When I purchased shares of Zoom Video Communications (ZM 2.82%) in late 2021, I knew its growth wouldn’t be as good as it had been in 2020 and early 2021. However, I believed the adoption of Zoom’s other products — Phone, Rooms, and (later) Contact Center — would provide enough of a runway for it to still be a good investment.

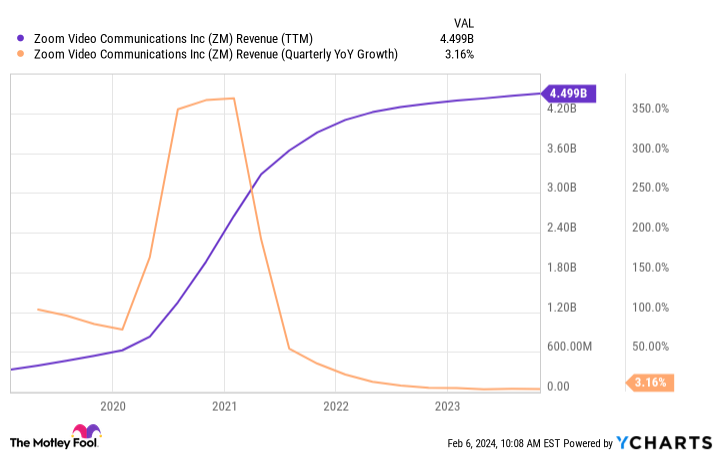

It’s now 2024, and while adoption of Zoom’s other products has been great, its top-line growth has disappointingly been almost nonexistent. Revenue in its fiscal 2024 third quarter was only up 3.2% year over year.

On Jan. 11, Zoom CFO Kelly Steckelberg spoke at the 26th Annual Needham Growth Conference. She made some comments that might explain why revenue growth is meager even though product adoption is strong. And it’s something that could truly challenge the company’s return to more robust top-line growth in the coming year.

The headwind blowing against Zoom

According to a report from Challenger, Gray & Christmas, layoffs during January reached historically high levels in the U.S. The data only goes back to 2009, but Jan. 2024 was the second-worst month for layoffs during this time with only Jan. 2023 being worse.

Not even Zoom is immune from this trend. On Feb. 1, the company announced it was laying off 2% of its own workforce.

Many of the layoffs have been in the technology sector, and that’s why this is particularly problematic for Zoom. The company works out contracts with its customers (many of which are in the tech industry) based on the number of “seats” needed. In other words, it’s based on the number of employees a company has.

According to Steckelberg, Zoom’s contracts average about three years in length, and many were up for renewal during the company’s fiscal 2024, which ended in January. Many of these customers have reduced their base of workers, meaning they need fewer seats in their new contracts with Zoom.

For fiscal 2025, the same headwind will keep blowing against Zoom. Steckelberg said, “I do expect that in FY ’25 we are going to see more discussions with our customers about getting rightsized.” That’s a nice way of saying customers will be looking to spend less by paying for fewer seats.

This dynamic seems like it will challenge Zoom’s return to more upbeat growth in 2024.

Zoom’s silver lining

The good news for Zoom is its business is quite healthy. The company had about 220,000 enterprise customers as of its fiscal Q3, up 5% year over year. And customers spending $100,000 or more annually jumped a more impressive 14% to over 3,700.

Therefore, it’s not as though Zoom is losing customers. Revenue is still at an all-time high, as you can see below.

Data by YCharts.

The problem for Zoom is that its growth has stalled because its existing customers have downsized and consequently don’t need as much from the company.

The additional silver lining is that Zoom does have other products to offer customers. Its core product is Zoom Meetings, and here, customers are needing fewer seats. But the company’s sales team has been able to offer other products and bundles to keep overall spending up.

If it weren’t for the availability of these other products, Zoom’s revenue might have taken a step back by now.

What it means for investors in 2024

As I listened to Steckelberg’s commentary, I realized that Zoom’s encouraging gains in newer products are being offset by losses in paid seats. And this is a trend that can continue in the coming year.

Steckelberg also said its “exit growth rate” for fiscal 2024 might be indicative of what to expect in the coming year. Based on guidance, Zoom only expects about 1% year-over-year revenue growth in the fiscal fourth quarter. That’s nothing to write home about.

Therefore, I wouldn’t expect Zoom to have enough momentum to be a market-beating candidate this year.

The wild card in this discussion, however, is that Zoom is free-cash-flow positive, and it has around $6.5 billion of cash and equivalents on its balance sheet. While the outlook for growth in the business looks weak now, the company certainly has options.

That said, it’s hard to make a case for investing in Zoom stock today based on that wild card. For now, its growth outlook for 2024 looks meager. While its downside might be limited due to its cheap stock price, its upside might be limited as well. Therefore, investors might be better served looking for stocks with a stronger outlook.