The United States is not building enough transmission lines to connect regional power networks. The deficit is driving up electricity prices, reducing grid reliability, and hobbling renewable energy deployment.

At the heart of the problem are utility companies that refuse to pursue interregional transmission projects, and sometimes even impede them, because new projects threaten their profits and disrupt their industry alliances. Utilities can stall transmission expansion because out-of-date laws sanction these companies’ sweeping control over transmission development.

As we increasingly electrify our homes, transportation, and factories, utility companies’ choices about transmission will have huge consequences for the nation’s economy and well-being. About 40 corporations, valued at a trillion dollars, own the vast majority of transmission lines in the United States. Their grip over the backbone of U.S. grids demands public scrutiny and accountability.

Many Lines, Stable Power

High-voltage transmission lines move large amounts of energy over long distances, linking power generation to consumption. A transmission network contains webs of connections, which create a reliable, redundant power-supply system of massive scale.

At any given time, thousands of power plants supply just enough energy to transmission networks to meet demand. The rules that orchestrate the movement of electricity through this network determine who generates power, and how much. The goal is to keep the lights on at a low cost by utilizing an efficient mix of power plants.

Building more transmission increases the capacity and connectivity of the system, allowing new power plants to connect and more power to flow between transmission networks. This is

why utility companies are not embracing transmission expansion. They don’t want their power plants to face competition or their regional alliances to lose control over their networks.

Expansion can open opportunities for new power-plant and transmission developers to undercut utility companies’ profits and take control over the rules that shape the industry’s future. Utility companies are prioritizing their shareholders over the public’s need for cleaner, cheaper, and more reliable energy.

Old Alliances, Old Technology

Transmission networks in the United States, which move alternating current, were built over the last century largely by for-profit utility companies, and to a lesser extent by nonprofit utilities operated by governments and local communities. The lines tend to be concentrated around fossil-fuel reserves and population centers but are also shaped by historic utility alliances.

Where utilities agreed to trade energy, they built sufficient transmission to move power between their local service territories. As utility alliances expanded, transmission networks grew to include new members, but connections to nonallied utilities tended to be weaker.

The result of these generations-old alliances is a U.S. system fragmented into

about a dozen regions with limited connectivity between them. The regions are distributed across three separate and largely isolated networks, called “interconnections”–Eastern, Western, and most of Texas.

An October 2023

report from the U.S. Department of Energy reveals the severity of the problem. Based on studies conducted by national labs and academic researchers, the DOE calculated that interregional transmission in the United States must expand as much as fivefold to maintain reliability and improve resilience to extreme weather and provide access to low-cost clean energy.

The value of linking regional networks

is widely accepted globally. The European Commission in 2018 set a target for each member country to transmit across its borders at least 15 percent of the electricity produced in its territories. By the end of 2022, 23 gigawatts of cross-border connections in Europe were under construction or in advanced stages of permitting, with much more on the way.

Big Benefits

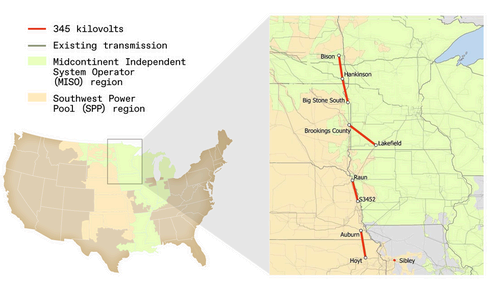

One of the main values of connecting regional networks is that it enables, and is in fact

critical for, incorporating renewable energy. For instance, four proposed high-voltage lines totaling 600 kilometers along the seam of regional networks in the upper Midwest could connect at least 28 gigawatts of wind and solar. These lines have been on the drawing board for years, but utilities in the neighboring regions have not moved them forward. The cost of the project, estimated at US $1.9 billion, may seem like a major investment, but it is a fraction of what U.S. utilities spend each year rebuilding aging transmission infrastructure.

Plus, adding interregional transmission for renewables can

significantly reduce costs for consumers. Such connections allow excess wind and solar power to flow to neighboring regions when weather conditions are favorable and allow the import of energy from elsewhere when renewables are less productive.

Proposed new transmission lines in the upper Midwest could connect at least 28 gigawatts of wind and solar to regional networks.Joint Targeted Interconnection Queue Study (JTIQ), MISO, SPP

Proposed new transmission lines in the upper Midwest could connect at least 28 gigawatts of wind and solar to regional networks.Joint Targeted Interconnection Queue Study (JTIQ), MISO, SPP

Even without renewables, better integrated networks generally lower costs for consumers because they reduce the amount of generation capacity needed overall and decrease energy market prices. Interregional transmission also enhances reliability,particularly during extreme weather.

In December 2022, Winter Storm Elliott

disabled power plants and pipelines from North Dakota to Georgia, leading to power outages in the South and billions of dollars in excess energy charges across the Eastern United States. Limited interregional connections staved off disaster. These links moved electricity to where it was most needed, helping to avoid the sort of catastrophe that befell Texas’s isolated electric grid the year before, when a deep freeze left millions without power for days.

Power, Profit, and Control

But from the perspective of utility companies, interregional transmission presents several drawbacks. First, building such connections

opens the door for competitors who may sell lower-priced power into their region. Second, utilities make far more money constructing power plants than building transmission lines, so they are reluctant to build connections that might permanently reduce their opportunities for future generation investments.

