Game industry mergers and acquisitions hit $11.8 billion in 2023, the lowest level since 2019, according to M&A advisory firm Quantum Tech Partners.

That was down from $106.4 billion in 2022, which was a record year thanks to Microsoft’s acquisition of Activision Blizzard, Take-Two’s purchase of Zynga, Unity’s purchase of IronSource, and Sony’s purchase of Bungie.

The deal count was down 43% in 2023 compared to a year earlier while transaction value was down considerably as well. Other analysts at Drake Star Partners and InvestGame have also published their 2023 numbers. Most agree that it was a pretty weak year for deals of all kinds.

Savvy Gaming Group accounted for much of that amount with its $4.9 billion acquisition of mobile game maker Scopely, followed by Goldman Sachs’ $1.7 billion acquisition of Kahoot, Tencent’s $1.6 billion purchase of Techland, Aristocrat’s $1.2 billion purchase of Neo Games, and Sega’s $775 million purchase of Rovio.

GB Event

GamesBeat Summit Call for Speakers

We’re thrilled to open our call for speakers to our flagship event, GamesBeat Summit 2024 hosted in Los Angeles, where we will explore the theme of “Resilience and Adaption”.

“Even with the Activision Blizzard deal removed, the M&A deal value is still down about 70%,” said Alina Soltys, cofounder of Quantum Tech Partners, in an interview with GamesBeat. “There’s still deals that are happening, but the small and medium sized ones don’t get disclosed on value and so that obviously impacts the total.”

While Microsoft closed its $68.7 billion acquisition of Activision Blizzard in October 2023, Quantum Tech Partners counts when the deal (January 2022) was announced for the attached year.

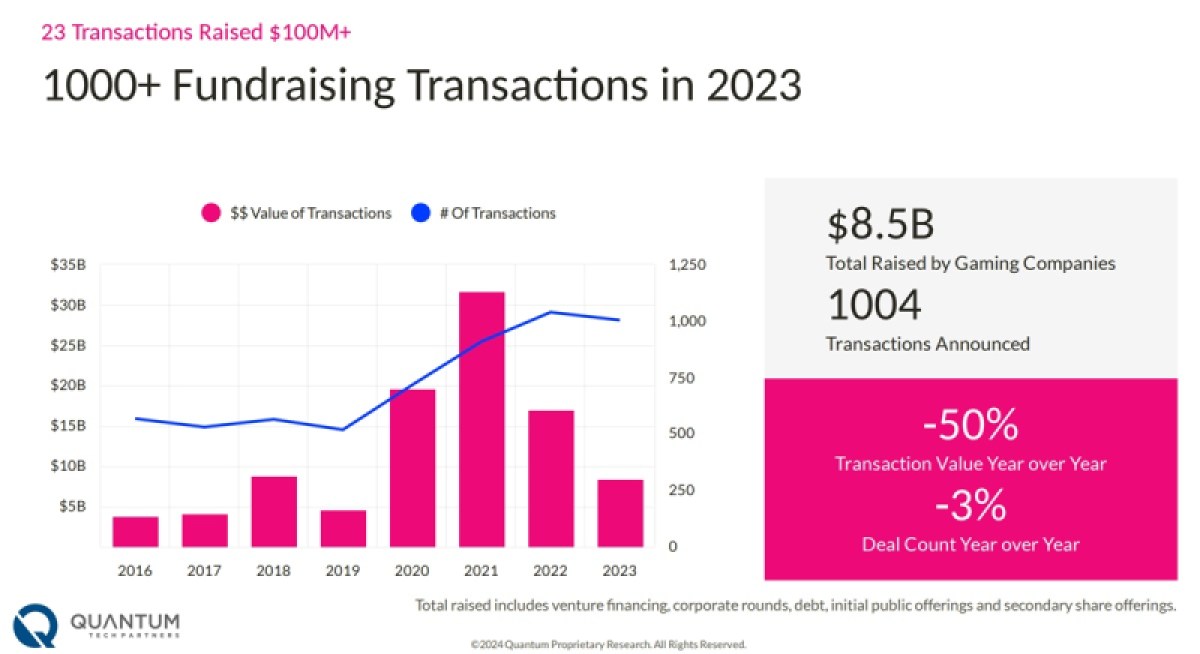

Venture investments

There were more than 1,004 investments into game companies in 2023, with $8.5 billion raised. But the deal count was down 3% from 2022 and transaction value was down 50%. On average, companies raised $12.98 million per round.

