The big picture: Apple’s M3 launch stood out for its focus on how people actually use computers, the lack of AI acronyms and the fact that they launched three chips all at once. It is only getting harder to compete with them. As with all things Apple, the M3 has been extensively covered in the press, but beyond the performance metrics, a few things stood out for us, and here’s our thesis on the overall sector.

First, Apple has made a smart move in repositioning the way in which it segments its products. They are now basically asking users to first decide a screen size and then pick a chip depending on how much compute they need. In their launch videos they spent a lot of time describing the tasks suitable for each of the three chips.

Editor’s Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

The basic M3 works fine for us – email and web browsing, the M3 Pro for people who code, and the M3 Max for people running heavy simulations or video/design software. This is much cleaner, and reflects Apple’s true core competency – understanding how normal people use computers. A lot of their recent product launches have strayed from that, and it makes sense for them to revert to something far easier to grasp – now we just hope they do the same for their iPad line-up.

We also found it fascinating that Apple is the only semiconductor designer to introduce a chip this year without mentioning AI once in the product launch. To be precise, they do mention AI, but only in the context of that is one task that users might want to do with the high-end M3 Pro. But they provided no mention of any of the chip’s technical specifications – no FLOPS, TOPS, cores, speeds or specs.

We think this reflects Apple’s return to its core messaging themes around user human usability. There is currently no way to talk about AI in a way that is meaningful to people not neck-deep in semiconductors. We think the M3 line-up is highly capable in terms of raw neural network performance, but until there are more consumer usage patterns they see no point in mentioning it.

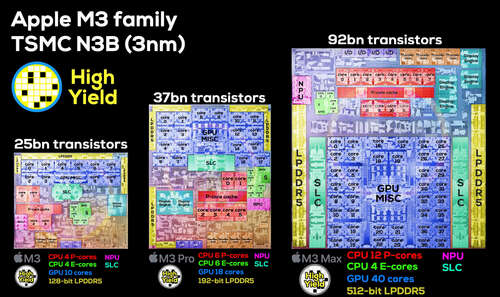

Perhaps the most significant facet of the M3 launch was the fact that they are launching three chips at once. Our initial assumption was that these were the same chip, ‘binned’ in production, but that was wrong. These are three different chips, with the differences manifest in their very different sizes of each and visible to the naked eye in the die photos (below). This is somewhat staggering, as we have to assume that tape out costs alone for the three has to be close to $1 billion. Very few companies can afford this large an undertaking.

Which leads to our broader view of the market. There are really two different sides of the PC market – Apple and everyone else. Intel remains, by far, the leader in PC CPUs, with AMD in a solid if not exciting #2 position. Qualcomm, who held their own launch event the week prior to Apple’s, has unveiled their latest Windows PC CPU. As much as this looks like a highly performative chip, with some of the best AI performance out there (see above how much this matters), it is hard to be optimistic about the outlook for the product.

Add to this the news that Nvidia and AMD are also planning to launch Arm-based PC CPUs, and this tiny sliver of the market is looking very crowded. To put this in perspective, let’s say Qualcomm sells 6 million of their CPUs at $150 each, that works out to $900 million in revenue for roughly 2% market share. Their total revenue for this product is less than the theoretical tape out expense for Apple’s new family. This is not a direct comparison, but it does highlight the huge advantage Apple is building for itself.

Also read: PC CPUs are getting more interesting, and competition is coming

Historically, one of the big advantages that merchant silicon firms like Qualcomm and Intel enjoy versus internal silicon like Apple’s is that the merchant firms typically enjoy larger R&D budgets for developing new products which they can amortize over multiple customers. Apple has flipped that equation on its head, as they are, in this sense, outspending the merchant vendors, something made possible by the large profit pool they enjoy in mobile and PCs.

There are almost no other companies in the world that can afford to do this. Dell, HP, Asus and Lenovo can’t. Maybe Samsung could, but their PC market share is too small to expect a good return. Maybe Google, if they really put their minds to it and could maintain the attention long enough. Huawei, with its seemingly bottomless access to capital, could probably pull it off, and for all we know they could be working on something.

In short, the PC market is likely to remain split for a long time to come with Apple continuing to capture the bulk of segment profitability. In fact, conditions are likely to worsen for the merchant vendors as the new entrants to the market are likely to create price pressure for CPUs. As much as they all say they will not compete on price, one of them will break.