Sviatlana Zyhmantovich/iStock via Getty Images

While inflation remains a stubborn issue, the softening economy suggests that developed-market monetary easing could start sometime this year.

If you like ambiguity and mixed signals, the current economic and market climate has something for you. Following 2023’s solid progress on inflation, markets became convinced by the start of 2024 that the Federal Reserve was on track to cut rates in short order. However, so far this year, the U.S. economy has remained surprisingly resilient, inflation has largely stabilized at above-target levels and bond yields have generally inched upward, with the 10-year U.S. Treasury at 4.2% as of March 31, and year-to-date fixed income returns in modestly negative range.

That said, central banks do seem to believe that restrictive monetary policy is having an effect, and after curbing costs in goods could gradually see impacts in services, which tend to lag. The U.S. Federal Reserve is said to be waiting for the “Godot” of higher unemployment and wage softening before it can push the button on reducing the fed funds rate from the current 5.25 – 5.50% range. The markets, which initially anticipated up to six interest rate cuts this year, has gradually come around to the Fed’s consensus of three rate cuts.

With this backdrop, we continue to believe that further interest-rate declines are a matter of when, not if. But getting caught up in the “when” may prove counterproductive, given the conflicting nature of the data and imbedded liquidity in the system. Better, as noted in our recent Make Your Money Move white paper, to put excess cash to work in preparation for what is likely to come.

In our view, there are ample opportunities for flexible investors. Yields in the two- to five-year range remain compelling given current levels and the potential roll-down as rates eventually decline. Corporate credits remain at tights, but deservedly so given resilient fundamentals and extended maturities. A long-awaited increase in mergers and acquisitions could provide openings for research-driven managers. Across loans and securitized products like mortgage-backed securities and collateralized loan obligations, income-generation potential may be substantial. Finally, we think that after the outflows of 2022 and 2023, emerging markets debt has the wind at its back.

Patience and directional thinking may be the watchwords as this year progresses. The five market and investment themes that follow reflect and provide additional color on our views.

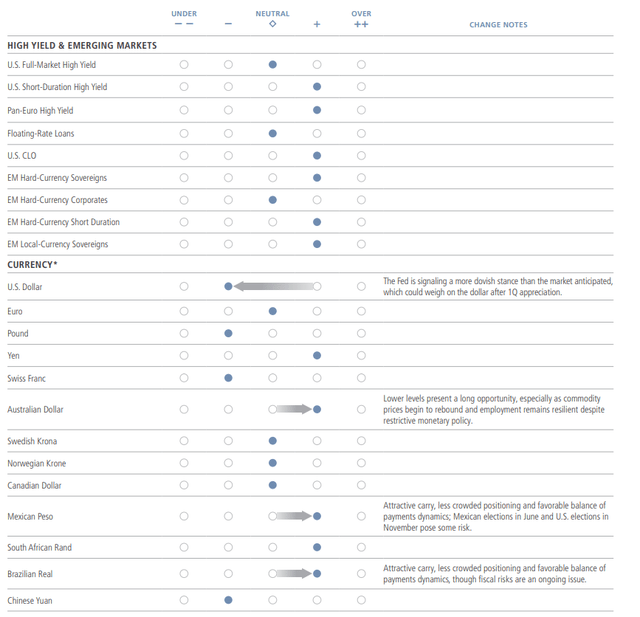

1. U.S. and China Growth Should Be Stable, but Europe Could Struggle

Despite recent upbeat data reports that put markets on their heels regarding forecasted Federal Reserve actions, economic activity isn’t exactly booming. After a generally strong second half of 2023 and a healthy January for U.S. payrolls and wages, the latter have recently been somewhat soft, while the unemployment rate has inched up and consumption has been tepid. Some sectors of the labor market, such as technology, finance and real estate, are experiencing layoffs, but education, health care and hospitality have been supportive. In Europe, growth remains stagnant at low to slightly negative levels, with risk tilted toward continued sluggish activity. Helped by policy support, we think China’s growth should be stable, although there’s little to suggest current upside. More broadly, emerging markets are showing relative strength, but data is likely be idiosyncratic by country and affected by commodity prices (higher prices helping producers at the expense of developed markets).

