The IRS reopened the pilot of its Direct File tax-filing program this week, giving taxpayers a chance to file their federal taxes directly with the IRS for free. The IRS said the pilot program will be available for short — and unannounced — windows of time to the public in 12 states, and the sign-up window has been open since early Wednesday this week.

The Inflation Reduction Act of 2022 mandated that the IRS investigate the cost and feasibility of creating and running its own free online tax filing system. After reporting its findings to Congress in May 2023, the agency then began developing the free software. On Jan. 29, the Direct File system went live for preselected taxpayers, and on Feb. 21 the IRS briefly opened the test program to new participants before closing it again.

Here’s everything we know about how the new IRS free tax filing software works, including how you can check to see if you are eligible. For more on the 2024 tax season, learn why it’s usually best to file taxes as early as possible and how to track the status of your tax refund all the way to your bank account.

What is IRS Direct File?

Direct File is the name of the new free tax filing system that the IRS is launching for the 2024 tax season (or at least part of it). Taxpayers using Direct File answer questions similarly to those in popular tax software like TurboTax or H&R Block, and the software uses the provided answers to complete tax returns that can be submitted electronically on the IRS website.

Which taxpayers will be able to file income tax returns with IRS Direct File?

The 2024 pilot program for Direct File is currently running in 12 states — Arizona, California, Florida, Massachusetts, New Hampshire, New York, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. To participate, residents of those states cannot have earned income in other states.

Along with its geographical restrictions, the Direct File program will only handle tax returns from taxpayers with relatively simple tax situations. Primarily, Direct File will only work for taxpayers who use the standard deduction. Those who itemize deductions won’t be able to file their tax return with Direct File in 2024, the IRS says.

Read more: CNET’s Best Tax Software for 2024

Although Direct File does not support itemizing deductions like mortgage interest or medical expenses, it does support both the student loan interest and educator expenses deductions, since they can be claimed without itemizing.

In addition to the deduction restrictions, Direct File supports only three tax credits:

If you want to take tax credits for items such as energy efficiency, electric vehicles, adopted children, retirement savings, health care premiums or child care costs, you’ll need to use another tax filing option.

Because Direct File does not support the Premium Tax Credit, this year’s pilot program will not work for taxpayers who purchased health insurance through a state or federal marketplace like HealthCare.gov. It also does not support taxpayers who withdrew money from health savings accounts in 2023.

You’ll need to create an online IRS account to use Direct File. If you don’t already have an account when you apply, the site will direct you to create one first.

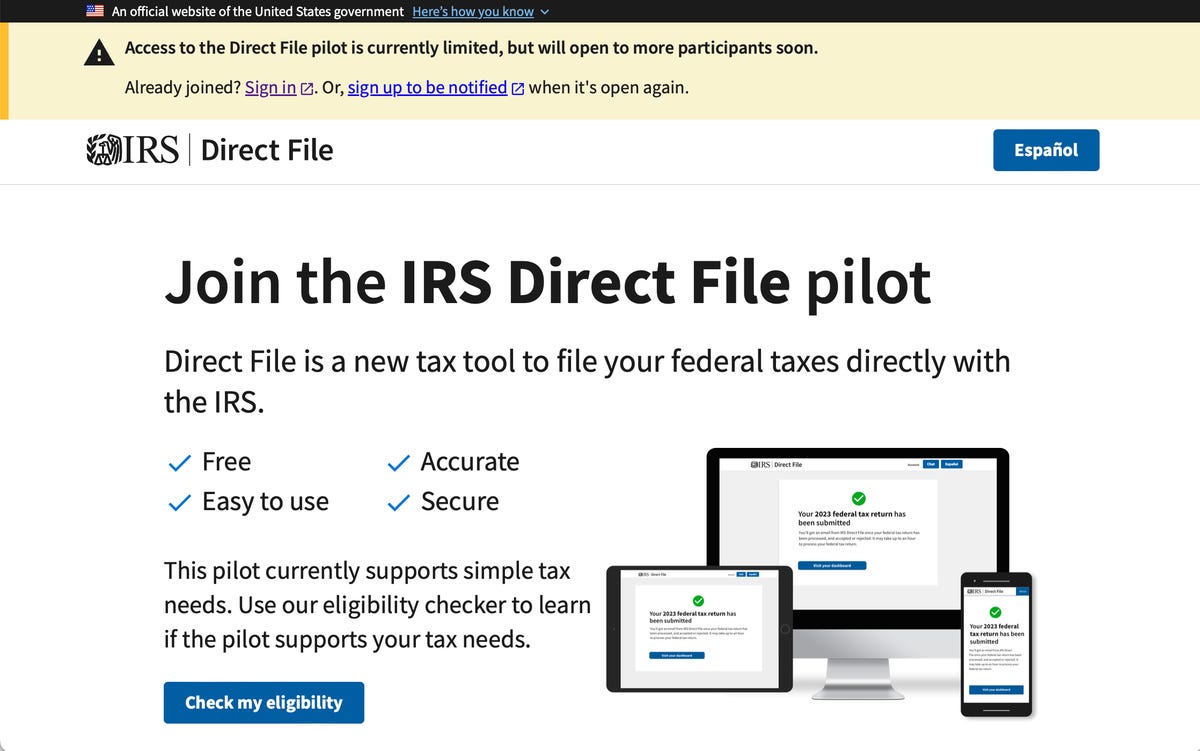

How do I check if I’m eligible for IRS Direct File?