VSPO raised $265 million for its esports broadcast and tournament business, while Candivore and Marvel Snap maker Second Dinner raised $100 million each.

Web3 investments declined a lot, with 276 companies raising $1.2 billion. The deal count was down 36% from a year ago and transaction value was down 75%.

Esports investments saw 133 transactions and $1.2 billion raised, with deal count down 15% and transaction value down 10%. Bilibili raised $409 million for its esports streaming platform.

Esports will likely see more consolidation, and we saw ESL Faceit Group announce plans to lay off 15% of the staff this week.

“The more we spend time with international people outside the U.S., the more interesting esports becomes as a key piece of the gaming industry,” Soltys said. “I see that specifically in conversations with a lot of Middle Eastern companies and investors. They view esports as a big opportunity, as they don’t have traditional NBA, NFL or other big sports. The young populations love esports.”

Gaming VCs invested a lot of capital, with new funds announced including Alignment Growth, Boost Capital Partners, Courtside VC, Game Dev Fund, Gem Capital, GFR Fund, Lumikai, Moonfire, Play Ventures, Sony Innovation Fund, Transcend and Vahalla Ventures.

Key franchises for triple-A, originality for indies

During the year, fans gravitated to well-known franchises like Hogwarts Legacy and Monopoly Go, and this strategy of sticking with the familiar is likely to continue for the big game companies.

Meanwhile, the breakout successes for original titles were made by indie game studios. Zeekerss’ broke through the noise with Lethal Company. And this year, the trend continued with Pocket Pair’s Palworld and Arrowhead Game Studios’ Helldivers 2.

We can expect this success to continue as indies tap their own creativity, ability to move fast, and access to quality development and live ops tools, Soltys said. The indies that will do best will be the ones with a history of developing and shipping hit games.

Rise of AI

The explosive growth of generative AI will continue to have ramifications in the game market, with the effect making development more productive and efficient.

Soltys sees this as “armor” for developers, as big changes can threaten the status quo. As budgets grow, player expectations increase and novel tech advances. Devs can’t afford to be left behind. They need to focus on building experiences using AI to lower costs or face an existential risk, Soltys said.

The Future of NPCs report said 99% of players view AI as having a positive impact. Some 78% will spend more time with such games and 81% will spend more money. This wave of optimism is why companies like Inworld AI were able to raise $50 million at a $500 million valuation.

“I think the best way to think about generative AI right now is that you use it to your advantage to help build your products faster, more efficiently, with better context where you can test more things,” said Soltys. “That can help companies make games with smaller budgets while still being creative.”

Still, she said there are challenges around obtaining intellectual property in a legal way.

