Michael Saint Maur Sheil/DigitalVision via Getty Images

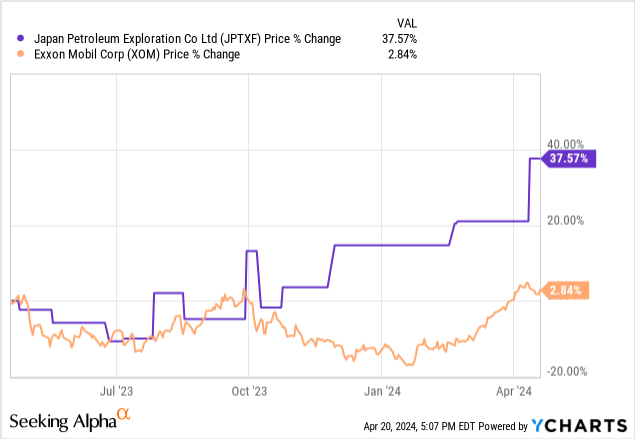

Japan Petroleum Exploration Co. (OTCPK:JPTXF), which we like to call JAPEX, continues to make strides in terms of price action, as detailed in our previous coverage, mostly due to improving corporate governance outlook. Commodity prices have not really increased YoY, and natural gas is under some considerable YoY pressure in terms of price, but the stock has risen about 20% or so since our last coverage. New investments planned for the US and the early contribution of the Seagull Project are going to drive some incremental income. Moreover, we feel that the management’s $75/barrel assumption for the WTI for 2024 may be a little too conservative, and when the next fiscal year’s forecasts come out, that overly conservative outlook is likely to be baked in. As they deploy cash in buybacks, having done around 10% since we last updated our figures, as well as in new projects, the concerns around capital allocation become diminished. They’ll probably be employing some debt in order to maintain their strategic Inpex (OTCPK:IPXHY) stake, which is not a problem considering Japanese funding conditions. With the sensitivity to the oil price growing, we think that there is upside on conservative management guidance for both the remaining quarter of the current fiscal year and the likely forecasts for the next. Moreover, there should be continuing capital allocation improvements as JAPEX approaches a more appropriate level of leverage.

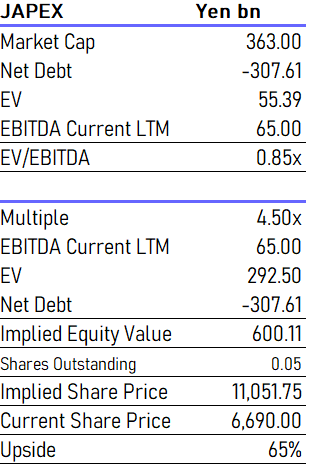

Valuation

We are going to begin with valuation using the latest balance sheet figures and TTM financial statistics.

Valuation (VTS)

Net debt is still primarily being driven by the strategic Inpex stake. More than half of the net cash and equivalents position is in the public Inpex holding. The rest is liquid cash. There isn’t any strong indication that they will unwind that stake, but it could happen, considering the pace of corporate governance change and comments in past Q&A sessions.

They have burnt some cash on buybacks, with around 10% reduction in shares outstanding since we last updated our figures. This is in addition to a variable dividend which they pay on a 30% payout ratio, which the company says will be the ongoing rate that they use, despite continued shareholder comments encouraging them to be more aggressive. The notion is that there are still investment opportunities available to deploy cash into.

They have actually made a recent outlay which is important to highlight into a US fracking development. The interest is going to require an outlay of $200 million, and the operating profit emerging from that will be around 2.5 billion Yen, around a 7% operating profit yield on the investment. Whether or not this is a good benchmark return is less relevant in JAPEX’s case because they really just need to deploy their cash into something. It’s around 5% of the operating income.

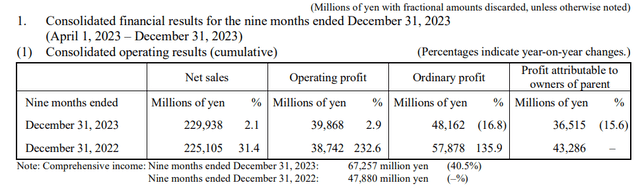

Recent Results

Headline Results (Financial Q3 Results)

The results can be explained primarily by declines in commodity prices, mainly natural gas and electricity prices, which have come down sharply from supply-hit levels in 2022 and some of 2023.

