Ever since the advent of the app stores, game companies have been paying the 30% “tax” on digital purchases for the mobile app stores. But heartened by legal rulings, companies like Xsolla have been creating alternative web shops to help developers recover lost revenues.

And rival Coda Payments stepped into the picture with the launch of Activision Blizzard’s first-ever Call of Duty: Mobile Web Store in 44 countries, giving the company (now owned by Microsoft) a way to recover direct connections with players. I talked to Shane Happach, CEO of Coda, about this.

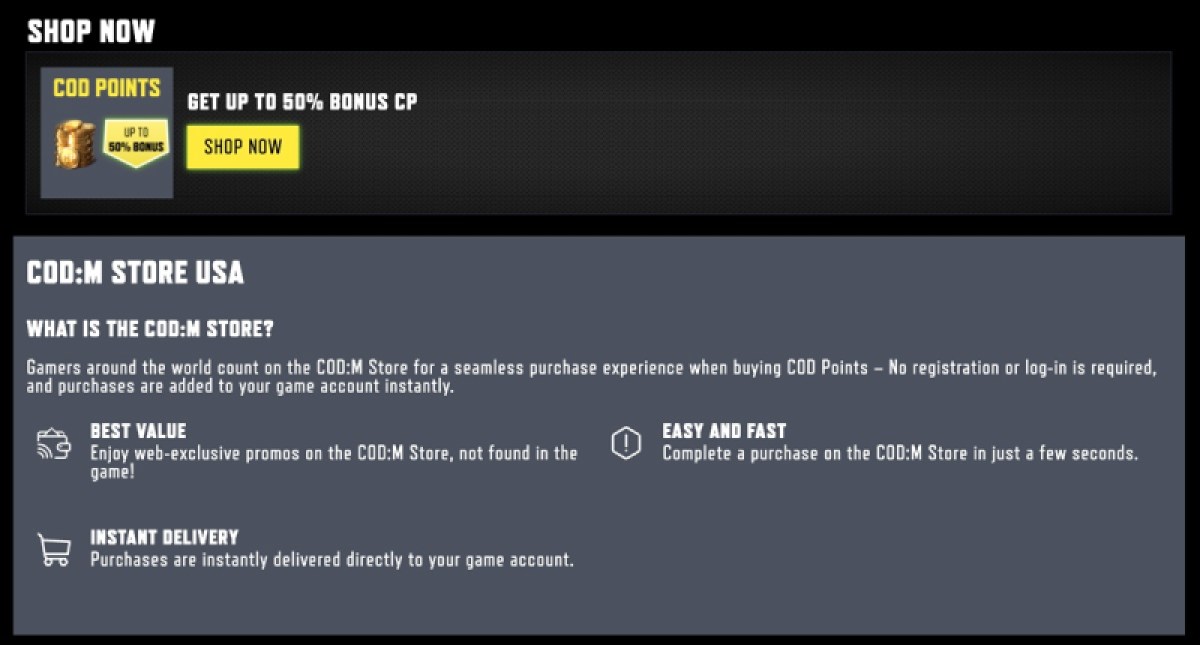

In November, Coda launched a service called Custom Commerce, a web store system that allows companies and creators to sell and process payments directly with consumers. The system lets merchants adopt the so-called direct-to-consumer model, in which a brand or manufacturer sells its own products directly to end users.

This wasn’t really possible until Epic Games challenged the alleged monopolies of the app stores for Apple and Google, which charge a 30% royalty on every app sale that goes through their stores. Epic lost its case against Apple except for one ruling: Apple could not muzzle game developers like Epic from advertising lower prices on web shops that were off the store.

GB Event

GamesBeat Summit Call for Speakers

We’re thrilled to open our call for speakers to our flagship event, GamesBeat Summit 2024 hosted in Los Angeles, where we will explore the theme of “Resilience and Adaption”.

Then Epic Games prevailed in its antitrust lawsuit against Google, further reinforcing the direct-to-consumer strategies. And now the European Union’s Digital Markets Act will go into effect shortly, preventing “gatekeeper” companies from monopolizing digital stores.

