Dimensions/E+ via Getty Images

Zumiez (NASDAQ:ZUMZ) is an apparel retailer focused on skater-style clothing and skate-hard goods. The company’s operations are mostly US-based, but it has sibling store concepts and brands in Europe (Germany, Austria) and Australia.

I believe the company has quality aspects: a long-tenured, competent management team, customer focus, brand value, an engaging digital presence, a history of growth, and a strong balance sheet.

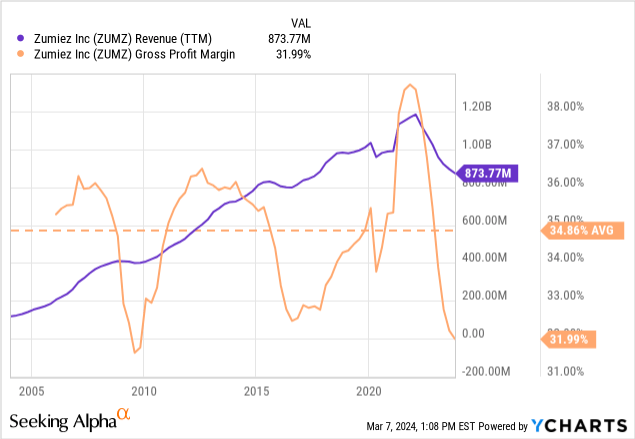

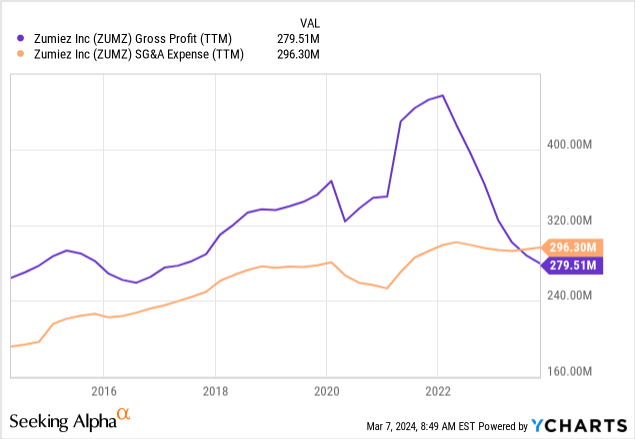

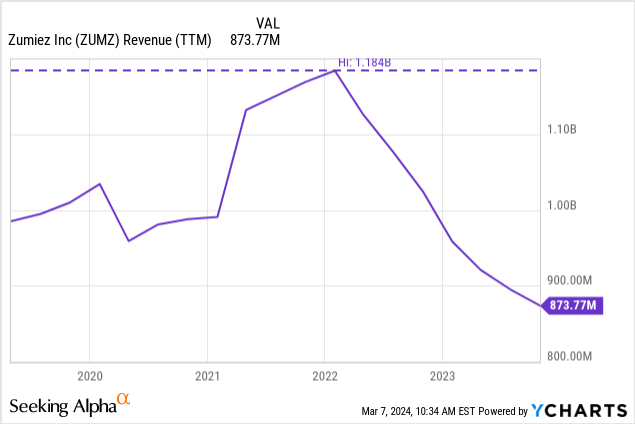

After the pandemic, the company has been suffering significantly. Sales are down 30% from their 2021 peaks, and gross margins are down eight percentage points. The company is already presenting operational losses.

I believe a big part of the problem comes from the competition’s excessive promotional efforts, while the company focuses on full-price selling. This competition steals revenue from them because Zumiez does not control its merchandise and, therefore, can be undercut on price.

I think Zumiez could recover when the inventory-clearing cycle ends and that it has the cash to survive the cycle. However, the stock price already discounts this scenario, so the stock is not an opportunity.

Company Introduction

Customer and product: Zumiez sells skater and action sports-style apparel to young male customers, and skate articles like skateboards. The apparel style is LA skater: oversized and dark colors mixed with vibrant graphics.

