It was the best of times. It was the worst of times. As a former English major, I have always wanted to write that in one of my stories. In fact, I think I’ve used the line multiple times. But it sure feels like it applies to the game industry at the moment, with both layoffs and job creation happening at the same time. Perhaps our new normal is uncertainty.

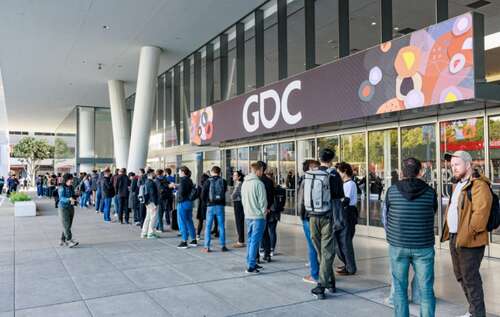

It’s an important thing to figure out whether gaming’s future is bright or a crash lies ahead. I feel like we got a little bit of information this week. Some of the data from the ground floor came from the Game Developers Conference, which this week released its developer survey conducted back in October.

The survey of 3,000 developers found that about 7% of game developers had been directly laid off. That’s sounds relatively small, but the impact of that was resounding, as it meant that 35% of all game developers had either been laid off or knew colleagues at their own companies who had been laid off. That tells you there is broad industry impact from the estimated 11,000 layoffs in 2023. And perhaps it made it seem like the industry was in a state of downfall.

Quality assurance developers were hardest hit with 22% reporting layoffs, compared to an industry average of 7%. The apprehension extends to the future, with 56% expressing concerns about possible layoffs in the next 12 months, said Alissa McAloon, publisher and editorial director at Game Developer, in an interview with GamesBeat. Business and finance professionals reported the least layoffs (2%).

And it appears that there has been no slowdown in the number of layoffs and shutdowns. Emily Greer and Shelby Moledina announced that they had to close their small mobile game studio after four years. The studio had raised $10.5 million in two rounds in 2020 and 2021, but it was focused on the brutally competitive mobile gaming market, where targeted marketing is much harder. Many of the team will join Scopely’s GSN Games division. But not all of them.

Other recent layoffs hit Behaviour Interactive (45 people), CI Games (10% of staff), Pixelberry Studios, and more. Discord cut 17% of its jobs and Twitch eliminated 500 more people.

Earlier in 2023, Embracer Group closed multiple studios and there were mass layoffs at Epic Games, Unity and more. EA cut 6% of its staff and there were many other job cuts. That would seem to suggest that it’s the worst of times, especially given many developers see more layoffs coming ahead.

When asked to share their thoughts on the rise of layoffs in the game industry, many developers cited post-pandemic course correction, studio conglomeration, and economic uncertainty as possible explanations, and some expressed a desire for unionization to better protect workers.

Some developers said this felt like a bubble bursting, a post-pandemic correction, or this was part of a normal cycle, McAloon said. The latter suggests that there are some optimists out there. After, one of the normal practices of the game industry is to build up studios while making games and then reduce them after the games ship.

There is a consequence to this uncertainty. No one wants to hire a lot of people or spend a lot on marketing when the market is declining. Yet eventually developers have to be hired if the number of titles starts to decline. The game development pipelines can’t be empty.

The big picture gets murkier when we consider the arrival of generative AI. Many fear AI will be responsible for more job cuts ahead. Making studios more efficient and productive with generative AI is generally a good thing, but it can also mean that AI can enable companies to do the same work with fewer people, prompting cuts. About 84% of those surveyed said they were concerned about the ethics of using generative AI, particularly if it leads to more layoffs.

On the bright side

Market researcher Circana reported yesterday game industry revenues in December were up 4% from a year ago. Overall, total video game and PC revenues were up 1% from a year ago for all of 2023. That was below the forecast of 3% growth.

It’s noteworthy that this happened in a relatively light sales year for Call of Duty, which dominated in December but was not — as it usually is — the top selling game of the year. That honor fell to Hogwarts Legacy. One game can make a huge difference in gaming.

Accessories saw growth of 14% in December from a year ago, while hardware sales grew 4%. That’s nothing to brag about, but it’s not a disaster either. The December results were much better than the 24% year-over-year drop in November and 23% in October.

As we saw with the closing of the $69.8 billion Microsoft acquisition of Activision Blizzard that game companies are getting acquired for more and more money. When an acquisition happens, the founders can cash out, start new game studios, and then hire more employees. It will be interesting to see how the game investments and M&A deals look at the close of 2023. The numbers should be out soon. While it’s natural for the deals to decline in value and numbers, I don’t think it’s going to be a disaster.

Overall, venture capital investments and exits were tepid in 2023, according to the NVCA, so it’s quite possible that we are weighted more on the side of job destruction than job creation. On the other hand, investors were pouring more money into gaming because it seemed like it was paying off better lately.

Amir Satvat, who provides LinkedIn job resources that have gotten more than 1,000 people jobs, has tracked the market closely. He believes the layoffs we saw in 2023 were four or five times more than what we see in a typical year. And he recently said that it may be August before we see a reversal of the layoff trend in favor of hiring more people to refill game pipelines. Satvat amended that slightly to saying he expects the trailing 60 days or hires versus layoffs will likely hit a crossover in September 2024.

That is good to see. In the tunnel of the layoff environment, it seems like the lights up ahead are those of an oncoming train when we’re in the midst of layoffs. And yet it’s rare to hear much of the good news — that startups are hiring or getting funding so they can hire — as that’s the quiet part of the news. I believe the game industry is in a constant state of creative destruction, where there are winners and losers. The winners create new jobs. The losers shed them.

We’ve seen some evidence of winners lately. This month, Marvel Snap developer Second Dinner raised $100 million. And Everywhere developer Build a Rocket Boy closed a $110 million round this week. We also saw investment rounds with Obelisk Studio ($2 million), Talofa Games ($6.3 million), 3thix ($8.5 million), Pine Games ($2.25 million), and ArenaX Labs ($6 million). As you can see, not all of the news is bad.

In other words, this too shall pass. Let’s hope so.

GamesBeat’s creed when covering the game industry is “where passion meets business.” What does this mean? We want to tell you how the news matters to you — not just as a decision-maker at a game studio, but also as a fan of games. Whether you read our articles, listen to our podcasts, or watch our videos, GamesBeat will help you learn about the industry and enjoy engaging with it. Discover our Briefings.