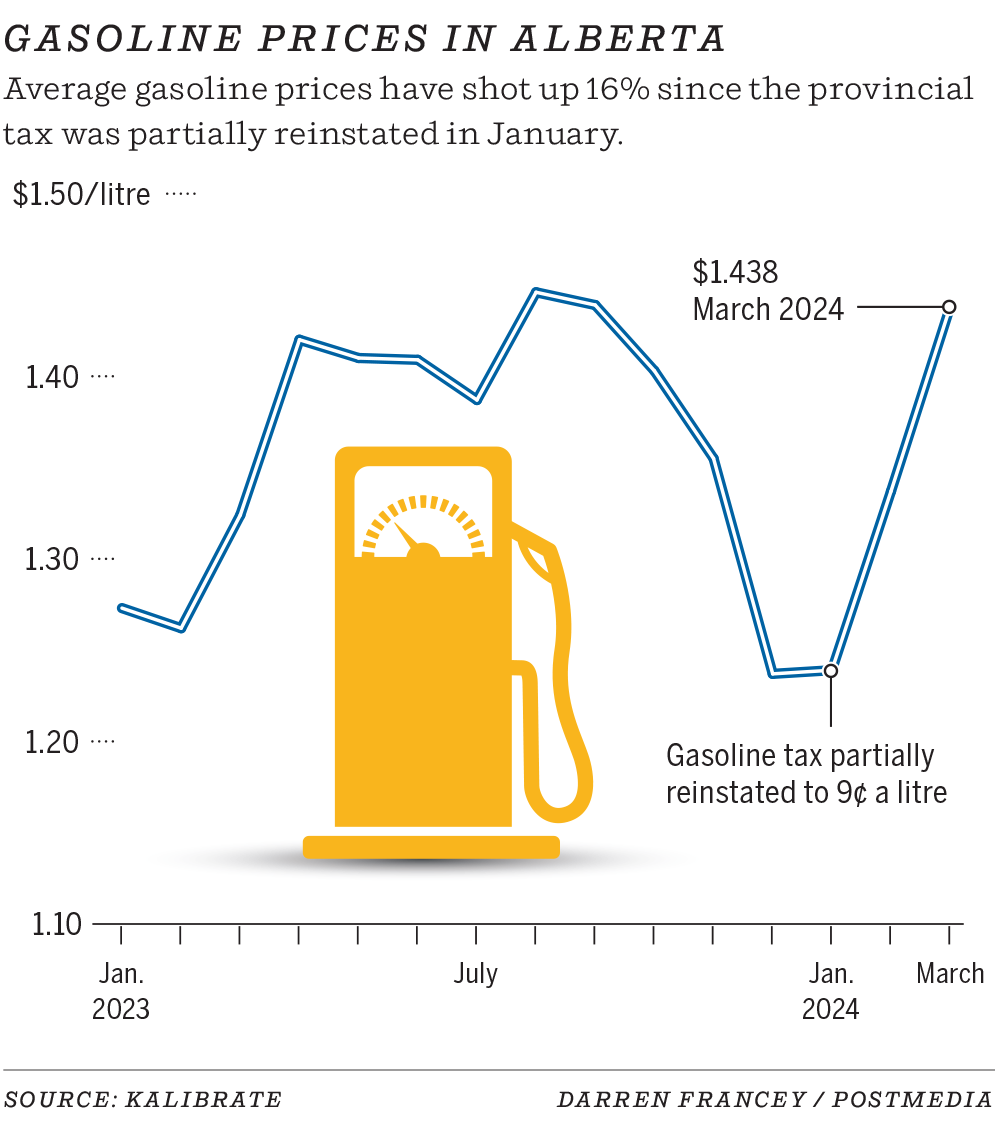

Retail gasoline prices have risen across the province this year, from an average of $1.24 per litre reported in January up to $1.44 in March, according to analytics firm Kalibrate

Article content

Albertans have felt increased pain at the pumps this year and gasoline prices are widely projected to rev up in the coming weeks.

On April 1, gas prices are forecast to increase due to the effect of federal and provincial tax increases, while experts say escalating oil prices and several other market forces will likely propel rates even higher through the spring and summer.

Advertisement 2

Article content

Article content

“Brace for impact,” Dan McTeague, president of Canadians for Affordable Energy, said Monday.

“I see a scenario here in Alberta where prices are up 25 cents a litre by the time we get into the full swing of the Memorial Day-May (long) weekend, as we head toward summer.”

“I do think there’s quite a bit of room for prices to go up,” added Susan Bell, senior vice-president of downstream at Rystad Energy, estimating Albertans could see a hike of about 20 cents a litre by mid-May.

Retail gasoline prices have risen across the province this year, from an average of $1.24 per litre reported in January up to $1.44 in March, according to analytics firm Kalibrate.

