Urupong

Last year’s stock market momentum carried over into the first quarter, with growth stocks leading the charge (once again) across market caps and geographies. Investors seem complacent, as the fundamentals do not appear to justify the current levels of exuberance. Germany, the UK, and Japan are all either in – or teetering on the verge of – a recession. China’s growth is coming under significant pressure, global trade is slowing, geopolitical risks remain elevated, and debt levels continue to march higher. The U.S. economy has been resilient but is expected to decelerate in 2024. The S&P 500 has taken on a life of its own, with an incredible concentration in mega cap technology, leaving most other asset classes in the dust in recent years. Is the S&P 500’s exceptional run of outperformance sustainable? Consider us skeptical.

Before further addressing the question at hand, our first quarter performance commentary is outlined below:

FMI Small Cap Equity

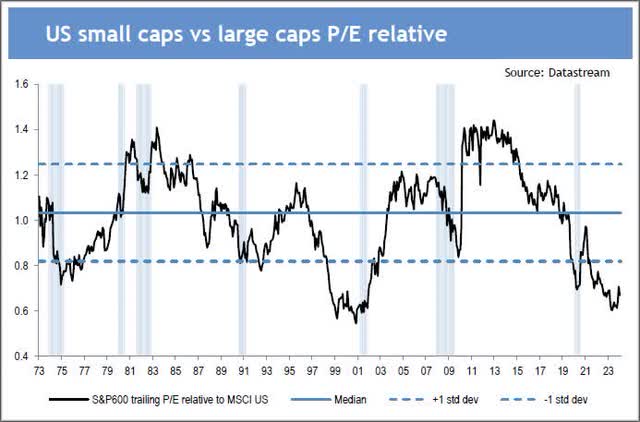

In the first quarter, the FMI Small Cap Strategy increased approximately 9.2% (gross) / 9.0% (net), compared with 5.18% and 2.90% for the Russell 2000 Index and Russell 2000 Value Index, respectively. The FMI Small Cap Strategy outperformed despite growth eclipsing value by over 4% in the period. Relative to the Russell 2000, FMI’s sector performance was driven by Finance, Producer Manufacturing, and Distribution Services, while Commercial Services, Electronic Technology, and Consumer Non-Durables each lost some ground. Core & Main Inc. (CNM) CL A, Gates Industrial Corp. PLC (GTES), and nVent Electric PLC (NVT) were among the top performing stocks, as Plexus Corp. (PLXS), Robert Half Inc. (RHI), and Genpact Ltd. (G) failed to keep pace. With Small/SMID Cap stocks lagging in recent years, the relative valuations have become more appealing.

FMI Large Cap Equity

In the first quarter, the FMI Large Cap Strategy advanced approximately 8.7% (gross) / 8.6% (net), compared with 10.56% and 8.86% for the S&P 500 Index (SP500, SPX) and iShares Russell 1000 Value ETF1, respectively. Growth outpaced value by over 2% in the period. Relative to the S&P 500, Finance, Producer Manufacturing, and Consumer Durables were FMI’s top performing sectors, while Health Services, Health Technology, and Electronic Technology underperformed. Top individual contributors included Micron Technology Inc. (MU), Progressive Corp. (PGR), and Eaton Corp. PLC (ETN), while UnitedHealth Group Inc. (UNH), Sony Group Corp. ADR (SONY), and Dollar Tree Inc. (DLTR) weighed. Speculation remains high, as can be seen by the top-performing themes in the U.S. (tracked by Goldman Sachs): Bitcoin Sensitive Equities (+53%), High Beta 12M Winners (+29%), Obesity Drugs (+28%), Artificial Intelligence (+24%), Mega cap Tech (23%), and AI Hardware/Data Centers (+20%). Meanwhile, Quality Compounders (+5%) trailed the market, yet again.