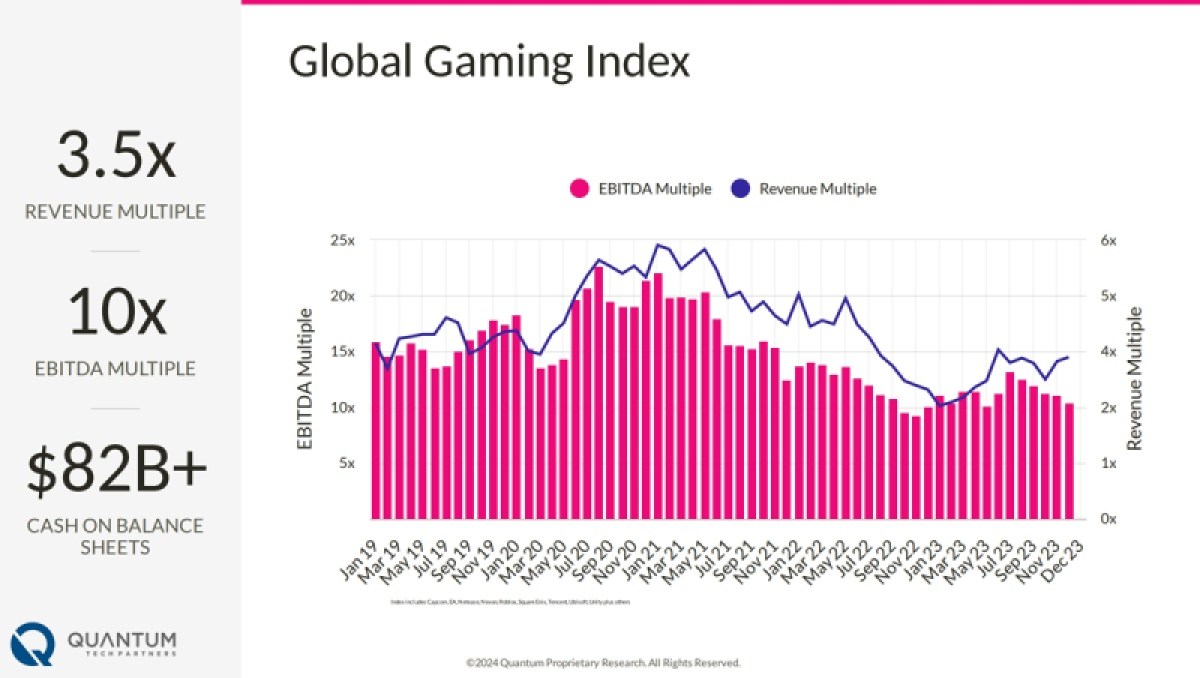

Public markets recover

The public value of game companies recovered somewhat during the past year. The public index revenue multiples increased by 23% in 2023, while earnings before interest, taxes, depreciation and amortization (EBITDA) increase 10% from a year ago as investors came back to games.

Soltys believes that the market could still recover more in 2024, as the feared recession hasn’t yet materialized and the Federal Reserve may eventually start lowering interest rates, which have had a bad cascading effect on venture capital investments. With high rates, limited partner investors can park their money rather than risk it in deals with venture capitalists.

Some initial public offerings (IPOs) may come back, as we’ve seen with Reddit filing to go public. But Soltys doesn’t believe the craze of the SPACs (special purpose acquisition companies) will come back yet.

Low prices will lead to more deals

Back in 2022, revenue multiples were 2.8 times on average when one company acquired another, while on an earnings basis companies were acquired at a valuation of 10 times EBITDA. And companies had $82 billion in cash on balance sheets.

Now the global gaming index of public game companies shows that revenue multiples are higher at 3.5 times and EBITDA multiples are about the same at 10 times. So sellers may feel like they’re getting a fair price, while buyers may not feel they’re overpaying anymore.

“We’re definitely no longer in the realm of overvalued companies. I think we’re at fair valuation levels,” Soltys said. “Everything else being normal, you’re rewarded if there’s growth, or you have very unique moats around your business or have very unique IP. Absolutely. But if you look at the median, which this shows at 10 times EBITDA, it’s in a good place.”

Now that prices have come down from the crazy days of the pandemic, cash-rich buyers will have opportunities to buy companies that previously weren’t up for sale. Valuations have stabilized at a fair market value, and that should lead to deals, Soltys said.

