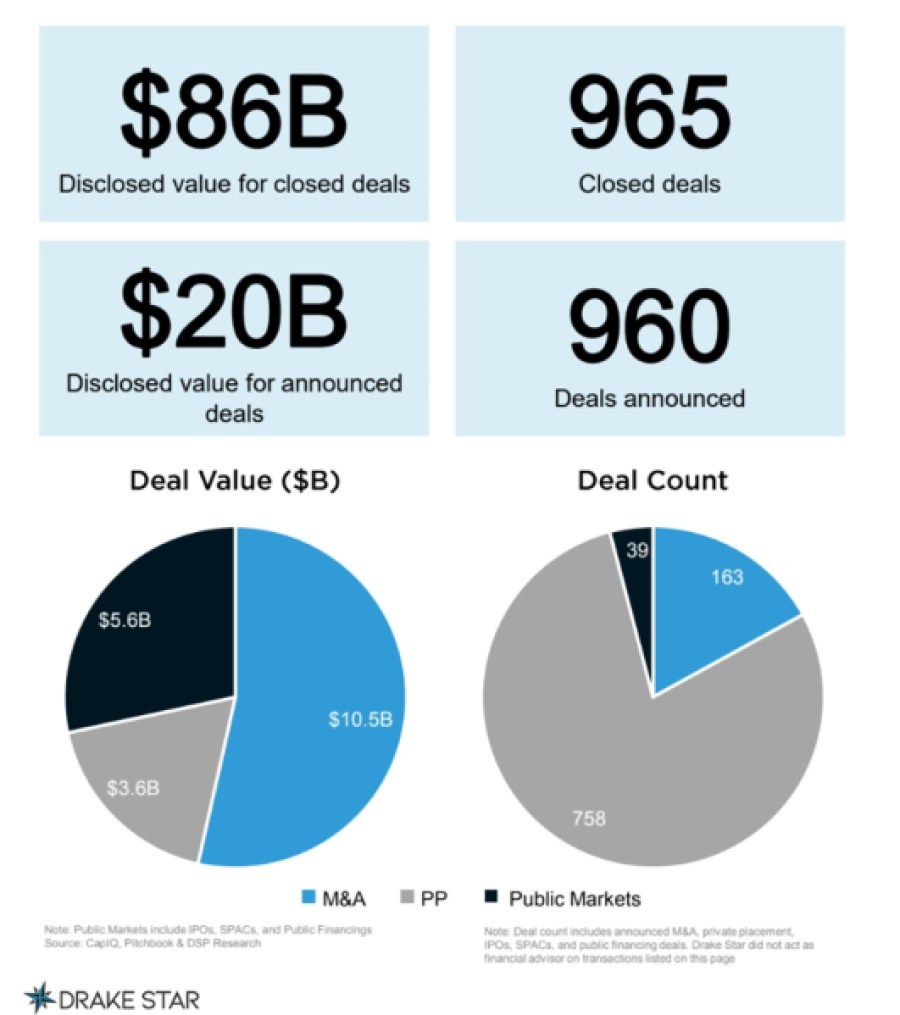

In 2023, the value of closed game mergers and acqusitions hit a record of $86 billion, according to the Drake Star Global Gaming Report 2023. But deal activity for both acquisitions and fundings was mixed at the end of the year.

Most of the $86 billion in value came from the closing of Microsoft’s $68.7 billion acquisition of Activision Blizzard. That deal, delayed by regulatory challenges, reflected the gung-ho financial environment of 2022. But deals launched in the fourth quarter of 2023 were a lot less exuberant.

Overall, 2023 was a robust year with $20 billion in disclosed value of deals that were announced (but perhaps not yet closed). And Q423 saw a notable pickup in M&A deals compared to Q3. M&A advisory firm Drake Star Partners predicts M&A activity to steadily increase again in 2024.

The Drake Star Global Gaming Report 2023 analyses the fourth quarter and full year 2023 for Gaming and Esports and outlines what to expect for 2024. Highlights include over $20 billion in 960 announced deals during 2023.

