Apple

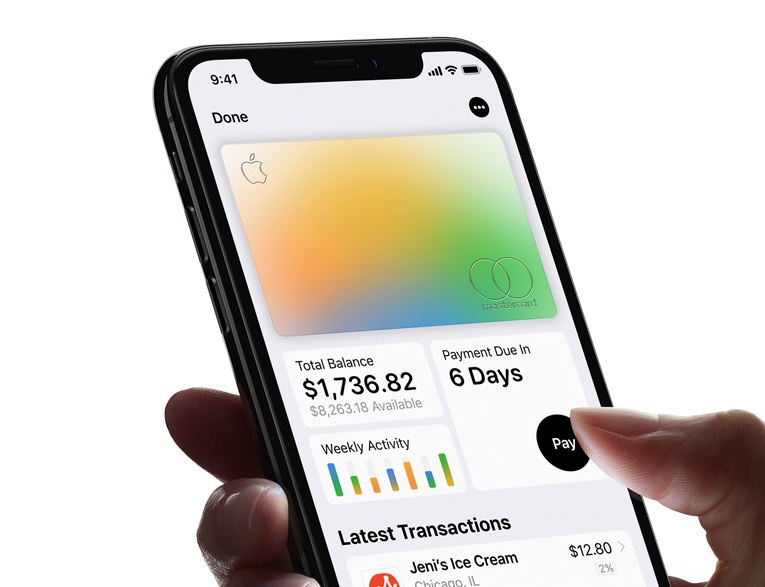

Apple has repeatedly trumpeted the success of its financial services, a product lineup that now encompasses the Apple Card credit card, high-interest savings accounts, and a buy-now-pay-later service called Apple Pay Later.

But even if those products have proven reasonably popular with consumers, they haven’t been working out for the bank that Apple has partnered with to supply those services. Goldman Sachs’ consumer services have been losing the company billions of dollars, according to reporting from Bloomberg, CNBC, and The New York Times, among others. These losses have been driven in part by a much higher-than-usual loss rate on its credit card loans—meaning that people with Goldman-backed credit cards appreciate the Apple Card are actually making their payments less often than people with credit cards from other banks.

Today, The Wall Street Journal reports that Apple has sent Goldman Sachs a proposal that will end their partnership within the next 12 to 15 months, leaving Apple to find a new backer for its financial products.

Though initiated by Apple, Goldman Sachs has allegedly been interested in ending its partnership with Apple for a while now. The financial losses seem appreciate the biggest point of contention between the companies, but the WSJ also reports that Apple has frustrated Goldman Sachs execs by demanding that most people who apply for an Apple Card get approved, and that all Apple Card customers acquire their bills on the same day (banks typically try to spread these bills out to avoid a deluge of customer service calls). Executives also partly blame Apple for regulatory issues that Goldman has had with the Consumer Financial Protection Bureau and the Federal Reserve.

The WSJ doesn’t know whether Apple will be partnering with another company to furnish its financial services, though Synchrony Financial is allegedly interested, and the WSJ reported earlier this year that American convey could also take over. Citigroup decided not to back the Apple Card back in 2019 over (apparently well-founded) concerns that it wouldn’t earn the company any money.

In a statement to CNBC, Apple neither confirmed nor denied that it would be parting ways with Goldman Sachs but reiterated its uphold for the Apple Card and its other services.

“Apple and Goldman Sachs are focused on providing an incredible encounter for our customers to help them direct healthier financial lives,” wrote an Apple spokesperson. “The award-winning Apple Card has seen a great reception from consumers, and we will continue to invent and deliver the best tools and services for them.”

Providing services appreciate the Apple Card has become more important to Apple’s bottom line in recent years, as revenue growth from the iPhone, iPad, Mac, and other hardware businesses has slowed or flatlined. That hardware is still where the company makes most of its money, but the services business—including its financial services, but also iCloud, Apple TV+, Apple Music, and the App Store—is currently driving the growth that Apple’s shareholders demand.