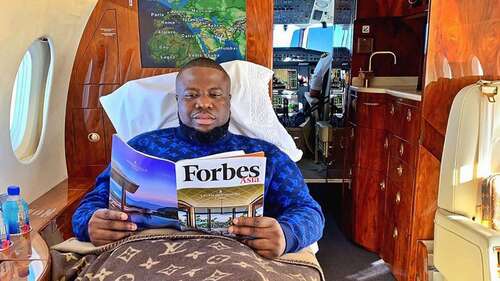

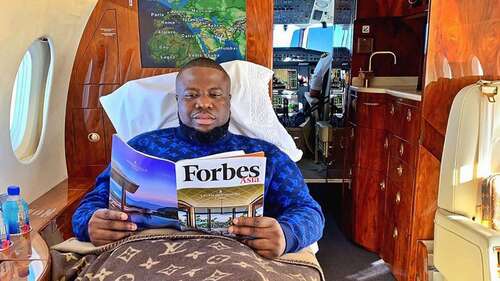

On the shallow surface of Instagram, Ramon “Hushpuppi” Abbas was a quintessential influencer. The flamboyant Nigerian portrayed a lavish lifestyle of private jets, luxury cars, and designer clothes. His glamorous adventures had earned him over 2 million followers and millions of dollars. But his posts concealed a darker reality.

The 41-year-old was “one of the most prolific money launderers in the world,” according to the FBI.

By his own admission, Hushpuppi conspired to launder over $300mn in just 18 months. One of his alleged clients was a certain Kim Jong Un — the supreme leader of North Korea.

With his penchants for cybercrime, cryptocurrency, and social media, Hushpuppi embodied a new era for his profession. Tech was transforming money laundering.

His escapades caught the eye of Geoff White, an investigative journalist based in the UK. White had earned acclaim for The Lazarus Heist, a podcast and book about a cybercrime collective linked to the North Korean state.

In 2019, the group broke into Malta’s Bank of Valletta.

“At that stage, they’re in the bank’s vaults,” White tells TNW. “They can take the money out, but they need to send it somewhere. They can’t send it to Kim Jong Un’s bank accounts — that would be pretty obvious. So instead, they dial up Hushpuppi.”

Hushpuppi was open for business. The fraudster provided bank accounts to wash the stolen money. Prosecutors said he helped launder around $14.7mn from the raid.

The Maltese heist exposed the value of a tech-savvy money launderer. Even virtuous hackers backed by a nation-state needed an ally like Hushpuppi.

“The North Korean hackers, allegedly, are extremely good at breaking into banks and financial institutions,” says White.

“Once they get there, they’re not necessarily so good at spiriting the money away. For that, they need collaborators and accomplices who understand how international finance works, how bank accounts work, and how money mules work. So they turn to a whole bunch of dark web accomplices.”

These accomplices became the subject of White’s forthcoming book, Rinsed. At the TNW Conference on June 20-21 in Amsterdam, he’ll discuss his investigation in detail. Ahead of the event, White provided a sneak peek at the findings.

Hushpuppi’s social media fame made him an unusual accomplice. Using Snapchat and Instagram, he recruited money mules to help transfer stolen money from victims to criminals. As the profits filtered through a net of bank accounts, they became harder to trace.

Prospective money mules were offered big bucks for tiny tasks — and a window into far larger fortunes. With his theatrical displays of wealth, Hushpuppi was a living billboard for the potential rewards.

“I realised that it wasn’t just cyber criminals that these high-tech money launderers were helping out.

Younger followers are particularly susceptible to the temptation. In 2019, researchers found that under-25s are six times more likely to fall victim to criminals using social media platforms than over-50s.

“It’s not just that the social media channels give you a way to find people and communicate with them,” White says. “It also allows the mule recruiters to show off how much money you can make; to show this extravagant lifestyle, driving Bentleys, wearing Yeezys. And that’s a powerful tool for recruiting money mules.”

It certainly proved powerful for Hushpuppi. According to the FBI, the charismatic felon built a global network of mules who moved money on his command. They would use either their existing bank accounts or open new ones. The cash would flow between them via electronic transfers.