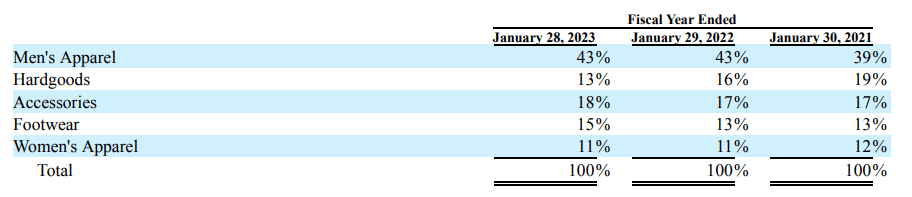

Zumiez’s sales by category (Zumiez FY22 10-K report)

Third-party brands: The company sells mostly third-party brands, representing 80% of sales. Its private label assortment is growing, from 10% in FY20 to 18% in FY22. I believe the focus on third-party assortment affects the company’s margins, more on this below.

Global footprint: The company’s core footprint is in the US, with 600 stores, particularly in California (92 stores), Texas (50), Florida (38), and the New York, New Jersey, Pennsylvania triangle (70).

However, Zumiez operates with the same brand in Canada (51 stores) and with other brands in Europe (Blue Tomato, 78 stores, mainly in Germany and Austria) and Australia (Fast Times, 21 stores).

Quality Characteristics

I believe Zumiez has many quality characteristics.

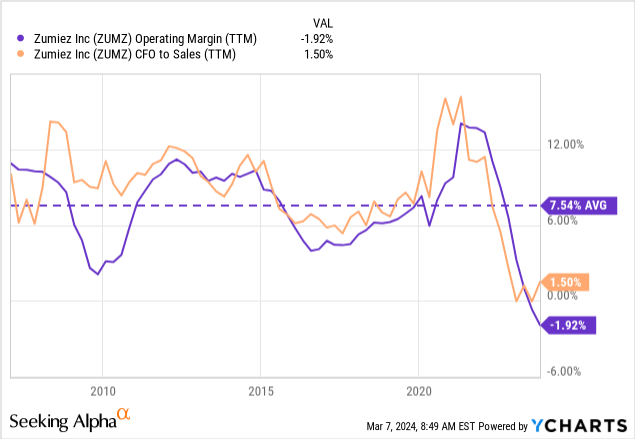

Profitable growth history: Until the post-pandemic period, the company had grown almost uninterruptedly since it went public in 2005. Not even the GFC or the pandemic seemed to affect its trend upward. Further, the company was consistently profitable, with operating margins averaging 8% for the period.

Long-tenured, capable management: The company’s CEO has been with the company since 1993 and has served as CEO since 2000. The company’s CFO has been with the company since 2007, the President for North America since 2008, and the President for International since 2005. This is the team that created the explosive growth above.

The team also owns shares in the company. The CEO is the largest non-passive shareholder, with 13% of the stock. The Chairman owns another 5%, and the rest of the management team 2%, to reach a global 20% of the company.

Compensation is reasonable, with the management team making $8 million in 2021 despite the company’s record profitability year ($170 million in operating profits). Given the company’s dire situation, the CEO received no bonus in 2022.

Organic digital presence: Action sports apparel and product companies have long been known for their community involvement. Most skater brands sponsor skaters or events.

This is, in part, the case of Zumiez. For example, a few days ago, the company published videos showing festivals in Minneapolis, Dallas, NYC, Miami, and Phoenix on its YouTube channel. These festivals featured extreme sports, music, and NGOs. A few years ago, the company was famous for its Zumiez Couch Tours (its logo was a couch).

Their social media presence is strong. Their Instagram account has 1 million followers, and each store has its own account with thousands of followers. The company has a Discord channel with 40 thousand members and organizes live events with brands twice-weekly.

All of this was done with only $10 million spent on marketing in 2022.

The Zumiez app has excellent reviews on the App Store and Play Store, averaging 4.5 stars. However, traffic to the company’s main website has declined and is not as impressive. It reached 11 million monthly visitors during the pandemic and is around 2/3 million today.

Zumiez can fulfill online orders from stores and offers free shipping to a store counter. I believe this is an indication of good logistics management.

Hate from core skaters: A quick search on social media reveals that many people make fun of Zumiez’s employees for not being super knowledgeable about skate articles.

It seems that the core skater community despises brands like Zumiez or Tilly’s because they make money out of their culture. Independent skate shops are run by true skaters and promote the community much more than Zumiez does.