Happach talked about the monetization scene for games, how the payments space is opening up, and what that means for the prices that consumers will pay for their digital items in the future.

Here’s an edited transcript of our interview.

GamesBeat: The last big topic we covered was the Activision mobile web project.

Shane Happach: That was our big product launch of the year, not that long ago. We went from public launch to soft launch to full launch in about a month. It’s coming up on 30 days that the store’s been live. It went live in Japan last week, which was one of the last geographies they wanted to roll out. It’s been fun to work on. So far it’s successful. The client is happy, which means we’re happy.

GamesBeat: Is there a pretty solid growth phase still happening for Call of Duty Mobile? I know that Warzone for mobile is still in the works.

Happach: When I talk to the Activision guys, they’ve said they were expecting Call of Duty Mobile to mature and trail off, and Warzone was the answer for that. But not only has it not tailed off, it’s still showing late stage growth. At the release of the game–it’s two things. Obviously, like all releases, they had a lot of bugs and it’s taken longer to get the game tested. But what they told me was that the pressure to release the game is lower, because of the enduring success. They can take their time and get it right because they still see such good engagement from Call of Duty Mobile.

GamesBeat: How did that all come together, especially in the context of the European Union acting to control the gatekeepers?

Happach: I’ve been at Coda since June of last year. The relationship between Coda and Activision predates me. It started in the more classic Coda product, where Activision listed some of its content on our consumer-facing shop in a couple of geographies where they were underpenetrating, in southeast Asia. That was successful for them and for us. That’s how the relationship build started.

As more and more publishers, predominantly in China, started experimenting with first-party stores, we engaged Activision. They said this was something they wanted to do, particularly since the climate was swinging more favorably towards publishers controlling their own destiny. But they didn’t want to build it themselves. So could we build it for them? Of course we could. It became a year-long collaboration, which we’ve now turned into a product line, and we hope others will follow suit.

GamesBeat: Does it normally take you that long, a year, to work on a new web shop? Or was this a bigger undertaking?

Happach: It’s not the technical development. It’s more the ideation. We’re building something that can be used by many companies, whereas each larger publisher will have certain things they want. To be honest, some of the elapsed time was due to Activision’s own corporate goings-on. The deal was off and then on. It was on right at the time we signed the agreement. So how did we make sure nobody at Microsoft was bent out of shape about it? It was just more classic enterprise stuff. It took a year from idea to delivery, but the engineering effort was obviously less than that. So much of it is reusable conceptually for other publishers, so the cycle time is coming way down for future customers. The launch customer obviously takes a lot of care and attention.

GamesBeat: Are you able to describe any of the success so far, the results that have come from this?

Happach: The way we set up the commercial projections has to do with what proportion of customers are migrating from the app store into the web store. Most publishers set a year one goal of something around 10%, with the upper bound of that closer to 30%. That’s a wide range, depending on how much marketing effort they put in and how successful it is. Against that benchmark, a couple of months in, we’re meeting and exceeding that goal. That’s why we’re both happy.

The second thing to say about that is, we’re able to track people that have never transacted with Coda before. In Activision’s eyes we’re bringing them a new player. Sometimes we’ve built up audiences in certain geographies through the work that we’ve done with Coda Shop and so on. The pleasant surprise has been that this isn’t just people migrating from Apple and Google because of a better deal. There’s also some player discovery going on. We’re bringing net new Call of Duty Mobile players, which is exciting. People transacting for the first time on the web store, as opposed to repeat players migrating from the app stores.

GamesBeat: How do you communicate the awareness to them, that maybe you get a better deal on the web store? Are you able to do that yet, especially on iOS?

