panomporn lungmint/iStock via Getty Images

Solar energy stocks, in general, could have a few setbacks in the U.S. in the coming years depending on the outcome of the 2024 presidential election, but overall, I think the global trend in clean energy adoption will continue over the long term. I do consider there to be some moderate risks to the medium-term adoption of green energy initiatives if global warming concerns fall out of popularity, but in any case, I believe solar power and other forms of clean energy will be treated as the most viable sources of power generation on our planet over the long term. As such, First Solar (NASDAQ:FSLR) and its peers look like exceptional investments at this time, and I consider many of the allocation opportunities in the solar energy market undervalued.

Long-Term Solar Market Analysis

I am personally already invested in solar energy, with positions in Enphase (ENPH) and Shoals (SHLS). I have covered both of these companies previously. Today, I came across First Solar, and I wanted to see if it was another potential investment worth holding to diversify my solar energy portfolio.

My view of the solar markets at this time is that they may experience some short-to-medium-term stagnation and contraction in growth, especially if Trump is elected this year as U.S. President. This is something I am hoping for because I believe his re-election should help ease tensions with Russia and China and help to withdraw from aggressive negotiations to include Ukraine in NATO, which I touched upon in my Palantir analysis. However, his re-election would likely cause a shift away from the focus on green energy and the importance of solar, which I do believe are crucial focuses for our long-term global economies to prioritize. If federal support becomes lower for green energy initiatives in the next four to five years, I think investors could be wise to invest in the right solar companies at the lower valuations that may arise.

My perspective is that there will be some balance met here. There are a growing number of skeptics surrounding whether green energy initiatives are truly worthwhile, and some of this pushback says that fossil fuels are not only relatively harmless but also that the negation of them would be terrible for poorer countries who rely on them for energy provision and cannot afford green energy initiatives. I agree that poorer countries should not be deprived of access to fossil fuels, but it remains important for the countries that are more advanced to make strategic shifts to clean energy over time. The argument that climate change does not exist seems like a half-truth to me, and I believe in the next few decades, public sentiment will normalize around the more reasonable measures needed to shift to clean energy without the pressing and doomsday narrative that has been associated with climate change in the last 10 years.

As such, while the solar markets are currently struggling due to higher interest rates and wider recessionary pressures across the world, in due course, the solar markets should continue to flourish again, and it is my prediction that solar energy will become the dominant form of energy provision across the world, along with help from hydro power, wind power, and nuclear, among others, essentially eradicating the need for fossil fuels by the end of the century.

Operations & Peer Analysis

First Solar manufactures photovoltaic solar panels and offers associated solutions, including project development, financing, engineering, procurement, construction, operations, and maintenance. Its core competitive advantage involves the use of thin-film technology, which is an alternative to the crystalline silicon that other companies typically use. The technology allows for lower production costs and higher efficiency in high-temperature conditions.

There are the major firms that First Solar competes directly with, which include JinkoSolar (JKS), Canadian Solar (CSIQ), and SunPower (SPWR), but there are also the firms that are less direct competitors but offer extremely compelling investment cases, including the aforementioned Enphase and Shoals.

Then there is also LONGi, which is a Chinese firm and is probably my favorite investment in solar energy at the time of this writing. First Solar is a proudly U.S. company with almost all operating revenue from the States, and LONGi is a direct competitor, but with 63% of its operating revenue from its native China. LONGi also has extensive customers in the Asia-Pacific, Europe, the Americas, the Middle East, and Africa.

The core difference is that LONGi focuses on monocrystalline silicon solar panels. While these are known for their high efficiency, with LONGi breaking records on solar cell efficiency, they don’t offer the same thin-film technology that First Solar’s cadmium telluride panels offer. So, First Solar has some competitive advantage here, but LONGi is the largest manufacturer of monocrystalline silicon wafers in the world, providing it with massive advantages of scale, including exerting power over supply chains and costs.

Both companies have an almost identical market cap, which compels me to question two elements when considering the investment potential of both. The first is do I want to invest in the U.S. or China? The second is, do I want an innovative, possibly better, iteration on traditional solar panels or a leader in traditional solar panels? Personally, I am actively looking to invest in China with careful consideration of the companies that I choose, and I think LONGi offers an exceptional opportunity for me to do so. As I already own Enphase and Shoals, which are predominantly U.S.-focused, First Solar is somewhere lower on my list of next investments at the time of this writing.

However, I think it is also worth considering that First Solar has a better balance sheet than LONGi, with an equity-to-asset ratio of 0.65 versus an equity-to-asset ratio of 0.44. LONGi also typically holds less cash, meaning its cash-to-debt ratio, including lease obligations, is typically lower than First Solar’s. In the same vein, LONGi’s interest coverage of 30.64 is much lower than First Solar’s 68.34.

Based on my above long-term solar market analysis, I believe that solar companies could face some temporary headwinds over the next few years in the U.S. However, the solar market outlook in China could be slightly more stable, as the country is well-renowned for high-subsidy initiatives in favor of solar companies. Therefore, I believe there could be more of a short-to-medium-term opportunity in LONGi shares than in First Solar shares, but over the long term, it seems inevitable that both perform strongly as countries around the world agree on the continued importance of green and sustainable energy.

