How many points will AI add to Microsoft’s financial scoreboard?

That’s the big question going into the Redmond company’s earnings report on Thursday afternoon, for the third quarter of the company’s 2024 fiscal year.

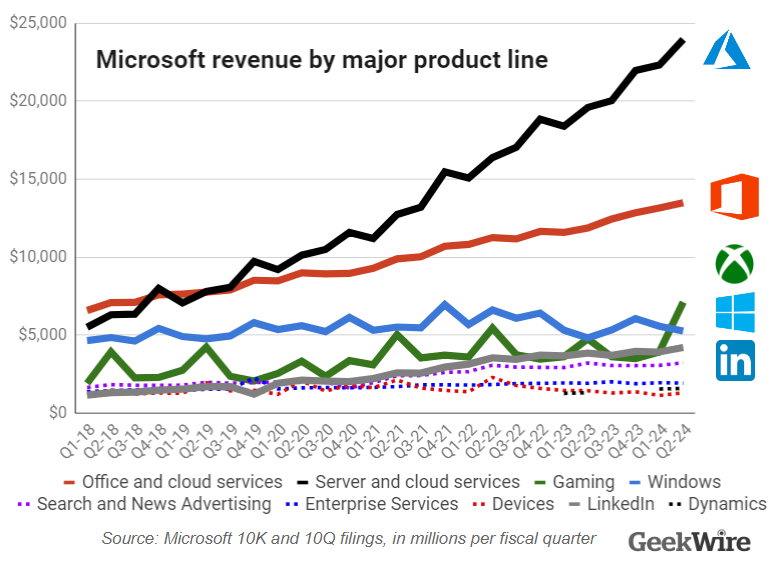

In the second quarter, Microsoft reported a 30% increase in revenue from its Azure cloud platform and related services, which included a 6 percentage point boost from artificial intelligence. That lift came primarily from Microsoft’s Azure OpenAI service, which provides access to models from Microsoft’s key AI partner.

Analysts and investors will be watching that number closely in the upcoming earnings report, but there will be a new AI benchmark to monitor. Revenue from Microsoft 365 Copilot, its AI tool for businesses, will be included in the Office Commercial product line, promising to make that a pivotal line in this week’s report.

Microsoft 365 Copilot launched Nov. 1, too late to make a meaningful difference last quarter, but the upcoming results will include a full quarter of sales. The potential for this product line has been on the minds of investors since last year, when Microsoft announced pricing of an additional $30/user per month.

It’s a key barometer for AI’s broader economic potential.

“If you have an economy that’s around $100 trillion, we may have $7- to $10-trillion more of GDP growth driven by this next generation of AI technology,” Microsoft CEO Satya Nadella said at the time of the Microsoft 365 Copilot pricing announcement, describing it as “a massive partner opportunity.”

In the latest example of the momentum from AI, Microsoft on Tuesday announced a $1.1 billion spending commitment from Coca-Cola as part of a five-year strategic partnership focusing on cloud and AI technologies.

Big picture: Microsoft is the most valuable publicly traded company, with a market capitalization of more than $3 trillion. Its shares are up more than 44 percent over the past year, trading at more than $407 as of publication time.

The company had about $81 billion in cash and equivalents as of the end of 2023, down from $111 billion six months before that, following the completion of its $68.7 billion all-cash purchase of game giant Activision-Blizzard.

More recently, Microsoft has been opting for strategic partnerships and investments to expand into AI, rather than outright acquisitions, seeking in part to avoid the regulatory hurdles that it encountered in the Activision deal.

ChatGPT maker OpenAI represents the company’s biggest AI investment. More recent examples include a $1.5 billion investment in G42, an AI holding company based in the United Arab Emirates; and its hiring of key execs from Inflection.ai, including DeepMind co-founder Mustafa Suleyman, as part of a $650 million deal.

These types of investments by Microsoft and other tech companies are drawing regulatory scrutiny nonetheless.

Meanwhile, legal disputes such as the New York Times’ copyright lawsuit against Microsoft and OpenAI promise to test the tactics used by the major tech platforms to develop the large language models driving much of their growth.

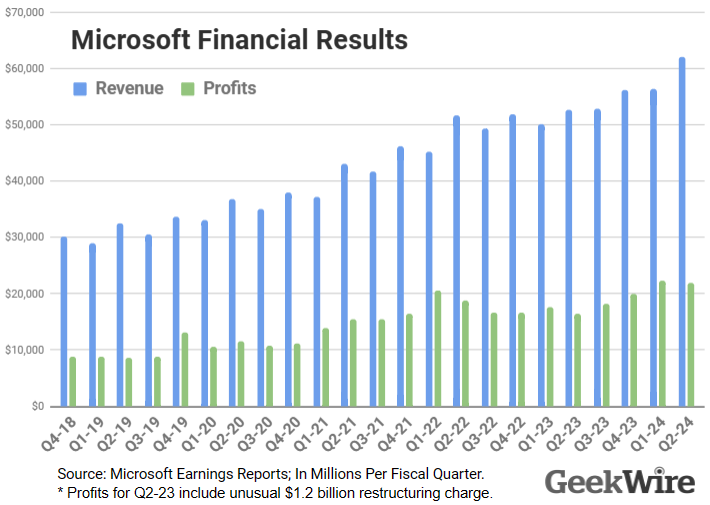

Wall Street expectations: Analysts expect the company to report earnings of 2.83 per share, up more than 15% from 2.45 per share a year ago, on revenue of 60.77 billion, up more than 15% from $52.9 billion a year ago.

Brad Sills, research analyst at BofA Global Research, wrote in a research note that the firm expects a “healthy 1% upside” to its quarterly revenue estimate of $60.5 billion based on its calls with key Microsoft partners, primarily driven by Azure and Microsoft 365 strength, including growing usage of the company’s AI products.

“Channel feedback suggests some uptick in Copilot activity, primarily in the pipeline, but also early adoption,” Sills wrote, citing evidence of increased average selling prices for Microsoft 365 enterprise licensing plans.

Wedbush analyst Dan Ives, previewing Microsoft earnings in a note to clients, said the growing demand for AI is likely to translate into “major momentum heading into the next 6 to 12 months as AI use cases explode” for businesses.

“We view this as Microsoft’s ‘iPhone Moment’,” Ives wrote, “with AI set to change the cloud growth trajectory in Redmond the next few years and recent checks giving further confidence in this dynamic.”