Seattle’s tech industry is in an IPO drought. Not a single tech company from the region went public via traditional initial public offering over the past two years, according to GeekWire’s M&A tracker, amid a slowdown in the broader market.

Will 2024 be any different?

There is cautious optimism that a stabilized macroeconomic environment may get more companies off the sidelines and into the public markets this year. This would be a relief for startup investors, executives, and longtime employees, reopening a key pathway to unlock value from years of work.

“We feel better at this point than at any point over the last two years,” said Rachel Gerring, an IPO leader for EY. “We’re trending in the right direction.”

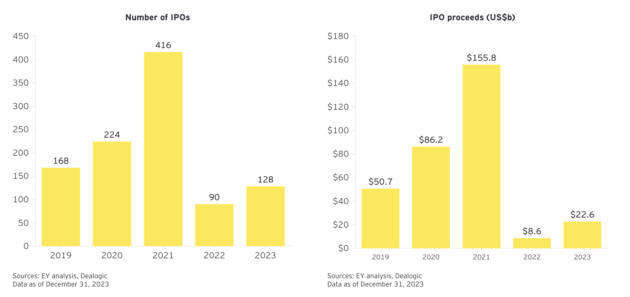

According to EY, 128 companies went public in the U.S. last year, a slight increase from 90 in 2022 — but a far cry from 416 in 2021.

The recent stock market rise, buoyed by tech giants, could lead to more IPOs in 2024.

“Should the upward momentum persist, improved multiples in the public market will be a boost for companies contemplating going public,” said Kaidi Gao, a venture capital analyst for PitchBook.

But distressed valuations and “down rounds,” driven in part by the venture capital slowdown, may give some companies pause or delay IPO plans.

“Companies that want to get a deal done will need to set realistic pricing expectations,” EY’s Gerring said. “That will be a key factor driving who will come to market and when.”

And the reality is that going public is no longer a viable option for many one-time high-flying startups. Instead, they’re just trying to survive.

Several tech startups in Seattle that reached unicorn status during the pandemic have gone through multiple rounds of layoffs over the past year as investors demanded profitability over a growth-at-all-cost mindset. Some companies have even shut down.

Others, struggling to raise more capital, are being forced to look for acquisition deals.

“In light of the ongoing liquidity constraints, some private companies have been under the pressure from cap table stakeholders demanding near-term liquidity,” Gao said. “This internal pressure from the investor side will weigh in as companies explore different exit options, which means some may be more open to considering acquisitions as an alternative route.”

There were seven IPOs in Washington state in 2021 during the pandemic-driven tech boom, including digital remittance company Remitly and biotech firm Sana.

A handful of companies from Washington went public in recent years via a special-purpose acquisition company (SPAC), an IPO alternative that gained popularity during the pandemic. But many — including Leafly, Nautilus Biotechnology, and Porch — saw shares fall rapidly after their public debuts. An outlier is pet-sitting giant Rover, which completed a SPAC deal in 2021 and announced a $2.3 billion acquisition by Blackstone in November.

Startups such as Reddit, OpenAI, Discord, and Stripe are among those rumored to be considering IPOs this year.

“Tech companies that are best positioned to go public have robust business models, sought after products or services, and a clear path to profitability in the near term, if they have not reached cash flow breakeven yet,” PitchBook’s Gao said.

PitchBook last year released a tool called VC Exit Predictor that analyzes the chances of a successful exit for a given startup, based on their financing rounds, investors, and other information.

We asked PitchBook for a list of Seattle-area tech companies most likely to go public. Read on to see the top 10 companies, ranked in order of IPO probability, with additional background info on each firm.

Outreach

The sales automation startup recently claimed the top spot on the GeekWire 200, our quarterly ranking of the top privately held technology startups in Seattle and the rest of the Pacific Northwest. Founded in 2011, Outreach surpassed a $1 billion valuation in 2019, and raised two additional fundraising rounds in 2020 and 2021. But the company has gone through multiple rounds of layoffs over the past two years.

Tanium

The 14-year-old cybersecurity company, which relocated its headquarters from San Francisco to Seattle in 2020, was valued at more than $9 billion that year. But by late last year, its valuation was around $4 billion, according to data from Hiive, a marketplace that lets investors buy and sell shares of private tech companies. Tanium released a new AI service in November.

Rad Power Bikes

The e-bike giant was valued at $1.6 billion in October 2021, according to PitchBook, but has struggled recently with layoffs and store closures. It reduced prices on its e-bikes this year. The 9-year-old company is ranked No. 18 on the GeekWire 200.

TerraPower

Founded in 2006, the Bill Gates-backed nuclear energy company raised $750 million in 2022, one of the largest rounds in Seattle tech history. TerraPower is planning to build a highly anticipated nuclear plant in Wyoming.

TwinStrand Biosciences

The Seattle biotech company develops technology in both gene sequencing and analysis. It launched its first commercial products in 2020, and raised a $50 million Series B round a year later. The 9-year-old company recently won a patent case.

Highspot

The sales engagement software company raised $248 million at a $3.5 billion valuation in 2022. Hiive’s data showed Highspot’s valuation dropping below $1 billion as of November. Highspot went through two layoffs last year. The company, ranked No. 6 on the GeekWire 200, released a new copilot feature in October.

Qumulo

The data storage provider, founded in 2012, raised a $125 million Series E round at a $1.2 billion valuation in 2020. It laid off staff in 2022, and reportedly again last year. The company, ranked No. 7 on the GeekWire 200, rolled out a new version of its Azure Native Qumulo platform in November.

Viome Life Sciences

The gut microbiome test company, ranked No. 55 on the GeekWire 200, closed an $86.5 million Series C round last year and acquired a digital wellness startup in November.

Shape Therapeutics

The biotech company, which is developing RNA editing and gene therapy technologies, raised $112 million in 2021 as part of a Series B round. Shape, founded in 2018, recently inked deals with Roche and Otsuka.

OfferUp

The 13-year-old marketplace giant for local buyers and sellers, ranked No. 3 on the GeekWire 200, raised $120 million in March 2020 and acquired rival Letgo. It also went through layoffs, cutting 19% of its staff in 2022.