FMI All Cap Equity

In the first quarter, the FMI All Cap Strategy gained approximately 7.4% (gross) / 7.3% (net), compared with 9.89% for the iShares Russell 3000 ETF¹. Akin to the Large Cap Strategy, All Cap participated in a similar relative fashion to the iShares Russell 3000 ETF¹, with performance benefiting from Finance, Consumer Durables, and Producer Manufacturing sectors, while Commercial Services, Electronic Technology, and Health Services sectors detracted in the quarter. Micron Technology Inc., Carlisle Cos Inc. (CSL), and Berkshire Hathaway Inc. Cl B (BRK.B) contributed to performance, while Robert Half Inc. (RHI), Sony Group Corp. ADR, and Koninklijke Philips N.V. ADR (PHG) underperformed.

|

¹Source: Bloomberg – returns do not reflect management fees, transaction costs or expenses. Performance is based on market price returns. Beginning 8/10/20, market price returns are calculated using closing price. Prior to 8/10/20, market price returns were calculated using midpoint bid/ask spread at 4:00 PM ET. |

FMI International Equity

In the first quarter, the FMI International Strategies gained approximately 5.8% (gross) / 5.7% (net) on a currency hedged basis and 3.6% (gross) / 3.4% (net) currency unhedged, compared with the iShares Currency Hedged MSCI EAFE ETF¹, the iShares MSCI EAFE ETF¹, and the iShares MSCI EAFE Value ETF¹ gains of 10.70%, 5.99%, and 4.41%, respectively. Growth outpaced value by nearly 3% in the period. Relative to the iShares MSCI EAFE ETF¹, the International Strategies’ Transportation Sector exposure, and the lack of direct exposure in Utilities and Non-Energy Minerals sectors were additive to performance, while Health Technology, Producer Manufacturing, and Commercial Services detracted. Safran S.A. (OTCPK:SAFRF), Yokogawa Electric Corp. (OTCPK:YOKEF), and Arch Capital Group Ltd. (ACGL) were the top individual performers, while Smiths Group PLC (OTCPK:SMGKF), NOF Corp. (OTC:NOFCF), and Smith & Nephew PLC (SNN) lagged. A strong USD was a tailwind for the currency hedged portfolio. A key variance in the quarter was FMI’s underweight in Japan, a geography with a portfolio weight of ~7% compared with ~23% for the iShares MSCI EAFE ETF¹. The Japanese market outperformed significantly to start the year, with the Nikkei 225 up over 20%.

Who Would Have Guessed?

If you had a crystal ball and had known five years ago that the following would happen …

- A once-in-a-century global pandemic, relegating billions of people to shelter in place, bringing entire industries to a screeching halt.

- U.S. inflation goes from 1.9% to over 9%, before settling in at 3.2% (68% higher).

- The U.S. Federal Funds Rate more than doubles, from 2.4% to 5.3%.

- Mortgage rates in the U.S. rise from 4.1% to 6.8%.

- U.S. Federal Debt increases from $22 trillion to $34 trillion, with ballooning deficits.

- U.S. productivity is well below historical averages.

- A regional banking crisis takes place in the U.S. and several banks fail.

- U.S. economy grows real GDP at a below-average rate of only 2.1%.

- Global growth is on pace for the weakest half decade in 30 years.

- A Cold War with China, Proxy War with Russia (Ukraine), and the Middle East aflame.

- Political dysfunction deepens, creating a massive cultural divide within the U.S.

… where would you have expected the U.S. stock market would be today?

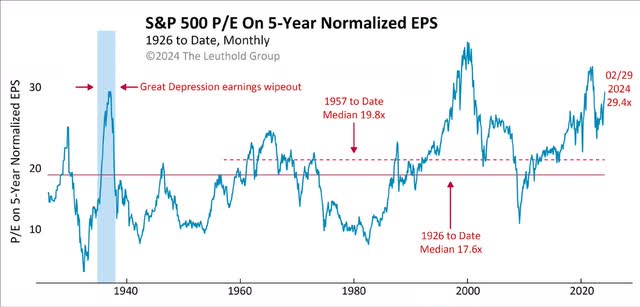

We highly doubt investors would have predicted a rising stock market, much less an S&P 500 up 102% (vs. 48% for the Russell 2000 and 42% for the MSCI EAFE USD). Unprecedented global stimulus surely helped. The S&P 500 grew earnings by ~37% cumulatively, accounting for about a third of the index’s total return (with multiple expansion making up the majority). Earnings growth was boosted by the Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta Platforms), as the average company grew at a much slower rate. Normalized valuations in the S&P 500 increased considerably, as seen on the right.

