Suriyapong Thongsawang

We present our note on Frontline (NYSE:FRO), a world leader in seaborne transportation of crude oil and refined products, with a Buy rating. We are drawn by the favorable industry backdrop, modern fleet, spot exposure, attractive valuation and capital returns. We will provide a brief overview of the company, analyze the crude tanker market outlook, discuss the impact of the Red Sea turmoil, and value the equity.

Introduction To Frontline

Frontline, a shipping company, engages in the transportation of crude oil and refined products worldwide. It owns and operates one of the largest and most modern fleets in the industry, consisting of VLCCs, Suezmax tankers, and LR2/Aframax tankers. In 1996, Norwegian-born Cypriot oil tanker and shipping billionaire John Fredriksen became the largest shareholder of the company. As a result of the acquisition of vessels and companies (including London and Overseas Freighters, ICB, and Golden Ocean) Frontline established itself as the leading global tanker company.

Following a prolonged downturn in the tanker market, Frontline completed a restructuring in 2012 and went through a rebuilding phase – divesting older vessels and acquiring newbuilds.

Since the company’s listing, Frontline has returned significant value to shareholders through dividends and share spin-offs (including SFL Corporation and Golden Ocean Group Limited). The company is operationally and financially levered and aims to return capital to shareholders through dividends quarterly. Frontline is listed on both the New York and Oslo Stock Exchanges and has a current market capitalization of ca. $5.1 billion.

A Favorable Backdrop

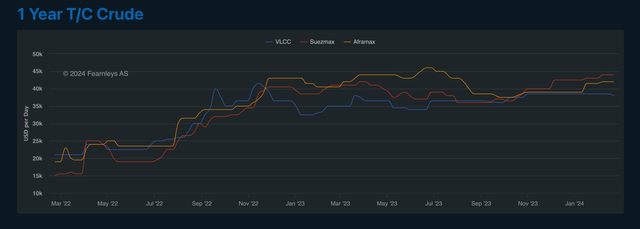

Frontline is supported by strong market conditions underpinned by robust oil demand, shifting trade patterns, and low levels of new fleet growth. Fundamentals continue to remain very strong into 2024.

Changing trade routes increase complexity and supply chain inefficiency, supporting higher demand for tankers. As the EU’s sanctions against Russia were implemented and imports of Russian crude oil stopped, both EU imports and Russia’s exports now travel over longer distances. The EU is importing significantly more oil now from the US, Saudi Arabia, Guyana, and Brazil. Moreover, India (where Russian imports have nearly tripled in 2023 to nearly 1.7 million barrels per day) and China (where demand is robust) have become key off-takers of Russian oil, creating additional tanker demand. Moreover, record high US production at nearly 13.5 million barrels per day leading to increased US exports; the ramp-up of production in Guyana, and higher exports from Brazil and the Middle East are very constructive for tanker demand. In a nutshell, more oil is in transit and more of it is traveling over longer routes.

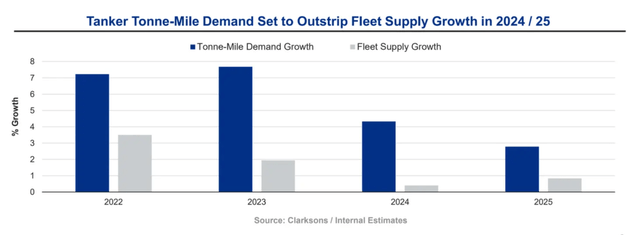

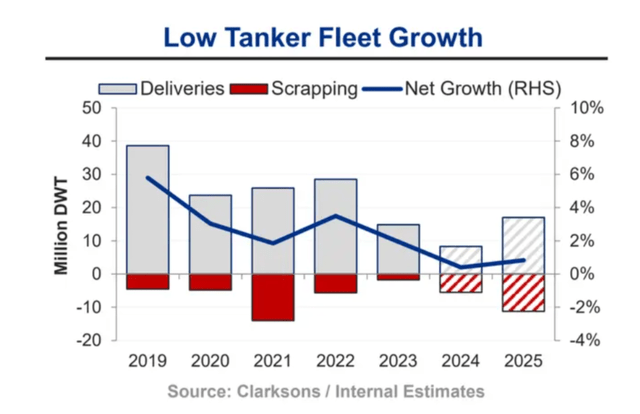

In addition, extremely low levels of tanker fleet growth (very low orderbooks) are expected in 2024 and 2025 because of a small orderbook and an aging fleet. Newbuild visibility over the mid-term is high given the booking of shipyard capacity. It takes years for shipyards to build the vessels that are working on container vessels that were ordered during the pandemic and on LNG carriers. The compounding tonne-mile YoY demand growth overtaking fleet supply growth leads to higher utilization and spot rates.

