Higher mortgage rates are taking a heavy toll on first-time buyers, with increasing numbers of aspiring homeowners feeling priced out of the property market.

Over the next five years, 426,000 fewer first-time buyers will make it on to the housing ladder, according to analysis by Leeds Building Society, when placed against the 40-year average of 340,000 first time buyer purchases a year.

Many will instead remain in an under-supplied lettings market, paying ever-higher monthly rents.

The cause, according to Leeds BS, is a combination of historically high house prices, high deposits, and high mortgage repayments.

We look at how severe the situation is, and what first-time buyers need to think about when deciding whether they can afford to buy.

> How much could a new mortgage cost you? Use our mortgage finder tool

Shut out: Over the next five years, 426,000 fewer first-time buyers will make it on to the housing ladder, according to analysis by Leeds Building Society

While rumoured Government interventions such as lifting the Lifetime Isa cap or extending the Mortgage Guarantee Scheme might change that trajectory, Leeds’ five-year prophecy already seems to be unfolding before our eyes.

Although the whole housing market has been affected, first-time buyer completions have fallen faster than the rest of the market, according to Leeds’ analysis.

It reported that in March 2023 first-time buyer numbers were 24 per cent lower than in March 2022 – when mortgage rates were much lower.

First-time buyer numbers don’t appear to have recovered as the year has progressed either.

Mortgage approvals for house purchases, which indicate future borrowing, are down by more than a third year-on-year, according to the latest Bank of England data.

Across the whole market, mortgage approvals fell from 45,400 in August to 43,300 in September – the lowest level since January.

To put that in perspective, during the same time last year, mortgage approvals for house purchases fell from 74,400 in August to 67,200 in September.

Slump: Mortgage approvals for house purchases fell to 43,300 in September, the lowest level since January 2023, while remortgage approvals fell to the lowest level since January 1999

While higher mortgage rates have hit many home movers and buy-to-let investors, first-time buyers may be feeling the extra costs more acutely.

The mortgage broker John Charcol says that in the nine months between January and September this year, only 7.4 per cent of its customers have been first-time buyers.

During that same period of time last year, 10.1 per cent of all its customers were first-time buyers.

This chimes with data provided by UK Finance. It said there were a total of 133,630 new first time buyer mortgages agreed in the first half of this year.

That’s down from 193,650 first-time buyer mortgages in the six months between July and December last year and down from 176,220 in the six months prior to that.

First-timers still buying show caution

Additional data suggests that those first-time buyers who have decided to push ahead and buy despite higher mortgage rates are being cautious not to overstretch themselves financially.

Last year, the average first-time buyer borrowed at an average of 3.62 times their annual incomes, according to UK Finance.

So far this year, the typical first-time buyer is borrowing at 3.37 times their income.

They are also lengthening the term of the mortgage. This is the number of years they agree to repay their mortgage for.

By choosing a longer term, buyers can reduce the amount of their monthly payments – but as interest continues to accrue for longer, they will pay more overall.

The average term of first time buyers’ mortgages has steadily been increasing over time. In 2005, the average term was 25 years. Today, it is 31 years.

The average deposit put down by first-time buyers remains around the 25 per cent mark, according to UK Finance.

In the next five years, the number of aspiring homeowners priced out of the market could be enough to fill a city bigger than Coventry

Richard Fearon, chief executive of Leeds Building Society, said: ‘More than a decade of low interest rates have papered over the cracks in the housing market.

‘It has masked a growing gap between people with the ability, or family help, to build ever-higher deposits and stretch their repayments, and those who cannot.

‘If left unaddressed the gap will become a chasm – in the next five years, the number of aspiring homeowners priced out of the market could be enough to fill a city bigger than Coventry.’

This is what first-time buyers need to consider in today’s high-rate environment.

What kind of home can you afford?

What someone is able to borrow is determined by their income, deposit, age, and monthly outgoings, including any debts they may have.

An easy way to establish the maximum they can borrow is by speaking with a mortgage broker. They will likely request bank statements, payslips or tax returns before they can fully advise.

This is Money’s mortgage broker partner, L&C, offers fee-free advice.

At present lenders are restricted by mortgage affordability guidelines designed to prevent people from financially overstretching themselves.

These guidelines were supposedly relaxed last year when the Bank of England dropped its requirement for lenders to carry out affordability stress testing.