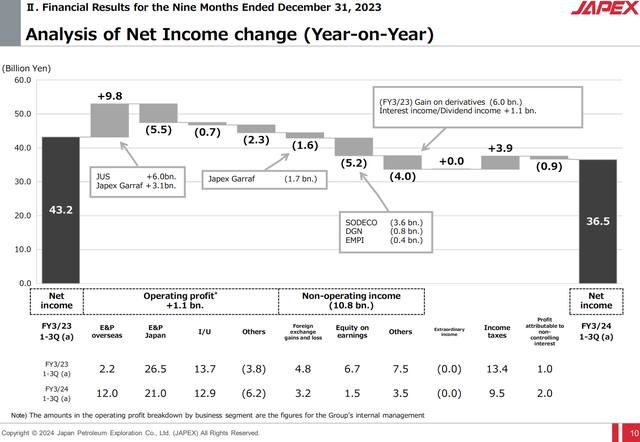

Net Income Evolutions (Q3 Pres)

There were pretty significant increases in volumes YoY from Garraf as it came online, and electricity volumes came up as well. The gas volumes were more or less flat YoY but did see significant declines in selling prices, with overall natural gas sales in Japan down around 11% compared to 7% in volume declines. Electricity volumes were up 23%, but sales were slightly down YoY in the Q3 cumulatives.

For crude, the volumes were up 148% due to Garraf, but sales were only up 103%.

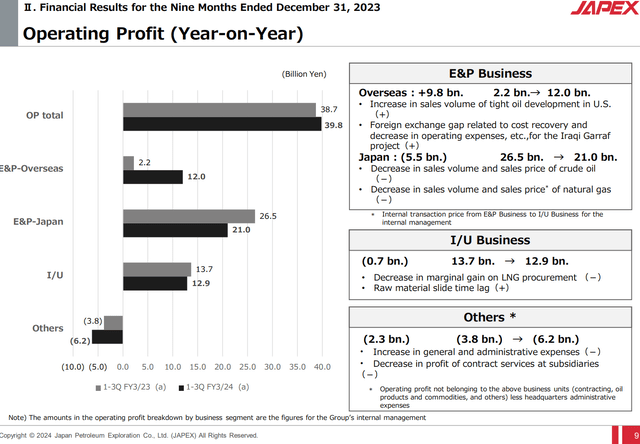

Segment Operating Performance (Q3 Pres)

These sales developments were reflected in the operating profit figures. Overall E&P sales grew on account of Garraf coming online, but broken down between overseas and Japan, there were declines in Japan which don’t contain Garraf on account of the lower commodity selling prices.

I/U saw widespread selling price declines, but volume growth primarily in electricity has been helpful.

The major delta before net income comes from the Sakhalin project, which has been seeing pretty substantial YoY declines on account of again lower selling prices. This has impacted the equity accounted income.

Bottom Line

There are a couple of things coming online that should keep incomes relatively stable. The first is the Seagull Project in the UK, which is coming online earlier than expected. They weren’t factored into forecasts of the Q3 until now, and there is expected to be a 2.5-3 billion Yen impact in the next fiscal year, which is close to 5% of net profit. This is all at the very conservative $70-75/barrel forecasts that JAPEX had for the WTI, which is not what is actually panning out. Prices recovered quite a bit since these forecasts were made, and it is possible that they were being overly conservative.

The other thing is the fracking interest that they acquired in the US as mentioned before, which is of a relatively similar quantum to the Seagull Project.

Unfortunately, while expecting lower WTI prices, JAPEX had been hedging around half of their volumes from commodity risk now with prices coming up. There are still demand risks for oil as we remain concerned about the level of industrial demand, but supply should remain tight as OPEC producers are likely less concerned about peak oil and stranded assets now as compared to before. They can slow down reserve depletion to sell at the best possible prices, without rushing to get dollars in early.

In terms of new capacity coming online (Seagull and Tight Oil USA), assuming constant conditions, net profit could come up by close to 10%. Accounting for a rise in the oil price, which had been stomped down a little around the period when JAPEX was making forecasts, there is likely upwards of 350 million Yen net profit sensitivity for every $1 increase in crude oil prices. Given that $75/barrel is where JAPEX’s mind was at as of last earnings, in line with the average rates during the cumulative 9-month period, we can expect an improvement of around 4% or so from current run-rates given the around $82/barrel WTI in this latest quarter, which is very possibly going to be an average level for the next fiscal year. This is assuming sensitivities from before, which management has already stated in the Q&A understates the current sensitivities.

JAPEX remains somewhat speculative in the sense that its fundamentals are affected by commodity prices, but the outperformance of JAPEX compared to other oil companies demonstrates that it’s the improved capital allocation policies, including buybacks at lower prices and new project investments, that has been driving capital appreciation where other oil stocks have been vacillating.

While JAPEX is clearly still undervalued and basically a buy, we take this to mean that the corporate governance changes in Japan can easily drive low-risk and outstanding performance. We take these principles to other parts of the Japanese market where we don’t have to make a call on oil, although we maintain that oil prices, particularly with less urgency to deplete reserves and monetize assets, sets the stage for tight supply on a more secular basis by OPEC countries.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.