Further, the skater community is an undercommunity by definition and includes a component of dislike for large corporations. Zumiez, in the end, is skater culture in a mall, and there is some contradiction in that. Zumiez is therefore considered a posser brand.

I don’t believe this is a problem, as the core product is apparel, and the company has commented on earning calls that it sells skateboards mostly to kids and their parents, not to core skaters.

I believe the company’s core customer is a posser or skater wannabe, especially young kids who want to look cool. This is not an issue as long as the company can keep engaging some influencers in its favor (as it does consistently on YouTube, for example).

Cost-conscious: Although SG&A is a sticky expense category, the company has grown its store base by 10% since 2018, yet it has not grown in total employees. Its labor costs are 25% higher, yet its SG&A expenses are only 8% higher than in 2018 (Labor costs and employees from the company’s proxy chapter on CEO pay ratio from FY18 and FY22).

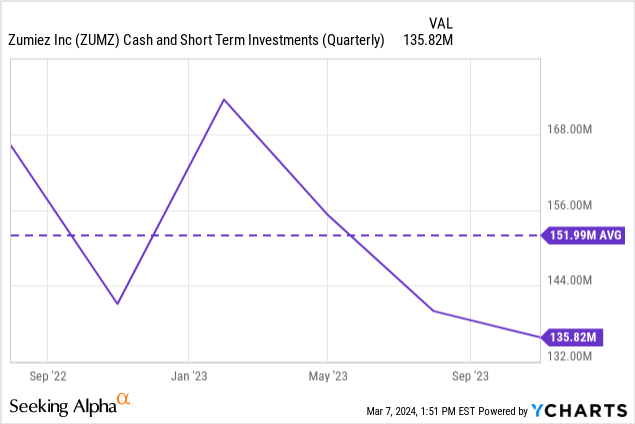

Strong balance sheet: Using yearly averages (retailers’ 3Q tends to be low-cash), the company has half of its market cap in cash reserves.

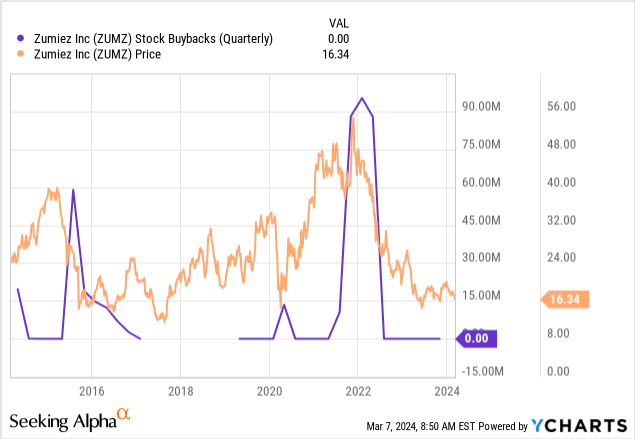

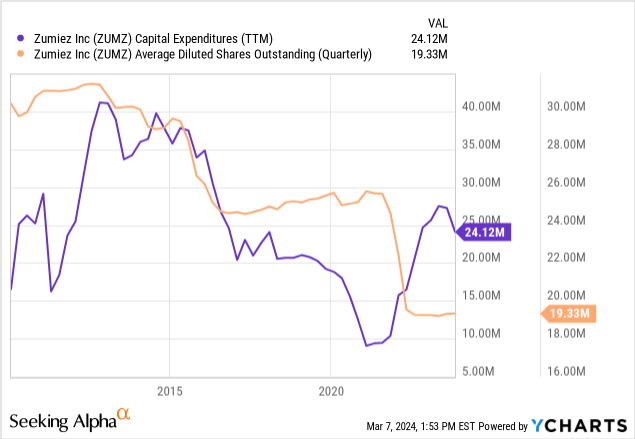

‘Conservative’ capital allocation: The company’s CAPEX has been consistent before and after the pandemic, without bouts of investment. It has used excess cash to repurchase close to 30% of its diluted share count, unfortunately, at peak stock prices.