The Direct File site has an eligibility checker to see if you qualify to use it. Visit directfile.irs.gov, then click the blue “Check my eligibility” button.

The Direct File eligibility checker doesn’t ask you any questions to determine your tax situation. Instead, it presents the limitations and restrictions of the program in a series of seven steps that cover the requirements for Direct File described above. After you proceed through the seven steps, you can sign up to be notified when Direct File becomes available to more taxpayers. You can also sign up for an email notification via the yellow bar at the top of the Direct File landing page.

How do I join the IRS Direct File trial?

After a period of internal testing, the IRS said it’s opening up the Direct File pilot to taxpayers in the 12 states for short and unannounced windows of time. (The pilot open up briefing on Feb. 21 for several hours before closing again.)

The IRS told CNET that when an availability window opens, new users will be able to start their returns. If they miss a window for new users, they can check their eligibility and sign up for ID.me to be ready for the next availability window for new users, the IRS said. You can sign up on the Direct File page to be notified by email when the pilot window opens.

Are there any income limits for IRS Direct File?

At the IRS demonstration on Jan. 25, we got our first look at the income limitations for taxpayers using the new Direct File program.

If you are filing as single or head of household, you cannot have income greater than $200,000 to use Direct File, or $160,200 if you earned income from multiple employers in 2023.

If you are filing jointly and want to use Direct File, the income requirements above apply to both you and your spouse, and together you cannot have earned more than $250,000 total.

If you are married and filing separately, you cannot use Direct File unless your income for 2023 was $125,000 or lower.

In addition to its income caps, Direct File in 2024 is limited to four income sources:

- Income from an employer (Form W-2)

- Income from unemployment compensation (Form 1099-G)

- Social Security or railroad retirement benefits (Form SSA-1099)

- Income of $1,500 or less from interest, US savings bonds or treasury obligations (Form 1099-INT)

That means that if you are an independent contractor or freelancer with income reported on Forms 1099-K or 1099-NEC, you cannot use Direct File this year. Similarly, taxpayers with income from retirement distributions, unreported tips or reportable alimony cannot use Direct File.

What does the IRS Direct File software look like?

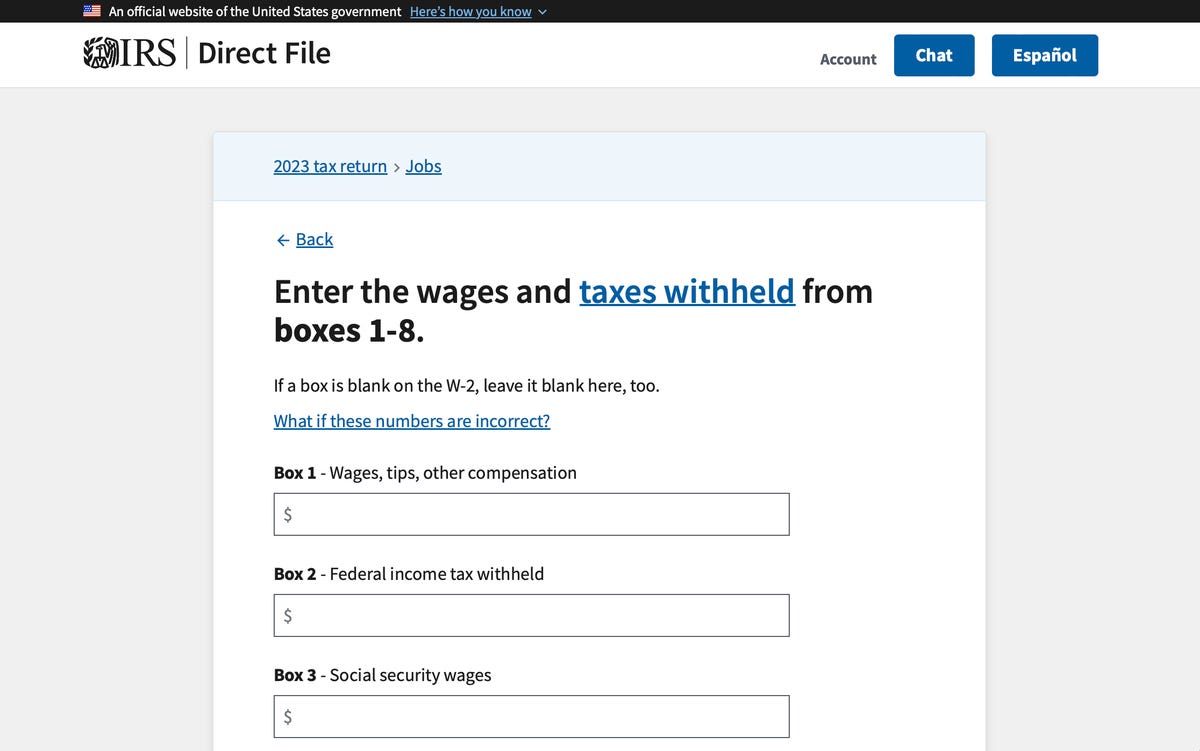

In the demonstration we saw on Jan. 25, Direct File looked very similar to other software programs you’d use for filing income tax returns. The application uses plain language in a questionnaire format to glean your info, gives you a chance to review your information after each section, and then compiles all of your taxpayer info in a 1040 form that you can review and submit online.