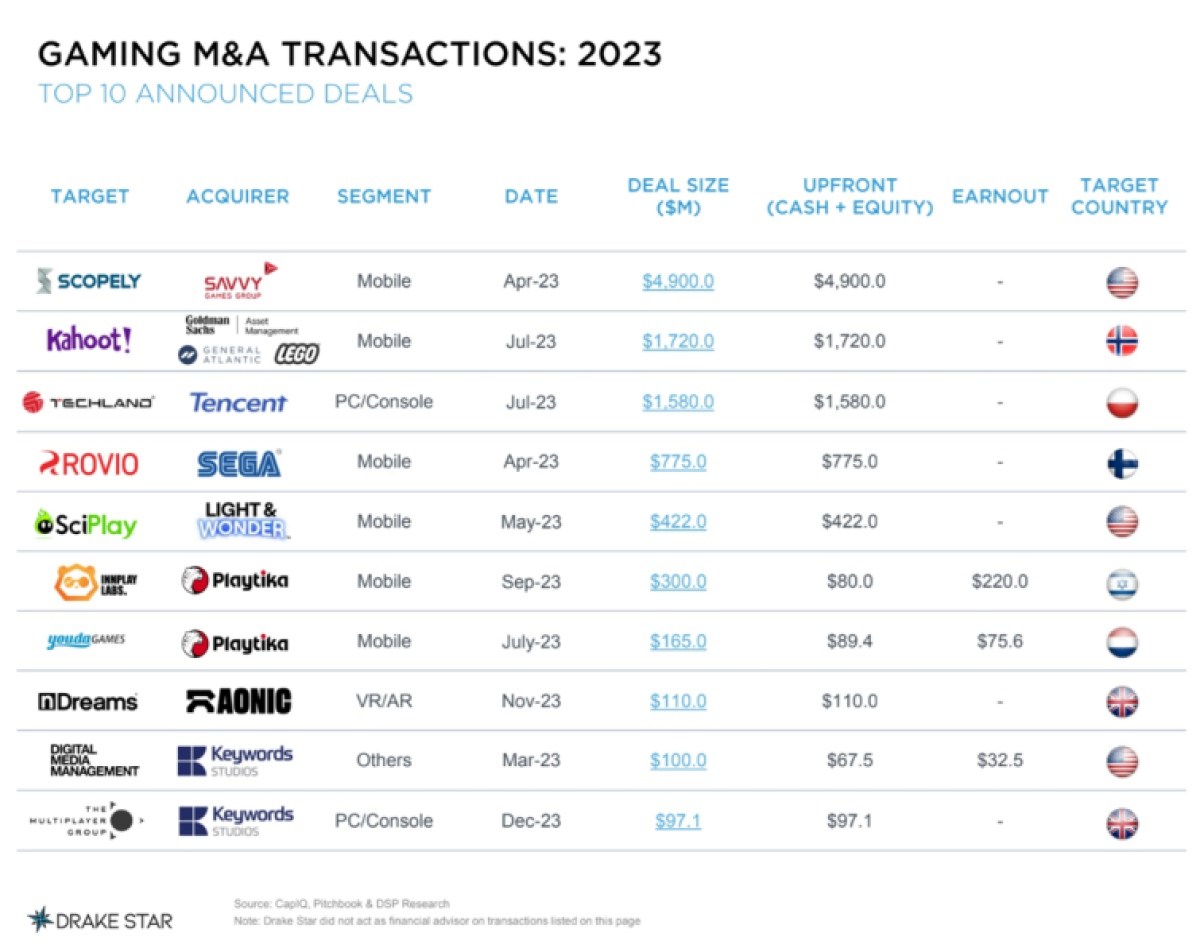

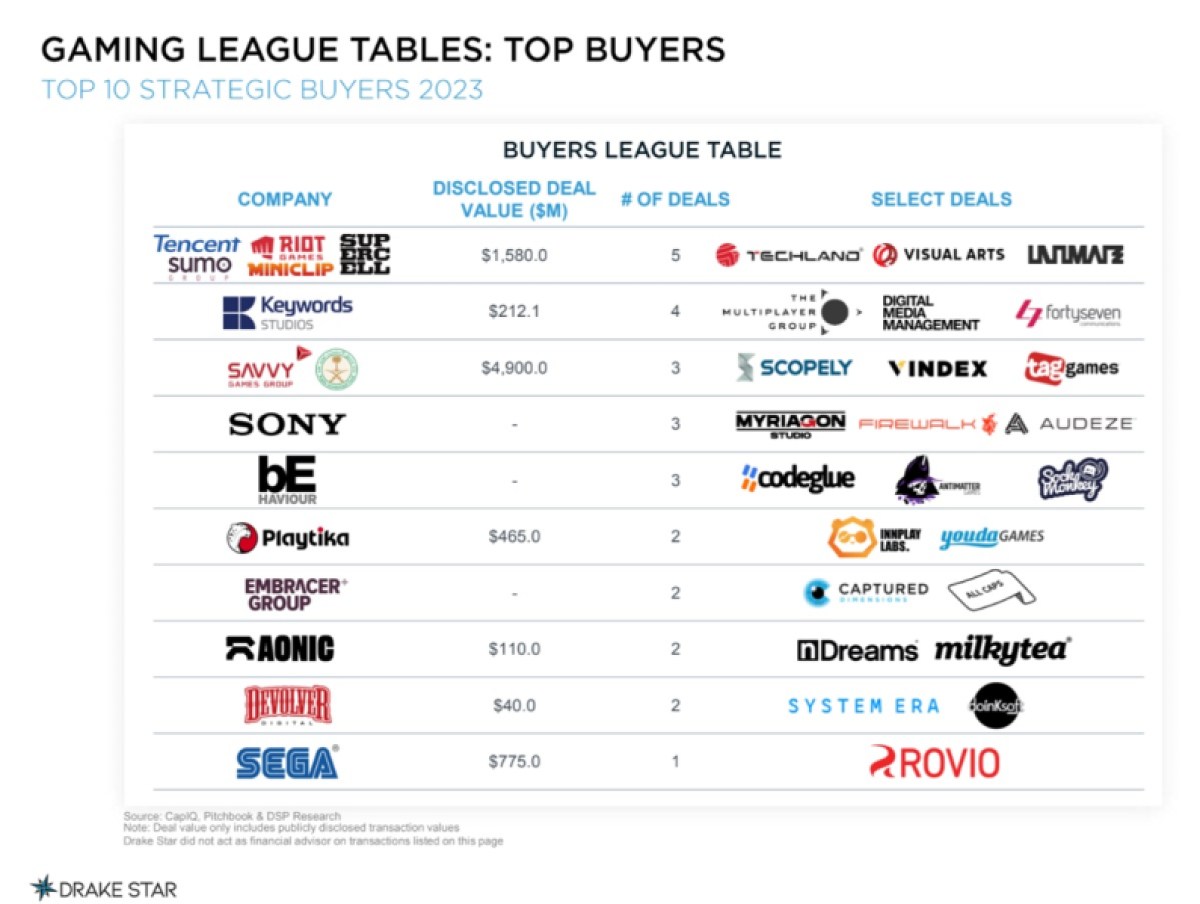

There were 163 M&A deals were announced during 2023 with over $10.5 billion in disclosed deal value. Savvy Games Group/PIF’s (Saudi Arabia’s Public Investment Fund) acquisition of Scopely for $4.9 billion led the chart and Kahoot’s acquisition by Goldman Sachs consortium $1.7 billion and Techland’s majority acquisition by Tencent (at $1.6 billion) were the only other billion-dollar-plus deals during the year.