Happach: You can’t really message people in the app, but obviously there’s an active player community. If you look on Reddit, for example, you can see thousands of posts from people saying, “Is this legit? Have you used it? What was your experience?” We have a couple of player champions saying, “It’s great. I leveled up. I spent this much and got this and that. It worked seamlessly.” Or, “I had a problem, but I contacted customer service and they sorted it out right away.” We’re getting a lot of grassroots marketing. Activision is able to do promotional activity on the web store that might not be running concurrently in the app store. That’s a bit of their marketing calendar plus our muscle as well.

GamesBeat: Are they able to say anything in their traditional app about how you can go to the web shop and get lower prices?

Happach: No, not yet. There are a number of people leading the charge. The Spotify billboards–I think some people are leaders on that and some are followers.

GamesBeat: With the Supreme Court not hearing the case, it seems like they’ve let the lower court ruling stand, that this is permissible. Maybe that hasn’t yet translated into policy?

Happach: We’re all reading the same stuff, the same analysis of what goes on. Which isn’t always the same thing as whatever’s enforceable. There’s still a business relationship between Apple, Google, and all these developers. Very few people are prepared to have that relationship go to zero in order to win an ideological point. Everything has its limits. A lot of these companies are just using it as–maybe the trade winds, if you can call it that? A shift in mindset, a shift in mentality, and a bit more of a balancing of power.

If you start to get 30-40-50% of your purchases occurring outside the app store, you have enough competition where, regardless of what a court says, you get into a more normal economic situation where prices and other things normalize in order to get the share that Apple and Google want. If they want an 80-90% share of purchase traffic, they can get it, but the deal needs to change. If they don’t, again, it probably won’t go to zero, but there will be all sorts of soft incentives for consumers and content creators to invest in infrastructure that allows people to transact off the app store.

GamesBeat: What about Apple’s response to the EU, where it was going to levy a 27% tax on off-app-store transactions? Mark Zuckerberg said in their earnings call that this negates any advantage of going to web shops. It seems like a policy thing that might be struck down by the EU. Maybe some people are hoping for that. But does this affect your customers in some way for the time being?

Happach: It’s a bit like what I said earlier. People are having increasing confidence to experiment with things that aren’t the original 30% terms. No one I’ve spoken to has described this as any sort of concession that they intend to make use of. Fees aside, it’s also quite technically convoluted to comply. You need to do a lot of work. It’s a crappy user journey. There are a lot of T&Cs around reporting and audit rights and so on. We’re not seeing anyone ask us, “Can you help us develop a link out product so that people can transact?” Compared to the effort to make a first-party web store, it seems quite a bit more complicated to do the link.

GamesBeat: You just make people aware of the first-party web store in other ways, rather than making it come from the app store.

Happach: I’ve lived in Europe for 20 years. Europe has been suing Apple and Google in some form for most of the time I’ve been here. Whether it’s taxes in Ireland or data protection, there’s a huge cat and mouse between these big American tech companies and the EU. Apple is probably thinking there’s no way they get away with this in the long run, but the wheels of justice grind slow in Europe.

GamesBeat: It’s a rear guard action.

Happach: It might stick for a year or three or five. It’s quite difficult to enforce some of this stuff. Europe has done a good job of keeping bank and payment fees low, creating all sorts of infrastructure so people can compete in financial services, but enforcing on big tech companies is difficult.

GamesBeat: If 10% of the revenues start coming from outside the stores, and you’re not paying that 30% tax, can you help me with the math on what that means for a developer’s bottom line?

Happach: Year one is 10-30%. If you look at a couple of the publishers that have been the most successful in the off-app environment, though, the figure is way higher than 10%. It’s very hard to independently verify, but self-reported, some publishers have said 40-50% of revenue now comes from off-app. But off the app store can mean a lot of things. It can mean a web store. It can mean retail distribution like gift cards. There are all sorts of direct-to-consumer things that fall in that bucket.

