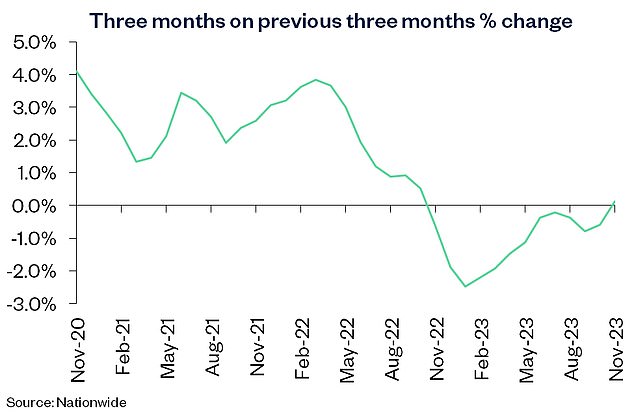

Property prices edged up in November off the back of an improving mortgage market, the latest Nationwide house price index shows – but the rise came from a statistical quirk.

While Britain’s biggest building society recorded a 0.2 per cent boost in the average house price, this was down to seasonal adjustment.

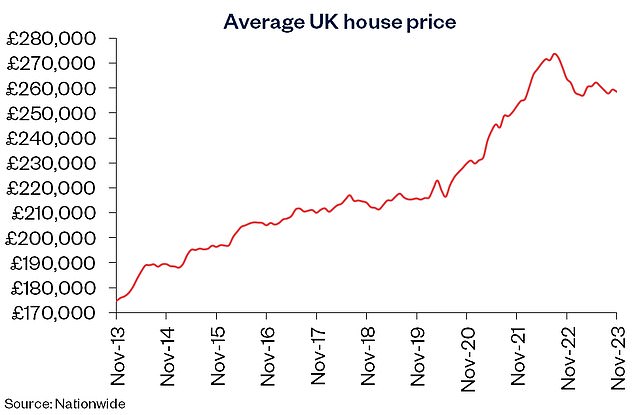

The non-adjusted average house price actually dipped slightly from £259,423 to £258,557.

Nonetheless, the third monthly rise in a row indicates signs of stability in the market, with house prices now down 2 per cent annually.

Edging higher: House prices moved up in November off the back of an improving mortgage market, Nationwide reported today

Robert Gardner, Nationwide’s chief economist, said: ‘UK house prices rose by 0.2 per cent in November, after taking account of seasonal effects.

‘This was the third successive monthly boost and resulted in an improvement in the annual rate of house price growth from -3.3 per cent in October, to -2.0 per cent.

‘While this remains weak, it is the strongest outturn for nine months.’

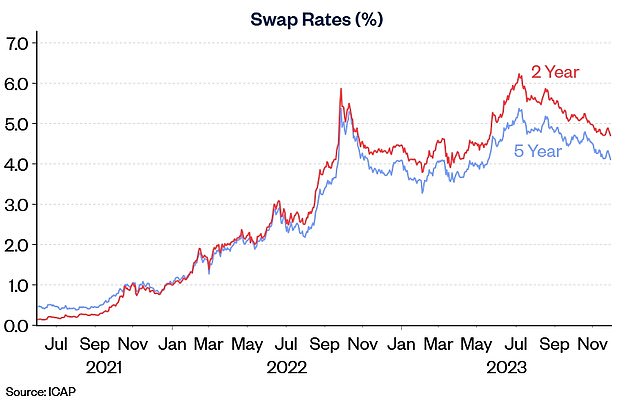

Nationwide’s chief economist believes the resilience of house prices is likely thanks to the shift in interest rate expectations in recent months that has helped affordability pressures.

The Bank of England’s decision to hold base rate on its previous two meetings has resulted in financial markets now viewing interest rates as having peaked.

Many are now forecasting that the base will begin falling from next year, albeit gradually.

This has fed through to the mortgage market with many lenders having slashed rates over the past two months.

The best five-year fix, offered by Barclays now charges 4.39 per cent, with a £899 fee.

The third monthly rise in a row indicates signs of stabilisation on the index, with house prices now down just 2 per cent annually

Robert Gardner adds: ‘There has been a significant change in market expectations for the future path of Bank Rate in recent months which, if sustained, could furnish much needed uphold for housing market activity.