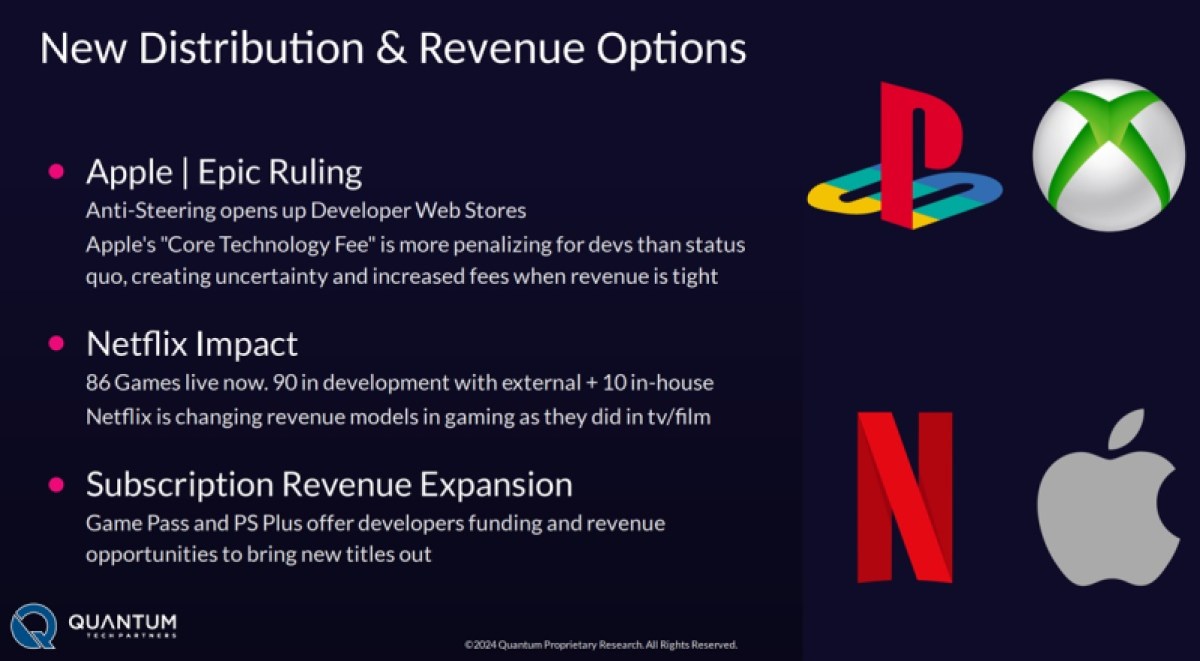

App Store alternatives

Game developers will have more opportunity to set up their own web shops and other stores without consequences from big platforms, based on new regulations going into effect in the European Union.

The Digital Markets Act going into effect this spring will force “gatekeeper” platform companies to play nice, and that will enable devs to capture more profits. Favorable antitrust rulings in the Epic vs. Apple (a partial victory related to web shops) and the Epic vs. Google cases will help game companies avoid 30% platform fees. This change could help developers get closer to their players as well.

On top of that, Netflix is also offering significant new distribution opportunities, as it now has 90 games in development and 86 live games on its streaming platform. It is also making 10 in-house games. Meanwhile, Apple Arcade is also a home to new distribution opportunities. Both Netflix and Apple Arcade allow game companies to focus on innovation rather than monetization, Soltys said.

More UGC deals

Steam had nearly 15,000 new games last year, making it seem overcrowded. Developers may need to look elsewhere for more opportunities.