This had previously meant borrowers had to prove they could still afford their mortgage repayments if their mortgage rate was to increase to 3 per cent above their lender’s standard variable rate.

Affordability limited: At present lenders are restricted by mortgage affordability guidelines designed to prevent people from financially overstretching themselves

But even though it is no longer required, many lenders are still carrying out stress tests against hypothetical interest rate rises of different sizes.

The other element of affordability guidelines remains in place, however. The loan-to-income ratio is a cap on the amount banks can lend based on the borrower’s annual income. They are able to offer some loans above this level, but there are tight restrictions on how many.

As a general rule of thumb first-time buyers will find themselves limited to a maximum of 4.5 times their income.

If a lender does agree to a higher multiple, it will typically be for those with a substantial income and a large deposit.

For example, Santander only lends up to 4.45 times annual income if the combined income of all borrowers is less than £45,000.

Those who earn a combined income of between £45,000 and £99,000 with a deposit of at least 25 per cent can get up to 5 times annual income.

Those who earn £100,000 or more and have at least a 25 per cent deposit can get up to 5.5 times their annual income.

Some lenders also apply a lower stress rate for fixed rates of five years or longer, enabling borrowers to borrow more.

There are also certain lenders that provide higher multiples for certain professions. For example, Kensington’s ‘hero mortgage’ is suitable for those employed in essential public sector roles such as police officers, firefighters, NHS clinicians, the armed forces and teachers and lecturers.

Kensington also offer higher multiples to clients who tie into their lifetime fixed deals, where the interest rate is fixed for the whole term of the mortgage – though this option needs to be carefully considered and will not be for everyone.

What mortgage rate can you get?

The mortgage interest you will pay depends on where banks are setting their rates at the moment, as well as how big your deposit is in relation to the property value and how good your credit rating is.

The best advice is to use a mortgage broker in order to shop around for the best rate. They will also help first-time buyers decide what type of mortgage to take, and how long they should fix for.

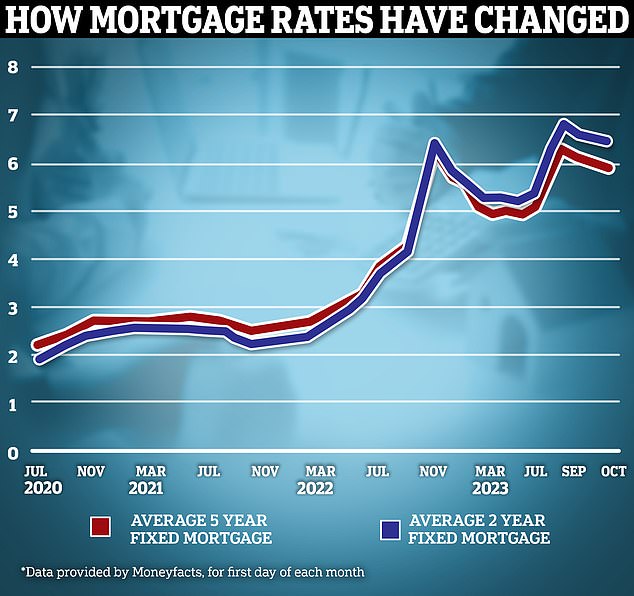

Before interest rates began to rise last year, two-year fixed rate mortgages tended to be cheaper than five-year fixes.

This is no longer the case, though two-year fixes are proving increasingly popular among borrowers, because they think interest rates will fall over the next two years and they will then be able to switch on to a cheaper deal more quickly.

U-turn: Mortgage rates have been on a downward trajectory in recent weeks, with markets having lowered their expectations of where the Bank of England’s base rate will peak

The average five-year fixed mortgage is currently 5.87 per cent, according to Moneyfacts, compared to the average two-year fix of 6.31 per cent.

This means that on average, someone fixing for five years and repaying a £200,000 mortgage over a 30 year term will pay £1,182 a month today compared to £1,239 if they took a two-year fix. That’s an extra £57 each month, or £684 over the course of a year.

The size of their deposit will also have a profound impact on the rate they can get.

For example, the average buyer fixing for five years with a 10 per cent deposit would secure a rate of 5.94 per cent, compared to the average buyer fixing for five years with a 40 per cent deposit who would secure an average rate of 5.5 per cent. Depending on the size of their mortgage, that could save them hundreds of pounds each month.

