alvarez

JFrog (NASDAQ: FROG) is a US-Israeli provider of a software supply chain development platform that enables organizations to manage end-to-end lifecycle of software development, from development, to release, and to security.

I have covered FROG before last year in June, when I wrote about its attractive potential, despite rating the stock neutral at that time. I felt that the upside was fully priced in and that investors should wait for a better entry point then. For the months following my hold rating, FROG remained relatively flat, reinforcing some of my initial concerns. However, those concerns dissipated quicker than I had anticipated, as FROG saw a surge starting in November and is now up by about 41% since my last rating. The good news is that given the current environment, I believe investors can still capture some more upside in FROG.

I have upgraded FROG to buy. My modeled 1-year target price of $43 projects a 16% upside. FROG remains a beneficiary of the secular digital enterprise transformation trend. The recent temporary headwinds in the form of delayed enterprise cloud migration projects may potentially subside in the second half. The recent pullback to $37 provides a solid buy opportunity, in my opinion.

Financial Review

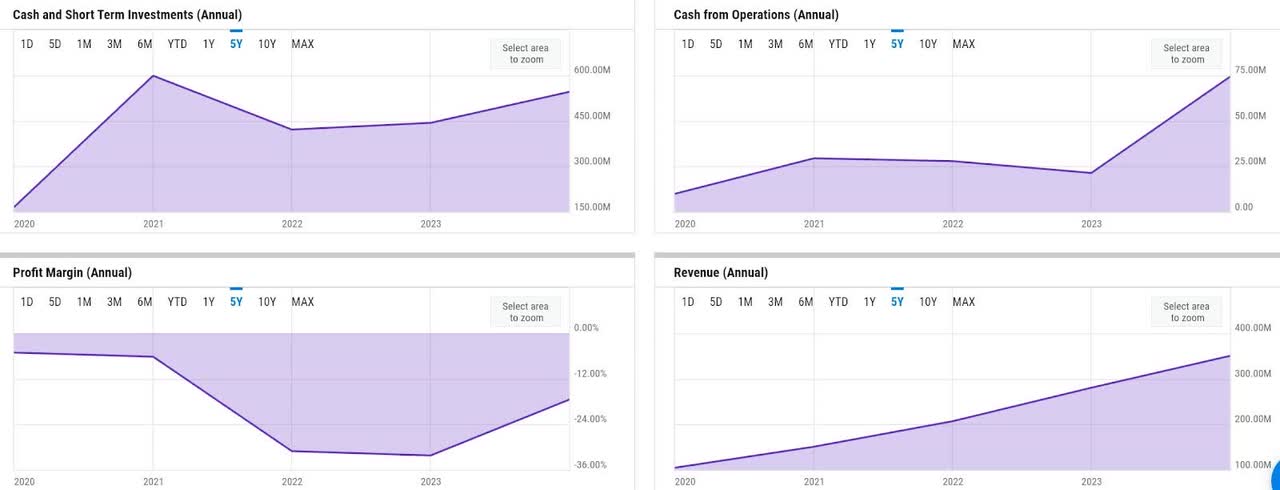

Aside from the weak GAAP profitability, FROG has decent fundamentals, which I also noted in my previous coverage. Revenue growth has normalized from over 60% to 25% over the past five years. In FY 2023, FROG delivered a revenue of $350 million, a 25% YoY growth. Net loss margin has narrowed a little bit to -17%, though it is still far away from break even. One positive thing in FY 2023, in my opinion, is the significant operating cash flow (OCF) expansion to $74 million, more than triple that of last year. This has resulted in a decent liquidity boost for the year. FROG ended FY 2023 with over $545 million of cash and short-term investments.

Catalyst

As per my previous coverage, I believe FROG will overall continue to benefit from the secular enterprise digital transformation trends. In this coverage, it is probably worthwhile to understand how FROG actually has been benefiting from the trend and how it is progressing so far.

In Q4, it appears that FROG’s main go-to market entry point in the enterprise digital transformation segment may have been cloud migration. Cloud migration is the process of moving on-premise business data and applications to the cloud, making it a critical part to modernizing an enterprise IT environment.