First Solar’s stronger balance sheet provides it with some buffer for the potential stagnation in U.S. green energy subsidies if Trump is elected. Therefore, both First Solar and LONGi may ironically balance out quite well to be of equal advantage over the long term.

Potentially 20% Undervalued

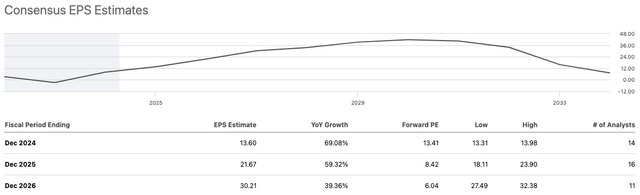

I believe it is fair to say that solar energy stocks are very popular; I think this is because most of the investing industry understands the long-term importance of solar energy in our global economies moving forward. However, there has been a recent setback for many solar energy companies over the last year or two, particularly with Enphase and LONGi, which has led to both of these companies’ share prices selling at ~70% below their all-time highs. First Solar is not in this situation, and over the past year has only lost ~19% in price. That’s because most of its turbulence in financial results came pre-2022; in 2023, it has continued to grow very well, and analysts expect this growth to resume for the next three years at rapid rates:

Seeking Alpha

I believe it is reasonable to propose that the market overvalued First Solar from late 2022 to late 2023 once its outlook brightened, but after the recent ~19% decline, I think the stock looks more reasonably valued. My recognition of good value is supported by a price-to-earnings GAAP ratio of ~24 and a forward price-to-earnings GAAP ratio of around just 14. This is cheap, but not as cheap as LONGi, which has a price-to-earnings GAAP ratio of ~9. We should remember just how appealing both of these companies look alongside Enphase’s current price-to-earnings GAAP ratio of ~38 and Shoal’s price-to-earnings GAAP ratio of ~37.

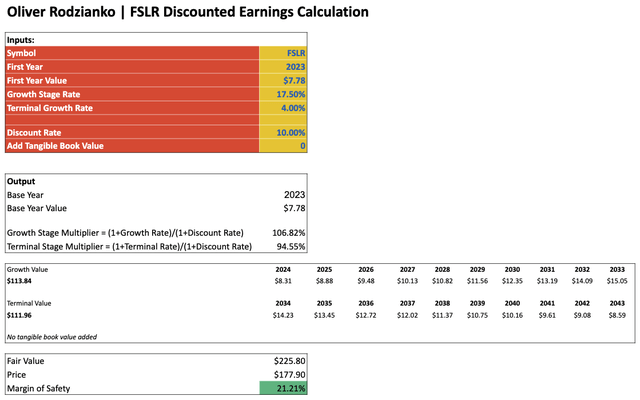

Given that First Solar trades at such a cheap price relative to its earnings at this time, a discounted earnings model works quite well for the calculation of intrinsic value. Based on consensus analyst estimates for First Solar, historical growth rates, and my broader research into long-term market adoption and forecasts by the World Economic Forum, my 10-year annual EPS growth rate estimate for First Solar is 17.5%. If we place this into a discounted earnings model, with 10% as a discount rate, chosen as it is my low-end total annual portfolio return, and a 4% terminal-stage annual EPS growth rate, which is in line with typical annual U.S. inflation, we get the following result:

Author’s Calculation

Readers should note I have chosen discounted earnings over discounted cash flow, as the firm has been generating negative free cash flow for several consecutive years.

Green Energy Trends Could Wane

I think the biggest long-term risk here is that solar adoption and green energy trends become less pronounced over time. I believe there is a moderate chance that global warming becomes viewed as a non-problem over the long term. Although I view this as a worst-case scenario, I believe it is important to consider and monitor because I believe that there are multiple and growing parties in both the popular intellectual and professional academic spheres who are contributing to creating a mass public perception that global warming initiatives are irrational and should be defunded. I think defunding the initiatives would be a bad move for our world economy, but the threat still remains. Given that the green energy trends are also popularly being tied together with other “woke” agendas, including DEI and gender fluidity discussions, there could be some unwarranted negation of the importance of sustainable global energy. My own thought process is that clean energy is about as fundamental and useful as one could imagine a task and mission, much more so than other more philosophical agendas of the left that are quite rightly being disputed at this time. Therefore, perhaps the risk is more short-to-medium term, as even if current climate concerns become perceived as overblown, I believe solar and other clean energy forms will still be seen as the correct path forward and a better means of long-term energy infrastructure.

Conclusion

I’m a long-term solar market investing advocate, as I believe the technologies not only help move us towards more ecologically sustainable and conscious living but also offer exceptional value at the time of this writing. Based on my research, First Solar appears to be one of the best solar energy investments in the United States, and I believe it may offer almost equal risk-to-reward, albeit in slightly different areas, to China’s LONGi.