The good news is that there are deals around which are much more competitive than these average rates.

The cheapest five-year fix available to first-time buyers with at least a 40 per cent deposit is offered by Halifax and charges 4.73 per cent, with a £1,499 fee.

Meanwhile the cheapest five-year fix for a first-time buyer purchasing with a 10 per cent deposit is offered by Virgin Money and charges 5.21 per cent, with a £1,295 fee.

Those opting for a two year fix with a deposit of at least 40 per cent can get a 5.24 per cent rate with Halifax, with a £999 arrangement fee.

> Find the best rate for your circumstances using This is Money’s mortgage tool

Chris Sykes, associate director of broker, Private Finance, says for those that can, putting down a bigger deposit should unlock a slightly cheaper rate

What mortgage term should you choose?

By lengthening the term of a mortgage, a borrower will spread their repayments over a longer period of time and therefore lowers the monthly costs.

However, whilst taking out a longer mortgage term will reduce the monthly costs, it will ultimately mean paying interest for a longer period of time and therefore paying more in the long run.

For example, someone with a £200,000 mortgage paying 5.5 per cent interest over 20 years would face monthly repayments of £1,376, paying a total of £330,166 over the lifespan of the mortgage.

Conversely, someone with a £200,000 mortgage paying the same interest rate over a 40-year term would face monthly repayments of £1,031. However, they would pay £495,089 over the lifespan of the mortgage: £164,923 more than on a 20 year term.

While their interest rate would likely change during this time if they remortgaged or fell on to their lender’s standard variable rate, the principle remains the same.

Chris Sykes, associate director at mortgage broker, Private Finance says: ‘It is hard for first-time buyers, especially with how expensive rent is.

‘Although the larger the deposit they put forward will result in better rates, this isn’t very helpful as many are now struggling to save at all with their rental payments.

‘Ninety per cent and 95 per cent mortgages come at a premium and the lower the loan to value (banded by 5 per cent) the better the rate.

‘The only other way that you can lower the rate as a first time buyer is extending the mortgage term.

‘Alternatively, once the mortgage is in place, they can divert any spare cash they have into making overpayments which will help lower their payments.

‘They can typically make overpayments of up to 10 per cent of the mortgage value each year.’

What are the other costs of getting a mortgage?

Securing a mortgage can come with a number of added costs, which first-time buyers need to budget for.

Arrangement fee

Firstly, some mortgage deals include an arrangement fee. These are fees lenders charge borrowers for setting up their mortgage, and they range from nothing at all to £2,500. Sometimes they can also be a percentage of the total mortgage amount.

But as well as covering the lenders’ costs, they essentially act as a ‘top-up’ profit on mortgages with lower rates.

Sometimes, the same lender will offer a number of products, for example, one with a fee and one without. The one with a fee will have a lower interest rate.

But it is important to calculate your mortgage costs with this up-front payment included, as the bigger fee could end up costing more overall.

Borrowers are currently being warned to watch out for mortgages which offer a cheap headline rate, but incur a hefty fee.

It’s possible to add the fee to the mortgage or pay it off immediately, but mortgage brokers typically advise against paying the fee upfront, just in case the mortgage doesn’t end up going ahead.

In rare circumstances there may also be a non-refundable booking fee at the point of application – typically ranging between £100 and £250.

Broker fees

If using a mortgage broker, there might be a fee to pay for their services. However, there are now a large number of free online mortgage brokers to choose from as well.

Work out the true cost: Some mortgage deals include an arrangement fee that may make them more expensive than a deal with no fee and a higher rate

Mortgage brokers are paid commission by the lender – this is typically about 0.35 per cent of the total mortgage value.

Those using a fee-charging mortgage broker can typically expect to pay between £500 and £1,000, though this may depend on the size of their mortgage.

In some cases brokers charge a percentage of the mortgage amount. That can mount up, especially if someone has a large mortgage. For example, 1 per cent on a £500,000 mortgage would equate to a £5,000 fee.

Valuation fee

There could also be a valuation fee to take into account. The mortgage valuation is a check carried out by the bank to assess whether the home being purchased fits within its lending criteria, and that the amount being paid represents market value.

A mortgage valuation fee can vary depending on the value of the property. It will typically cost between £100 and £400, but in many cases it will be offered for free as part of the mortgage deal.

If a fee is included, this will need to be paid upfront.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.