Brad Barket/Getty Images Entertainment

Yext (NYSE:YEXT) reported a disappointing FQ3 as the company failed to make any progress towards returning to solid growth. The AI explore company has prioritized profits over growth in the last year to the demise of the stock. My investment thesis is still Bullish on the stock at the current ultra-cheap valuation, but Yext isn’t likely to rally until the company prioritizes and produces growth.

Record Profits Aren’t Enough

Yext reported FQ3’24 revenue that disappointed the market with growth of only 2% as follows:

The AI explore company has been generating revenues of around $100 million going back to the $98 million reported in FQ2’22. The new management team has been in place for 6 quarters with no meaningful revenue growth reported despite all of the hype around AI.

The company has shifted towards solid profits, but the stock trades at yearly lows and is now approaching the $4 all-time low in 2022. Yext only produced annual revenues in the $400 million range and the markets clearly say that the lack of growth isn’t appealing in a tech sector where relevance is now at question with so many companies rushing into AI.

Yext reported a record adjusted EBITDA of $13.5 million on $101.2 million for an adjusted EBITDA margin of 13.3%. The company has gross margins approaching 80%, which would normally furnish a path to adjusted EBITDA profits in the 20% to 30% range, but the market clearly needs growth those margins reached under a scenario where revenues grow.

The stock market mantra of the last year was that profits matter and the market action was clear that growing at all costs wasn’t acceptable, but to the same extent focusing on pure profits isn’t rewarding either. Management guided to FQ4 revenue of just $100.0 to $100.5 million setting up a sequential refuse to end the year.

The issue may be out of the control of the company with a large customer apparently running into financial trouble. On the FQ3’24 earnings call, the CFO made the following comment:

We reckon the impact of this customer churn alone to be approximately $11 million in ARR and our Q4 revenue guidance factors this in. Our outlook also includes our assumptions for the continuing effects of a challenging macroeconomic environment.

A customer with $11 million in ARR would approach nearly $3 million in quarterly revenues. The customer churns out on December 31, so Yext won’t feel the full impact until FQ1.

Unfortunately, on the path to improving efficiency, one has to wonder if Yext hasn’t restricted growth to the extent of hurting stock performance. If the company had produced similar bottom-line results on higher sales offset by higher costs, the stock would likely be significantly higher.

Yext reported just 2% sales growth, but sales and marketing costs were down 7%. The sales efficiency is up, but the company could’ve probably achieved sales efficiency by generating higher growth rates, though at lower margins.

Investors are left with only hope the CFO actually has the business back on producing ARR growth in FY25, per this statement on the FY25 earnings call:

The net result is that fiscal year ’24 revenues and ARR will not see the reacceleration we anticipated when we began the fiscal year. We think this is temporary because we see real improvement in underlying trends around pipeline, sales productivity and profitability, and we remain confident that we’ll see a return to high single-digit ARR growth next year.

Call Option

The stock has fallen to $5 and is mostly a call option on the management’s ability to return the business to growth. Yext guided to ARR growth approaching 10%, an amount that would send the stock soaring.

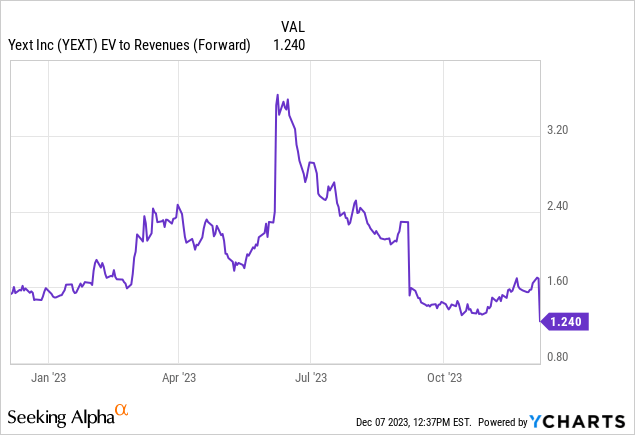

The company guided to $51 million in adjusted EBITDA with the stock trading at a market cap below $700 million now. Yext has a cash balance of $182 million placing the forward EV/S multiple closer to only 1x. As well, the stock only trades at ~10x EV/EBITDA targets.

At 10% ARR growth, the stock would start trading back towards the 3x EV/S peak in mid-2023 and possibly even higher. The company has spent the last year buying $100 million worth of stock and the current profitable business provides the cash flows to continue with share buybacks, though mostly offsetting stock-based compensation.

Takeaway

The key investor takeaway is that management has a lot to verify with Yext. The stock is more of a call option here with the stock unlikely to advance much without the company reporting stronger growth while the upside is significant on Yext being rerated at higher multiples.