That said, there’s a chance of U.S. economic reacceleration at the beginning of the rate-cutting cycle, specifically in rate-sensitive markets that have already bottomed, such as housing, industrial or consumer-driven areas. Elevated immigration to the U.S. may be stimulative to growth and spending with limited impact on inflation. Overall, we continue to expect moderation in U.S. economic activity that is consistent with the “lower bound” of a soft landing, possibly with GDP growth of 1.5 – 2% this year, with risks to both the up- and downsides.

Multiple Tiers Of Economic Expansion

Real Gross Domestic Product (Year-Over-Year % Growth)

Source: Bloomberg forecasts. As of March 25, 2024.

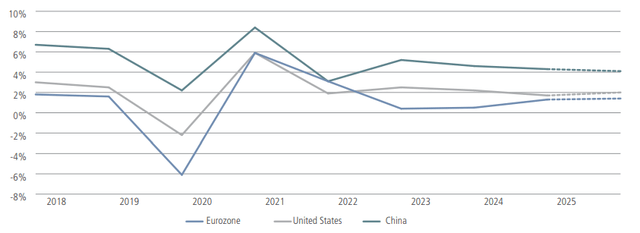

2. Even With Volatile Inflation, Rates Are Likely Headed Downward

Coming into the year, the consensus believed that, outside of Japan, developed-market central bankers were done with interest rate hikes and poised for immediate rate cuts on the back of accelerated disinflation. However, recent inflation overshoots, the healthy labor market and generally robust economic data (reflecting unique strengths within the U.S.) turned policymakers less dovish and pushed back the expected start of the cutting cycle.

This contributed to wild swings in market pricing, but we believe that rate cuts are on the way. In the U.S., the reductions would be driven by moderating (albeit irregular) disinflation, the Fed’s mandate to support employment and its desire to achieve a soft landing. Although rebalancing of the labor market has been slower than expected, with normalization being driven by shrinking vacancies rather than the typical increase in joblessness, we do not expect this to hinder interest rate cuts if inflation continues to ease. Moreover, the Fed could choose to initiate “insurance” cuts in advance of hitting its target to achieve its policy goals.

The European Central Bank, for its part, may be on a clearer track toward cutting interest rates as early as this summer, with the market anticipating three reductions this year. Given forecasts suggesting the potential for lower growth and inflation, policymakers at the March ECB meeting suggested that cuts could start as early as June should incoming data, including on wages, come in as expected. That said, ECB President Christine Lagarde was cautious in her tone, noting that the council was “just beginning” to discuss dialing back its restrictive stance.

With the downward direction of rates (although not the timing of rate cuts) relatively clear, we continue to favor adding duration to portfolios, although less aggressively than in 2023, when the yields made their dramatic move downward. We see particular value in two- to five-year maturities, but in aggregate are more cautious on longer durations given issues around debt sustainability. More broadly, the current likely peak in rates reinforces the potential benefits of moving out of excess cash positions while time allows.

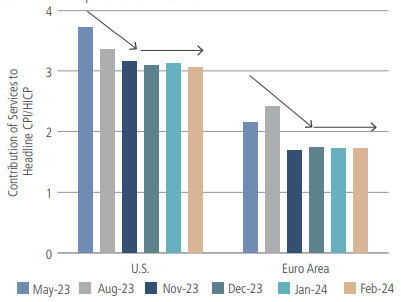

Near-term Data Has Made The Fed And ECB Cautious

Three-Month Inflation Is a Key Focus for Policymakers

Services Price Improvement Has Stalled

Source: ECB, Eurostat, BLS as of February 2024. Neuberger Berman calculations were used to annualize data. Core defined as total inflation less food and energy. Ex-energy services excluding goods.

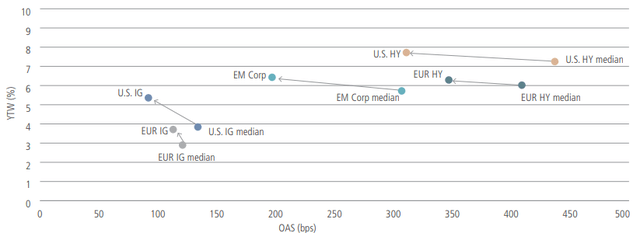

3. In Corporate Credit, Yield Matters More Than Spreads

Corporate spreads remain tight, but with some justification. Many companies have been able to adjust to higher interest rates, while consumers have proved resilient and willing to spend. The potential for defaults has been pushed out given extended maturity walls and the robust economy. Meanwhile, investor demand has been robust, as corporates’ all-in yields have attracted those looking to reinvest their cash or move away from extended equity valuations. Thus, market technicals could continue to prove a key support for the sector moving forward.

