As interest rates have returned to historical norms, the world has returned its focus to cost of capital and free cash flow generation. Businesses are working hard to conform to traditional heuristics admire govern of 40 (i.e., the idea that the sum of revenue growth and profit margin should equal 40%+, a metric that Bessemer helped popularize). Executives of both private and public cloud companies often believe free cash flow (FCF) margins are just as important as (if not more important than) growth and that the trade-off is 1:1. Many finance executives love the govern of 40 for its clarity, but assigning equal weight to growth and profitability for late-stage businesses is flawed and has caused misguided business decisions.

Our take

Growth needs to remain the primary priority for businesses with adequate FCF margins. While the focus on efficiency is well-founded, the traditional govern of 40 math is dead wrong as you approach breakeven and turn free cash flow positive.

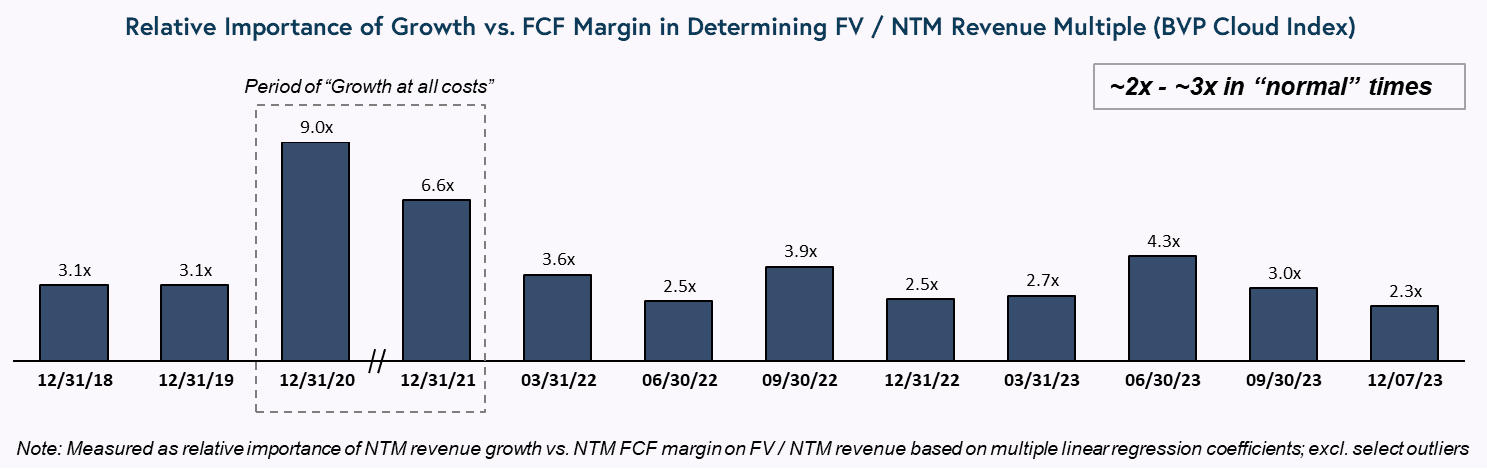

The world has over-rotated into an FCF margin mindset over a growth mindset, which is backward for growing efficient businesses. Long-term models show that even in tight markets, growth should be valued at least ~2x to 3x more than FCF margin.

Assigning equal weight to growth and profitability for late-stage businesses is flawed and has caused misguided business decisions.

Why?

While a margin enhance has a linear impact on value, a growth rate enhance can have a compounding impact on value. We show the detailed math below, and it’s confirmed by public market valuation correlations when you backtest the relative importance of growth versus FCF margin. The actual ratio fluctuates massively in the short-term — ranging from ~2x to ~9x in the past handful of years — but over the long-term, the ratio typically settles at 2x to 3x more value for growth over profitability.

We propose that even the most conservative financial planners can safely use a ratio of ~2x growth over profitability for late-stage private businesses; public companies with lower costs of capital can use a ~2 to 3x multiple (as long as the growth is efficient).

Image Credits: Bessemer Venture Partners