Why it matters: Five years ago there were only two companies that made CPUs, today there are a dozen. Most of the new entrants went after the big, profitable data center market, but now competitors are coming for PCs. Nvidia and AMD are reportedly preparing Arm-based CPUs for PCs. With Microsoft opening up the market for Arm laptop CPUs, this spells bad news for Qualcomm today, and potentially bad news for Intel over the very long term.

As much as Intel has struggled in the data center for the past five years, they have managed to hold onto share in PCs. These products do not offer as rich margins as data center CPUs, but they are significant volume and go a long way to keeping Intel’s fabs utilized, and thus viable.

Editor’s Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

Intel has held onto its PC share largely due to two factors: the Intel brand and “channel control.” Consumers do not care about, or are even much aware of, semiconductor production processes or instruction set architectures, but they do know the Intel brand, the result of the company’s multi-decade advertising spending.

Selecting a PC CPU, for most consumers, is a maze of impenetrable specs, and so even if the latest AMD CPU was better on paper than the competing Intel CPU, Intel could still win out. Secondly, consumers are not buying from Intel, they are buying from one of the PC brands – HP, Dell, Asus, Lenovo, etc. Those companies are tightly coupled to Intel, in no small part due to the marketing payments they receive from Intel which make up the bulk of their PC profitability. Those companies are loathe to move too far away from Intel for fear of losing out on those subsidies.

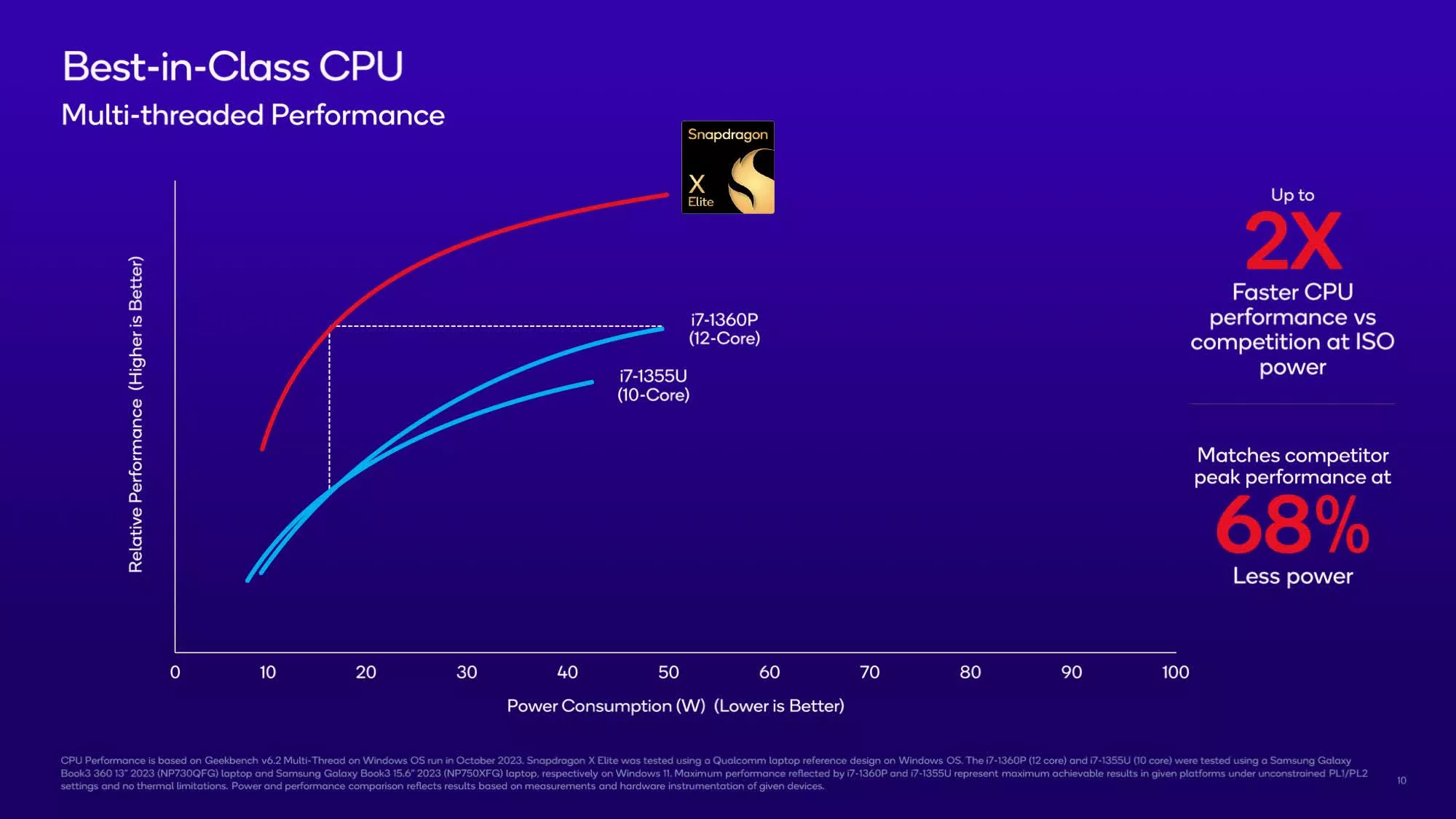

In fact, the only company to enter the PC CPU market in recent years is Qualcomm. Qualcomm has been working for almost a decade to prise open a share of the market with its Arm-based CPUs. This took a lot of work, porting Windows to Arm was never going to be easy, and the relationship between Qualcomm and Microsoft has been strained as a result. That said, Qualcomm now seems to have a fairly competitive CPU.

