Feverpitched

While the broader equity market surged this week as interest rates fell, shares of Zillow (NASDAQ:Z) declined despite the decline in mortgage rates. Weakness in Zillow shares is attributable to:

- While Zillow’s 3Q23 results handily beat guidance/estimates, the market seems disappointed by Zillow’s 4Q23 guidance.

- The NAR (National Association of Realtors)/defendant group (which does not include Zillow) lost the $1.8 billion Sitzer/Burnett lawsuit. There is concern in the industry that this could significantly disrupt the commission structure of the residential real estate industry, particularly on the buy side, which is where Zillow generates the vast majority of its revenue and profitability.

I will dive into both of these topics today and discuss why I believe that significant disruptive change to the commission structure of the residential real estate industry should be a significant positive for Zillow. I used last week’s weakness as an opportunity to build my Zillow position at what I consider to be a very attractive price.

3Q23 Results

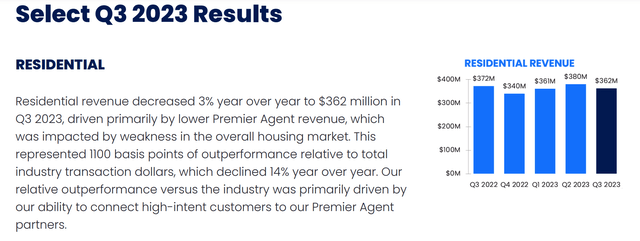

Zillow generated 3Q23 Adjusted EBITDA of $107 million which was +22% above the high end of guidance (and 38% above the midpoint) given with 2Q23 results. Despite significant deterioration in housing market transactions (and a 14% decline in industry transaction value) due to higher mortgage rates/low housing affordability (discussed in my recent article), Zillow’s residential segment saw revenue decline just 3%.

Zillow 3Q23 Residential Segment Performance (3Q23 Investor Letter )

The resilience in this segment is attributable to continued gains in the company’s Enhanced/Flex markets which is driving meaningful improvements in economics to Zillow. Notably, management announced that Zillow has expanded Enhanced/Flex from 4 to 9 markets and will accelerate its expansion during the remainder of 2023 and into 2024. Enhanced/Flex is a critical long-term growth driver as increased conversion benefits both agents and Zillow.

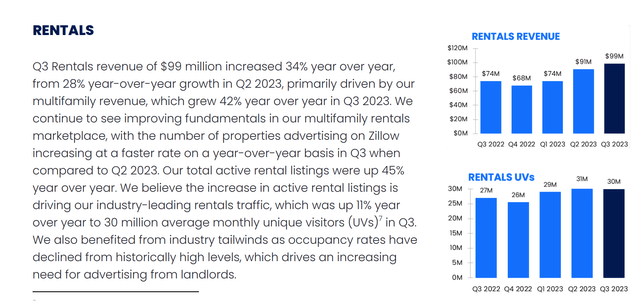

While the core residential segment has suffered from the most difficult housing market in decades, Zillow’s rental business is thriving. Here the company has been a beneficiary of the softness seen in the apartment market where higher vacancy has led to increased spend by landlords seeking to boost occupancy:

Zillow Rentals Quarterly Performance (3Q23 Shareholder Letter )

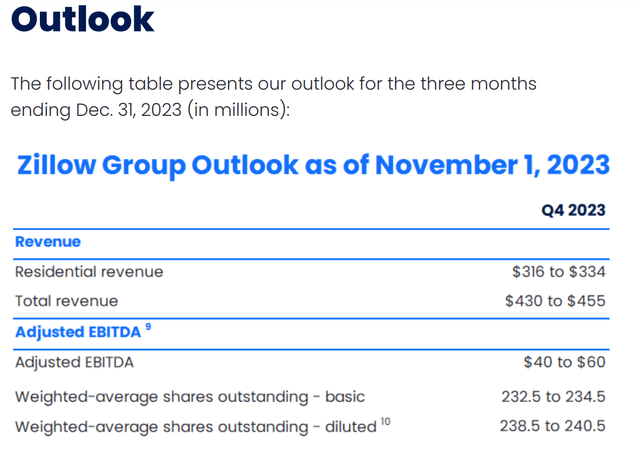

So what didn’t the market like about 3Q23? Guidance came in light with a midpoint of just $50 million expected for 4Q23:

Zillow 4Q23 Guidance (Zillow 3Q23 Shareholder Letter )

On the one hand, the midpoint of guidance ($50 million) is 32% below the midpoint of 4Q22. On the other hand, Zillow has handily beaten guidance throughout 2023 -moreover the company had likely factored in 8+% mortgage rates into the guide (have since eased back to the 7.3-7.5% range). For those that read my work regularly, you know that I’m not overly concerned with quarterly fluctuations and am more focused on the long-term big picture and the results reported last week confirm that Zillow is successfully executing its business plan.

What might the Sitzer/Burnett verdict mean for Zillow?

The Sitzer/Burnett case centered around the payment of commissions to buyers’ agents, known as ‘cooperative compensation’. In almost all US home listings, the commission split available to the buyers’ agent (commission is paid by the seller but is typically split 50/50 between buyers and sellers agent) is pre-determined and communicated via the MLS (Multiple Listing Service). The MLS is a centralized database which contains listing information on residential properties available for sale (and includes commission splits). While the residential real estate brokerage industry is very fragmented (which would otherwise make collusion impossible), the transmission of the predetermined commission split via the MLS facilitates the ‘collusion’ (price fixing). The verdict in the case was that these compensation agreements for buyers’ agents represent a collusion on the part of brokers (via the MLS) to overcharge commissions.

