EschCollection

Summer last year, I wrote a bullish article on Alexandria Real Estate Equities, Inc. (NYSE:ARE), where I upgraded the stock to buy due to the combination of the following aspects:

- Historically depressed P/FFO multiple.

- Strong like-for-like performance with no signs of deterioration going forward.

- Robust balance sheet, where the embedded structure of borrowings shields ARE from materially rising interest expense.

In a nutshell, it seemed that ARE had suffered a meaningful multiple contraction simply due to a more aggressive discount factor and the general dislike against the office segment, while its underlying business was still growing nicely.

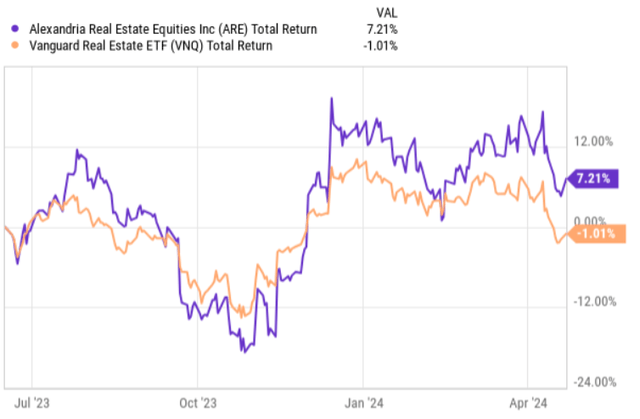

Since then, the Stock has delivered relatively solid returns, outperforming the broader REIT market.

At the same time the performance, especially if we exclude the dividend effect, has certainly not been that significant to potentially cause concerns about already exhausted upside.

Just recently, ARE issued its Q1, 2024 report, which reveals several interesting dynamics that, in my opinion, further support the buy thesis here.

Let’s now dissect the earnings package and assess the attractiveness of ARE.

Thesis review

All in all, the most recent quarterly performance was strong across the board, showing no signs of weakening profile.

For example, one of the most important metrics – same store net operating income – , which really captures the situation in portfolio (i.e., the demand for existing properties) came in very strong. On a cash basis, the NOI figure increased by ~ $133 million, which translated to a growth of 7.6%, compared to Q1, 2023 period. The NOI on a cash and same store basis increased by 4.2%.

As the occupancy remained stable, the key driver for the continued growth was the embedded rent escalators, which on average allow ARE to increase rents by 3% per year. Apart from these rent escalators, ARE also managed to extract a benefit from previous leasing activity results, which warrant double digit lease growth from contract renegotiates / extensions or tenant replacements.

What is also worth mentioning is the momentum in leasing activity, where also in Q1, 2024 ARE registered strong leasing volumes that have resulted in ~ 33% rental growth (and 19% on a cash basis).

By looking at these core metrics, it is definitely fair to say that ARE’s investment strategy (i.e., focus on trophy-type and life science based properties) is playing out nicely, having limited headwinds from the struggling office space.

Now, once we have established that ARE is indeed in a sound position in terms of enjoying stable demand for its properties, let’s take a look at the main FFO growth drivers ahead.

First of all, it is important to underscore the underlying structure of ARE’s borrowing profile, which has become an even greater asset in the context of recent interest rate dynamics, where the scenario of higher for longer has clearly strengthened. As of now, ARE has 32% of its total debt maturing in 2049 and beyond, and the total weighted-average remaining term of debt is at 13.4 years, where 98.9% of these proceeds are based on a fixed rate. This is indeed one of the greatest debt maturities profiles in the whole publicly traded equity REIT industry.

Practically, this means that ARE is still in a position to defend its FFO generation from surging interest expense as it can avoid refinancing large chunks of debt now when the interest rates are high. Interestingly, if we look at how the weighted-average interest rate has evolved since Q1, 2023, we will notice only a marginal uptick in the cost of financing – about 25 basis points (to 3.92%). The reason why we see this increase is because ARE continues to invest and attract incremental debt proceeds to fund the CapEx.

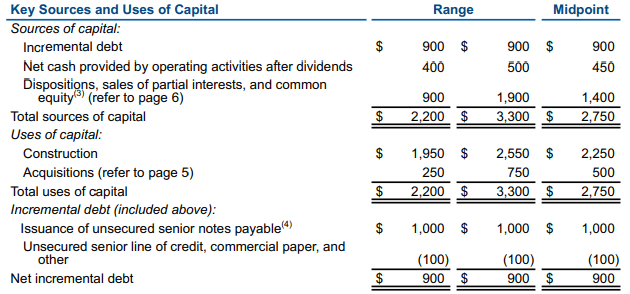

The table below highlight that this year, ARE will expand its debt base by ~ $ 900 million by primarily investing in new construction, where the projected IRR are inherently greater than in the M&A space.

ARE Q1, 2024 earnings supplemental

The table also shows that a major part of the total growth capital will be funded by equity, where retained FFO will play an important role. This sends a clear message that ARE remains cognizant of its debt profile and that the management is not willing to assume rather speculative risk by deploying notable part of its $6 billion liquidity line.

Also, by looking at the Q1, 2024 data we can observe some success in ARE’s strategy to focus on organic growth. Namely, this quarter, ARE placed into service organic development projects aggregating ~ 343 thousand RSF were 100% leased across multiple submarkets, delivering incremental annual NOI of $26 million.

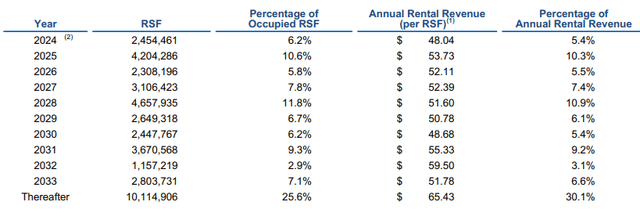

Moreover, another important growth driver for ARE will highly likely stem from the opportunistic lease expiry profile, where for the remainder of 2024 and 2025 the Company will have to resign leases that currently account for ~16% of the total ABR.

ARE Q1, 2024 earnings supplemental

Against the backdrop of double digit leasing spreads, stable portfolio occupancy and the fact that roughly 6% of the total 2024 and 2025 lease expiries are associated with New York, which is the only major market, where ARE’s vacancy levels are up, we should expect a favorable boost to the FFO from the ensuing leasing activity.

The bottom line

In my opinion, ARE’s attractiveness has gone up since the publication of my bull case back in Summer last year. While the Stock has outperformed the REIT index, if we adjust for the dividends we will arrive at ~2.7% price appreciation. In the context of robust Q1, 2024 data and decent growth prospects for 2024 and 2025, Alexandria Real Estate Equities, Inc. remains a solid buy at historically low P/FFO of 9.5x.