We have written a bit about Qualcomm’s efforts here, and the summary is that it is unlikely Qualcomm can win meaningful share in this market any time soon, unless on-device AI support soon becomes very important to consumers. This seems unlikely, but Qualcomm seems to have the best laptop-grade AI cores (aka, NPU) on the market for the moment.

Qualcomm has come under intense heat for its long investment in PCs, not least from us. However, one of the key selling points Qualcomm had working in its favor was the exclusive nature of its relationship with Microsoft. For all these years, Qualcomm was the only company Microsoft worked with to port Windows to Arm. Which is why the Reuters story about Nvidia and AMD Arm CPUs is so important.

Microsoft has moved on and will support other vendors’ CPUs for Windows, ending Qualcomm’s exclusivity. Critically, both of the new entrants have much deeper Windows roots than Qualcomm. Qualcomm has clearly struggled to get the software ecosystem around Arm-Windows up and running, and we have to suspect that the new entrants will have a much easier time of it, in some part due to the work that Qualcomm has already done. We have to think that Qualcomm will now revisit its efforts in PCs. A small share of a market that is not growing, but which has suddenly become more competitive – this is not the kind of markets where Qualcomm excels.

And what are we to make of Nvidia and AMD’s efforts? AMD’s entrance frankly just confuses us. They already have a decent market share in PC laptops, but decent in the sense that they have always been a distant #2 to Intel despite years of work and lots of Intel stumbles. We have to imagine they did this in part as a goodwill effort to their long-time partner Microsoft (something that Qualcomm needs to learn how to do).

Is AMD really going to spend serious marketing dollars to win share here, when there is a good chance they will just be cannibalizing their own share? What is the average consumer going to do when they compare an AMD x86 laptop to an AMD Arm laptop? They are going to be confused is what, and probably move down the shelf to the Intel brand they know.

On the other hand, Nvidia has at least a credible case. They already have a strong consumer brand, admittedly one centered on gaming, but that counts for a lot. They also get the benefit of doing a favor for Microsoft, a big customer and partner, and they have no competing product to cannibalize. We could even make the case that they will invest in marketing here because an Nvidia CPU/GPU combination laptop could be a real product category. We know many gamers who would probably flock to pick one up.

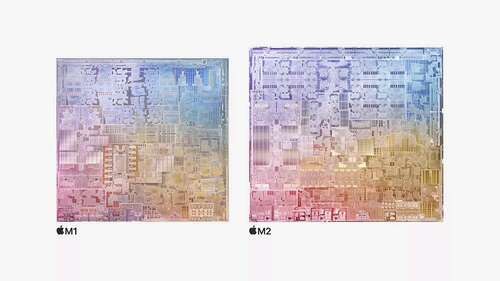

All of which brings us to the real topic of this piece – Apple. We are constantly surprised that in so much discussion of PC CPUs the semis vendors avoid mentioning Apple – a giant blind spot. We have even heard Intel executives claim that “we do not compete with Apple.”

Apple has steadily chipped away at PC market share, and most critically at PC profitability share. The average Windows PC sells for at least $500 less than the lowest priced Mac. Apple consumes the vast bulk of personal computing profitability, just as they do in mobile phones. We have not crunched the data lately, but we are fairly certain that shift to Apple silicon’s M1 CPU has only exacerbated this gap. This problem is so large for the other laptop makers that it is almost easier not to think about it.

Microsoft is keenly aware of the issue, and while their fortunes do not depend on the PC market so much, it is still a large, important market for them both in terms of profitability and broader strategy. They need an answer to the lack of PC profitability and seem to have landed on the CPU as an important element in their strategy. There is some logic to this, the M-powered MacBooks enjoy a reputation for being more power efficient than Windows laptops. However, we know many in the Windows supply chain who seem to fetishize Arm CPUs – if only we had Arm CPUs we could compete better with Apple. We think this misses the mark badly. Apple succeeds because it can tie its software to its silicon so tightly – the Arm part is not the differentiation.

Be that as it may, the new Windows CPUs may inject some life into the market. Arm-based chips succeeded in mobile in large part because of the many semis vendors competing here. Arm makes a big deal about its mobile ecosystem (in its IPO prospectus, for instance), all those companies competing led to faster innovation and advancement.

Also read: Intel boss Pat Gelsinger calls Arm’s PC threat “insignificant”

This may come to pass in laptops, too, especially if Nvidia and AMD are just the first entrants. A healthy Arm-Windows CPU ecosystem has the potential to spark a new round of innovation in Windows laptops, by allowing deeper segmentation. Nvidia can take the high-end with expensive gaming laptops, AMD and Qualcomm can find their niches, someone will take the low-priced approach and give Google Chromebooks a run for their money.

Too soon to tell if this will actually come to pass, but the possibility now exists. For the moment, we think Intel is fairly sheltered, especially as it starts to bring better products to market with its improved manufacturing. Over the longer term though, if we start to see healthy competition from the Arm CPU makers, Intel could face a real challenge.