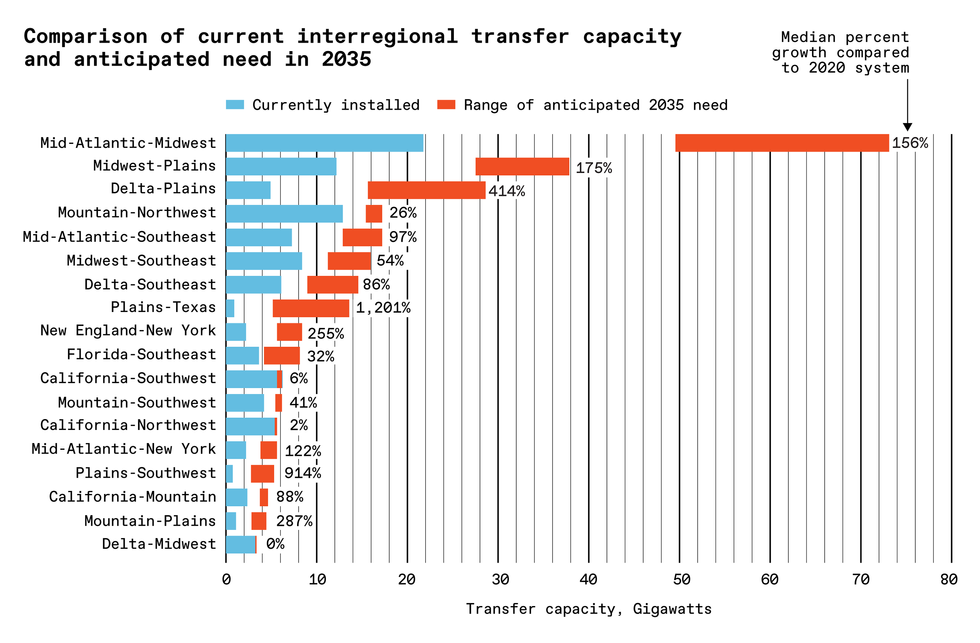

This comparison of current interregional transfer capacity and anticipated need shows that regions will need to increase transmission significantly, assuming moderate load and high clean energy growth.“National Transmission Needs Study,” U.S. Department of Energy

This comparison of current interregional transfer capacity and anticipated need shows that regions will need to increase transmission significantly, assuming moderate load and high clean energy growth.“National Transmission Needs Study,” U.S. Department of Energy

Third, major interregional transmission projects are less financially attractive to utility companies in comparison with smaller ones. For larger projects, utilities may have to compete against other developers for the opportunity to profit from construction. The utility industry sponsors

third-party oversight of such projects, while smaller projects are less scrutinized by the industry. Smaller projects are easier to pull off and more profitable than the larger ones, because they need fewer construction permits, face less review by regulators and industry, and are built by utilities without competition from other developers.

Fourth, interregional lines threaten utility companies’ dominance over the nation’s power supply. In the power industry,

asset ownership provides control over rules that govern energy markets and transmission service and expansion. When upstart entities build power plants and transmission lines, they may be able to dilute utility companies’ control over power-industry rules and prevent utilities from dictating decisions about transmission expansion.

Help on the Hill

Addressing the transmission shortage is on the agenda in Washington, but utility companies are lobbying against reforms. In September, Senator John Hickenlooper (D-Colo.) and Representative Scott Peters (D-Calif.) introduced the

BIG WIRES Act to force utilities or competing developers to build more interregional links. In 2022, Senator Joe Manchin (D-W.Va.) proposed an approach in which transmission developers recommend projects to the DOE. If the agency deems a project to be in the national interest, federal regulators could permit the project’s construction and force utilities to pay for it.

Meanwhile, the Federal Energy Regulatory Commission (FERC) is currently reevaluating how utilities develop and operate transmission networks and

may issue new rules in the coming months. In response, utilities are preparing litigation that could strip FERC of authority to impose any transmission rules at all. Their goal is to protect their profits and control, even if it comes at the consumer’s expense.

The U.S. Department of Energy is pitching in too. On 6 February, the department announced it would award $1.2 billion to support new high-voltage transmission lines, on top of the $1.3 billion it provided last fall to three interstate projects. Later this year, it plans to unveil its long-awaited

national plan for a large-scale transmission build-out. But without industry support or tens of billions in additional funding from Congress to build these projects, the agency’s vision will not be realized.

Leading With Technology

New business models and technologies offer hope. Investors and entrepreneurs are developing long-distance

direct-current lines, which are more efficient at moving large amounts of energy over long distances, compared with AC. These DC projects sidestep the utility-dominated transmission-expansion planning processes.

Many high-voltage DC (HVDC) transmission lines are already in operation, especially in

China and Europe. In fact, DC lines are now the preferred choice in Europe’s plans to unite the continent.

The United States lacks a coordinated national planning effort to connect regional networks, but developers can make progress project-by-project. For example, future DC lines will connect generators in

Kansas to a neighboring network in Illinois, stretch from Wyoming to California, and move wind and solar energy across the Southwest. Each of these projects will move renewable energy from where it can be generated cheaply to larger market2s where power prices are higher and in doing so, help bolster the country’s regional transmission networks.

These pioneering projects show that utility companies in the United States don’t have to build interregional lines, but they do need to get out of the way. Transmission rules written by utilities and their industry allies can

obstruct, delay, and add costs to these new projects. Streamlining federal and state permitting processes can encourage more investment, but cutting government red tape will not neutralize utility companies’ objections to interregional transmission.

U.S. regulators and Congress must press forward. Promising proposals that promote new business models and limit utility control are on the table. Our energy future is on the line.

From Your Site Articles

Related Articles Around the Web