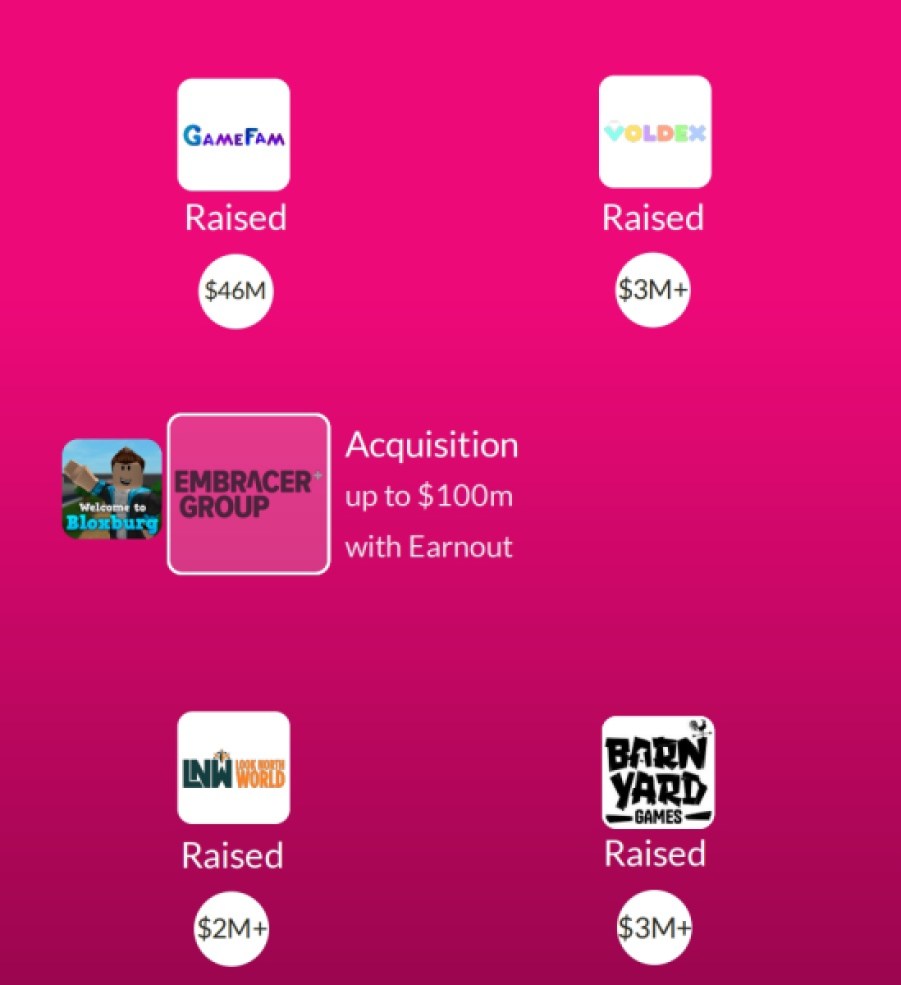

Soltys believes that more transactions will happen in the user-generated content ecosystems of Roblox and Fortninte (Unreal Engine Fortnite). Buyers will realize they can’t afford to ignore these core platforms attracting millions of players.

Roblox paid out more than $741 million in developer exchange fees in 2023, while UEFN gave out an estimated $240 million. That’s a big source of new revenue for developers.

“I think there are more fundamental changes that are happening than a lot of people realize, and if you look at it completely from the negative perspective, this means a lot of things need to be done differently,” Soltys said. “But I think it also opens up a lot of opportunities. And so that’s been something that we’ve been focusing on. What do these changes mean? One of them is access to new platforms. Developers are making significant amounts of money on Roblox and Fortnite.”

“Those platforms now are paying out a billion dollars in the year. So it’s a significant number. And I think it also drives to the biggest factor for developers, which is getting access to players. They both have hundreds of millions of players,” she said.

The biggest buyers in the year were Tencent, which bought five companies; Xsolla, which bought four; Keywords, which bought four; Savvy Games Group, which bought three; and Sony Interactive Entertainment, which bought three.

On the positive side, Soltys sees M&A picking up in the second half of 2024, with conversations starting in the middle of the year and deals happening by year end and in 2025. Soltys also sees the layoffs slowing down and more hiring happening in the second half.

As for the layoffs that have plagued the industry, it’s hard to say how it makes sense. It seems more like an overreaction, or a reflection of the fact that there are always winners or losers. But many companies may be playing it safe by living in survival mode.

“It’s often people overreacting,” Soltys said. “It’s totally fair if the company has to do something to ensure its survival. But in the grand scheme of things, it’s better to keep your core team together, even if it means reducing some of your expenses. But there’s a whipsaw effect.”

Quantum Tech Partners is an adviser for game companies interested in acquisitions or investments.

VentureBeat’s mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Discover our Briefings.