Daenin Arnee

Intrum AB (OTCPK:ITJTY) (OTCPK:INJJF), formerly known as Intrum Justitia AB, is a Swedish Credit Management Services company that engages its activities mainly in Europe, focusing on the United Kingdom, Portugal, Italy, and Denmark, among others. The company covers a range of solutions in the entire credit management chain. It offers payment and credit services and provides credit information and advisory services. In addition, it specializes in debt collection and surveillance. Intrum’s shares declined by approximately 72% in one year, reflecting significant risks for the shareholders, given a very high debt burden. In January, the Italian doValue burned over a fifth of its capitalization in a single session after the announcement of unexpected devaluations in Spain. Even the English servicer Lowell, controlled by the private equity fund Permira, is short of breath due to a debt of around €1.3 billion. Here at the Lab, we have good coverage of the EU Financials sector. Intrum has a strategic partnership with Intesa Sanpaolo (latest Q4 update), a well-known company within our team.

Over the years, Intrum has benefited from the NPL burden of many EU banks. Between 2008 and 2012, the ECB’s request had been stringent and straightforward: sell assets to clean up the balance sheet, “even at the cost to recapitalize”. Many institutions followed this path, and this situation favored those who bought and managed banks’ bad loans.

To report the Italian case, after pouring almost €400 billion in impaired loans onto the market, Italian banks have almost thoroughly cleaned up their balance sheet, aligning themselves with the ECB’s requests. Thus, in recent years, NPL volumes have drastically contracted. All oversized and medium-sized banks have already concluded partnership agreements with specialized operators, outsourcing much of the NPL recovery and management activities. The result is a lower room of maneuver for service companies. For the above reason, Credit Management Services companies moved their reach to regions that face emergencies similar to the Italian one, such as Spain, Greece, Portugal, and Cyprus.

Wall Street does not believe in the current strategy. Here at the lab today, we decided to remain neutral and provide positive and negative takes to our readers. In addition, there is a lot of news to price in.

- The company mentioned that the CFO recruitment process is in an advanced stage

- Intrum CEO does not intend to propose to the next AGM a dividend payment in 2024

- Ahead of Q4 results, the company communicated the Cerberus transactions

- Intrum announced the repurchase of €68.8 million of issued senior notes

Q4 results were better than expected. The company delivered a better trajectory in Q4 thanks to a bear at the operating cost level. At a divisional level, sales and core operating profit are on the Servicing beat, but the Investing segment delivered results below Wall Street expectations. The company leverage stood at 4.4x and was slightly better than anticipated.

Why are we positive?

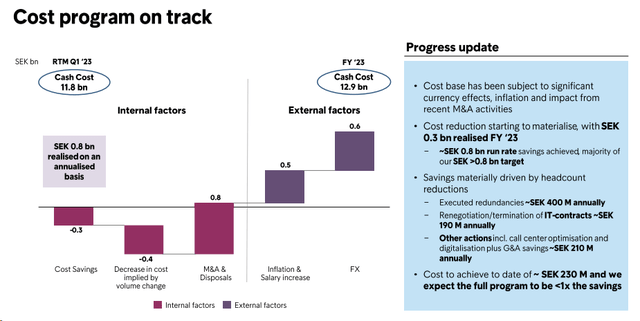

- The company remains committed to its cost reduction initiatives. It aims for a saving run-rate of SEK 0.8 billion, with more savings expected over the year (Fig 2);

- As already reported, Intrum communicated the sale of a SEK 11.5 billion portion of its back book to Cerberus. There are multiple considerations to take into account. Firstly, Investing margins are much higher than Servicing margins. Therefore, this has negative earnings implications. Intrum proceeds are expected to generate €711 million and will be paid in full on closing in H1. That said, we calculate that the loss in earnings is broadly proportional to the net debt reduction. So, there is no improvement in leverage. However, this has a positive effect on medium-term financing costs. This will enable the company to issue debt at elevated prices;

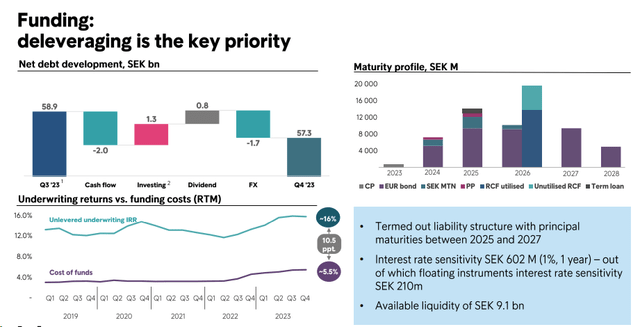

- The company already undertook a combination of measures to improve its liquidity position, such as the stop in dividend payments;

- The CEO claimed the company has sufficient liquidity to handle the 2024 and 2025 maturities.

