A new report from Morgan Stanley concludes that while Apple is saying little about AI, it is ready to profit as consumers adopt AI-based tools in everyday life.

Artificial Intelligence has been the buzzword of 2023 with everyone, except Apple, who has said so little that there’s a presumption it has fallen behind, and is spending heavily to catch up. In reality, AI in the form of Machine Learning has been integral to Apple products for years, and Tim Cook recently described it as “fundamental technologies.”

Investment firm Morgan Stanley believes that Apple is not only further ahead in the field than it publicly states, but that as early as 2024, it will become one of six “key beneficiaries… [in] a catalyst year for ‘Edge AI’.”

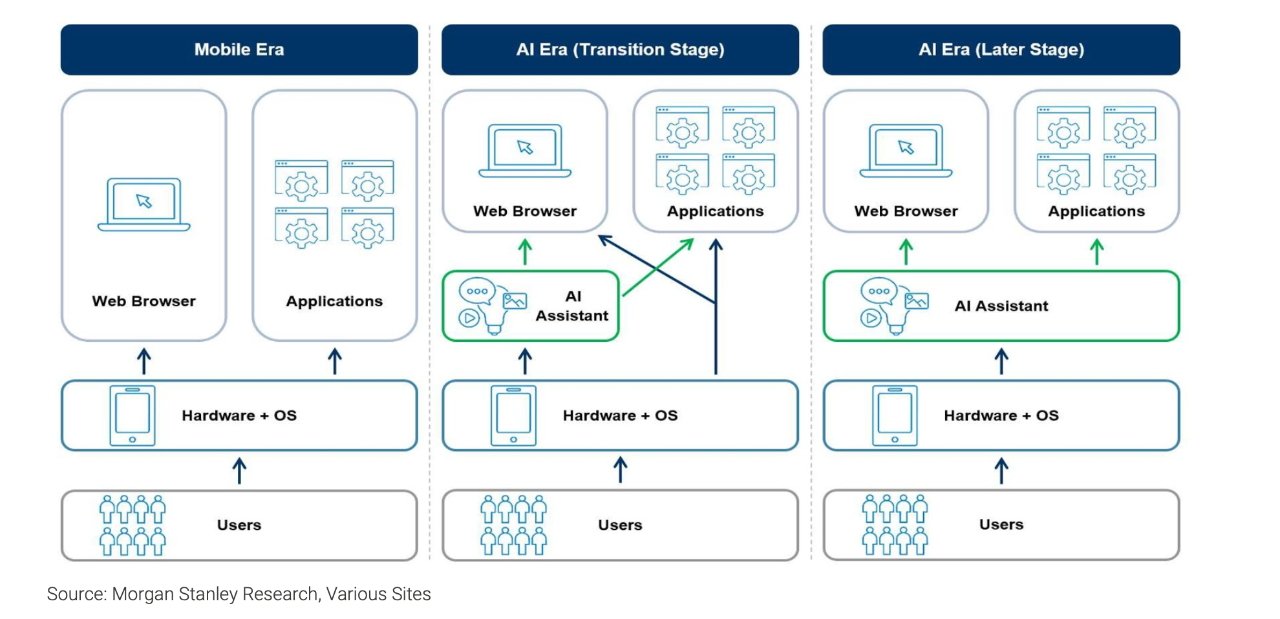

“Edge AI” is Morgan Stanley’s fuzzily-defined label for what happens when AI stops being a ChatGPT-like app and instead is woven into all computing. “[As] AI permeates into new consumer use cases, we expect the edge to become an emerging enabler of AI inferencing in 2024 given the benefits of lower query costs, improved latency, greater personalization, better data security/privacy, and easier accessibility.”

So where now generative AI is increasingly included as an option within apps such as Microsoft’s Bing, in future AI will be less of a distinctly separate service. Instead, AI will be invisibly powering tools for consumers.

“[When] we shipped iOS 17, it had features like personal voice and live voicemail,” said Tim Cook during Apple’s latest earnings call. “AI is at the heart of these features.”

“While some investors question Apple’s AI intentions, we believe Apple will be an AI enabler,” says Morgan Stanley. ” We believe Apple will emerge as one of the key winners — or ‘Edge AI Enablers’ — in this race given the unique data from Apple’s 2 billion+ devices and 1.2 billion+ users, Apple’s focus on data privacy, and Apple’s leading hardware, software, silicon and services vertical integration.”