The motivation is quite clear – cloud-hosted applications offer better economics long term through easier maintenance and better scalabilities. However, this also means migrating an often sizable application codebase to the cloud and securing it. Since FROG’s offerings help enterprises achieve this by streamlining the software development supply chain from code-development to release, investing in FROG seems like a sensible decision to achieve such a marginal benefit in a capital-intensive digital transformation project.

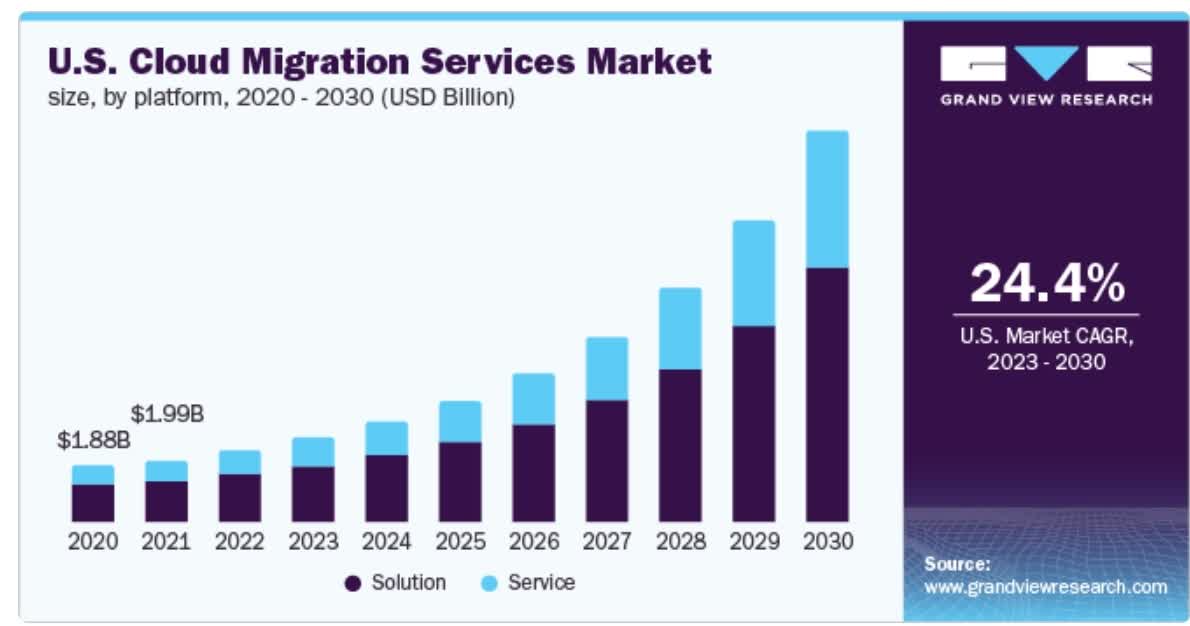

Grand View Research

Growing at 24.4% CAGR, cloud migration is projected to be an $18 billion market on its own in 2024 in the US alone. Though this is not a direct market opportunity for FROG, its offerings have been in demand due to the increase in enterprise cloud migration activities, as commented by the management in Q4 earnings call:

Third, I want to address growth in the enterprise adoption of the JFrog platform. The move toward a unified universal platform for the enterprise is not only a technology or tool initiative but also a change we see in how companies are being structured to streamline digital deliveries. We see roles like CIOs and CISOs becoming one and cloud migration projects targeting multiple aspects like tooling consolidations to achieve speed and trust throughout the software flow.

Source: Q4 earnings call.

At this point, I believe that there are two key takeaways that would highlight near-term catalysts for FROG. First of all, the macro challenge that has delayed several enterprise cloud migration projects FROG has been involved in may potentially subside, providing bookings acceleration in the second half of FY, as commented by the management in Q4:

Slowly into the year, we saw an improvement in the frequency of on-prem to cloud migration projects being restarted alongside extending consumption in the second half of the year as we shared in previous calls.

Source: Q4 earnings call.

Second of all, I believe the restart of these delayed cloud migration projects will continue to emphasize the importance of IT cost optimization, which is achieved mainly through vendor consolidation. FROG is well-positioned to reap the benefit here, because of the nature of its solutions that address the whole software development supply chain.

