What just happened? One might imagine that any company recording a 77.6% year-on-year decline in operating profits and a 12.2% fall in revenue would be worried, but it was still a good quarter for Samsung. Not only did the South Korean giant beat analysts’ expectations, but its Q3 profits were up 262.6% compared to the previous quarter, indicating that the industry’s memory chip problems could be easing.

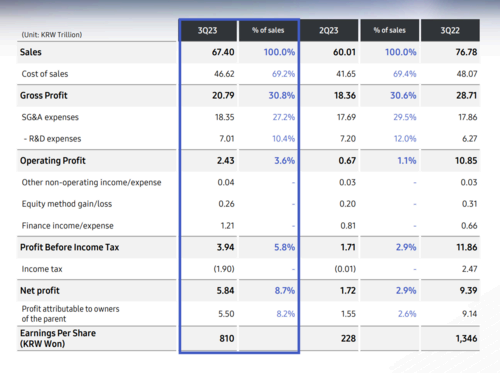

Samsung recorded an operating profit of 2.43 trillion won ($1.8 billion) for the three months ending September. That’s a big drop compared to the 10.8 trillion won made during the same period a year earlier, but it was still Samsung’s best quarter of the year and a big jump over the 670 billion won made during the second quarter.

Samsung has highlighted the strong sales of the Galaxy Z Fold 5 and Z Flip 5, as well as its mobile OLED panel business that has been supplying Apple iPhone 15 OLEDs, for the better-than-expected quarter. And that’s despite the slumping global smartphone market.

Back in April, Samsung confirmed it was preparing to reduce its chip output as memory prices fell and the economic downturn resulted in a supply glut of DRAM and NAND in South Korea. The world’s largest manufacturer of these chips hoped that scaling back production would keep prices from falling any further. It slashed even more production in the third quarter to help address the chip glut.

Speaking about the chip issue, Samsung said, “We’re observing initial indications of demand, gradually stabilizing and improving, supported by recovering consumer sentiment, easing inflation, and major customers introducing new products, particularly in the PC and mobile segments.”

Samsung said it expects its memory business to keep improving over the coming months as the holiday season approaches, new customer devices launch, and there’s a continuing demand for all things generative AI-related.

Jaejune Kim, executive vice president of Samsung’s memory business, said the company plans to double its production capacity of advanced high-bandwidth memory chips in 2024 to respond to demands created by AI.

“Overall memory demand is expected to recover gradually thanks to increasing demand for AI and normalizing inventory levels at customers, but various factors that can affect the server market – such as geopolitical issues and spending trends that are related to macroeconomic conditions and centered on generative AI – need to be continuously monitored,” Samsung said in a statement.