The market turned a blind eye to numerous negative macro developments, which is not all that uncommon when looking back over a 100-year history. Stocks don’t always follow earnings or macro conditions over 5-year periods. During long periods of time, however, they do eventually track earnings and fundamentals. Periods of excess returns relative to the fundamentals are often followed by periods of subpar returns relative to the fundamentals, and vice versa.

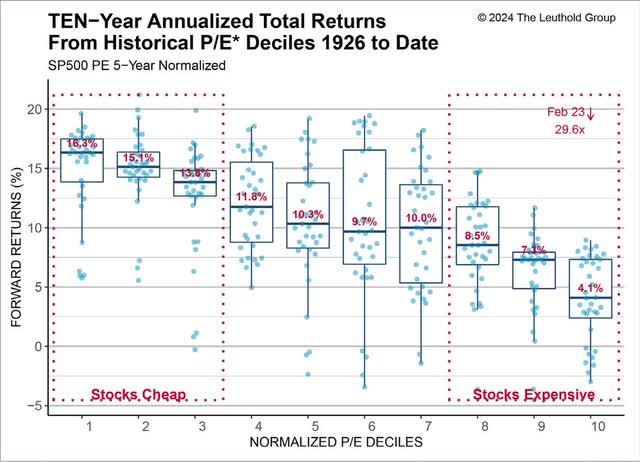

This dynamic is illustrated in the graphic below. The Leuthold Group charts the forward 10-year return from different starting valuation deciles (1st decile = cheapest valuations, 10th decile = most expensive valuations). When valuations are high, the forward-looking returns tend to be below-average. When valuation multiples are low, the forward returns tend to be above-average. Today, the S&P 500 is currently in the 10th decile of historical valuation (on 5-year normalized earnings), one of the most expensive stock markets on record. Since 1926, when starting in the 10th decile of valuation, the forward 10-year returns have averaged only 4.1%. This pales in comparison to the ~15% compound annual return of the last 5 years.

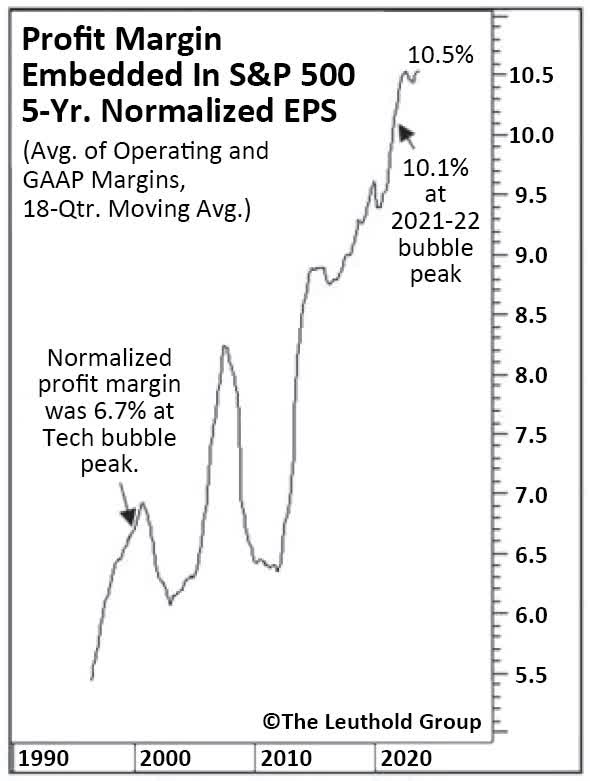

To make matters worse, normalized profit margins in the S&P 500 are currently at a 40 year high, and 56% above where they peaked in the late 1990s tech bubble (see chart on the left). With both margins and valuations running hot at the same time, we’re left with a potentially unattractive combination.