Current Collapse

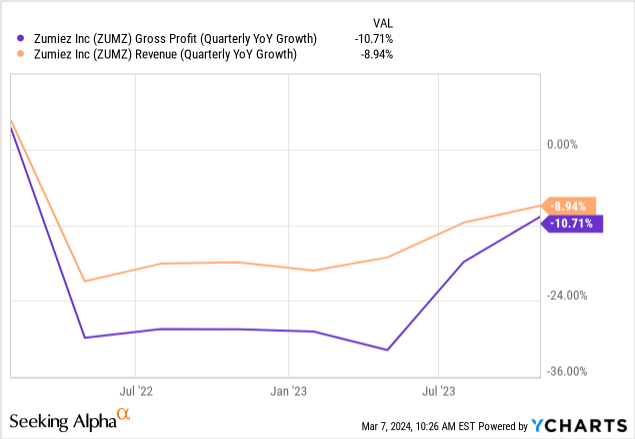

As seen above, the company’s revenues are 30% below its peak, and holiday sales data revealed by the company show that the decline continues.

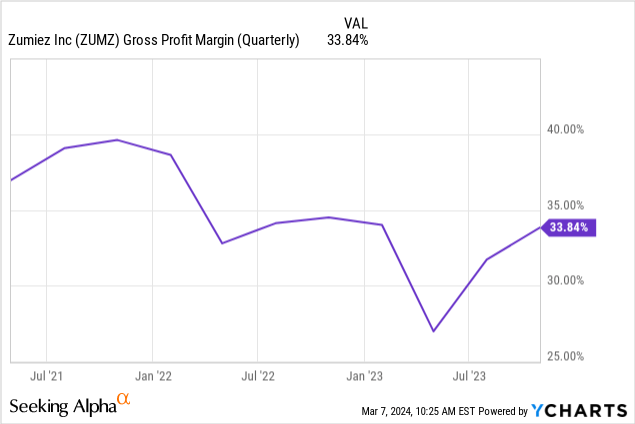

Gross margins have also collapsed seven percentage points, leading to the company entering operational loss territory.

The Margin Problem

Like in most companies, management has blamed the recent problems on inflation affecting their customers, plus aggressive competitor inventory markdowns.

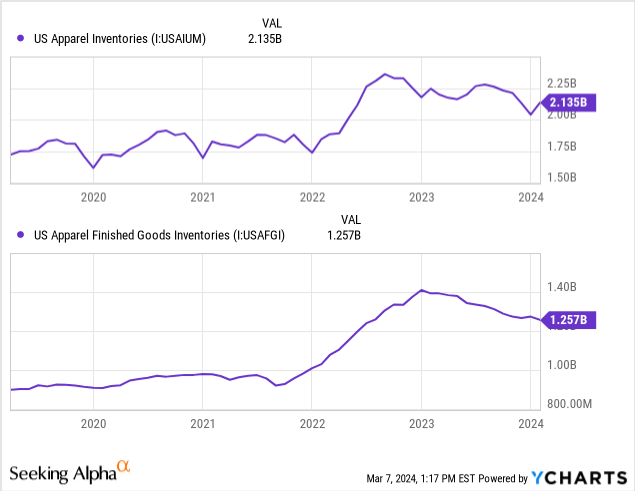

Indeed, apparel inventories are still at record levels despite the industry’s more than a year of falling gross margins. The figures below are an example, although they represent the whole apparel universe and not the specific subsegment where Zumiez competes.

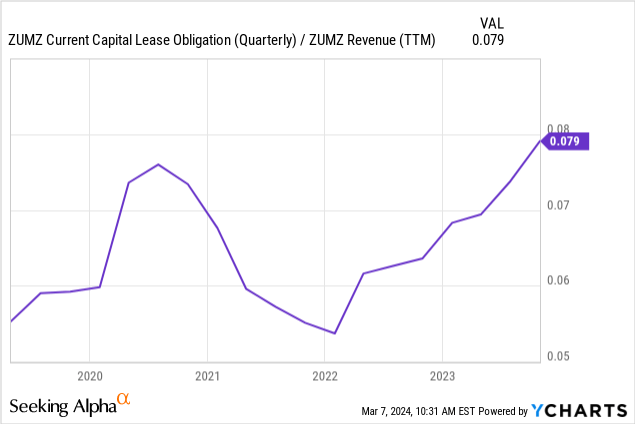

I believe Zumiez has a point, and at least part of the problem is not theirs to blame. First, its gross margins include inflexible store lease costs, which can eat gross margins on the way down. As seen below, from the valley in leases to revenue (peak in gross margins) to today, rent deleveraging is responsible for 2.5 out of the seven gross margin percentage points lost.