It was a lucrative operation, but it came with costly drawbacks.

Investigators used Hushpuppi’s Instagram and Snapchat to track his whereabouts and collect evidence. The findings contributed to a sentence of 11 years in federal prison and an order to pay his victims $1.7m in restitution.

Still, that was chump change next to the sums circulating in tech’s biggest contribution to modern money laundering: cryptocurrency.

Cryptocurrency can be a force for good. It can bank the unbanked, disrupt centralised financial systems, and add privacy to transactions. All of these attractions appeal to law-abiding citizens. Unfortunately, they’re also highly alluring to money launderers.

With no central authorities to validate and monitor transactions, crooks can exploit regulatory gaps and quickly move money across borders.

Because vast sums constantly circulate at fluctuating valuations, the dirty money is also easier to hide. When the cost of an individual coin can reach a growth rate of 10,000%, holders have a handy explanation for sudden increases in wealth.

Accounts are also quick and free to open. By using computer scripts, it’s possible to execute large-scale money laundering schemes with thousands of transfers.

It’s a process that’s becoming increasingly accessible. Specialised cryptocurrency money laundering services have removed the need for technical expertise.

According to Chainalysis, illicit addresses sent nearly $23.8 billion of cryptocurrency in 2022 — 68% more than in 2021. Mainstream centralised exchanges were the biggest recipients, accounting for just under half of all the funds.

Another reason for this growth is the cost savings. A traditional money launderer could charge a first-time client a whopping 60% cut of the proceeds. White says. Even regular customers can pay 40-60%.

In the world of cryptocurrency, the fees can drop dramatically. White knows of brokers who charge as little as 4%. In exchange, they convert cash into crypto, scrub away the dirt through various transactions, and then send the cleaned money to the client’s account.

“Depending on the scale of the enterprise, that can mean millions of pounds more profit than you would have if you’d used traditional money launderers,” he says.

Sometimes the cryptocurrency industry is not only a facilitator for money laundering. It can also be a target.

Another application for cryptocurrencies is blockchain-based games. Using a business model dubbed “play-to-earn,” these games reward successful players with tokens and NFTs that have real-world monetary value.

One of the genre’s most popular titles is Axie Infinity, which has attracted millions of players. It’s also caught the attention of cybercriminals.

In March 2022, hackers stole over $600mn worth of cryptocurrency from the digital ledger that powers Axie Infinity. Investigators soon pinpointed a culprit: North Korea’s Lazarus Group.

The gang had pulled off one of the biggest-ever crypto heists. To launder their stolen fortune, they turned to a service called Tornado Cash.

Tornado Cash is what’s known as a “crypto mixer.” These services collect digital assets from various users, blend them together, and then redistribute the funds to the designated recipients.

“It helps people protect their privacy, which in crypto transactions is important,” White says. “Unfortunately, it also helped the North Koreans successfully launder $488 million of the stolen money

A technology invented by libertarian coders had been exploited by one of the world’s most authoritarian regimes.

In August 2022, the US government blacklisted the service. Two founders of Tornado Cash were charged with laundering more than $1bn in criminal proceeds.

The Lazarus Group had created another headline-grabbing case of high-tech money laundering. But they were merely the tip of the iceberg.

In his research for a new book, White discovered that the new techniques were going mainstream.

“I realised that it wasn’t just cyber criminals that these high-tech money launderers were helping out,” White says. “It’s all types of criminals: drug dealers, prostitution rings, child sexual abuse rings. They all generate money and they all have to launder that money somewhere — and often that money is dropping into the same funnel.”

As for Hushpuppi, he remains detained in the US, but his legacy as an influencer lives on.

“I hope someday I will be inspiring more young people to join me on this path,” read one of his final Instagram posts.

The advances in money laundering suggest his wish has come true.

Geoff White is speaking at this year’s TNW Conference on June 20-21 in Amsterdam! If you also want to experience the event (and say hi to our editorial team!), we’ve got something special for our loyal readers. Use the code TNWXMEDIA at checkout to get 30% off your business pass, investor pass or startup packages (Bootstrap & Scaleup).