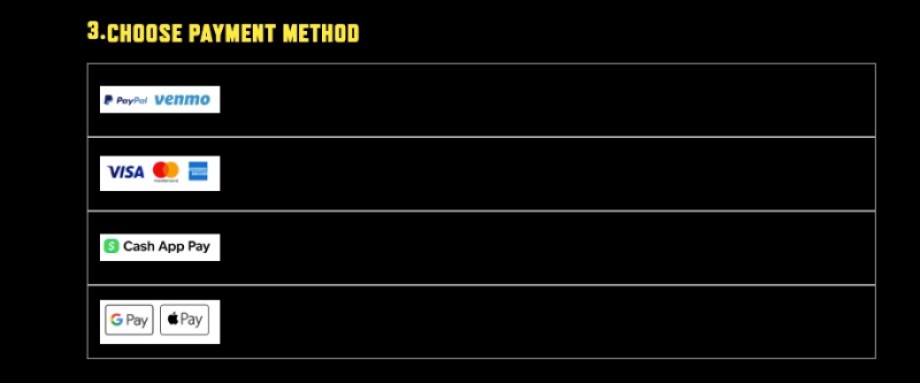

Specific to the web store, we’re able to offer a fee that’s much lower than 30%. That fee varies a lot depending on the geography, because there’s an embedded cost of payments. Payments costs are low in some geographies, but still stubbornly high in some places depending on how the customer chooses to pay. If you’re in southeast Asia, consumers paying with carrier billing, that’s still going to be more expensive than someone putting a credit card down.

If you want a super simplified math example, especially for credit and debit cards, the payments cost is going to make up–let’s call it 5%. The rest is a bit of what we earn for hosting the infrastructure, doing the product development work and customer service and so on. It’s well south of that. What it rolls up to as a bundle will depend on a lot of variables, but it’s not an insane thing to say that the publisher’s cost is going to be 10-15%, or even less.

GamesBeat: There was some FUD up in the air about how anyone moving off the app stores would face a security nightmare. You don’t know who you’re downloading stuff from.

Happach: That’s true. I think that refers a bit more to people actually getting Android apps directly on the phone, though. That’s not what we’re doing. You don’t download the Call of Duty Mobile app from Coda. You just make payment transactions using your game ID. The security becomes the usual consumer purchase security question. I’ve been in payments a long time. PayPal built a whole business out of scaring the crap out of people about putting their credit card number in a website, even though that was no more or less secure than giving your password to your PayPal account. There’s payment data security and other things. But there’s a lot of framework around that. There’s HTTPS. Most browsers are scanning for malicious URLs. We have a badge on our site that talks about our compliance and so on.

We haven’t seen people not wanting to transact because of security fears, especially once they’ve posted on a forum asking, “Is this a legit company?” If you google Coda you can see that we feature a consumer marketplace with a bunch of different publishers, titles, and content on it in 65 countries around the world. We haven’t seen an adoption hurdle based on fear. But yeah, as you get into more exotic ways of working around the app store rules and you start putting content on your phone, I’m sure both Apple and Google will flag that and make sure that they absolve themselves of responsibility if you put something on your phone that’s dangerous. To me that makes sense. If it hasn’t been through the iOS security review, then it’s not as secure as if it had been.

GamesBeat: If you look at the global picture for web shops, what do you see as far as other trends we haven’t talked about so far?

Happach: I still think it’s the most compelling in markets where the app store penetration is the weakest. Certainly we see a lot of uptake in emerging markets, or where there are payment or other operational gaps from either Apple or Google. If you look at the U.S. market, the payment friction is low. Most of the consumers on those apps are banked consumers. They’re easier to get to. From a global perspective, we have a lot of value to add in helping monetize people in some of the geographies that publishers find challenging.

I also think there’s a broader global trend. A lot of the companies we would deal with in the U.S. may have been publishing games through partners in southeast Asia. As they get more confident that a company like Coda can help them succeed on their own, it also informs a bit about their publishing strategy. How do they want to bring games to market?

One of the broader industry trends I’ve seen speaking to clients, there was a couple of years in the pandemic and so on where some launches were pushed back. This is an unusually active year for content. For some of these new launches that have never featured in an app store, strategically publishers are having to make a decision. Do you launch in multiple channels at once? Is there a faster cycle time between how you may have ordinarily thought about putting a game in an app store, seeing if it succeeds, then maybe looking at other forms of distribution? Versus going out through multiple channels on launch day. I don’t think there’s a singular approach, but it’s something people have to think about. We’re having a lot of conversations about that.