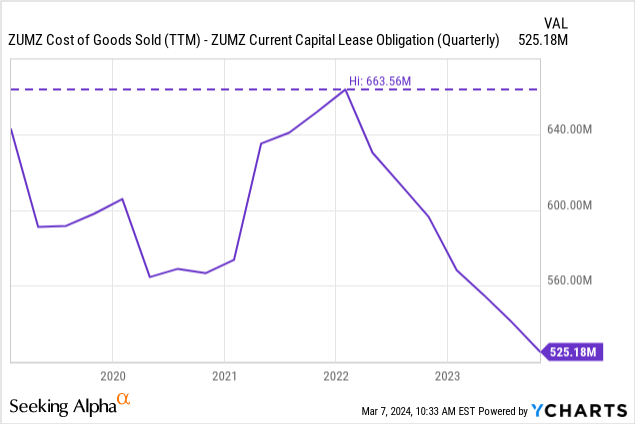

We can also approximate the company’s product margin by comparing CoGS plus rent expenses to revenues. This is not exact, given that CoGS also includes other fixed costs like fulfillment and distribution center operations. But it serves as an indication.

At its peak, the estimated product margin was 44%; it is now 40%, which adds another four percentage points to the gross margin loss. The fall in CoGS ex-leases also shows that the company’s unit sales are decreasing.

Therefore, the culprit is falling product margins or running more promotions and markdowns. As mentioned, the company constantly repeats that it doesn’t want to run promotions and wants to keep a full-price model.

However, I believe this is more difficult if you don’t control your merchandise, as is the case of Zumiez, which gets 80% of its sales from third-party products. When other retailers also have your product, their aggressiveness automatically decreases sales, especially with a young, connected audience. The situation would be better if Zumiez had more sales from its own or exclusive brands.

Scenarios And Valuation

Heavy discounts across the industry will eventually reach a limit as the less profitable players stop buying inventory because they can no longer afford it.

If a quality, large, established player like Zumiez is already bleeding operationally, others are probably deep in the red.

From a survival standpoint, the company’s $150 million in cash, which covers close to 2 years of lease expenses, is more than enough to carry the company through a few years of problems, especially if it does not need to do so much clearance because it tunes down inventories.

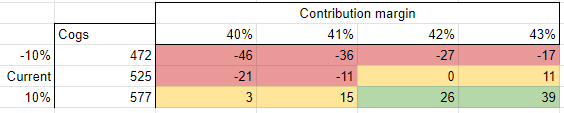

However, we do not know how long that can take. That is why I prefer to play with scenarios. The main assumptions are fixed costs, contribution margins, and taxes. The company has no permanent debt, so interest costs are negligible.

We have $300 million in SG&A and $80 million in lease expenses for fixed costs. For contribution margins, we can work with an average of 43% (35% historical gross margins plus 8% of revenues in lease costs added back), or the current 40%. Revenues are modeled via CoGS ex-leases. That is, an increase in CoGS represents an increase in units sold.

The table below results are NOPAT, considering 30% income tax rates. The red scenarios imply negative NOPAT, the yellow ones profit below a 10% yield, and the green ones profit above a 10% earnings yield (compared to a current EV of $175 million).

NOPAT scenarios depending on COGS (volumes) and contribution margins (Quipus Capital)

What is expected in the future? Comparable sales are improving their trend, and so are margins, as seen in the two charts below.

The company has released holiday season sales data showing it was down 5.5% YoY.

Its revenue midrange guidance for 4Q23 of $277 million implies a 1% decrease compared to last year, which, adjusted for the extra week this quarter, implies a fall of 5%.

This means that the fall continues, albeit slower. At the current margins and sales level, Zumiez is unprofitable, but a volume recovery of 10% would already put it close to a 10% earnings yield ($15 million NOPAT versus $175 million EV).

This is a fair valuation considering the company’s quality, balance sheet strength, and low visibility over the macroeconomic future. The scenarios diverge significantly because of operational leverage.

The company has what is necessary to return to profitability when the cycle improves, either in macro terms or with more competitors leaving the market. However, the stock is only fairly valued, meaning it does not represent an outsized opportunity at these prices. I prefer to wait.