AI is starting to generate real money for the big cloud providers.

Global spending on cloud infrastructure services topped $68 billion in the third quarter, up 18% year-over-year. That’s the new estimate from Synergy Research Group, a market researcher that provides data and analysis on IT and cloud-related markets, after results last week from Amazon, Microsoft, and Google.

“The current economic and political climate has crimped some growth in cloud spending, but there is clear evidence that generative AI technology and services are starting to help overcome those barriers,” Synergy Research said.

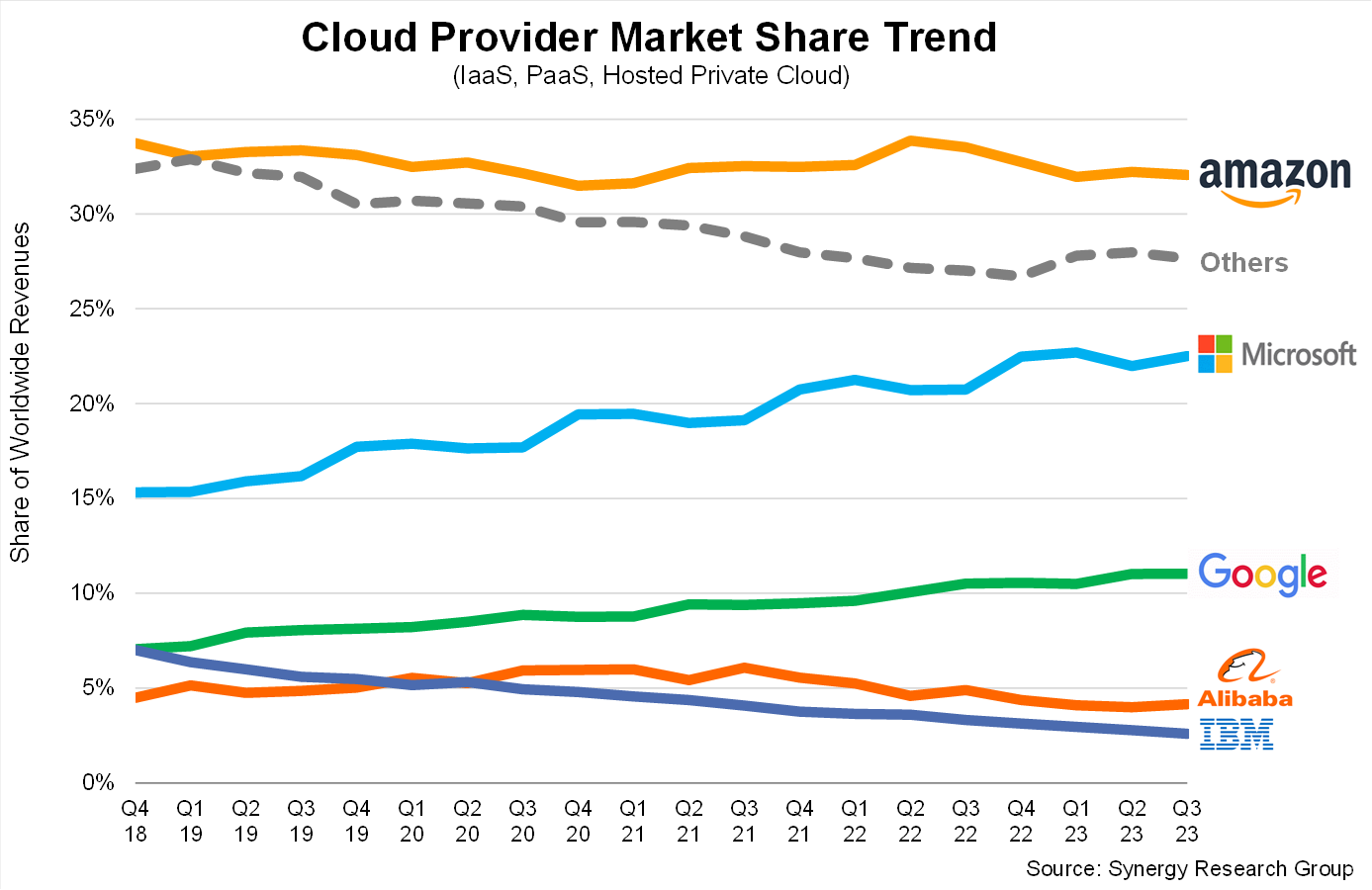

Microsoft Azure’s market share rose 2 points to 23%, with Amazon at 32% and Google at 11%, followed by Alibaba (4%), IBM (3%), Salesforce (3%), Oracle (2%) and Tencent (2%), according to Synergy chief analyst John Dinsdale.

- On its quarterly conference call, Microsoft said 3 points of the 29% growth in its Azure cloud revenue came from AI, exceeding the 2% contribution from AI that the company had predicted going into the quarter.

- Microsoft is seeing customers start new projects driven entirely by AI, which leads to increased consumption of other Azure services (i.e., storage and computing). “AI projects are not just about AI meters; they have lots of other cloud meters as well,” said Microsoft CEO Satya Nadella on the call.

- Analysts at Bernstein said Microsoft has “has taken the AI [mantle] from Google, and that Azure could become a bigger and more important hyperscale provider than AWS,” as reported by CNBC.

Not so fast, says Andy Jassy. “It’s a little hard to measure them apples to apples, but in our best estimation, the amount of growth we’re seeing in the absolute amount of generative AI business we’re seeing compares very favorably with anything else I’ve seen externally,” the Amazon CEO said.

- Speaking on Amazon’s earnings call, Jassy said he foresees “a very substantial, gigantic new generative AI opportunity,” saying the field will generate “tens of billions of dollars in revenue for AWS over the next several years.”

- Overall, AWS revenue increased 12% to 23.1 billion, compared with the same quarter a year ago. Operating income was $7 billion in the segment, representing more than 62% of Amazon’s total operating income.

- Amazon Web Services offers chips for AI training and inference; its Bedrock service runs multiple AI foundation models; and its code-generating tool CodeWhisperer is a rival to Microsoft-owned Github’s Copilot.

Google Cloud revenue rose 22% to $8.4 billion, with operating income of $266 million, compared with a $440 million loss in the same quarter last year, fueled in part by demand for AI and data services.

- Investors, however, knocked Google Cloud for missing Wall Street estimates of $8.62 billion, its slowest quarterly growth since at least the first quarter of 2021, according to a Reuters report.

- On the company’s earnings call, Google CEO Sundar Pichai said more than half of all funded generative AI startups are Google Cloud customers.

- Google offers Nvidia GPUs for training and running AI models, in addition to its Vertex AI platform for building and deploying AI applications.

COMING UP: Microsoft’s Ignite conference for developers and IT pros is Nov. 15-17; and Amazon’s big cloud conference, AWS re:Invent, is Nov. 27-Dec. 1.