4kodiak/E+ via Getty Images

Introduction

The utilities sector is interesting today as the odds of the Federal Reserve reducing the interest rates are increasing. Therefore, there is still an opportunity to lock on higher dividend yields offered by these regulated, stable, low-beta companies. These are not exciting companies, but often, boring wins, as with no hype, you may be able to buy a decently growing company with limited downside and a reliable dividend.

One interesting company, in my opinion, is IDACORP (NYSE:IDA). When I analyzed Avista (AVA) in the past, I got acquainted with IDACORP as they both serve similar areas and leverage hydroelectric power. I will explore the company and hope to find a reliable dividend, several growth prospects, and a decent entry point from the valuation perspective.

Seeking Alpha’s company overview shows that:

IDACORP engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States. The company operates 17 hydropower-generating plants in southern Idaho and eastern Oregon, three natural gas-fired plants in southern Idaho, and is interested in two coal-fired steam electric-generating plants in Wyoming and Nevada. The company provides electric utility services to approximately 618,000 retail customers in southern Idaho and eastern Oregon. The company serves commercial and industrial customers, which are involved in food processing, electronics and general manufacturing, agriculture, health care, government, and education.

Fundamentals

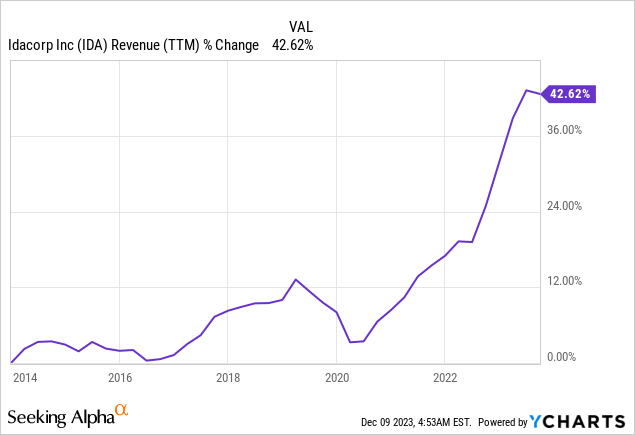

The revenues of IDACORP have increased by 42% over the last decade. The revenue growth is associated with price increases allowed by the states and an boost in the number of customers as the population grows. The company can also boost sales in the future by expanding its coverage area. In the future, as seen on Seeking Alpha, the analyst consensus expects IDACORP to keep growing sales at an annual rate of ~3% in the medium term.

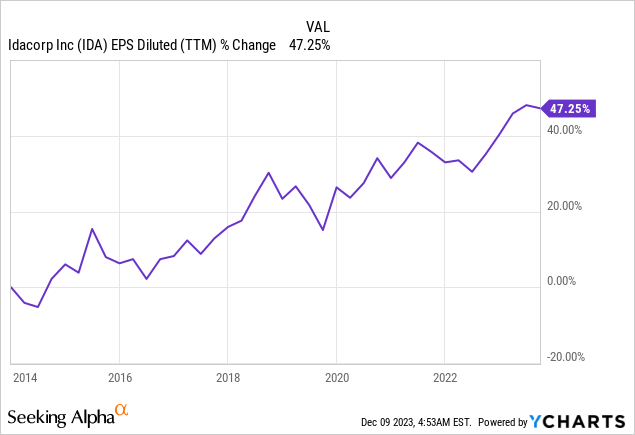

The EPS (earnings per share) during the same period has increased by a similar figure of 47%. The company enjoyed a slight margin improvement that propelled the EPS growth, together with the sales growth. No significant buybacks were made during that decade. Investors should take the stability and predictability of the EPS growth from the graph below. In the future, as seen on Seeking Alpha, the analyst consensus expects IDACORP to keep growing EPS at an annual rate of ~6% in the medium term.

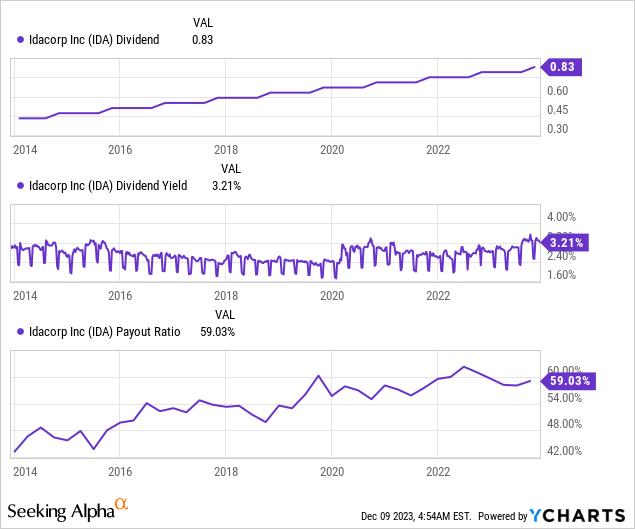

IDACORP has been paying a dividend without reducing it for the last eighteen years. In the previous eleven years, the dividend has been increased annually. The latest boost of 5% was announced in September. The dividend yield is attractive at 3.2%, with room to grow. The company pays 60% of its EPS in the form of dividends. It means the dividend is likely safe and has room to grow in line with the EPS growth. Therefore, investors should expect a mid-single-digit dividend boost.

