A British Columbia man who put more than $700,000 of his money into what he thought would be a safe investment, only to have it taken by a fraudster, says the discovery of a Winnipeg fraud case is likely to thank for the recovery of his money.

That’s because a company associated with the B.C. case is also linked to a 2022 fraud case in Manitoba that saw a Winnipeg man lose more than $600,000 of his retirement savings.

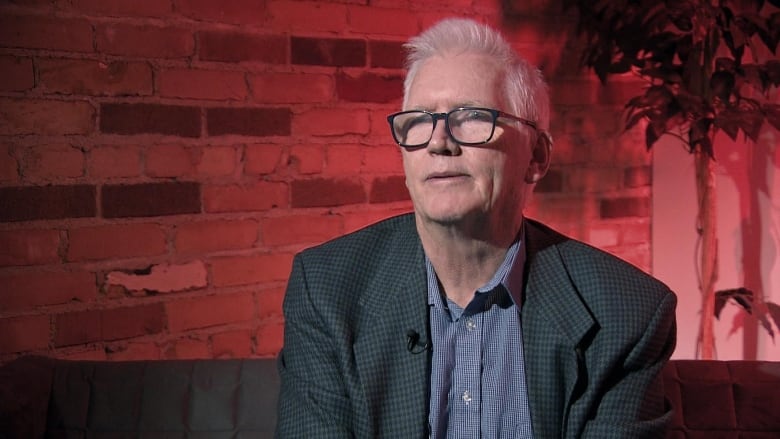

Allan Landa operates two businesses in B.C. — one in real estate development and another that sells arcade games across Western Canada.

In November 2022, he was searching for placement for his investment money, which he planned to use for a future property development project.

“I was putting money away for my development that I would need in about six months, and I was just looking for somewhere to store it, at a good interest rate, until I needed it for the development,” Landa said in an interview from Vancouver.

But when he discovered his money was taken by a fraudster, he was devastated.

“I couldn’t be any more candid than saying I wanted to kill myself. Period. I couldn’t believe that I blew my nest egg.… Honestly, I wanted to curl up into a little ball and never be seen again,” Landa said.

After looking around on social media and websites in 2022, he saw ads for high-interest returns on investments. Then, within a couple of days of looking at the social media ads, his phone rang, with a call from someone who got his number through “some method unbeknownst to me,” he said.

The call was “from a guy saying that he’s with HSBC Jade wealth management, and they’ve got a great product for me. Would I be interested?” said Landa.

“And I probably spoke to him two or three times over two or three days before I thought, OK, well, maybe I should look at this.”

Landa says he checked the name the caller gave him with HSBC’s main bank branch in downtown Vancouver and found the person was listed as working there.

He tried to call the person but got a voicemail response, “which sounded exactly the same — thick, British-style accent,” Landa said.

He left a message and then got a call back, but would later learn it was not the actual HSBC person returning the call.

‘What was I thinking?’

Court documents later filed by Landa say the calls came from a man identified as the “imposter,” fraudulently posing as an adviser at the Jade division of HSBC bank.

“The deal was I had to … wire transfer money,” said Landa. He told the caller he didn’t want to do that, but could deliver a cheque in person.

“‘No no no,'” he was told. “He convinced me that this was a much better way of doing it.”

In December 2022, Landa ended up making two wire transfers to the person who contacted him — one for just over $160,136 and the other for $575,000, totalling just over $735,136.

The transfers went ahead, despite staff at the banks where his own accounts are — TD and RBC — grilling him with tough questions before reluctantly sending them, which Landa said initially annoyed him.

“‘What is all this aggravation you’re giving me?'” he told them.

“I’m such an idiot now, in hindsight. What was I thinking?”

The money went into an RBC bank account in the name of a company called B21 Trade (Canada) Ltd.

That’s the same company Winnipeg’s Peter Squire had wire transferred more than $648,000 to as an investment in November 2022. Squire later learned his money went to a fraudster.

A couple of days after Landa’s money was wired to that same company, he was contacted by TD Bank, which said there were red flags on B21 Trade’s RBC account and it had been frozen.

Landa thinks that was because of the discovery of fraud in Squire’s case.

“Nobody’s going to tell us one way or the other, of course, but highly likely that’s what happened,” Landa said.

The freeze meant the money Landa sent couldn’t be removed by the alleged fraudster.

‘Some satisfaction’ in knowing fraud prevented

Squire says that even though he lost more than $600,000 to fraud, he’s glad his case may have helped someone else.

“There is definitely some satisfaction to know that even though I’m out my money, that another Canadian was able to recover all of his as a result of something I did,” Squire said.

After his incident, Landa said the events and interactions with the imposter replayed nonstop in his mind.

“Every phone call, every word spoken, went through my head over and over again, and I kept going, ‘Well, that was a red flag. How did I miss that one? Oh my God, how did I fall for this?'”

Landa filed a lawsuit in B.C.’s Supreme Court against B21 Trade (Canada) Ltd., the “John Doe” imposter posing as the HSBC Jade adviser, and a “Jane Doe” who held the RBC bank account where Landa’s funds were transferred.

He was able to get a court order to get his money back.

But Landa says banks need to tighten the rules on transactions like his with the imposter.

“They should be probably a lot more strict than they are, and they are very strict,” he said, adding he suspects fraud is “unbelievably rampant.”

“Every time I go to the bank, somebody is talking about the fact they had a fraud,” he said.

His experience left him thinking regulations should be changed to impose a seven-day hold on wire transfers before the money is moved.

But ultimately, “I blame myself, because it was my fault. Period,” he said.

“It’s nobody else’s fault but your own. You’re the one making the decision to do it.”

Fraud ‘worst it’s ever been’: police sergeant

Fraud is “very bad right now,” said Sgt. Shiv Gill, who leads the financial crime unit with the Vancouver Police Department.”

“I would say it’s probably the worst it’s ever been.”

Once the COVID-19 pandemic hit, “everyone got very comfortable with … doing business online,” and “businesses got very comfortable with accepting payments and doing business online,” Gill said.

But people shouldn’t blame themselves if they get caught in a fraud, he said.

“It’s devastating,” both financially and emotionally, he said.

“They’re embarrassed. They can’t believe that they fell for the scam. So they have difficulty telling people. I’ve noticed, actually, they have difficulty reporting it to the police,” he said.

“And it affects their families. A lot of people lose their retirement savings. And these individuals that get victimized, I feel quite sorry for them.”

Gill said he can’t comment on the specifics of Landa’s case, but in general, he’s observed that “it’s highly unlikely” fraudsters will get caught and be charged in Canada.

“Typically the criminal organization is located overseas. And they’re in areas of the world that’s outside the reach of Canadian law enforcement,” he said.

As well, “the money’s transferred in less than 30 seconds,” so the funds hypothetically could be moved multiple times within minutes, he said.

But in order to search bank accounts, police need things like search warrants from court officials, and a bank could have up to 60 days to provide the records, said Gill.

The fraud may occur within minutes, “but it would take the police, just to uncover how it really occurred, a minimum of four months, 120 days,” depending on the circumstances, he said.

In order to reduce incidents, Gill said he favours seeing government change banking regulations so that “if their customers are legitimately defrauded, in a very quick, socially engineered fraud scam, that somehow they’re made whole again, or there’s an ability for them to recoup their losses.”

If you or someone you know is struggling, here’s where to get help: