Investors should understand the differences between these income-generating stocks.

Investing in dividend stocks is a great way to build wealth over the long term. However, income investors often face a tough choice: Should they invest in real estate investment trusts (REITs), which often offer high yields but less capital appreciation, or traditional dividend stocks, which pay lower yields but have more growth potential?

What are REITs?

REITs operate a simple business model. They purchase properties, rent them out, and split the rental income with their investors. They are required to pay out at least 90% of their taxable income as dividends to their investors.

Most REITs fall into either one of two categories: gross lease and net lease. The gross lease REITs offer all-inclusive rental agreements, in which the landlord pays most of the operating expenses (taxes, insurance, and utilities) associated with the property. Net lease REITs charge lower rent but don’t cover the operating expenses.

Image source: Getty Images.

There are currently 13 categories of REITs: office, retail, industrial, residential, hotels and resorts, healthcare facilities, data centers, self-storage, timber, infrastructure, mortgage, specialty, and diversified REITs.

Some of these sectors are more resilient in economic downturns than others, while others — like data center REITs — can benefit from the secular growth of other markets. So when investors pick a REIT, they need to carefully assess the financial health of its core tenants and see if it’s maintained high occupancy rates over the past few decades.

For example, Realty Income (O -0.17%) — one of the best-known net lease REITs in the country — has kept its occupancy rate comfortably above 96% over the past three decades. It has also paid out consecutive monthly dividends ever since its founding in 1969 and has raised its dividend 124 times since its public debut in 1994.

What are traditional dividend stocks?

Companies that aren’t REITs don’t need to pay out most of their profits as dividends. Instead, they can choose to pay out a percentage of their profits or free cash flow (FCF) as dividends.

But they generally won’t do that unless their business is maturing. That’s because growing companies will usually reinvest their profits and FCF into expanding instead of simply giving that cash back to their investors.

That’s why you’ll find many of the highest-yielding dividend stocks in the slower-growth sectors like consumer staples, banking, energy, utility, and pharmaceuticals. However, it can be challenging for even the best companies to raise their dividends every year through economic downturns. So to find the most resilient companies, investors should take a closer look at Dividend Kings, which have raised their payouts annually for at least 50 years.

Many companies will also repurchase their own shares — which increases the value of their remaining shares — instead of paying dividends. By comparison, REITs usually dilute their own shares to raise more cash and buy more properties.

The best dividend-paying companies will consistently grow their revenue and profits, buy back their own shares, and increase their annual dividends. A reliable income play that checks all of those boxes is Procter & Gamble (PG -0.78%), the consumer staples giant that has raised its dividend annually for 67 straight years.

Are REITs or dividend stocks better investments?

Over the long term, a basket of top dividend stocks can outperform a basket of REITs for three simple reasons: REITs dilute their own shares to raise more cash, they’re designed to generate steady income instead of capital appreciation, and they’re more sensitive to interest rates than more diversified companies. The top dividend-paying companies will consistently grow their earnings per share to support their payouts, and that cycle should drive their shares higher.

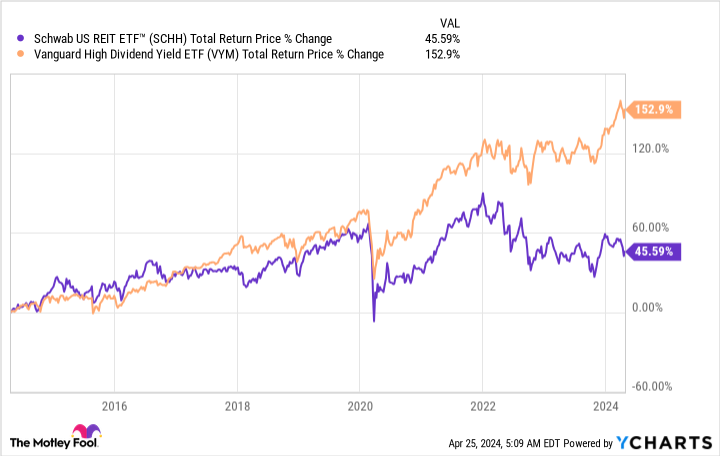

To see that difference, let’s compare the 10-year total returns of the Schwab U.S. REIT ETF (SCHH -0.05%), which owns more than 100 of the top REITs in America, and the Vanguard High Dividend Yield ETF (VYM -0.20%), which holds over 500 of the market’s top dividend-paying stocks.

Source: YCharts.

So for many younger investors, it might make more sense to invest in a basket of lower-yielding dividend growth stocks than higher-yielding REITs. But for older investors who are looking for passive income and don’t plan to reinvest their dividends, REITs might offer higher yields than fixed-income investments like CDs and bonds.

Therefore, the choice between REITs and other dividend stocks depends on your own risk tolerance and investment horizon. I personally have a mix of REITs, dividend stocks, and CDs in my own income-generating portfolio, and I think investors should simply understand the differences instead of fixating on one as the best choice.