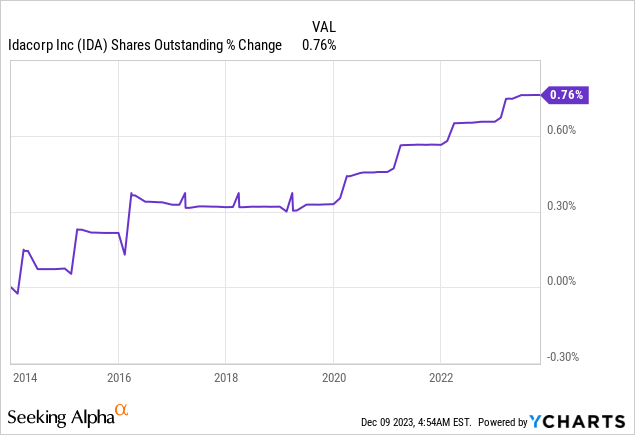

In addition to dividends, companies return capital to shareholders via buybacks. These share repurchase plans preserve EPS growth by reducing the number of shares, thus increasing shareholders’ ownership. IDACORP has not been buying back shares over the last decade, yet it has not issued shares. Therefore, shareholders weren’t diluted. The company should consider buybacks when the valuation is attractive to improve shareholder returns.

Valuation

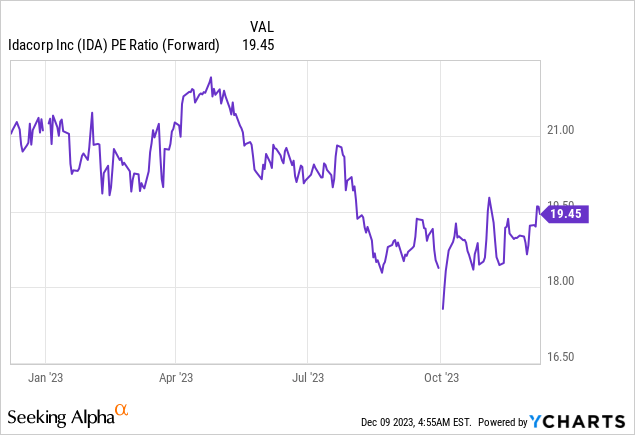

The P/E (price to earnings) ratio of IDACORP stands at 19.5 when using the 2023 EPS estimates. This is not an attractive valuation for a company with limited growth ability. The company is growing at mid-single digits and is tightly regulated. Thus, the growth rate is unlikely to improve significantly. Twenty times earnings when the risk-free rate is still high implies that the current valuation, while not expensive, is also not attractive.

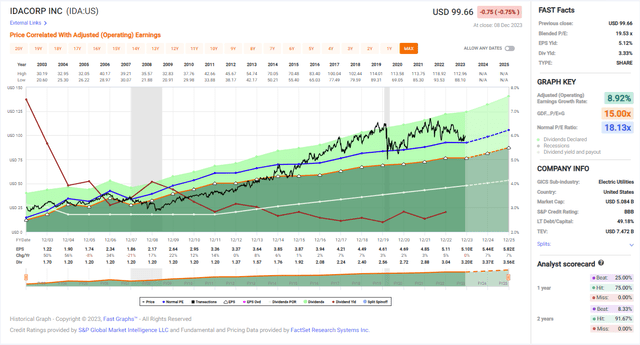

The graph below from Fast Graphs emphasizes why I believe the current valuation leaves investors with an insufficient margin of safety. The average P/E ratio of the company has stood at 18.1 over the last two decades. Today, the P.E ratio is 19.5. The average growth rate in the previous two decades was 9%, and today, the forecasted growth rate is 6%. Therefore, while the interest rate is higher, the valuation is higher, and the growth rate is slower.

Opportunities

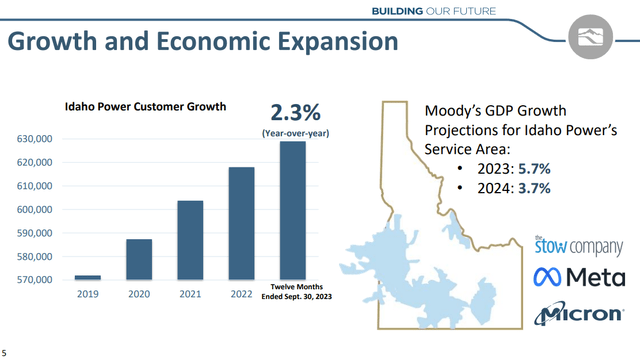

The first growth opportunity is customer growth and infrastructure development. IDACORP is experiencing significant customer growth, with a 2.3% boost last year. This growth is evident in the booming construction sector, particularly in the Treasure Valley area, where 26 tower cranes are visible. The company is actively developing infrastructure to address this growth, including completing The Stow Company’s facility in Nampa and several dairy biogas projects. Additionally, collaborations with companies appreciate Meta and Micron on data centers contribute to the potential for additional load.

