A German startup has secured new funding for a peculiar twisted-looking reactor that could prove a quicker path to clean, virtually limitless fusion energy.

Proxima Fusion has raised €20mn as it looks to bring its designs for the so-called stellarator fusion reactor to life.

“We are working to deliver a demonstrator of net-energy production in continuous operation by 2031, and a first-of-a-kind power plant in the mid-2030s,” Dr Francesco Sciortino, CEO and co-founder of Proxima Fusion, told TNW via email.

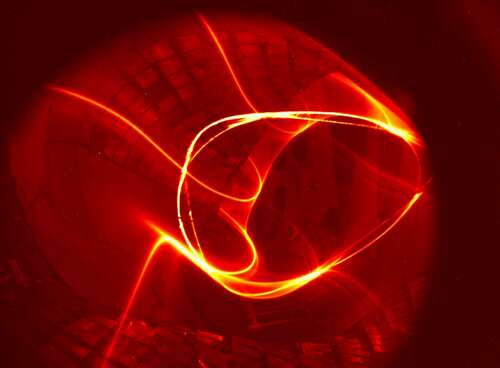

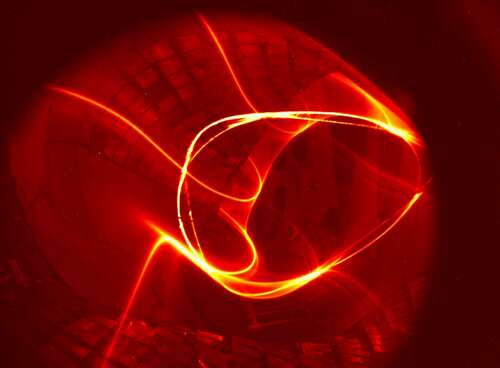

Much like the more well-known tokamak, a stellarator confines plasma using giant magnets. But instead of generating electric currents inside the plasma, stellarators use external coils to make a twisting magnetic field.

Huge electromagnets outside the plasma chamber give stellarators their bizarre shape. Tokamaks look more like a doughnut.

Stellarators have several advantages over tokamaks. They need less power to operate and make the plasma easier to control. Tokamaks are better at keeping plasma hot. But stellarators are better at keeping it stable. This stability is critical for a viable fusion energy plant.

The biggest drawback is complexity. Stellarators are notoriously hard to design and build. This is why they were largely set aside in the 1960s for their simpler cousin, the tokamak.

However, advances in computational power are closing the gap.

AI-enabled fusion design

“Simulation-driven engineering has been a key feature of Proxima Fusion since its inception,” said the company’s co-founder Martin Kubie. “Now, AI-enabled design has taken the centre stage.”

AI lets engineers simulate plasma’s behaviour in ways that weren’t previously possible. Instead of building thousands of reactors and hoping they will work, AI-powered supercomputers allow scientists to run countless simulations before arriving at a winning design.

“Proxima Fusion is strong in automated design, AI engineering, and high-temperature superconducting magnets. These strengths give us unwavering confidence in their ability to make steady-state fusion energy real,” said Benjamin Erhart. He is a general partner at UVC Partners, one of the startup’s investors.

Munich-based Proxima made history last year as the first company to spin out from the esteemed Max Planck Institute for Plasma Physics. The institute is solely dedicated to fusion research. It has more people working on plasma physics than MIT. It is also home to the world’s largest stellarator.

It’s called the Wendelstein 7-X. The machine is the result of 27 years of research and design (and €1.3bn of investment), aided by recent advancements in supercomputing and state-of-the-art plasma theory. As you can imagine, it provides an ideal testbed for Proxima’s technology.

The race is on

Proxima Fusion will now ramp up R&D and expand its team with “world-class engineers and physicists.”It has already attracted talent from the likes of MIT, Harvard, Tesla, and Google.

Proxima undoubtedly benefits from the wealth of knowledge based at the Max Planck Institute. Yet, it just is one of over 40 startups worldwide racing to commercialise fusion energy.

Marvel Fusion, also from Germany, and First Light Fusion from the UK, are working on a form of fusion called inertial confinement, that fuses atoms together using projectiles. Oxford-based Tokamak Energy is looking to commercialise the conventional tokamak, while Stockholm-based Novatron is designing a “mirror” reactor.

Some of these startups, particularly those based in the US, have attracted over a billion dollars in funding. According to the Fusion Industry Association, nuclear fusion startups pulled in $6bn in investment last year alone.

Fusion has long been seen as a “20-year-away” technology. But, in a recent survey by the International Atomic Energy Agency, 65% of experts said they think fusion will make electricity for the grid at a viable cost by 2035.

Swiss deep tech and software fund redalpine led Proxima’s “oversubscribed” funding round. Bayern Kapital, DeepTech & Climate Fonds, and the Max Planck Foundation also joined in. Existing investors — including founder-led Plural Platform, UVC Partners, High-Tech Gründerfonds, Wilbe, and TOMORROW of Visionaries Club — doubled down on their pre-seed buy-ins.