nycshooter

This article is an outgrowth of my own research on how your taxes reduce the money you have in retirement to spend. Those taxes come from many directions while you are working and then when you are retired. Most people accept them as a necessary evil to increase their net worth and accumulate a retirement nest egg. In August 2022, I wrote “Dividends Aren’t For Taxable Accounts,” which was part 1 in this journey. Now two years from the inception of this account we can see which stocks are doing the heavy lifting in producing a total return of 53% in two years while the market did about half of that.

First, a quick review of the rules of the road for this portfolio.

Setup and Ground Rules

I will invest in 10 Non-dividend paying stocks that are initially contained within the S&P 500 index. If they are later dropped from the index, I may sell and reallocate or do nothing. If they later decide to pay a dividend, I will try and sell prior to the x-date and reallocate the cash to a new stock or the ones remaining. When I invest the cash into these 10 stocks, I will generally invest an equal dollar amount into each 10 using the features of a broker which allows this type of “dollar” investing instead of “share” investing. In the spreadsheet below, I will show a scaled value of $100k. A small position of the equally weighted S&P 500 ETF (RSP) was added to track the market alongside the Portfolio. I have added a final bullet that allows me to “hold” stocks whose dividend is not “significant” (let’s call it less than 1.5% for now.)

Starting Positions

Below is an allocation by Sector:

Communication Services

Facebook (META), Alphabet (GOOGL), and Netflix (NFLX)

Consumer Discretionary

Amazon (AMZN), Chipotle Mexican Grill (CMG), and Tesla (TSLA)

Financials

Berkshire Hathaway (BRK.B)

Industrials

Boeing (BA)

Information Technology

Salesforce (CRM) and PayPal Holdings (PYPL)

Significant Portfolio News so far in 2024

- META pays a 50-cent dividend on March 26th which added .043 shares.

- GOOGL pays a 20-cent dividend later this year.

- CRM pays a 40-cent dividend on April 11th which goes to cash.

- CMG announces a 50 for 1 stock split, which will start trading on a split adjusted basis on June 26th.

- Last August and September, I added just shy of 20 shares of PYPL for an average price of $63.53.

- I have tried to set all stocks, except RSP, for dividends to be paid to cash.

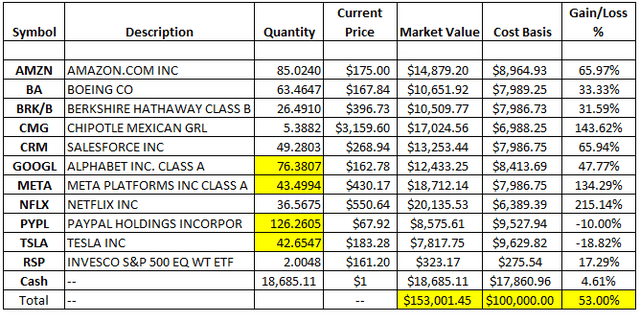

Below are the current standings as of 04/30/24

My spreadsheet of real data scaled to a cost basis of $100k.

As can be seen from the above, the total return of this portfolio over two years is 53%. The first year was 17% with another 36% tacked on in this second year. This 53% compares to the RSP benchmark of 17.3% and a SPY return for the first year of 3% and just shy of 23% for the second year.

I believe a lot of the success of this account so far has been catching the bottom of the mild pullback we had in 2022. In my previous article for the year one results, I described the discount gotten from the previous high for each stock bought. If you want to review that, you can find it here.

Noteworthy results

What surprises me the most is not that PayPal is down 10%, but more that Boeing is up by 33% in two years and Tesla is down by almost 19%. I think one of the main reasons why Boeing is in the portfolio is because I was able to buy it at a 71% discount to its high-water mark. I still think it is a good company and has a solid business and backlog, but living in the Pacific Northwest for many years has taught me that its business is very cyclical, so buying it at a big discount is a good countermeasure to that in my opinion.

Now, Tesla is still a young company and a work in progress. It has a lot of irons in the fire, but I believe it still has a big head start and is “not just a car company” as many suggest.

Conclusion

Most of you that have been following me for years know that I am not a proponent of timing the market or selling stocks just because they appear to be overvalued. That is a losing proposition in the long term, but in this case, the timing was right for me to take advantage of the “natural order of the market” which is, as we all know, up, then down, then up and more of the same.

It is important to understand how the total return of the investments you put in your account affects your retirement and the money left over for your heirs. We also know that the total return is directly related to the income you can generate in retirement. The math tells us that the income will be the same for the same total return, whether you sell shares to generate it or get the income directly from dividends. If you want to see that math worked out, here are two articles I wrote in 2019 demonstrating it, called Is There Magic in Dividends and A Dividend, What is it Good For.

Each person must understand their needs and be able to choose the strategy that best fits them. Just because something works for one person does not make it suitable for the next. Often, money may be tight during retirement, and which strategy you choose can make a difference. However, if the strategy is volatile beyond your tolerance level, that in itself can sometimes make that strategy unsuitable for you.

You also must realize that past performance is no guarantee of the future, and in that regard, all the information presented here is past performance. The information provided here is for educational purposes only. It is not intended to replace your due diligence or professional financial advice.