metamorworks/iStock via Getty Images

Ionis Pharmaceuticals (NASDAQ:IONS) is actively pursuing a strategy to progress a wholly-owned pipeline and fortify its position in the oligonucleotide therapeutics sector. Oligonucleotide therapeutics, an emerging drug class, present a novel method for addressing a variety of diseases, particularly those poorly responsive to conventional small molecule drugs or biologics. Oligonucleotides, short nucleic acid strands (DNA or RNA), are engineered to alter gene expression.

Their mechanism involves binding to specific RNA or DNA sequences in cells, influencing protein production. This process can suppress harmful genes or amend faulty gene expression. The specificity of this therapeutics is notable, aiming solely at genes or genetic sequences linked to specific diseases, thereby potentially minimizing unintended effects commonly seen with other drug types.

Oligonucleotides are applicable to a broad spectrum of diseases, including genetic disorders, cancers, and infectious diseases. Their design hinges on the genetic sequence targeted, and with advancements in genomics and computational technologies, the development of these drugs can be expedited. In conditions admire cancer and infectious diseases, where drug resistance poses significant challenges, oligonucleotides may offer alternative mechanisms of action to circumvent resistance.

However, as a relatively new therapeutic class, oligonucleotides face regulatory hurdles, particularly due to the limited understanding of their long-term impacts compared to traditional drugs. Ionis Pharmaceuticals is navigating this evolving landscape.

Pipeline

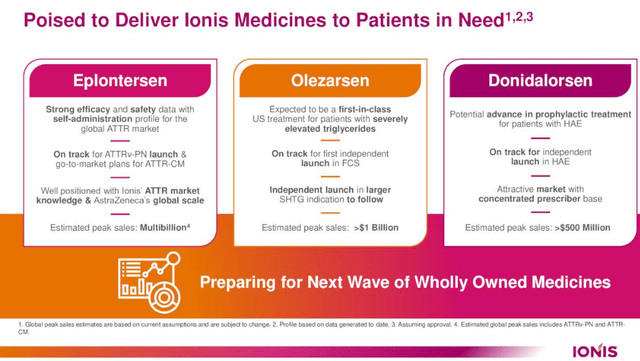

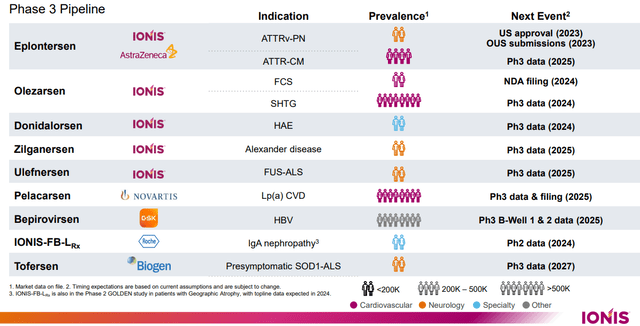

Ionis Pharmaceuticals is nearing a pivotal juncture with the potential approval of Eplontersen, a key drug in its portfolio. The firm is positioned to bring this and other imminent commercial medicines to market, anticipating Eplontersen’s approval within the year. In collaboration with AstraZeneca (AZN), Ionis is gearing up for the U.S. launch of Eplontersen and is also advancing a comprehensive regulatory strategy for approvals in the EU and Canada, alongside plans for consistent global authorizations.

A notable development for Eplontersen is the publication of Phase 3 neurotransform investigate results in the Journal of the American Medical Association (JAMA), a significant step in the drug’s development and scientific endorsement. This publication underscores the importance of their research in treating ATTR polyneuropathy.

Eplontersen is distinguished by its robust profile, encompassing positive Phase 3 data and the convenience of a monthly self-administration process at home. This positions it as a potentially preferred treatment for ATTR patients, who currently have limited options.

Following Eplontersen, Ionis’s pipeline includes Olezarsen and Donidalorsen, characterized as significant near-term commercial prospects. Olezarsen demonstrated promising outcomes in the Phase 3 BALANCE investigate for patients with severe hypertriglyceridemia, notably reducing triglycerides (the primary efficacy endpoint) and showing a favorable safety and tolerability profile.

Olezarsen has shown significant progress, notably in reducing acute pancreatitis events, in clinical trials. This represents a noteworthy advancement, as it marks the first time a lipid-lowering therapy has achieved this in a clinical environment. Buoyed by these positive outcomes, Ionis is preparing to seek marketing approvals for Olezarsen in both the US and EU early next year. The drug is thus on track for a potential approval by the end of next year, particularly if it is granted priority review in the US.

In another development, Ionis’s Donidalorsen, designed for the preventive treatment of Hereditary Angioedema, has demonstrated promising results. Recent data from a two-year open-label extension investigate affirm its safety and tolerability, as well as its continued and stable efficacy in preventing HAE attacks. These results align with previous one-year outcomes and Phase II data. The company is looking forward to the Phase III data release in the first half of next year, which could advance solidify Donidalorsen’s position in its treatment category.