Another bump is anticipated at the start of April, with the provincial fuel tax expected to return to 13 cents a litre after more than a year of full or partial relief, while a higher federal carbon tax will also be adopted.

The Alberta government completely removed the provincial levy throughout 2023, although it was partially brought back in January to nine cents.

Alberta’s fuel tax relief program is tethered to the price of benchmark U.S. oil prices. The higher oil prices go, the more revenue it generates for the provincial treasury — and the bigger the tax break the provincial government gives consumers at the pumps.

Article content

Advertisement 3

Article content

However, the reprieve only kicks in if West Texas Intermediate (WTI) crude averages more than US$80 a barrel for a 20-day period in the previous quarter.

The fuel tax falls to nine cents a litre if WTI crude averages between $80 and $85 a barrel. It’s set at 4.5 cents when oil averages between $85 and $90, and it’s completely removed if oil is $90 or greater.

On Monday, U.S. oil prices closed at $82.16 a barrel, up $1.58 for the day.

Yet, it appears a recent rally won’t be enough to hit the government’s $80-a-barrel threshold and provide help in the April-to-June period.

Recommended from Editorial

-

Varcoe: Alberta’s gas tax expected to jump in April, but rising oil prices may extend relief

-

Jan. 2: ‘Better than nothing’: Even as provincial tax break fades, some gasoline deals in Calgary remain

-

Gas tax paused in Manitoba, returns in Alberta at a lower rate

-

Fuel tax detrimental to consumers facing an affordability crisis: NDP

The average price for WTI crude for the past 20 trading days averaged just over $78.70 a barrel, noted Martin King, RBN Energy’s managing director of North American energy market analysis.

Advertisement 4

Article content

With WTI oil prices largely trading around $78 a barrel for much of the past month, that suggests the tax break will disappear, said Vijay Muralidharan, director of R Cube Economic Consulting in Calgary.

Based upon that scenario, the provincial tax is expected to jump to 13 cents a litre next month from nine cents, while the federal carbon tax increase also kicks in on April 1, adding another three cents, he noted.

“It’s over seven cents just in tax changes,” Muralidharan said. “And there are bigger headwinds coming.”

Ongoing refinery maintenance in North America is also expected to push gasoline prices up, as will the effect of higher oil prices and seasonal issues, such as rising consumption during the summer driving season.

On Monday, U.S. gasoline futures briefly reached US$2.77 a gallon, reaching its highest point in six months, according to Bloomberg News.

“I think you will see higher prices going into April and May. I’d say I wouldn’t be surprised if it’s $1.60 to 1.65” a litre at the pumps, Muralidharan said.

Suzanne Gray, a research analyst with Kalibrate, noted crude oil prices could increase in the coming months due to geopolitical factors and production quotas that were recently extended by OPEC+ countries.

Advertisement 5

Article content

Maintenance at oil refineries during the spring and other seasonal factors, such as the switch to summer-blended fuels, usually adds an average of four cents to prices between the winter and summer months, she said in an email.

News on the weekend of an unplanned pipeline shutdown in Manitoba could also affect fuel prices across Western Canada, as alternative supply is sourced.

In last month’s provincial budget, the government forecast that its fuel tax relief program would not kick in during the new fiscal year. It projected oil prices will average $74 a barrel. Government officials say the province will update the fuel tax issue by the end of the month.

But Kris Sims, Alberta director of the Canadian Taxpayers Federation, pointed out oil prices were below $80 a barrel last year and the province ignored its own formula and provided relief to consumers hit hard by inflationary pressures.

“Today, we still have the same affordability problems,” Sims said.

“Timing-wise, this really stinks. There is no way they should be tearing a strip off Prime Minister (Justin) Trudeau for jacking up the carbon tax by three cents a litre, when they are going to be increasing their fuel tax by four cents.”

Advertisement 6

Article content

Oil markets have risen above $80 a barrel in the past two weeks as global consumption is expected to climb in 2024.

Prices were rangebound for months, but a higher demand forecast for 2024 by the International Energy Agency last week and falling crude stocks in the U.S. are pushing markets up, said King.

“What the market was waiting for, to some degree, was kind of a psychological shift in thinking about demand,” he added.

Every $1-a-barrel increase in WTI oil prices over the course of the year pumps out an additional $630 million in provincial government revenues.

On the flip side, every one cent of the provincial fuel tax generates roughly $100 million in revenues, said University of Calgary economist Trevor Tombe.

“The overwhelming effect of high oil prices on the government is a positive lift in resource revenues,” he said.

“Long story short, if they do lower fuel taxes later, they will be in a much stronger fiscal position than they anticipated.”

Chris Varcoe is a Calgary Herald columnist.

Article content