Article content

By Heidi Klaassen

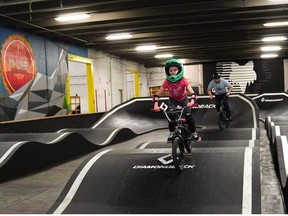

Step inside B-Line Bike Park on a Saturday and you’ll find pump tracks, berms and jumps filled with Calgarians having the time of their lives.

Article content

B-Line serves kids of all ages, from toddlers on balance bikes to local sponsored riders such as Liam Baylis and Jack Feick. It’s been open for more than six years, surviving the pandemic by selling off its entire stock of rental bikes during forced closures. Despite the success of this family-friendly startup, B-Line is on the verge of closing its doors.

Advertisement 2

Article content

What happens when a small business fails — not because of a weak business plan or mismanagement but due to a combination of financial burdens that make it impossible to pay the bills? The landlord has to survive, too, and property taxes keep rising.

Calgary claims to be the entrepreneurial capital of Canada, but small businesses are facing rising taxes, inflation and continued supply chain issues resulting from the pandemic. When B-Line opened its doors, its operating costs were $13,000 a month. Owner Ryan Greenberg anticipated that cost to rise to about $18,000 after 10 years but, after only six years in business, it now takes $37,000 a month to stay open. They just can’t pay the rent anymore.

The company has been transparent about its troubles, and a community of bike enthusiasts hopes to keep the facility going. Many Calgary families, including mine, depend on this business to keep our kids physically active and involved in an encouraging community of sport. Without B-Line, there’s nowhere to train in the colder months, and no camps to keep kids busy in the summer.

Article content

Advertisement 3

Article content

According to the Calgary Chamber of Commerce, 95 per cent of businesses in Calgary are locally owned, and 67 per cent of Calgary’s employed citizens work for these businesses. The burden of high property taxes and the highest inflation rate in the country is causing even successful businesses to face closure.

At what point will the little guy catch a break? Unless you’re an oil and gas giant, an airline or a wealthy and politically connected business owner, there’s no safety net.

Last month, Calgary’s inflation rate was 4.1 per cent, well above Canada’s average. Utility costs are up by 18 per cent. Smaller businesses have less capacity to handle the current pace of rising costs.

Why is a new arena for millionaire pro athletes a top priority, but family-owned sports facilities face blow after blow, making sustainability a dream only billionaires can afford? It’s all well and good to attract entrepreneurs and startups to our city, but what happens when insurance companies, energy providers and real estate investors steamroller small businesses, demanding more, forcing local owners to work for wages below the poverty line to keep their doors open, keep their staff and keep serving their communities?

Advertisement 4

Article content

At this rate, we’re destined to live in a city full of McBusinesses.

Last year, the Canadian Association of Insolvency and Restructuring Professionals (CAIRP) saw a 41.4 per cent rise in the number of businesses that filed for insolvency in Canada. The end of 2023 was also the deadline for repaying CEBA (Canada Emergency Business Account) loans, putting an increased burden on small businesses hit hard during the pandemic, which are now facing debt repayment on top of high inflation.

All of these pressures are piling up, and our communities are suffering. Many of us own small businesses or work for them, and these pitfalls directly affect our standard of living and prospects for our children.

The bike community in Calgary will be left with a huge void if B-Line closes. The kids who spend their evenings and weekends there will have nowhere to train. Twenty employees will be out of work, and another Calgary entrepreneur will have been let down by a city that brags about attracting startups only to stand idly by and watch their walk of shame the morning after.

Heidi Klaassen is a Calgary writer and small business owner.

Article content