Importantly, the market structure bears little resemblance to the last period of tight spreads in 2021, with higher coupons and lower average dollar prices at well below par. In a base case where the economy continues to expand, albeit stabilizing at a weaker trend, potential for rating deterioration appears limited.

That said, increasing idiosyncratic risk tied to rates and slower growth makes security selection especially important. In this context, burgeoning M&A activity could offer an array of opportunities for research-driven investors. From a positioning standpoint, we are seeing relative value at the front end of credit curves, and notably in mid- to higher-quality financials, which remain dislocated due to their identification with lower-quality peers. We are less optimistic on valuations at the long end of the curve, which are being influenced by technicals and longer-term uncertainty.

Corporate Credit Spreads Are Tight, But Overall Yields Remain Attractive

Yield to Worst vs. Option-Adjusted Spread: Current vs. Long-Term Median (Jan. 2004 – Mar. 2024)

Source: ICE BofA Indices, as of March 25, 2024. Yields are in local terms (USD for EM Corp). Indices shown: U.S. IG – U.S. Corporate, EUR IG – Euro Corporate, U.S. HY – U.S. High Yield, EUR HY – Euro High Yield, EM Corp – U.S. Emerging Markets Liquid Corporate Plus Index.

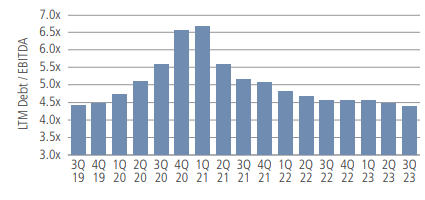

4. Value in Loans and Securitized Products

With a changing macro backdrop, we are seeing potentially generous opportunities across certain segments of the fixed income market, including loans and securitized debt. Given their often floating-rate structure, yields in these areas could benefit if rates increase or if easing unfolds less aggressively than many expect. While approaching these assets with a focus on quality fundamentals, we believe it can also make sense to pair them in portfolios with higher-quality, intermediate- or long-term assets such as mortgages.

Within floating rate loans, credit fundamentals remain resilient for most issuers and sectors, but dispersion in issuer performance across and within sectors persists. Although default rates are still low, they are returning to long-term averages, driven by a pickup in distressed exchanges. Deal supply has been increasing, with a notable pickup in M&A and leveraged buyout-related activity.

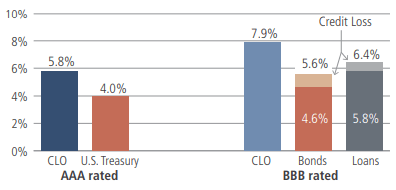

The CLO market is also in relatively healthy shape, benefiting from loan prices reaching a nearly two-year high and a low level of defaults. In our view, top-tier CLO debt rated at BB remains well protected against losses, even as CLO spreads continue to be near historical wides. New issuance including refinancings and resets (refinancing and extending the reinvestment period) has added to opportunities.

Commercial mortgage-backed securities also provide select opportunities. The sector has seen declining values across property types as capitalization rates have reset with rising interest rates, although specific drivers around property use cases, demand and leverage will likely determine loan-level outcomes. The office sector continues to face serious challenges on occupancy, contributing to rising distress rates, although credit performance across other property types remains stable. Importantly, more than 70% of conduit collateralized mortgage-backed debt outstanding is currently secured by non-office properties; and the average loan in this segment has much less leverage than found in the pre-Global Financial Crisis era.

Loans And CLOs: Solid Fundamentals, Appealing Yield And Diversification

Loan Issuer Leverage Well Below Historical Average1

CLO Debt Can Provide Attractive Yields2

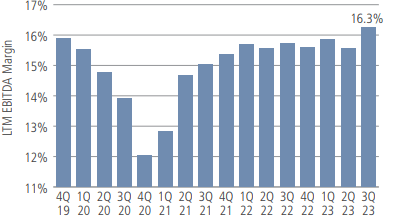

EBITDA Margins Continue to Grind Higher3

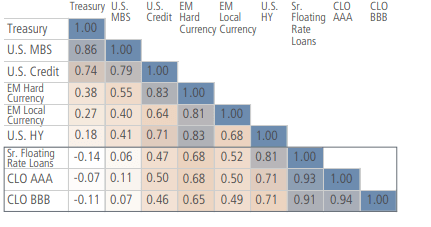

Differentiated Return Profiles for CLOs and Sr. Floating Rate Loans4

Data as of February 29, 2024. 1 Source: Bloomberg, JPM, ICE, Morningstar. 2 Source: Bloomberg, JPM and S&P/LSTA Leveraged Loan Index. Data shown represents CLO yield to maturity, loan yield to maturity, bond yield to worst. Benchmarks used were the BofA Corporate Bond Indices and JPM CLO Index. Excludes defaulted issuers. 3 Assumes 50% and 70% recovery on bonds and loans, respectively. 4 10-year correlation for the Bloomberg U.S. Treasury Index, Bloomberg U.S. MBS Index, Bloomberg U.S. Credit Index, JPM EMBI Global Diversified Index, JPM GBI EM Global Diversified Index, ICE U.S. High Yield Constrained Index, LSTA/Morningstar Leveraged Loans Index, JPM CLOIE Post-Crisis AAA Index and JPM CLOIE Post-Crisis BBB Index.

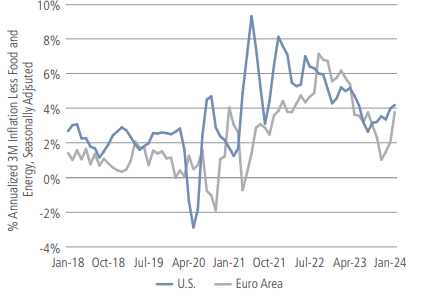

5. Productivity-Driven Growth Should Support Emerging Markets Debt

Despite persistent strength in the U.S. economy, growth differentials are generally expected to shift in emerging markets’ (EM) favor over the course of 2024. The IMF’s latest forecasts have advanced-economy growth “declining slightly” to 1.5%, while emerging economies are expected to “experience stable growth” of 4.1%. Coupled with easing inflation, and likelihood of a peak in global rates, we believe this should lay the groundwork for renewed fund flows to EM markets and a solid (if varied) performance across the asset class this year.

India, for one, stands out as remarkably robust economy, and should be a key engine of EM growth over the foreseeable future. It is on the verge of witnessing four consecutive years of growth in excess of 7%, driven by strong public capex investments, regulatory incentives to boost local manufacturing and a boom in services exports. Further, this productivity-driven growth has seen core inflation fall below the central bank’s target of 4%. Alongside faster-than-expected fiscal consolidation, strength in corporate balance sheets and upcoming inclusion of Indian local bonds in JP Morgan GBI-EM GD Index, it offers plenty of levers to policymakers to sustain the fast-paced growth while maintaining financial stability. Upcoming elections will likely see the current government retain power, resulting in a continuation of market-friendly policies.

In our view, the North Asian economies of South Korea and Taiwan are well placed to benefit from the artificial intelligence-driven upswing in the tech cycle. Recent months have seen surging equity inflows to both these economies, a trend that may not only continue, but also potentially spill over to some other regional economies. This should provide support to their respective currencies and allow a faster pace of monetary easing, if needed.

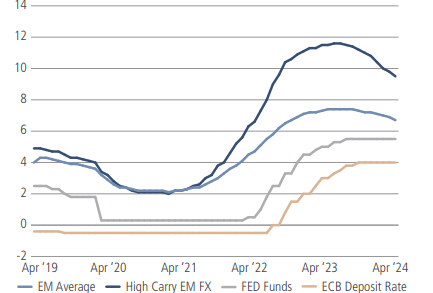

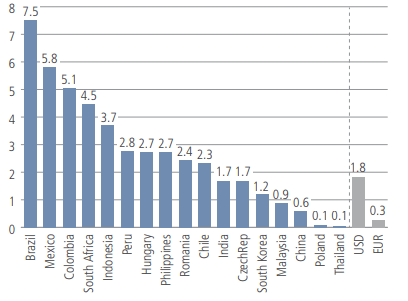

Continued weakness in export prices of Chinese manufactured goods should also aid the global disinflation process – another factor that could create space for a faster easing by some EM central banks, even in the absence of aggressive rate cuts by the Fed. Coupled with in some cases already attractive real rates (see display), this could create room for outperformance by EM local bonds in the second half of the year.