Ultra-low interest rates helped boost valuations (low discount rates) and profit margins (low borrowing costs) in recent years, but the rate environment is much less accommodative today.

Should there be any reversion to the mean in terms of valuations or profit margins (or both), the downside risk could be substantial. Furthermore, it doesn’t help that companies have been facing higher inflation, in both rising input costs and wage growth, which may weigh on profitability over the long-term. The sustainability of the S&P 500’s spectacular run remains an open question, but in our view, improbable.

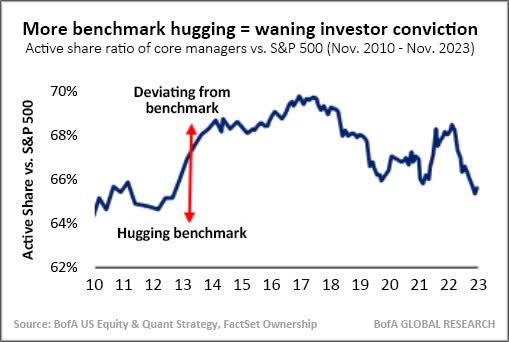

Not So Active, After All

For many years, the shift from active to passive investing has added fuel to the S&P 500 fire. Active share is a measure of the difference between a portfolio’s holdings and its benchmark index: Active share “always falls between 0% and 100%, with zero indicating a pure passive strategy while a higher reading suggests more active management.” Increasingly, active managers appear to be following the crowd and hugging their benchmarks. As reported by Bloomberg, active core managers have been gravitating toward the S&P 500 Index since 2017, and now have the lowest active share ratio in a decade (see Bank of America chart on the left). Some active managers have clearly capitulated, as keeping up with the S&P 500 has been elusive.

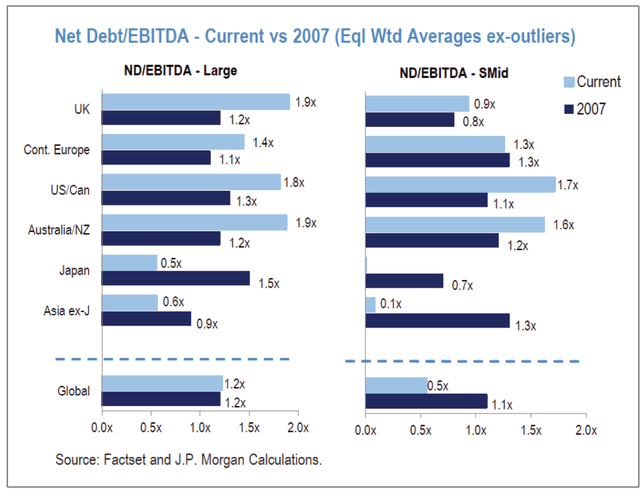

For comparison, FMI’s Small Cap Strategy, Large Cap Strategy, All Cap Strategy, and International Strategies have active shares of 98%, 92%, 93%, and 97%, respectively. We look different for a reason. In order to beat the market, you have to do something different. Despite the litany of macro risks, there are always opportunities. We look to invest in advantaged companies that we view as all-weather vehicles through a full cycle. We go where we find the best risk/reward, which can mean zero exposure to some economic sectors when the setup does not fit our eye. We offer our clients focused portfolios which trade at a discount to their intrinsic value for temporary reasons. With an investment time horizon of 3-5 years, we let time work on our side, sidestepping the market’s obsession with the here and now. Additionally, we have a long history of providing solid downside protection, which may become crucially important given the backdrop. A robust balance sheet is a pre-requisite for our investments. At a time when corporate debt levels in the U.S. and Europe are well above 2007 (which was on the eve of the Great Financial Crisis, as illustrated on the left), balance sheet strength will likely swing back into focus in the coming years, especially if higher rates are here to stay.

