Market research firm IDC has released some stunning smartphone market share numbers for 2023. The number one smartphone OEM is now Apple. The IDC says Apple hit an “all-time high market share” number for 2023 and that Apple has “the number 1 spot annually for the first time ever.” The analyst group says this represents “a sort of shifting of power” in the smartphone market.

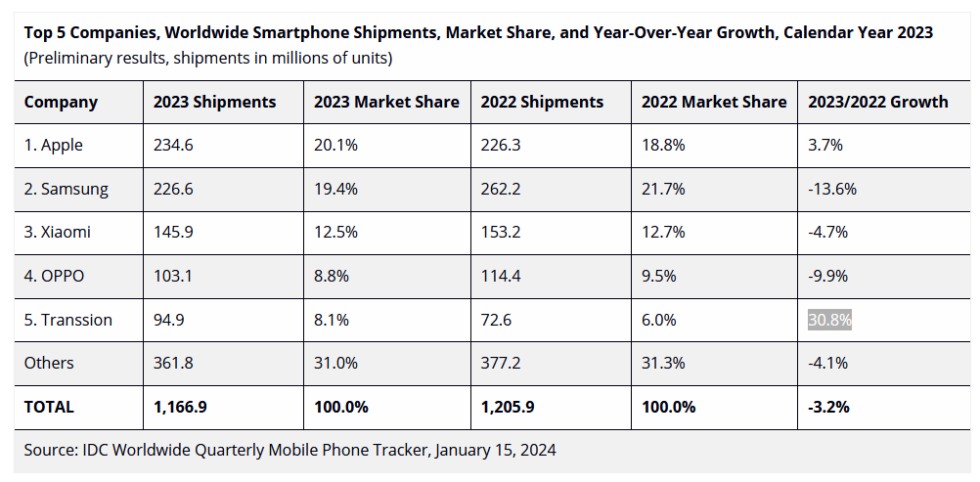

That all-time high market share puts Apple at 20.1 percent for 2023, a 3.7 percent growth over 2022. Nearly everyone on Team Android is way down, with Samsung now in second place after losing 13.6 percent in 2023 for 19.4 percent market share on the year. Chinese firm Xiaomi is down 4.7 percent for 12.5 percent market share, and Oppo (the parent company of OnePlus) dropped 9.9 percent and is fourth, with 8.8 percent of the market. Next up is “Transsion,” a company that is definitely not a household name but is big in emerging markets like Africa. Transsion is a big winner, with 30 percent growth from 2022 to 2023. With 8.1 percent market share, it takes the fifth spot.

Apple is usually not first in sales because the average iPhone purchase is much more expensive than an average Android phone. Samsung’s cheapest phones can be had for about $50, and while you can get a wildly expensive foldable that costs a lot more than an iPhone, Samsung’s bestselling models are often the midrange “A” series, which are in the $200–$450 range. Other Android manufacturers are in the same boat, with low-volume halo products and high-volume cheap devices.

According to Omdia’s top-10 model sales list for 2023, Apple’s bestselling phone—and the bestselling phone model in the world—was the $1,100 iPhone 14 Pro Max. The world’s second bestselling phone is the $1,000 iPhone 14 Pro. Third is the iPhone 14, which cost $800 for most of 2023. Apple’s cheapest phone is the iPhone SE at $429, but that model doesn’t sell well. The point is that Android manufacturers usually win these market share charts by selling cheap and midrange phones, but Apple was able to take the top spot while existing only in the mid-to-premium phone space. The industry lingo for this is “average sell price” (ASP), and for Q2 2023, the IDC has the average Android phone at $250, while the average iPhone costs $949.

In 2020, Apple was fourth in market share behind Samsung, Huawei, and Xiaomi, which made sense given Apple’s more expensive product line. In 2023, Apple beat all these Android OEMs while selling dramatically more expensive products. The IDC’s Nabila Popal wraps up the numbers by saying, “Apple’s ongoing success and resilience is in large part due to the increasing trend of premium devices, which now represent over 20% of the market, fueled by aggressive trade-in offers and interest-free financing plans.”