GamesBeat: How many people are at Coda now? Has that changed much over the last year?

Happach: We’re around 400, I think 430 at last count. We’re fully recruited. We’re still hiring in engineering and product. But as far as the overall company size, we want to stay lean. Obviously part of our pitch is we can help keep operating costs low for the publisher, so we need to think about how we spend our own money. But we’re still growing. We hope to be able to add to multiple teams throughout the year. It’s predominantly in engineering and product, because most of what we’re working on is bringing the web store product to life, working on loyalty products for example, and continuing to build and improve the payment network so we can help people reach more end consumers.

GamesBeat: What is the competition like? Is Xsolla the biggest competitor out there, or are there lots of others?

Happach: The biggest competitor is Apple. But in all honesty, games have always attracted a lot of talent and clever products, clever engineering. This is still a big end market. There are a couple of companies out there working on B-to-C strategies. Xsolla is one of them. Everybody’s thinking about it slightly differently. Some are building out of the box solutions. Some are building something a bit more custom. It depends on the relationship with the publishers and what you have to bring them.

Very rarely is a web store the only thing that we talk to a client about. If you look at the things we want to work on with Activision and Microsoft, the web store is a big project, but there’s also the Coda Shop. There’s payment activity for their own consumer-facing store, Battle.net, and so on. It’s always a multi-product sell for us.

It’s been a long time coming. Certain things can be gradual. But there can also be quite a bit of acceleration. We’re all taking a bet by working here that the secular tailwind will help us accelerate. My view is that the app store stuff is a bit like when I got my first mobile phone. One year no one had a phone, and then the next year everyone had one. Within 12 months it proliferated. In the same way, when Apple launched the iPhone, look how quickly the Nokia business died. It was pretty astonishing. That was probably a five-year R&D project, and for a long time people were talking about the mobile OS and so on.

It’s one of those things where it hasn’t caught fire yet, but there are enough things burning that at a certain moment, there could be a pretty seismic shift in the way people decide to consume and pay for content. We hope to be at the forefront of that. Obviously don’t feel too bad for Apple and Google. That’s one of many lines of business they run. It’s not even the biggest, or maybe even in the top five. I’m sure those companies will succeed in spite of whatever happens in app development. But it would make a lot of other successful companies, to be able to capitalize on that trend.

GamesBeat: Are there any other trends out there that you pay close attention to?

Happach: Obviously it’s a global business. The thing that sits above games is the overall view of globalization and country trade. We’re watching to make sure that we can continue to help people in some difficult spots where there might be currency controls or currency devaluation. Regulation comes in, not only on payment providers, but also on content providers. In general it’s been a touchy couple of years in geopolitics, but the globalization trend continues to go in one direction over the long term. We’re keeping an eye on different ways to help people. We’re doing a lot of work in the Middle East and Africa right now to open up payment networks. That’s something we keep a close eye on.

GamesBeat: Is there anything of interest on the crypto side of things, or is that something to steer clear of?

Happach: We don’t feature it as a form of payment in the Coda network, but that has a lot more to do with publisher demand for coverage and other wishlist items. Like any good company, if we needed to figure out a way to help people target the end consumer’s ability to transact for game content using digital currency, there are a number of companies that would be lined up to help us. It’s not something we would build. We’d work with one of the crypto payment companies. But it’s not something we’ve done anything major with.

Web3 gaming, again, we keep an eye on different publishers that want to launch different types of games and other content. None of this has reached a mass market yet. We’re still in the concentrated, more traditional mobile game publishing market. The big players, the Tencents, the Activisions and EAs of the world. That’s still our target audience. But like everything, we make sure we don’t get caught out by missing anything that would help our customers grow their revenue.

VentureBeat’s mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Discover our Briefings.