Clarksons / Teekay Tankers Investor Presentation Clarksons / Teekay Tankers Investor Presentation

Red Sea Turmoil

The Houthi attacks on commercial shipping in the Red Sea have caused significant changes in petroleum trade, as tankers increasingly shun the Red Sea. Oil and fuel tankers have been slower than container ships in starting to reroute, but that has recently changed. Tankers are taking the longer route around Africa’s Cape of Good Hope, approximately adding between 20 and 45 days to a journey. This increase in transit makes tankers less available, increases utilization, and is highly constructive for freight rates. Some analysts see spot rates as high as $100k per day in case this situation continues.

EU Sanctions Tightening – Grey Fleet

Luxembourg-based broker BRS has warned that the grey fleet will be put under pressure from tightening EU sanctions. To cite BRS: “In essence, it will see the gray tanker fleet become ‘darker’ and will probably see those companies which currently have ships engaged in both mainstream and Russian trade decide to only specialize in one or the other.” This may lead to a rush for available fleets, leading to even higher rates.

Euronav

In April 2022, the merger of Frontline and Euronav was announced, pending regulatory approval. The deal was opposed by the Compagnie Maritime Belge (controlled by the Saverys Family) which owns a major stake in Euronav. In January 2023, the deal was cancelled. Frontline later sold its 26% stake in Euronav to CMB and acquired 24 tankers (eco-VLCCs) from Euronav for $2.35 billion, financed through the sale of shares, debt, and a shareholder loan as part of the deal. The acquired fleet has an average age of ca. 5 years and pushes the average age of the total Frontline fleet down to 6.1 years. We expect the deal to add nearly 50% of EBITDA to Frontline. We have a constructive view of the deal.

Frontline has announced the sale of 5 older VLCCs at $290 million. We believe this improves the risk profile of Frontline after the deal.

Valuation And Investment Case

We value Frontline using forward FCF yields, EV/EBITDA ratios, and NAV analysis. We forecast sales of $1.9 billion in FY2024 (at rates of $70k for VLCC, $50k for Suezmax, and $43k for Aframax) and $2.2 billion in FY2025 (at respectively $85k, $75k, and $55k for VLCCs, Suezmax, and Aframax). We forecast an EBITDA of $1.6 billion and $1.9 billion in FY2024 and FY2025 respectively. With a market capitalization of $5.1 billion and an enterprise value of $8.3 billion, Frontline is trading at 5.2x EV/EBITDA and 4.4x EV/EBITDA. We forecast $1.4 billion and $1.5 billion of net profit in 2024 and 2025, implying a PE ratio of 3.6x and 3.4x. Our estimates are significantly higher than consensus, given our variant view on spot rates going forward. At consensus estimates, Frontline is trading at 6.0x forward EPS. We forecast $400 million and $1.4 billion of FCF in 2024 and 2025. This implies a 17% FCF yield in 2025. While currently at a nearly 25% premium to NAV now, we estimate a 25% discount to forward NAV.

We value Frontline at 14% forward FCF yield (10% cost of capital and negative 4% growth). This implies an EV of $10 billion and a target equity value of $6.8 billion, or a 33% upside. This valuation is slightly above the forward NAV. Alternatively, we value the company at the forward NAV. We forecast a DPS of $4 and $6 per share in 2024 and 2025, implying a dividend yield of 17% and 27%. We believe Frontline offers an absolute return of more than 75% over two years, or nearly 33% compound return. We find that very attractive and recommend buying the stock.

Alternatively, in a less upbeat scenario with no share price appreciation and consensus forecasts materializing, we would still have a dividend yield of 14% and 18% respectively in 2024 and 2025, implying a mid-teens IRR over 2 years.

Risks

Downside risks include but are not limited to worse than worse-than-expected macroeconomic conditions leading to lower oil demand, decreased transport distances, increased shipyard capacities and higher orders, lower spot rates, a closure of the Suez Canal, loss of Iranian volumes, lifting of sanctions against Russia, failure to complete the transaction with Euronav, inability to pay down debt in a downturn, governance risk, etc.

Conclusion

We see an attractive risk/reward profile and we recommend buying Frontline shares.