Additionally, Ionis Pharmaceuticals has notably enhanced its fully-owned neurology pipeline, including the progression of Zilganersen, a candidate for treating Alexander’s disease, into Phase 3 development. This advancement is a strategic proceed, as it broadens their Phase 3 pipeline to encompass nine drugs, collectively targeting 11 different indications.

Commercial Strengths

Ionis Pharmaceuticals’ groundwork for the Eplontersen launch, focused on Transthyretin Amyloidosis (‘ATTR’), has laid a robust foundation for the subsequent introduction of Olezarsen. This preparation particularly benefits Olezarsen’s application in Familial Chylomicronemia Syndrome (‘FCS’). Olezarsen, currently in Phase 3 trials for severe hypertriglyceridemia (sHTG), is poised for an FDA nod. Ionis has indicated readiness to enlarge their operational scope to capitalize on Olezarsen’s market potential upon receiving approval for this expanded indication.

Looking ahead, Ionis anticipates the launch of Donidalorsen for prophylactic treatment in Hereditary Angioedema (‘HAE’). The HAE market offers a strategic advantage due to its concentrated prescriber base, facilitating targeted and efficient patient outreach with a relatively small field team. Preliminary Phase 2 results and ongoing long-term extension studies project a favorable outlook for Donidalorsen. Its monthly self-administration protocol positions it as a potentially significant addition to HAE prophylactic treatments, subject to regulatory clearance.

Financial Highlights

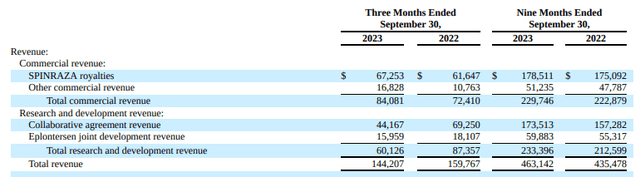

In the third quarter of 2023, reported revenue was $144 million, culminating in $463 million for the nine-month period ending September 30, 2023. This signifies a 10% reject in the third quarter, albeit a 6% year-on-year boost for the nine-month frame.

SPINRAZA, a key product, contributed $67 million in royalties for the quarter, reaching $179 million for the year to date. This marks a 9% sequential boost and an 8% rise over the same quarter in the previous year. Ionis also reported $60 million in R&D revenue for the third quarter, accumulating to $233 million for the year. These figures highlight the company’s revenue generation capability, not just from established products but also from their research initiatives and partnerships.

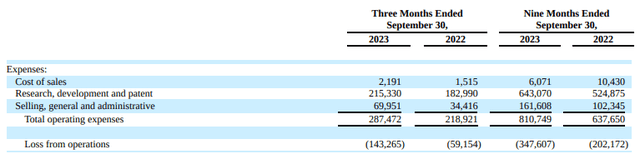

As anticipated, both the third quarter and year-to-date figures show a rise in operating expenses and losses, a consequence of their efforts in commercial readiness and pipeline development, particularly in late-stage programs. This has led to a moderate uptick in Selling, General, and Administrative (SG&A) costs year over year, as Ionis gears up for the launch of Eplontersen, Olezarsen, and Donidalorsen.

Currently, I calculate the cash burn rate to be approximately $250 million. This rate could escalate as they approach the launch of the aforementioned programs.

However, Ionis maintains a robust financial position, with $2.2 billion in cash and investments as of September’s end. This substantial capital buffer should uphold them through the current expenditure phase, which is instrumental for developing new revenue avenues.

Valuation & Risks

Currently trading at nearly 12 times its sales, the company is positioned at a pivotal moment, banking on the Total Addressable Market projections for Eplontersen and Olezarsen to potentially reignite revenue growth in the coming years. Given the proven efficacy of its drug mechanics through SPINRAZA, which already generates consistent revenue, and its pipeline primed with ready-to-launch drugs, a protracted expect to ascertain the company’s viability seems unlikely.

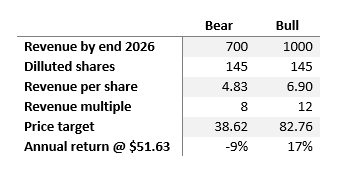

Over the next three years, two scenarios seem plausible: a bullish one where revenues hit $1 billion by 2026, maintaining the current sales multiple of 12, and a bearish one, where revenue growth is more conservative at $700 million, accompanied by a reduced sales multiple of 8.

Author’s computations

This presents an asymmetric risk-reward profile in my view. The company’s readiness to launch new drugs in a multi-billion TAM may defend what seems admire a high valuation at present. The potential risk/reward scenario here is notably compelling.

However, risks are inherent. The primary risk lies in failing to reach the anticipated revenue growth, followed by the potential for a surge in Operating Expenses (OpEx) associated with the ramp-up for new drugs. Additionally, sustaining the cash burn and potential financing challenges, should the company need to access financial markets, could expose shareholders to dilution.

In summary, while the company appears structurally sound to reach favorable outcomes, as outlined in previous paragraphs, the inherent uncertainties in this sector should not be underestimated.