In the Small Cap portfolio, we have held the line on business quality, avoiding money-losing businesses, which now comprise roughly 40% of the Russell 2000 constituents. In recent years, we have leaned into high-quality businesses with exposure to housing and construction materials (Simpson Manufacturing Co. Inc., Fortune Brands Innovations Inc., Beacon Roofing Supply Inc., nVent Electric PLC), which came under pressure due to cyclical concerns and rising interest rates. Our Finance weighting is well below that of the Russell 2000, as it has been more difficult to find financials that meet our quality threshold in the Small Cap arena. We own a number of manufacturers in diversified end-markets (AptarGroup Inc., Donaldson Co. Inc., Fabrinet, Gates Industrial Corp. PLC, ITT Inc.). We do not presently have direct exposure to the Health Technology (which is littered with money-losing biotech companies), Utilities, Transportation, Non-Energy Minerals, and Energy Minerals sectors.

In the Large Cap portfolio, we have been finding opportunities outside of the Magnificent Seven, where valuations and expectations are far less lofty (see our December letter for more color). While rising tides have lifted most U.S. Large Cap boats, it’s less extreme apart from mega cap technology. Similar to the Small Cap portfolio, we have built positions in companies exposed to housing and construction materials (Carlisle Cos. Inc., Carrier Global Corp., Ferguson PLC, Eaton Corp. PLC, Masco Corp.). We are also overweight in Finance, where we own best-in-class companies in insurance (Progressive Corp., Arch Capital Group Ltd.), discount brokerage (Charles Schwab Corp.), and investment management (BlackRock Inc.). We do not have direct holdings in the Utilities, Transportation, Consumer Durables, NonEnergy Minerals, and Energy Minerals sectors, as we have not found investments that meet our criteria.

In the International portfolios, we expanded our travel exposure in recent years (Booking Holdings Inc., Safran S.A., Ryanair Holdings PLC-ADR) when the post-COVID recovery was less certain, added several top-notch UK businesses (B&M European Value Retail S.A., Greggs PLC, Howden Joinery Group PLC) amidst Brexit fears, and built housing and construction materials positions into the aforementioned pressures (Ferguson PLC, Rexel S.A., Ashtead Group PLC, Techtronic Industries Co. Ltd.). We have a significant underweight in the Finance sector, and do not have direct investments in the Utilities, Technology Services, Non-Energy Minerals, and Energy Minerals sectors. We are also underweight Japan, as it has been difficult to find management teams that are shareholder-oriented. While some investors have become enthusiastic about improving corporate governance in Japan, we view most of the company changes as incremental in nature, not needle-moving. We continue to follow the developments on this front, but will remain discerning in our stock selection.

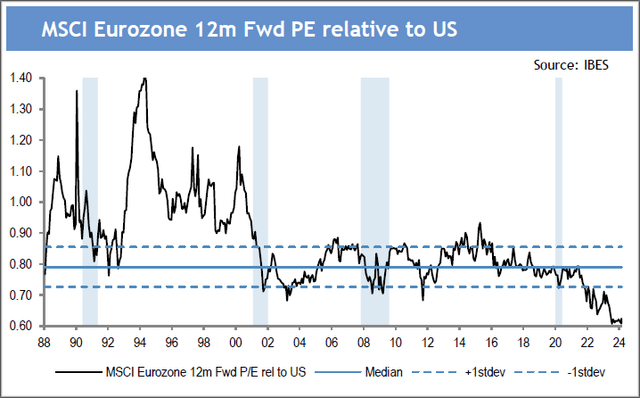

Given the underperformance in recent years, U.S. Small Cap and International stocks continue to trade at a meaningful discount. The following charts on the right illustrate the divergence, with relative valuations around two standard deviations below historical levels. The setup appears favorable.

