In 2021, while much of the U.S. was recovering from the pandemic, Bellevue’s tech scene was flourishing as Amazon, Meta and others rushed to expand their footprints in the city east of Seattle.

But now the impacts of a hybrid workforce and ongoing tech industry layoffs are taking some shine off the boomtown — and what comes next is unclear.

Office vacancies are on the rise. Parts of Amazon’s big construction plans are on pause. Meta and Microsoft put space on the sublease market.

But supporters say Bellevue is still an appealing alternative to Seattle. Its leaders want to grow and diversify the economy while safeguarding the features that drew companies and residents in the first place.

“We invest in public safety. We invest in transportation and our parks and green spaces. We make sure we have clean water, and we have excellent public schools,” said Bellevue Mayor Lynne Robinson, who was just elected to her third term. “All those things are what attract people and make them want to stay.”

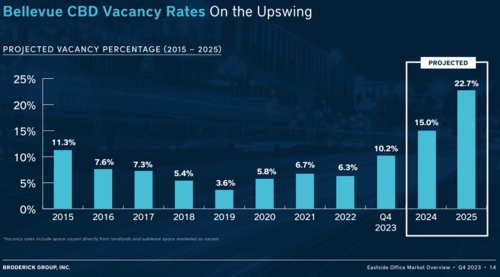

At the end of last year, office vacancies hit 9.7% in Bellevue’s city center, according to Kidder Mathews — a dramatic increase over recent years, though not as dire as Seattle, which has nearly 24% vacancy.

Meta started to sublease space in Bellevue last year amid ongoing uncertainties about the new Spring District development, where the social media giant was growing rapidly. T-Mobile also subleased offices at its global headquarters, and Microsoft ditched millions of square feet in the city, the Puget Sound Business Journal reported.

Amazon, which originally got its start in Bellevue, announced in 2019 plans to relocate its worldwide operations unit from Seattle to Bellevue. A year later it revealed plans to have 25,000 employees in Bellevue — up from just 700 in 2019.

But last year Amazon paused construction on a chunk of its downtown Bellevue development plans, citing a need to study the impact of hybrid work. Building has not resumed.

The company has finished other projects, including its 42-story building dubbed Sonic — but while Sonic is completed externally, the offices are only built out to the 19th floor.

Robinson sees a silver lining to the slowdown, particularly with Amazon, which now has about 11,000 employees in her city.

“This more gradual growth that they’re having in Bellevue,” she said, “has been just perfect.”

The city, with more than 150,000 residents, was prepping for the addition of 70,000 jobs across its economy and 35,000 new housing units over the next two decades.

But Amazon’s initial plans would have sped up the job and population growth. Amazon tapping the brakes gives more time for keeping pace with the demand for new homes and other infrastructure. Just this month, developers broke ground in downtown Bellevue on an apartment building with 172 affordable units. Amazon is supporting the project with a below-market-rate loan.

Meanwhile, the Bellevue City Council last week approved funding that will provide 350 units of affordable housing in Bellevue, and nearly 900 across the Eastside. And a new Sound Transit light rail line is expected to open later this year, connecting Bellevue to Microsoft’s campus in Redmond, and eventually to Seattle.

As Amazon and other giants curb their Bellevue expansion, mid-sized tech ventures and companies seeking smaller leases are filling the void.

When the market was hot, a lot of those businesses were unable to compete against the really big players, said Jeff Chaney, an executive vice president of Kidder Mathews. “They were handcuffed and sitting on the sidelines,” he said.

Now businesses including stock trading platform Robinhood, telecom company Lumen, and Zymeworks Biopharmaceuticals have new offices in Bellevue. TikTok parent ByteDance and Pokémon recently signed deals to significantly grow their presence in the city.

And it appears much more room is on the way.

CoStar Group analysts say office vacancy rates in downtown Bellevue could spike to nearly 22% next year, while Broderick Group put the number slightly higher, at nearly 23%. There is currently 4.5 million square feet of available space in downtown.

Bellevue boosters remain optimistic that the city will eventually fill those offices alongside existing tech ventures.

Three of the top five companies on the GeekWire 200 list of leading Pacific Northwest startups are in Bellevue: OfferUp, Zenoti and iSpot. Other longtime tech companies such as Apptio and Icertis remain in the city.

Out-of-town firms including cloud computing giant Snowflake and business automation software maker UiPath operate engineering centers in Bellevue — which sits right in between the headquarters of Amazon in Seattle and Microsoft in Redmond.

Cameron Borumand, a founding partner at Bellevue-based venture capital firm FUSE, said when he started his career a decade ago, most startup activity was in Seattle’s Pioneer Square neighborhood. But now startups are based across the region, and half of FUSE’s portfolio companies are on the Eastside.

Bellevue is attracting newer startups such as Rhythms, Symbiosys and Center that raised investments in the past few months.

“Several big tech companies have large offices in Bellevue, Kirkland, Redmond, or the surrounding neighborhoods, so there’s a good depth of talent here,” said Bashar Kachachi, CEO of Symbiosys.

“It’s pretty common for businesses in Seattle to at least consider moving to Bellevue.”

– Jeff Chaney, an executive VP at Kidder Mathews

Rhythms founder and CEO Vetri Vellore previously ran Ally, which was based in Bellevue. He sold the startup to Microsoft in 2021 and just launched his new company — also in Bellevue.

Vellore described Bellevue as “dynamic” and called out the “great office space” with ample parking.

That’s just the feedback Robinson — who has long worked to attract tech startups — wants to hear.

The presence of startups “makes for a really healthy ecosystem,” she said. She touted local efforts to support the city’s new entrepreneurs, including the T-Mobile Technology Center, which hosts startup pitch nights, and the Startup 425 program.

Bellevue is also looking to grow the local economy beyond its current focus on tech and telecommunications to draw life sciences businesses to the city.

Robinson, who has served on the Bellevue City Council since 2014, said there aren’t plans to create financial incentives to attract companies — but there’s also no interest in policies like Seattle’s payroll tax that could repel entrepreneurs.

Chaney predicted that Bellevue’s reputation as a desirable locale will hold, pointing to the vibrancy of downtown and the influx of new retail.

“There’s a lot of companies that want to be here,” Chaney said. “It’s pretty common for businesses in Seattle to at least consider moving to Bellevue.”