weareadventurers/iStock via Getty Images

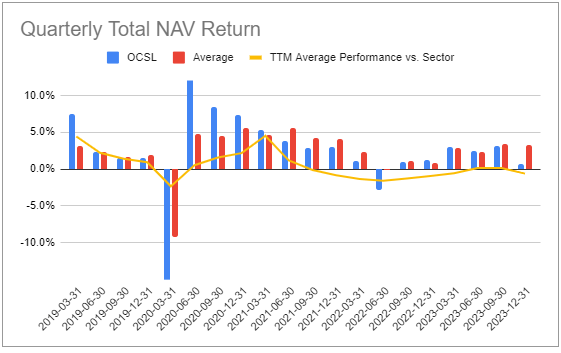

In this article, we catch up on the latest quarterly results of Oaktree Specialty Lending Corp (NASDAQ:OCSL). OCSL had a disappointing quarter, though it still eked out a positive total NAV return. A combination of rising debt service costs and idiosyncratic issues drove a number of new non-accruals, which were a key headwind to both the NAV and net income.

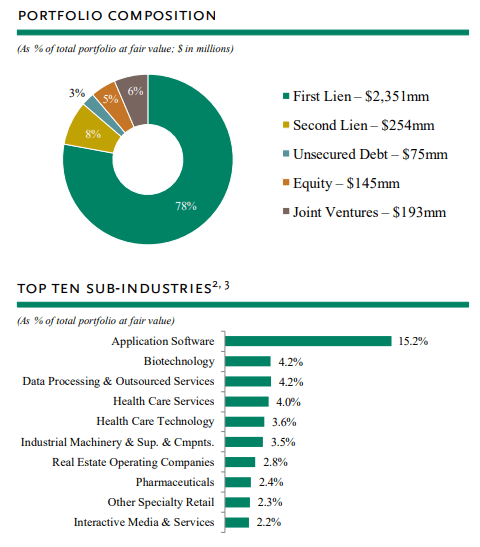

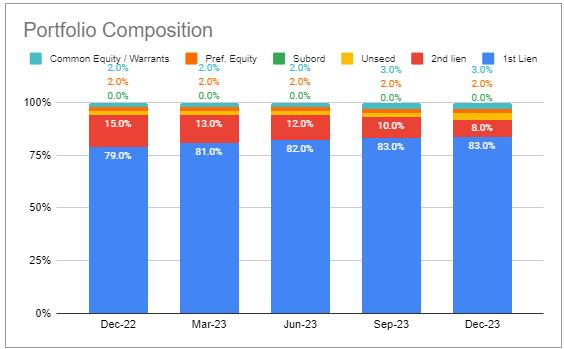

OCSL is primarily focused on secured loans, with a low allocation to equity securities. Its sector overweights are software and healthcare – a fairly common combination in the BDC space.

Oaktree

Quarter Update

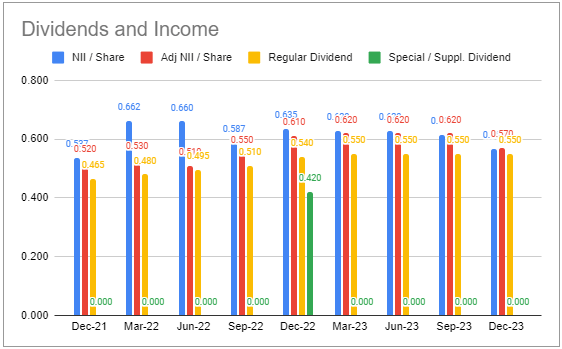

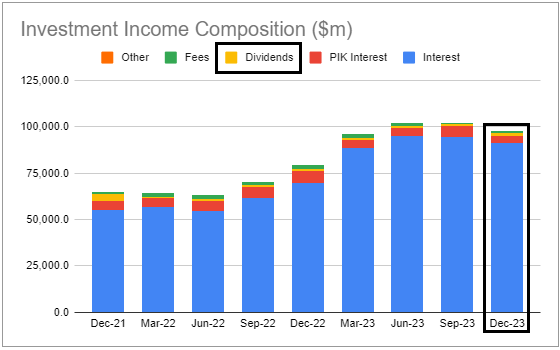

Adjusted net income fell by around 8% after staying steady for 3 quarters. As highlighted above, the key factor behind the drop was a number of investments that went on non-accrual and which pushed net income lower by 4 cents.