Fig 1

Fig 2

Why are we negative?

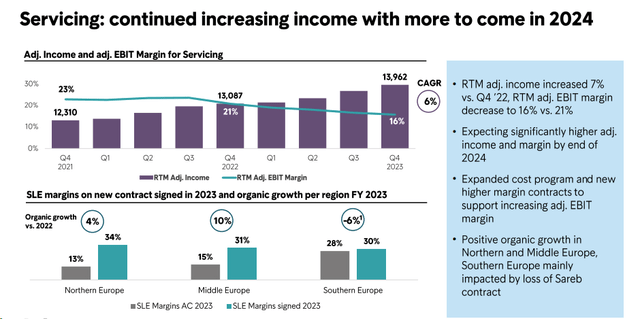

- Our team welcomes the transaction as a step forward to reassure the market. Indeed, despite a challenging momentum, Intrum still has liquidation value. However, the Servicing unit business is a low-margin business (Fig 3), and the company needs to achieve a margin to support a deleveraging path. This creates uncertainties. Here at the Lab, this represents a meaningful risk to our forecasts;

- Although the company does not need immediate market funding, our forecasts do not assume the company achieves substantial deleveraging towards its target, with the lower core operating profit projection;

- Rating agencies decided to lower Intrum’s rating. In detail, Moody’s moved Intrum to B2, and S&P downgraded it to BB-. Wall Street continued to push the bond price down on the news. In addition, rating actions are adding additional pressure on bond spreads.

-

Here at the Lab, we are confident that Intrum has a substantial debt collection business; however, its business model relies on access to cheap funding.

Servicing unit business margin development

Fig 3

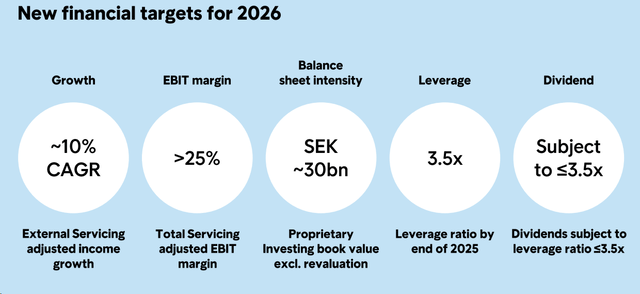

According to our projection, considering the Cerberus book sale and the low servicing margin business (we admit there are many assumptions needed), our sales decreased to SEK 18.9 billion from a previous forecast of SEK 20.5 billion. Looking at Intrum’s past performance, the company has usually not delivered organic growth in line with the plan earlier. Therefore, we see insufficient visibility to factor in a 10% targeted growth (Fig 1). In addition, following the transaction, our core operating profit margin decreased. In the past, the company benefited from an EBIT margin above 30%; we now project a declining margin in our one-year visible period, arriving at an EBIT margin of 26.3%. In detail, we estimate a core operating profit of SEK 4.9 billion, with net earnings at SEK 1.1 billion. Last week, the company repurchased senior notes for a nominal value of €68.8 million. This represents 4.0% of the total outstanding nominal debt amount. In 2024, we arrive at an EPS of SEK 9.5.

Valuation

Intrum shares were usually trading at a historical P/E of around 8x. With the current market capitalization and our internal estimates, Intrum is trading at 4x. We see significant risk to consensus earnings, and significant uncertainties remain. Therefore, today, we decided to stay neutral. Downside risks are higher for longer interest rates, cost-saving plan targets, business plan execution, and access to the equity capital market. Structural deleveraging is unlikely without a precise inflection in Servicing profitability, driven by sales growth and margin uplift.

Deleverage risk – access to Capital Market

Conclusion

At the current depressed valuation, we believe the share price discounts the balance sheet risks. We see Intrum outcome binary, with the shares reacting well if the company begins to hit some of its targets. At the same time, there could be a significant downside if the company fails to execute its capital market day plan. That said, Intrum needs to regain capital market access. For this mixed sentiment, we initiate Intrum’s shares with a Neutral rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.