’s price of $77 per share. Note that due to its volatility I excluded all carry (Principal Investing Income) which is expected at around $1 per share. That is simply further upside.

Bottom Line

I was previously sold on Brookfield and was putting my money where my mouth was. But recent findings that shed more light on the way in which BIP and BEP operate made me reconsider my position. I believe that BAM will struggle to meet its 15-20% growth target due to a negative earnings impact of about 7% from the decline in BIP’s and BEP’s market caps. Consequently, the stock is at risk of re-rating to a lower multiple which would inevitably lead to significant downside.

Apollo, on the other hand, has demonstrated impressive double-digit growth despite a tough fundraising environment and has proven to me that private credit and insurance are the best segments in this environment. Despite arguably being the best positioned alternative asset manager, Apollo stock remains undervalued even using conservative multiples, which is why upon selling most of my Brookfield I happily added to APO.