Systematic Income BDC Tool

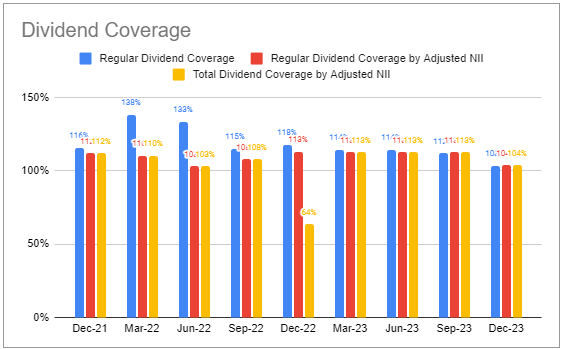

The regular dividend was kept unchanged at $0.55. This leaves dividend coverage at a modest 104%. Management guided that the timing of recent investments would push net income higher by a couple of cents, all else equal.

Systematic Income BDC Tool

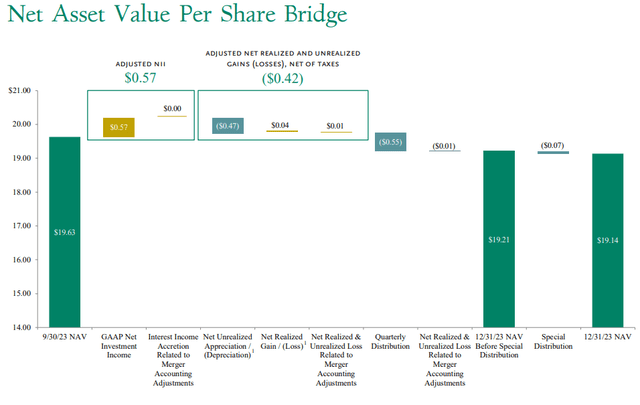

The NAV fell by 2.5% with about 0.25% of that due to the excess distribution during the quarter, primarily from the $0.07 special distribution. The main driver of the NAV drop was unrealized depreciation on two of the four new non-accruals.

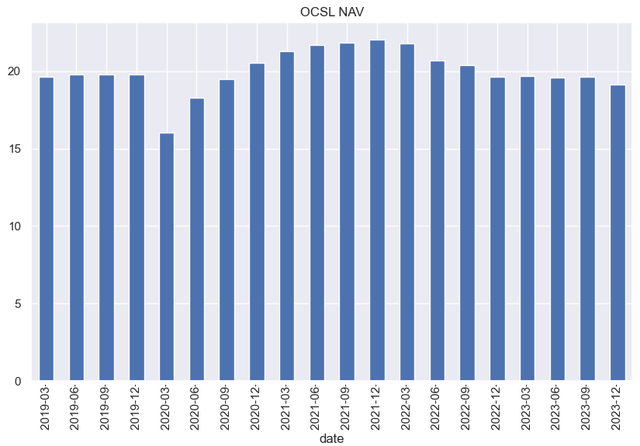

The NAV is now at the lowest level since the end of 2020, though it’s not far off the pre-COVID figure.

Income Dynamics

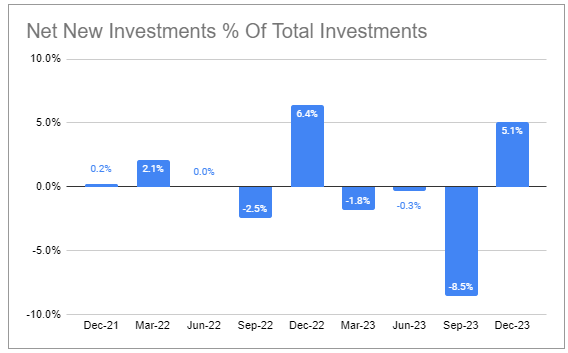

Net new investments were robust and rose to the second-highest level over the last few years.