Risk

In my opinion, FROG’s market share capture in the enterprise segment, which has been quite significant as of late, may potentially elevate revenue concentration risk. Almost half of FROG’s revenue in FY 2023 came from enterprise subscriptions, compared to just 38% last year. As per its 10K, this has resulted in the top 10 customers making up as much as 7% of FROG’s revenue as of FY 2023. Given the potential acceleration of major enterprise cloud transformation projects in the second half, I believe this figure could potentially increase further by the end of FY 2024.

Valuation / Pricing

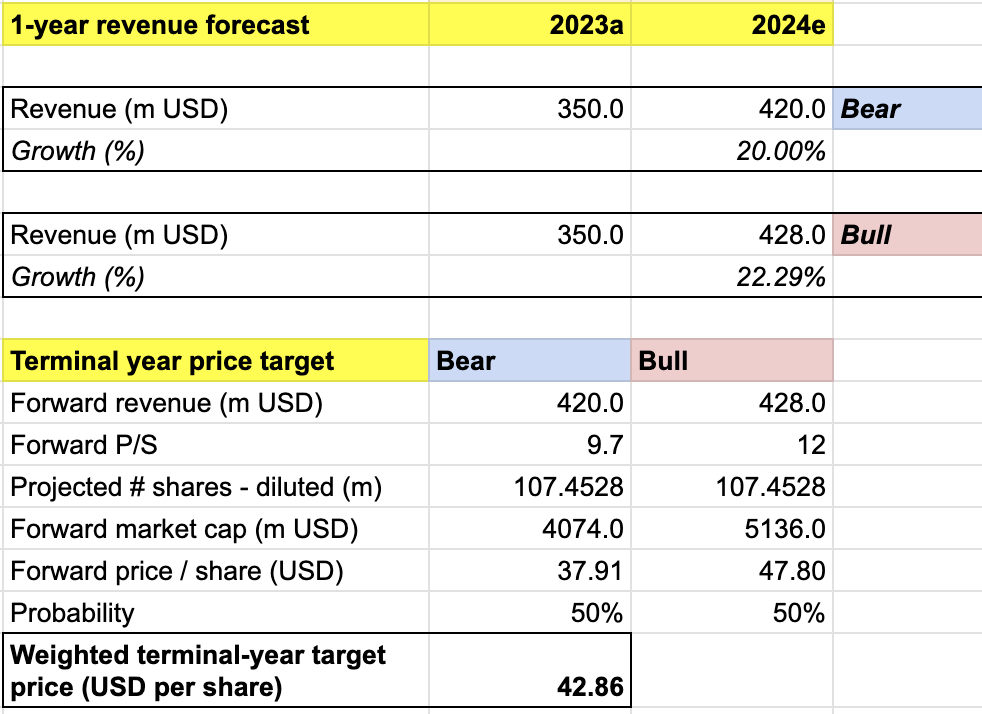

To estimate the target price for FROG in FY 2024, I assume the following bull vs bear scenario in a 5-year revenue projection:

-

Bull scenario (50%) – FROG to finish FY 2024 with a revenue of $428 million, a 22% YoY growth, in line with the company’s guidance. In this scenario, I expect most cloud migration projects to restart in the second half, giving FROG further revenue visibility into the FY. P/S to expand to 12x, the level where it recently saw a YTD high.

-

Bear scenario (50%) – FROG to finish FY 2024 with a revenue of $420 million, a 20% YoY growth, which is $8 million lower than the company’s low-end revenue guidance. I expect FROG to see continued headwinds and unexpected churn. In this scenario, the market will reach negatively, resulting in sideways price action for the stock.

own analysis

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of ~$43 per share. This represents almost 16% upside from the current price of $37. I upgrade FROG to buy.

Despite my conservative projection, FROG still delivers a solid upside, in my view. Nonetheless, the upside here also assumes FROG rebounding back to where it was before the pullback, which was right around $43, my target price. As such, I believe FROG may be oversold today.

Conclusion

As I highlighted in my previous coverage, FROG is a compelling opportunity. It will continue to benefit from the secular enterprise digital transformation trend, further fueled by the shift towards vendor consolidation strategy to optimize costs. Though FROG has seen a bit of temporary headwinds in the form of delayed cloud migration projects at its potential clients, the management has seen signs of potential restart in the second half. The recent pullback provides a good buying opportunity. My 1-year price target of $43 means that FROG is eyeing almost 16% upside at year’s end.