Funding rounds

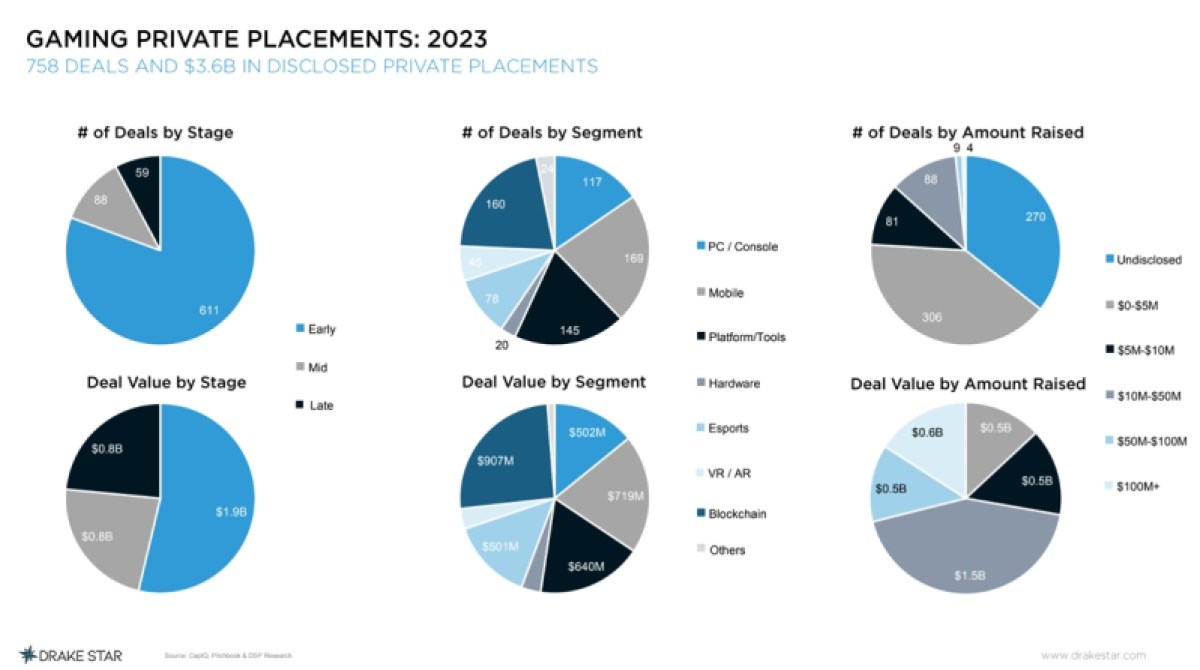

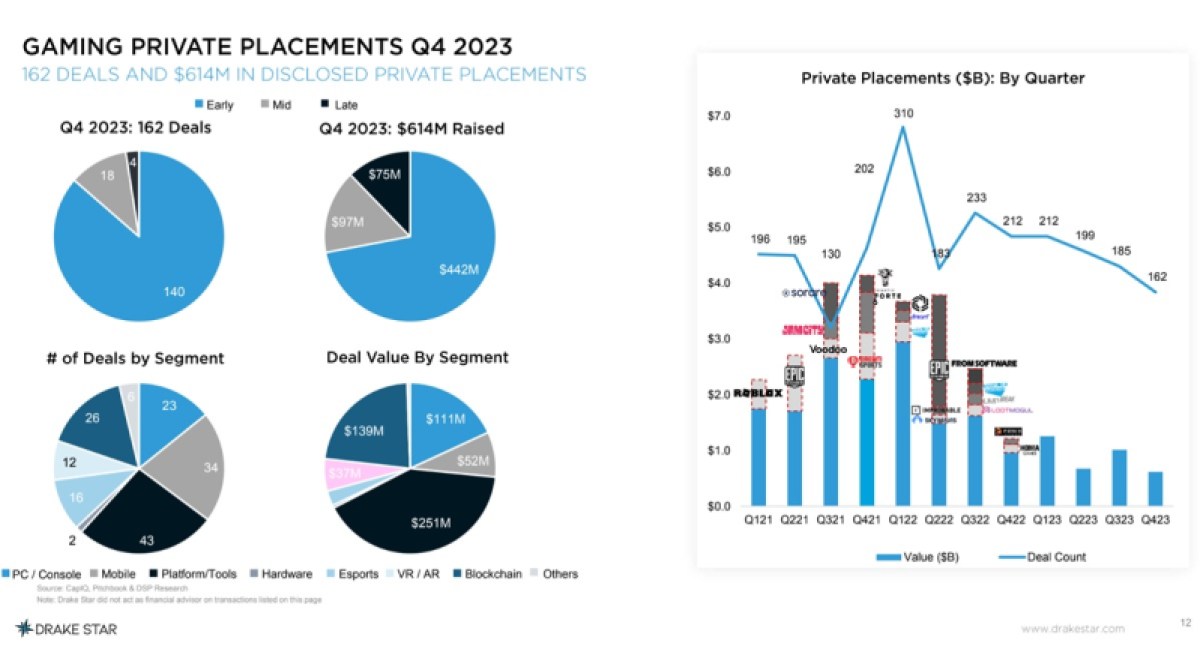

Over $3.5 billion was raised in 750-plus financing rounds of private companies, comparable to the $3.4 billion raised in 2020 (excluding the large Epic Games deal).

