Maximum Entertainment consolidated its labels into a unified brand and unveiled its robust game launch roadmap for 2024.

Stockholm, Sweden-based Maximum Entertainment is the only publicly traded game company that I know is run by a woman — CEO Christina Seelye. In an interview with GamesBeat, she said the company has made stides in the past couple of years and is now announcing the unification of its global publishing labels and presenting a robust roadmap for 2024.

The company, previously structured with four distinct publishing labels, has consolidated its identity under the unified banner of Maximum Entertainment, which has published more than 300 games to date and has 100 more in the works.

The company is one of the few that is still publishing physical games for retail locations. The previous labels — some acquired over the years — were Maximum Games, Modus Games, Just For Games and Merge Games. Now it has a single development division, Modus Games. Some jobs were cut in the past year — perhaps 15% — as this process happened, but the company now has about 210 people, which is fairly stable.

GB Event

GamesBeat Summit Call for Speakers

We’re thrilled to open our call for speakers to our flagship event, GamesBeat Summit 2024 hosted in Los Angeles, where we will explore the theme of “Resilience and Adaption”.

“We are extremely happy to share some big news today, including exciting new partnerships, as we step into the phase of true global integration,” said Seelye. “Working together as a single company with a shared mission, we are laser focused on the future and the opportunities it presents.”

Getting things in order

The company took some time to get its house in order.

“It’s been an interesting time in history. And so, for us, in particular, going through the integration involved combining seven different acquisitions into one unified company, in the midst of all of the other headwinds that we saw in the industry,” Seelye said. “It’s been a challenging year. But we’re very excited to be on the other side of it — at least for us. Not necesssarily for the industry.”

She added, “We’ve done the hard work to get us to where we are today,” she said. “We’re getting back to games and announcing them. Over this past year, it has been about infrastructure building and getting everybody onto one ERP system and harmonizing the tech stack across all of the companies.”

Maximum Entertainment reported its earnings for 2023 today, and it was able to increase its EBITDA (earnings before interest, taxes, depreciation and amortization) by 40% in 2023 compared to 2022.

“In a really rough year, we really executed and that is just because of the phenomenal executive team that that we’ve built here that is focused on the business and made sure that we are getting the games out the door and that we were generating the revenue that we needed toand it really shows in the numbers,” Seelye said.

Owned IP percentage

One positive change is that the percentage of revenue that comes from the company’s own IP and its own studios doubled from 5% of revenue in 2022 to 10% in 2023. The company is on track for 30% by the end of 2025.

“A lot of what you do in order to get games out the door is the not sexy stuff. It’s a lot of creative work, and we wouldn’t be where we are without the phenomenal talent and creativity of the developers,” Seelye said.

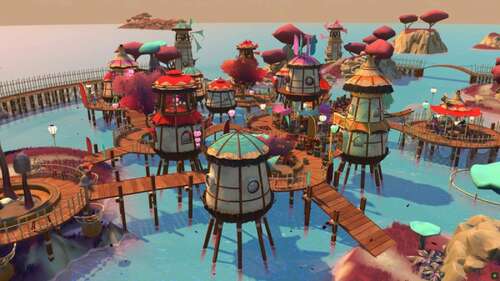

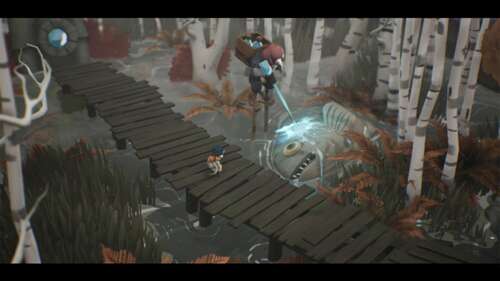

Seelye said the company has a new game in the works dubbed Selfless. It will have a fresh and intriguing gameplay that will diversify Maximum Entertainment’s portfolio. It also has a release date of today for Smalland: Survive the Wilds 1.0, a highly anticipated game that promises immersive gameplay experiences.

Maximum Entertainment also has an update for Maximum Football’s development, a release date of May 23 for Morbid: The Lords of Ire, a release date of April 19 for Whisker Waters and the first reveal of Leo: The Firefighter Cat.

As a strategically realigned global entertainment company that is now centralized for full integration, Maximum Entertainment seeks to increase intellectual property ownership to 30% of revenue

by 2025 and expand its reach in transmedia entertainment. It’s about 10% owned IP at the moment.

Maximum Entertainment currently has over 100 games in its content pipeline planned across PC and consoles, including 15 of its own IP, emphasizing in-house development of competitive fighting games, live service, and action/adventure titles.

As for the 100 games in development, Seelye said the company is a portfolio play, and no particular hits account for the vast majority of revenues among the 300 catalog titles. The company has three lines of business. The sub publishing business involves coming in to publish another developer’s game late in the development process, mostly by taking the game to physical retail. Much of the company’s catalog titles are in this category, with partners like Kepler Interactive and Scott Games (maker of Five Nights at Freddy’s). Sub publishing has historically been the largest business.

Publishing business

The company also has a publishing business, where it invests heavily in the game and does a lot of the work to get it out the door. In this category, the company usually doesn’t own the IP but it has the monetization rights. Selfloss is one of those titles coming soon.

And the company is also publishing its own IP with its own internal development studios. Smalland 1.0 is one of those titles — a survival crafting game that will be heading to PlayStation and Xbox. The company will also build a multiplayer fighting game for the Avatar: The Last Airbender universe. That brand is probably the best known one in the portfolio. About half the team is on the publishing side, and half is in development studios in places like Hungary, Romania, Sweden, the U.S. and Brazil.

While physical games are tapering off, they’re not for Maximum Games, as it is benefiting from consolidation in the industry. The company will add collectibles to make it valuable for those who still want to buy physical games.

“We are your best choice for this area of the business, and we have the infrastructure and the relationships,” she said. “We benefit from being the last one standing.”

About 65 games are from the sub publishing area among the 100 in the works. The budgets are below $15 million per game.

“We’re not putting all our eggs in one basket. We don’t want to go all in on one game. We are more of a portfolio. And so that’s how we look at the business. That’s how we run our business,” she said.

For its own IP, the company focuses on games with deep mechanics, games that can be played for a long time, with high replayability and social features. It targets the games at the PC and console market.

“That’s where we are focused. We want to make sure that regardless of the macro environments that we’re delivering quality games. In order to do that, we need to be disciplined about the development approach,” Seelye said. “I do think that it is hard to get a game funded today. The free money is over. Now you have to be making money in order to invest in your next game. And so that comes with some hard decisions. But I think that that’s where our structure of having these different lines of business allows us to generate revenue, and generate some margin with our self publishing and our physical business.”

Industry outlook

As interest rates change and access to capital is different, game companies have to figure out how to be more creative about getting good games out the door in an efficient and disciplined way, Seelye said. There are about 30 fewer game publishers than a year ago.

She thinks there will be more focusing on fewer projects being funded at the same time. Seelye believes there were too many games but one of the problems with that was poor management. Seelye believes the industry had crunch problems because there weren’t enough good managers who said “no” to demanding work schedules in order to take better care of workers.

“I think that now you’re going to see a little bit more focus on on taking care of the people that are making them,” Seelye said.

As for AI, Seelye said that game developers and gamers have high expectations for AI, since we’ve been playing games with AI for a long time.

“And so I think that do I think that they’re going to be able to completely do full AI games and have them be compelling and successful. I don’t think we’re there yet. That said, I think that there’s a lot of really good technology to help be more efficient. And we’re absolutely looking at those things,” Seelye said.

VentureBeat’s mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Discover our Briefings.