“We’ve had 2.3% customer growth since last year’s third quarter. This growth aligns with the trends we’ve seen for several years now and is readily apparent throughout our service area. There continue to be many tower cranes visible near our headquarters in downtown Boise—26 throughout the Treasure Valley area to be exact—and construction is booming.”

(Lisa Grow – President & Chief Executive Officer, Q3 2023 Conference Call)

Clean energy and renewable resource development is another crucial opportunity as the world shifts energy resources. IDACORP is seizing the opportunity to extend its clean energy options with the approval of the Clean Energy Your Way program by the Idaho Commission. This program allows industrial customers to partner with Idaho Power to progress new renewable resources through long-term arrangements. Collaborations with companies appreciate Meta and Micron show the program’s effectiveness in helping them accomplish their clean energy goals. The company’s commitment to providing 100% clean energy by 2045 aligns with the growing interest from various industries in adopting cleaner energy sources.

“As part of our efforts to confront customer demand and keep up with growth, we recently filed our 2023 Integrated Resource scheme. This program expands clean energy options available to our customers, including a construction offering that allows industrial customers to partner with Idaho Power to progress new renewable resources through a long-term arrangement.”

(Lisa Grow – President & Chief Executive Officer, Q3 2023 Conference Call)

Another great opportunity is developing a transmission line, allowing the company to offer its clean electricity westward towards the Pacific Coast. IDACORP is making notable progress in its infrastructure development, emphasizing the importance of the Gateway West transmission line. This project and the Boardman to Hemingway transmission line are crucial for maintaining reliability across the system, especially as the company moves towards a clean energy future. The transmission line projects are part of a comprehensive approach to address the increasing energy and capacity demands. The company’s commitment to working with partners appreciate PacifiCorp underscores its dedication to enhancing the transmission infrastructure.

“One infrastructure addition in particular I want to highlight is the Gateway West transmission line. In the 2023 IRP, the need for at least one segment of the transmission line moved into our five-year action planning window, and we’re now working with our partner PacifiCorp to proceed that forward.”

(Lisa Grow – President & Chief Executive Officer, Q3 2023 Conference Call)

Risks

As a regulated utility, the regulatory lag and general rate case frequency are critical risks. Despite positive regulatory outcomes, such as the approval of the Clean Energy Your Way program, IDACORP faces challenges related to regulatory lag. The settlement of the general rate case in Idaho, while demonstrating a constructive regulatory environment, introduces delays in collecting certain costs. The potential need for more frequent general rate case filings may pose challenges in addressing the company’s infrastructure investments and keeping up with the growing customer base.

“That lag in the collection, given our CapEx outlook, is what will likely put us in front of the commission with another general rate case or another form of rate inquire potentially as soon as 2024.”

(Brian Buckham – SVP & Chief Financial Officer, Q3 2023 Conference Call)

This risk may fuse with another risk- increasing capital expenditure and financial implications. IDACORP’s focus on infrastructure development and meeting the growing demand for energy leads to increasing capital expenditures that demand higher rates. The current and expected future CapEx budgets, including higher estimates for 2024 and beyond, may pose financial challenges. Higher depreciation, financing costs, and regulatory lag could impact the company’s earnings and cash flows.

“We’re currently estimating that our CapEx for 2025 through 2027 will land in the range of $2 billion to $2.5 billion over that three-year period, which is a pretty significant boost from what we included in our assess last quarter, which was $1.5 billion to $1.7 billion for that three-year period.”

(Brian Buckham – SVP & Chief Financial Officer, Q3 2023 Conference Call)

The company also deals with environmental impact statement revision and relicensing delays. Revising the arrange for issuing the supplemental environmental impact statement required for relicensing the Hells Canyon Complex presents a risk. While the company feels optimistic about the progress made towards relicensing, the potential delay until 2025 or later may impact the timeline for obtaining a new long-term Hells Canyon license. This delay could affect the company’s long-term planning and energy generation strategies.

“FERC recently revised its arrange for issuing the supplemental environmental impact statement required for relicensing the Hells Canyon Complex. We continue to feel positive about our progress towards relicensing, but this development likely pushes back a new long-term Hells Canyon license until 2025 or later.”

(Lisa Grow – President & Chief Executive Officer, Q3 2023 Conference Call)

Conclusions

IDACORP is a solid utility company, offering stability in revenue growth and a commitment to dividends. The company’s emphasis on clean energy and infrastructure development presents growth avenues, although regulatory risks and the need for frequent rate case filings unveil a level of caution.

This balanced landscape makes IDACORP a reasonable company, trading at a valuation that leaves no margin of safety. Therefore, IDACORP is a Hold in the current market environment. I’d be willing to reconsider it when the company trades for a P/E ratio of 16-17 or increases its EPS growth rate to 9%-10%.