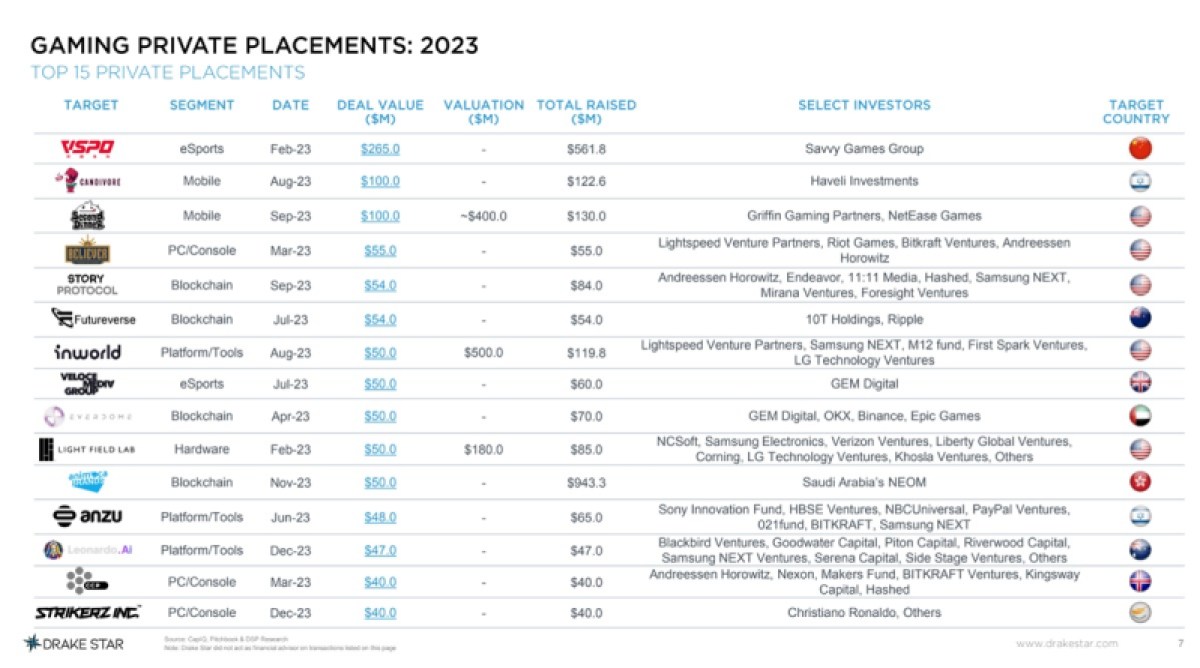

Mobile was the most active segment (168), followed by blockchain (159) and platform/tools (143). Top financings were VSPO ($265 million), Candivore ($100million) and Second Dinner ($100 million).

The most active VCs in early to late stage included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming while the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Sfermion and Shima Capital.

2024 outlook

After a hyperactive COVID-19 period (2020 to 2022), deal activity gradually shifted back to the pre-COVID levels in 2023 and Drake Star predicts M&A activity will steadily increase again in 2024.

Top buyers will likely be Tencent, Sony, Scopely / Savvy Games, Keywords and Take-Two, while ByteDance is about to sell its gaming business and Embracer will likely divest some of its studios. Drake Star expects Savvy Games Group to continue deploying more out of the $38 billion ear-marked for gaming M&A and

financings this year.

With a tightening regulatory environment in China, Drake Star foresees Tencent and other Chinese strategics to continue increasing their investments and acquisitions in the Western markets.

While Drake Star expect some large ticket sized M&A deals, the company forecasts a continued uptick in smaller to mid-size M&A deals in 2024. Private equity firms are attracted by the current lower valuations of listed gaming companies, and Drake Star thinks several gaming companies will be taken private this year.

Drake Star predicts a healthy amount of seed/early-stage financings and a limited amount of growth/later stage rounds. Hot segments will be AI/tools and AR/VR.

With public gaming market improving in the first half of 2024, Drake Star expects to see some of the IPO ready gaming companies to restart their going public efforts in the second half of the year.

GamesBeat’s creed when covering the game industry is “where passion meets business.” What does this mean? We want to tell you how the news matters to you — not just as a decision-maker at a game studio, but also as a fan of games. Whether you read our articles, listen to our podcasts, or watch our videos, GamesBeat will help you learn about the industry and enjoy engaging with it. Discover our Briefings.