Systematic Income BDC Tool

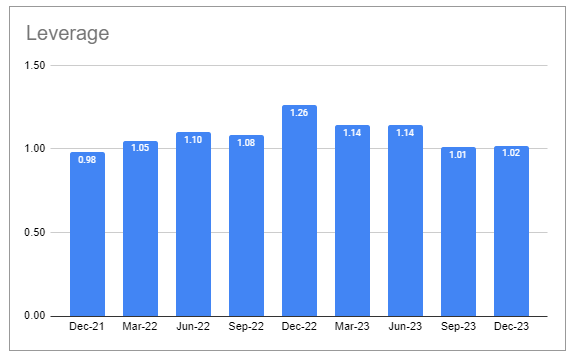

Leverage rose slightly but remained at the lower end of the 0.9-1.25x target.

Systematic Income BDC Tool

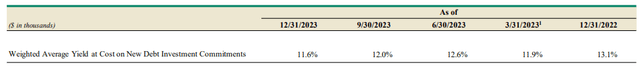

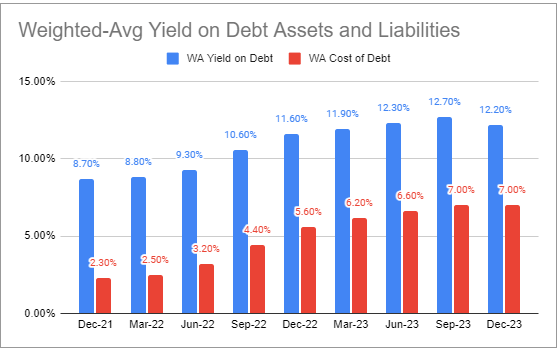

The portfolio weighted-average yield fell to 12.2% which was due primarily to the new non-accruals as well as a compression in credit spreads and a drop in spreads on new originations vs. repayments. Net interest expense remained steady. The company’s net yield of 5.2% is quite a bit below the sector average of 6.6%.

Systematic Income BDC Tool

The yield on new commitments over the quarter fell relative to the previous quarter and was below the portfolio yield due to a large amount of sponsored deals. This is a slight headwind to future net income.

Oaktree will waive $9m of the base management fee across two years, which comes out to around a tenth of the total base fee over this period. Over the quarter, OCSL waived another $1.5 million in fees. This results in a 2 cent or 3% uplift to net income, which will disappear eventually. Adjusted for this, base dividend coverage would have been 100% in Q4.

One net income tailwind was the increase in JV dividends by about 34%, resulting in a half-cent pick-up in net income, or about 1% of net income. This was due to a reduction in the cost of the JV’s credit facility and an increase in its dividend.

Systematic Income

Portfolio Quality

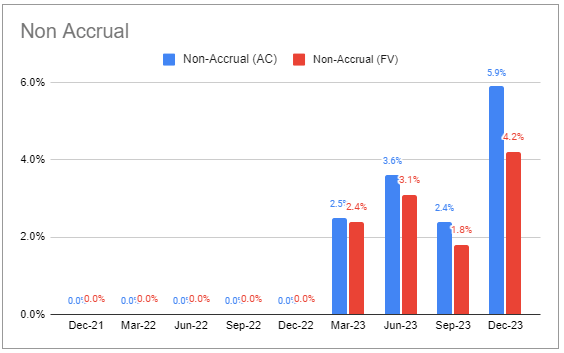

Non-accruals jumped to a 5.9% figure on at-cost and 4.2% on a fair-value basis.

Systematic Income

One holding – an Amazon aggregator – has faced operational challenges due to supply chain delays and reduced Amazon traffic and may require a restructuring. Another holding has faced headwinds from higher debt expense and will be acquired by Oaktree and other investors. A third holding in the biotech sector filed for bankruptcy and is engaged in a sale process as it exits bankruptcy. The last holding – the Singer sewing machine company – has entered a slowdown as the world returned to normality in the post-COVID era. Oaktree and other lenders are working on a solution for it. If there is a common thread here is that higher interest rate payments have pressured companies that already face other challenges in their business model.