Local Currency: Attractive Carry And High Dispersion Of Real Bond Rates

Policy Rates (%)

EM Local Bonds – Real Rates (%)

Source: Bloomberg, as of March 31, 2024. LHS: High Carry EM FX includes MXN, BRL, CLP, COP, HUF, ZAR. RHS: Based on five-year nominal rates minus 12-month forward CPI.

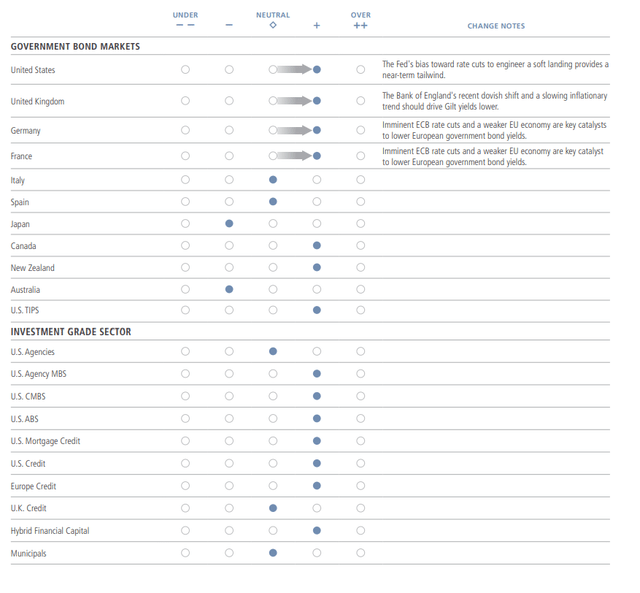

Market Views

Next 12 Months

Views expressed herein are generally those of the Neuberger Berman Fixed Income Investment Strategy Committee and do not reflect the views of the firm as a whole. Neuberger Berman advisors and portfolio managers may make recommendations or take positions contrary to the views expressed. Nothing herein constitutes a prediction or projection of future events or future market behavior. Due to a variety of factors, actual events or market behavior may differ significantly from any views expressed. See additional disclosures at the end of this material, which are an important part of this presentation.

*Currency views are based on spot rates, including carry.

This material is provided for informational purposes only and nothing herein constitutes investment legal accounting or tax advice or a recommendation to buy sell or hold a security. This material is general in nature and is not directed to any category of investors and should not be regarded as individualized a recommendation investment advice or a suggestion to engage in or refrain from any investment-related course of action. Neuberger Berman is not providing this material in a fiduciary capacity and has a financial interest in the sale of its products and services. Neuberger Berman as well as its employees does not provide tax or legal advice. You should consult your accountant tax adviser and/or attorney for advice concerning your particular circumstances. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. Neuberger Berman products and services may not be available in all jurisdictions or to all client types. Investing entails risks including possible loss of principal. Investments in hedge funds and private equity are speculative and involve a higher degree of risk than more traditional investments. Investments in hedge funds and private equity are intended for sophisticated investors only. Indexes are unmanaged and are not available for direct investment. Past performance is no guarantee of future results.

The views expressed herein are those of the Neuberger Berman Fixed Income Investment Strategy Committee. Their views do not constitute a prediction or projection of future events or future market behavior. This material may include estimates, outlooks, projections and other “forward-looking statements.” Due to a variety of factors, actual events or market behavior may differ significantly from any views expressed. This material is being issued on a limited basis through various global subsidiaries and affiliates of Neuberger Berman Group LLC. Please visit Neuberger Berman Global Communications for the specific entities and jurisdictional limitations and restrictions. The “Neuberger Berman” name and logo are registered service marks of Neuberger Berman Group LLC.

© 2009-2024 Neuberger Berman Group LLC. All rights reserved.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.