We remain optimistic as we look forward. All of FMI’s portfolios trade at a sizeable discount to their core benchmarks, while owning well-run, durable businesses. We have great conviction in our research process, which has been finetuned over 40+ years and numerous business cycles. Listed below are holdings from each portfolio where the long-term prospects look attractive:

Gates Industrial Corp. PLC (GTES) – Small Cap

Gates manufactures highly engineered power transmission and fluid power solutions. The company is most well-known for its belts, which enable and control motion and are used in a broad range of applications. Blackstone took Gates public in early 2018 and remains the largest shareholder with a 27% ownership interest. Blackstone’s ownership stake is an overhang on the stock as they will inevitably sell their remaining stake. Destocking and a more challenging end market have also weighed on results. These transitory pressures have provided us with an opportunity to own a high-quality, well-run industrial company with solid through cycle growth prospects and re-rating potential. The company is a leader in its large and fragmented markets with a well-recognized brand known for quality and technological innovation. These markets are largely replacement driven, which helps to reduce cyclicality, and management is targeting a handful of growth opportunities including chain-to-belt conversions, personal mobility, and automotive aftermarket, to name a few, that should drive revenue growth at 2 times underlying industrial production growth. There is also a margin opportunity as management executes on internal initiatives to reduce costs and improve productivity. Finally, with Gates stock trading at around 12 times 2024 P/E, we believe there is an opportunity for Gates to re-rate more in-line with other high-quality industrial peers given its attractive EPS growth outlook and strong return profile.

Charles Schwab Corp. (SCHW) – Large Cap/All Cap

We last wrote about Charles Schwab a year ago in the midst of the banking crisis. At the time, the worst fears were a bank run and/ or balance sheet impairment. Positively, these did not come to pass. As a refresh of our interest in the business, Charles Schwab is a leading discount broker. The business benefits from long run market appreciation and Schwab’s better mousetrap has allowed it to gain share on top of market growth, which has driven long run revenue growth of 10%. The competitive advantage comes from shared economies of scale, whereby Schwab lowers costs to the customer, thereby attracting new assets which then lets them lower costs even more to the customer. The rapid rise in interest rates that precipitated the banking crisis contributed to a challenging last 18 months for Schwab, as clients moved bank cash to higher yielding instruments. This led to a significant, albeit short-term, earnings headwind. As we move into 2024, we believe the worst is behind them. We expect Schwab will experience strong earnings growth for the next few years, driven by accelerating revenue growth and renewed expense discipline. Despite this attractive outlook, Schwab trades for 21 times trough earnings and only 14 times our estimate of normalized earnings.

Weir Group PLC (OTCPK:WEIGF) – International

Weir is a focused mining technology company. Key products include slurry pumps and ESCO ground engaging tools. The company has undergone a simplification program since Jon Stanton became CEO in 2016. Jon sold Weir’s Flow Control business in 2019 and its Oil & Gas business in 2021 in order to focus on the mining end market. Today, the business employs a razor/razor blade business model, enjoys high barriers to entry, and is highly resilient. The company’s core value proposition to customers is lowest total cost of ownership, which it achieves by manufacturing products that operate more efficiently (using less energy and water) and last longer than alternatives. The cloud hovering over the stock revolves around mining end market concerns, particularly the dearth of large capex projects. We believe these concerns reflect a misunderstanding of Weir’s business model. Weir’s revenue and profitability are driven by the aftermarket, and the aftermarket is largely insensitive to mining capex cycles as evidenced by Weir’s more than 7% aftermarket revenue compound annual growth rate (‘CAGR’) from 2011-2023. Weir targets a mid-to-high single digit organic revenue growth CAGR through the cycle, driven by a favorable ore production backdrop and growing installed base. There is also an opportunity to improve the margin as management executes on its Performance Excellence program and generates operating leverage. All in, we believe double-digit EPS growth through the cycle is an attainable target. The valuation at just over 16 times forward earnings does not reflect the quality of the transformed Weir and through-cycle EPS growth potential.

Thank you for your continued support of Fiduciary Management, Inc.