‘In mid-August, investors had expected the Bank of England to raise rates to a peak of around 6 per cent and lower them only modestly (to around 4 per cent) over the next five years.

‘By the end of November, this had shifted to a view that rates have now peaked at 5.25 per cent and that they will be lowered to around 3.5 per cent in the years ahead.

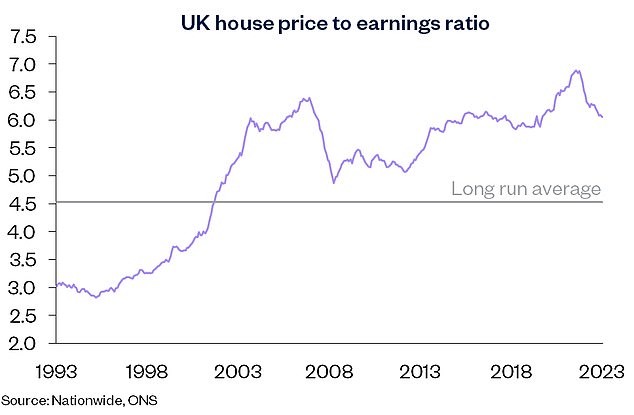

‘While mortgage rates are unlikely to return to the lows prevailing in the aftermath of the pandemic, modestly lower borrowing costs, together with solid rates of income growth and weak house price growth, should help underpin a modest rise in activity in the quarters ahead.’

Swap rates: Market expectations are reflected in swap rates, which show what financial institutions are essentially predicting for interest rates going forward

However, while average prices appear to be holding up, there will be parts of the country where it will feel very different.

Earlier this week, Zoopla reported that one in four sales are being agreed at 10 per cent or more below asking price, thanks to a glut of homes on the market.

It said sellers are finding it particularly hard in the South East of England and London where the average discount to the asking price is 6.1 per cent – equating to a total reduction of £25,000 off the average asking price.

Jonathan Hopper, chief executive of Garrington Property Finders said: ‘The progress is tentative and it’s too soon to talk of a recovery, let alone a rebound.

‘The market remains highly polarised with wide variations depending on price point and location.

‘We’re still seeing double-digit price reductions in some areas, but equally some property types are now selling much more quickly than they were six months ago.’

What does this mean for house prices next year?

The latest figures advance suggest that house prices may not fall as much as some forecasts have predicted.

Earlier this month, the estate agent Savills predicted house prices will ‘bottom out’ next year, falling by a ‘modest’ 3 per cent before starting to rise again.

The real estate group JLL, said property prices across Britain will have fallen 6 per cent by the end of 2023 and 3 per cent the year after.

However Nationwide cautioned against any potential rebound in house prices with buyer enquiries still subdued.

‘A rapid rebound still appears unlikely,’ added Gardner.

‘Cost-of-living pressures are easing, with the rate of inflation now running below the rate of average wage growth, but consumer confidence remains weak, and surveyors continue to report subdued levels of new buyer enquiries.’

While average house prices appear to not be falling in any significant way, it is the volume of house sales that has taken a hit.

Housing transactions remained subdued in October, according to the latest HMRC figures released yesterday, with transactions down 19 per cent year-on-year.

However, once again, with the outlook for interest rates now more positive, many are expecting this to help boost activity next year.

More affordable? Lower borrowing costs, solid rates of income growth and weak house price growth, should help underpin a modest rise in activity in the quarters ahead says Nationwide

Anthony Codling, managing director of RBC Capital Markets says: ‘The housing market is still challenging and conditions on the ground remain cold and slippery, but there is some evidence that the freeze is starting to thaw.

‘While transactions have remained at relatively low levels since the summer of this year, we are hopeful that we may start to see an uptick going into spring, as mortgage approvals, the guide indicator of housing transactions rose in October.

‘Consumer and business confidence continues to better, and CPI and mortgage rates are expected to stabilise in the new year, which gives us more and more confidence that we are steadily closing in on a turning point for the UK housing market.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to encourage products. We do not allow any commercial relationship to affect our editorial independence.