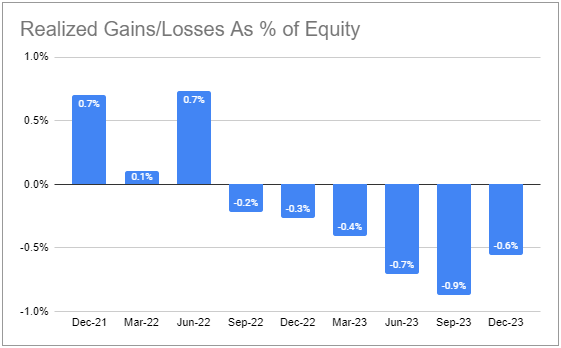

The portfolio registered net realized losses for the sixth consecutive quarter.

Systematic Income

The company’s portfolio has been moving up-in-quality over the last while, with a rise in the first-lien allocation and a drop in second-lien holdings.

Systematic Income

Return And Valuation Profile

The company’s quarterly total NAV profile shows that the company has mostly underperformed the broader sector since around the second half of 2021, though not by much. The reporting quarter is still young so we could very well see subpar results from the rest of the sector which would put OCSL Q4 results in a better light.

Systematic Income

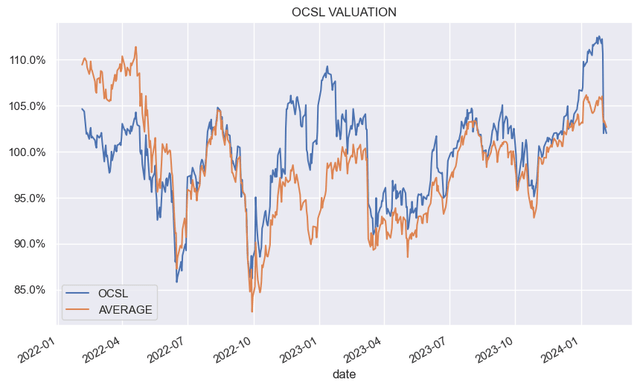

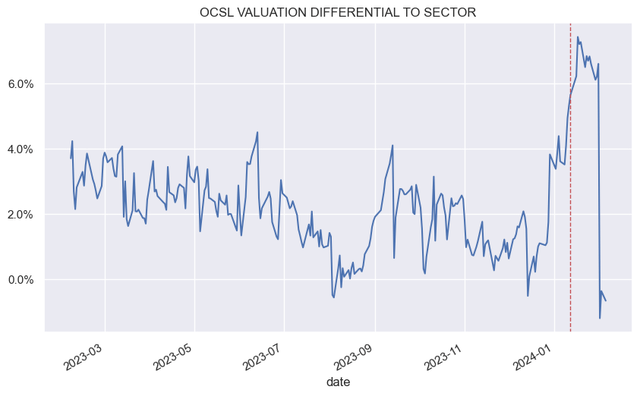

The company’s valuation has tended to trade above that of the broader sector, occasionally moving up to unusually high levels.

Stance And Takeaways

Our view on the company has been that its occasional NAV drawdowns are largely a function of its stricter mark-to-market policy during periods of spread widening. That has largely been the case as the company’s overall performance has been good, and its NAV is only slightly below its pre-COVID level.

That said, the fact that spreads are very tight across both public and private markets while the company’s credit metrics like non-accruals and net realized losses keep moving in the wrong direction makes us question this view. It’s too early to say whether there are concerns with the company’s underwriting process – at the very least we need to see how the rest of the sector reports. However, we would not add to our small position unless the valuation moves decidedly below the sector average.

We downsized our allocation to the stock in mid-January, as the following chart shows, when the stock’s valuation rose to a 6% premium to the broader sector. A discount to the sector average valuation closer to 5% or so would make it more appealing to add.