Home to over 2,500 convenience stores across the United States — making it the third largest c-store chain in the country — Casey’s General Stores (CASY 0.50%) is instantly recognizable to most fuel-pumping customers across the Midwest. However, despite these steady fuel sales, Casey’s operations inside its stores are what makes it a compelling investment proposition.

While it is not a groundbreaking notion to learn that convenience stores lean upon sales of food and beverage products to boost their profits, Casey’s is quietly perfecting the art of making these “inside” sales. So, how exactly does the company do it?

Pizza, mostly. Selling its first slice in 1984, Casey’s has grown to become the fifth-largest pizza chain (by kitchen count) in the U.S. — a somewhat peculiar feat for a convenience store. Powered by this surprising growth story, Casey’s inside sales now account for roughly 62% of the company’s gross profit, helping its stock rise by over 28,000% since its 1986 initial public offering.

Despite this incredible run, Casey’s remains as promising of an investment idea as ever, propelled by its higher-margin inside sales as it goes. Let’s have a closer look.

Pizzas and profitability

With roughly half of its stores located in towns with a population of 5,000 or less, Casey’s pizza operations are uniquely poised to thrive as the stores often act as a focal point for their small communities. As the de facto “centerpiece” of many tiny towns’ culinary options (speaking from experience here), the company and its pizza are truly embedded within the country-ish portion of Midwestern culture.

This matters for investors because these prepared food and dispensed-beverage sales maintain a gross profit margin of 59% — vastly superior to fuel’s 12% mark. To put these higher margins in perspective, consider that in the company’s most recent quarter, these food and beverage sales only accounted for 9% of sales but 26% of total gross profit.

This food and beverage unit pairs nicely with the rest of Casey’s inside sales — grocery and merchandise, which maintain a higher (than fuel) 34% margin. Combined, these two business segments generate 62% of the company’s gross profit despite barely accounting for one-third of Casey’s sales.

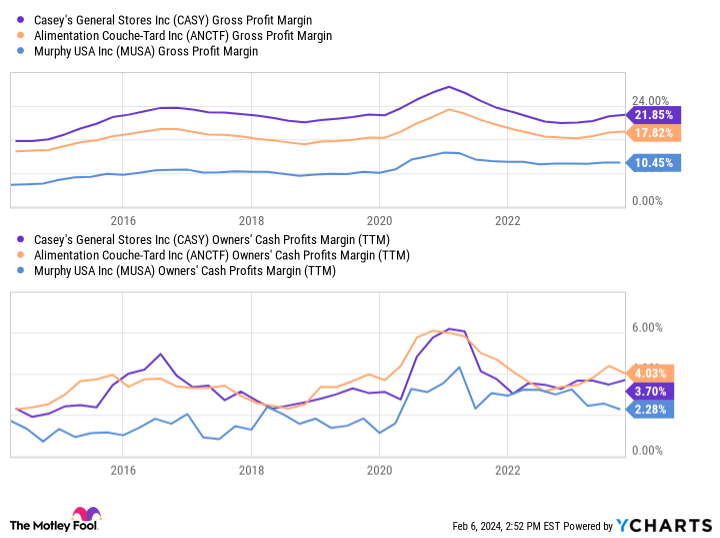

Thanks to this specialization on higher-margin food, beverage, and grocery sales inside its store, Casey’s maintains superior profitability compared to its two most similar peers.

CASY Gross Profit Margin data by YCharts.

Holding the best gross-profit margin of the group — and roughly tied for the best cash-from-operations margin — Casey’s provides investors with the highest margin-expansion potential of the group. What makes these impressive margins all the more noteworthy is that the company’s store count is roughly one-seventh the size of Alimentation Couche-Tard, meaning that it reached similar profitability despite not operating at its larger peer’s scale.

And the cherry on top for investors? After launching its new offerings in 2020, Casey’s has over 120 private-label stock keeping units (SKUs) on products such as beef jerky, ice cream, and nuts. Vertically integrating its operations like this is huge for the company as these private-label goods often improve margins anywhere from 2 to 10 percentage points, according to Chief Executive Officer Darren Rebelez.

Better yet, as promising as these inside sales and Casey’s high margins are, its growth marathon may still be in its first few miles.

Still in the early chapters of its growth story

Despite already being the focal point of hundreds of communities across the Midwest, Casey’s (and its investors) should see ample growth. Highlighting this point, 75% of towns with a population between 500 and 20,000 within the company’s current geographic footprint do not yet have a Casey’s. These small localities represent the next potential chapter in the company’s growth story as they already fit within its distribution network.

However, after pushing further south into Texas — the company’s 17th state with a store — an expansion to the coasts could represent Casey’s long-term ambitions. Relying upon a mix of smaller acquisitions and newly built stores, Casey’s has added over 1,000 stores since 2010, including 343 in the last three years alone.

Guiding for 350 additional new stores by year-end 2026, management looks to keep its recently formed mergers and acquisitions (M&A) team busy. With 63% of convenience stores in the U.S. run by proprietors who own fewer than ten stores, the c-store market is massively fragmented. This fragmentation across many small operators makes for a perfect M&A environment for Casey’s to choose from as its expansion continues.

Trading near market averages at 21 times earnings, Casey’s has a track record of outperformance, high-margin inside sales, expansion potential, and 24 consecutive years of dividend increases — all of which combine to make the stock an ideal investment.

Josh Kohn-Lindquist has positions in Casey’s General Stores and Murphy USA. The Motley Fool has positions in and recommends Alimentation Couche-Tard. The Motley Fool recommends Casey’s General Stores. The Motley Fool has a disclosure policy.