While Zillow was not a defendant in the suit, given that the vast majority of Zillow’s revenues are paid by agents representing buyers, the verdict against the plaintiffs clearly spooked the market last week. There is concern in that commissions to buyers agents could be under fire or that buyers agents will go away altogether. During the trial the value added by buyers agents was continually questioned. Given the tremendous amount of information available to consumers via sites/apps like Zillow (full listing data, comparable transactions, etc), it is possible that the forced end of cooperative compensation practices could lead to a dramatic decline in the use of buyers agents. What then?

Fortunately there are international markets which give us insight into how things might evolve for Zillow in such a scenario. In the UK, there is no comprehensive MLS and buyers’ agents are rarely used. Similarly Australia also lacks a comprehensive MLS and buyers agents are used in less than 5% of transactions. In these markets residential real estate portals are thriving. How do I know? They are publicly traded companies, Rightmove plc (OTCPK:RTMVF) in the UK and REA Group (OTCPK:RPGRF) in Australia which operate under a pay-to-play inclusion model.

While in the US buyers’ agents are highly motivated (via commissions) to make sure clients see listings which may be of interest, in the UK and Australia (where buyers agents are uncommon) listing agents connect with potential buyers through portals Rightmove and REA. Given the absence of buyers’ agents in these markets, Rightmove and REA Group are the primary means for home sellers to reach potential buyers. In the UK, listing agents pay Rightmove a monthly fee for the right to list properties on its website (over 90% of agents participate). Similarly, in Australia, the home seller is charged a fee (paid to the agent, the bulk of which is passed on to REA) to list properties.

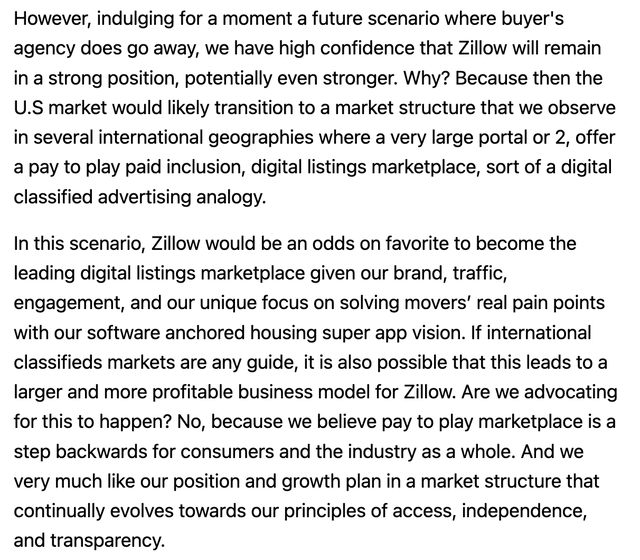

Zillow CEO Rich Barton comments on pay to play inclusion model (3Q23 Earnings Transcript from Seeking Alpha)

Both Rightmove and REA are fantastic businesses (essentially collecting a toll on all residential real estate) which generate 65-73% EBITDA margins. While much needs to be worked out if the US were to go down a similar path (this will likely be legislated for years via the appeals process), elimination of buyers agents would likely be significantly value enhancing for Zillow. While under the current system, listing agents count on buyers’ agents to bring them potential home buyers, in a world without buyers agents, home sellers/agents would need to find consumers and would be willing to pay for access to the leading portals.

Under the existing model, Zillow is paid by buyers’ agents to be featured beside a listing (listing agent’s contact info is not provided). Under the new model, Zillow would be paid by either the home seller or listing agent – in turn Zillow would provide listing agent contact details directly to potential home buyers. With a 63% market share of consumer traffic, Zillow is the dominant US portal and would undoubtedly be the key beneficiary of such a change. Instead of getting paid by less than 10% of agents, in the absence of buyers’ agents I believe it is likely that Zillow would get paid by 90%+ of agents (similar to Rightmove).

Zillow CEO Commentary on Potential Value (3Q23 Earnings Call Transcript from Seeking Alpha)

As shown above, in response to sell side concerns about potential changes to the business in the wake of the verdict, Zillow CEO Rich Barton suggested US investors take a look at international markets as a guide to what Zillow could be worth if we see an end to buyers’ commissions. While he didn’t do so on the call, I’ve gone ahead and done so here.

Rightmove, the UK’s dominant residential real estate portal, is valued at $5 billion (3.9 billion GBP) which works out to $74 per UK inhabitant (using 67 million people). REA Group is valued significantly higher but it is tougher to parse because it has exposure to fast growing emerging market regions. As such, I think it is best to use the UK as a proxy of what Zillow could be worth should such sweeping changes occur in the US commission structure. Using the UK as a proxy, at $74 per US inhabitant, Zillow would be valued at nearly $25 billion which implies a share price of just over $100 per share, or 163% upside to Friday’s closing price.

Again, this isn’t going to happen overnight (likely litigated for years) and may not happen at all (status quo could persist) but should such a change occur, I believe it would be a huge positive for Zillow.

Conclusion

While the prospect of such a large change in the industry has clearly upset investors, like Zillow management, I believe the change would be a significant positive for Zillow. I added to my position last week.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.