So at its core, Morgan Stanley’s logic is two-fold. It argues that AI tools need powerful devices, and that such tools also need t to reach a very wide audience.

Given that Apple already includes “powerful silicon… [such as] Apple’s A17 Pro SoC, which can process 35 trillion operations per second,” Morgan Stanley says its iPhone can already power AI on device. “We expect new battery tech, silicon, and edge devices to emerge in 2024 (and beyond),” it says, “helping to spark investor interest in this theme.”

“For AI to provide truly differentiated outcomes,” continues Morgan Stanley, “it needs to leverage unique data sets, and Apple’s 2B+ devices and 1.2B+ users generate more insightful data than most platforms we can think of.”

“When paired together will [sic] Apple’s industry-leading focus on data privacy,” says the report, “and some of the most powerful smartphone and PC hardware/silicon in the market today… we believe Apple can become a true ‘AI Enabler’ in ways many others can’t.”

“And while some investors question whether Apple is really ‘all-in’ on AI,” claims Morgan Stanley, “reports indicate Apple is spending billions on AI technology, suggesting Apple’s emergence as a leading provider of AI at the edge is a matter of ‘when’ not ‘if’.”

Siri could be key to AI’s future

“AI is traditionally deeply integrated across Apple’s product and services ecosystem (think FaceID, TrueDepth Camera, Fall Detection, Smart Dictation, etc.),” say the analysts. “Other edge AI use cases that are likely to emerge on Apple devices include more efficient code development, integrating AI into Apple’s native productivity apps, and AI-powered health, financial, and fitness assistants, amongst others.”

But Morgan Stanley also thinks that Siri “as the ultimate smart assistant is still the ‘killer’ AI app.”

“[Using] LLMs [AI Large Language Models] to power Siri as the ultimate virtual assistant is, to us, the clearest ‘killer AI app’ Apple can deliver to market,” the report continues, “and reports indicate this integration could come to Apple devices as soon as next year.”

“We believe Siri powered by LLMs could become an ‘intelligent layer’ that sits in-between a users iPhone and the websites/applications the access,” it says, “becoming an all- important gateway to many of the brands we use today.”

Expect AI news at WWDC 2024

“Moving forward, we will be closely watching for any announcements,” says Morgan Stanley, “related to 1) new Apple (or third-party) silicon launches that will power edge-AI workloads, 2) step-ups in AI hiring, capex, or component procurement plans, and/or 3) partnership announcements with current AI enablers, such as Alphabet (covered by Brian Nowak).”

Apple doesn’t tend to talk about AI even when it is launching a feature that uses it, such as voicemail transcription. Instead, Apple talks about the benefits more than it does the specific technology.

Apple tops Morgan Stanley’s list of just six firms it believes will benefit from “edge AI” (source: Morgan Stanley)

Nonetheless, Morgan Stanley says that it will “be closely watching for AI-related commentary during future product launches, and the rollout of AI-enabled services (and/or developer tools), with Apple’s next WWDC in June 2024 a likely key catalyst.”

Apple’s three advantages

Apart from having the capital to invest in AI, Morgan Stanley believes that Apple has certain specific advantages over other firms.

“We believe Apple will be a Gen AI enabler given 3 distinct advantages,” it says, “unique data from an installed base of over 2B diverse edge devices and 1.2B users, unmatched privacy standards, and vertical integration of hardware, software, silicon and services that enables a more powerful device to process Edge AI workloads.”