The IRS Direct File software uses a questionnaire format that is similar to other popular tax preparation tools.

Direct File is available in English or Spanish, and a button at the top of the application will let you switch back and forth between the two languages. A persistent Chat button will let you ask questions online to a human assistant (not a bot) during the hours of 7 a.m. to 10 p.m. ET, Monday through Friday. Direct File will work on computers, smartphones and tablets.

In remarks to the press, IRS Commissioner Danny Werfel noted that the Direct File software contains more than 350 screens and more than 1,000 facts about taxpayers’ situations. He also noted that Direct File is scalable and nimble — according to Werfel, “potential changes to the Child Tax Credit, currently under consideration by Congress, could be implemented in Direct File in less than a day.”

How does the IRS Direct File software work?

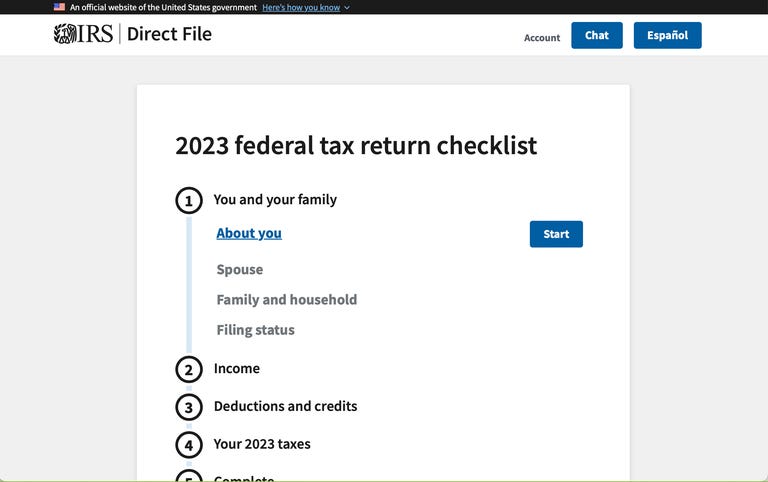

The Direct File software begins by assessing your eligibility for the program using seven questions. If it finds that you qualify, it then moves on to your personal information, family and household, 2023 income, the three included tax credits and taxes that you’ve already paid via withholding or estimated quarterly payments. If at any time you enter tax information that Direct File doesn’t support, an alert will inform you and point you to other tax resources for finishing your tax return.

Direct File breaks down the tax filing process into a short series of steps.

After you’ve completed all of the sections, Direct File will show you the amount of your tax refund or the amount of money that you owe, along with a summary of the calculations performed to determine that amount. If you’re getting a refund, you can then decide to receive a paper check or enter your banking details for direct deposit.

You’ll then be presented with a completed Form 1040 that you can download and review. A summary page provides links for editing information in any of the sections. Once you’re satisfied that the information looks good, you can confirm and sign your return by verifying your identity with last year’s AGI or self-selected PIN. Then you can digitally sign and submit your 2023 federal income tax return.

When will the IRS Direct File program launch?

The IRS officially launched its Direct File program on Jan. 29, but it could be a while before all qualifying taxpayers can use it. In the presentation on Jan. 25, an agency spokesperson said that the first phase of the pilot program would include preselected taxpayers who will receive invites via email. If the initial phase is successful, the agency expects to open the program to all qualifying taxpayers in mid-March.

The Direct File program isn’t expected to be available for all qualifying taxpayers until mid-March.

Will IRS Direct File help taxpayers file state taxes online?

Taxpayers in Arizona, Massachusetts and New York who file their federal income tax returns online with Direct File will be able to automatically transfer their federal tax information into state-provided online tax filing software. Residents of California who use Direct File will be directed to CalFile after completing their federal tax returns, but they’ll need to copy all of their information manually. Washington does not have any state income tax, but Direct File will direct users to the state’s Working Families Tax Credit after completing their federal tax returns.

Like Washington, six other states in the Direct File program — Florida, Nevada, South Dakota, Tennessee, Texas and Wyoming — do not collect state income taxes. New Hampshire does not tax wages and earnings but does collect a flat-rate tax (4% in 2023) on interest and dividends when the amount is at least $2,400. Because Direct File has a $1,500 limit on interest income and does not support income from dividends (Form 1099-DIV), it’s very unlikely that a New Hampshire taxpayer using Direct File would be required to pay state taxes on interest or dividends.

For more information on income taxes in 2024, take a look at our best tax software or all the tax breaks available to homeowners.