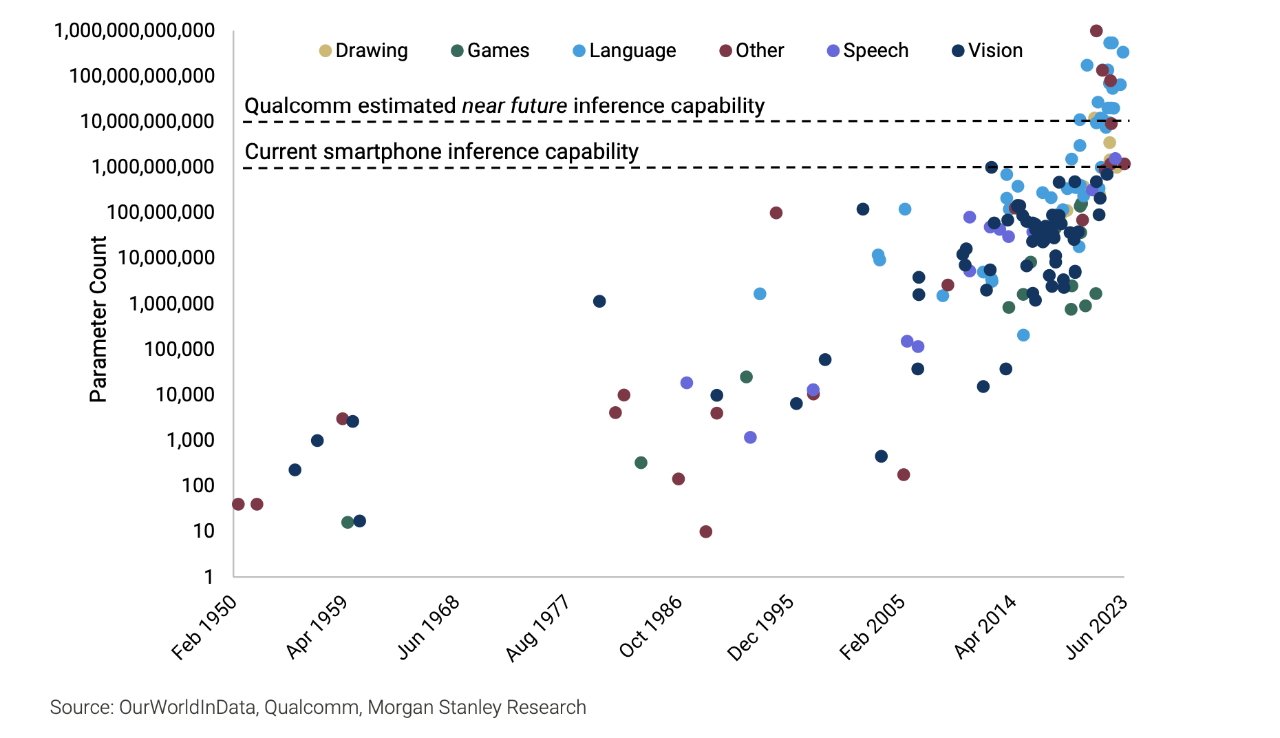

In a slightly mixed metaphor, Morgan Stanley says that Apple Silicon is already positioning Apple “at the center of AI at the edge.” That’s because “Apple-designed processors for the Mac and the iPhone are already capable of processing LLMs below 10B [billion] parameters.”

Plus of the six firms Morgan Stanley sees as profiting at this AI edge, only Apple has a vertical stack meaning it has computers, wearables, smartphones and more. The other firms including Dell, Qualcomm, and Xiaomi, all offer many but not every option Apple does.

The stages of AI adoption, L-R: no AI, AI as separate app, AI integrated into everything (source: Morgan Stanley)

Morgan Stanley’s position

While Morgan Stanley is predicting an enormously profitable future for Apple on the back of AI, it’s still holding its price target at $210. The company does not address that discrepancy, but it does acknowledge that it expects investors to be skeptical of its “edge” predictions.

“Why Apple? Are they even investing in Gen AI? We anticipate these being the two key questions we get from investors initially,” it says, “because Apple has — admittedly — been less vocal about their AI ambitions than many of their megacap tech peers.”

“What we know is that Apple is historically slow (and tight-lipped) to adopt new technologies — we can look back to the smartphone, 4G/5G networks, multi-cams, AR/VR headsets, and other products/technologies as examples where Apple was not first to market — as they typically take time to understand how to best monetize their products/ services and avoid potential regulatory headwinds,” continues Morgan Stanley.

“However, Apple has proven time and time again that this strategy pays dividends,” says the report, “as in each of the major markets Apple has entered over the last 10-20 years (smartphones, tablets, wearables), Apple’s entrance has helped to grow the TAM [Total Addressable Market] beyond the size of the prior incumbent peak, with Apple capturing the majority of profits in these markets today.”

To back this up, Morgan Stanley notes that since 2015, “AI-related job postings at Apple have risen from 5% of total Apple job postings to ~20% today.”

“We see this as clear confirmation of Apple’s AI intentions,” says the company, “and we’ll be closely watching Apple’s Capex and opex plans to better understand the added costs associated with enabling new AI workloads, which admittedly trail AI investments from many of Apple’s mega-cap tech peers today.”

Morgan Stanley’s optimistic view of even the immediate future does fit with recent rumors that, for instance, Siri will be improved by AI in 2024.