TERADAT SANTIVIVUT

Macroeconomic Outlook: A Tipping Point

By Francis A. Scotland

For the past couple of years, the major macroeconomic developments in the U.S. and to a lesser extent in Europe have reflected the aftershock dynamics of post-pandemic normalization – not your typical business cycle. The economic bust caused by the pandemic and lockdowns and the subsequent barrage of stimulus measures led to massive distortions in the economy, and for the past few years, the narrative has been about getting things back on track.

A lot of this normalization story has fallen into place. The reopenings and massive stimulus gave us a rocket-appreciate rebound across the board in terms of asset markets, the economy, and inflation while simultaneously upending normal economic relationships. Then in late 2021, the rocket ran out of gas, and things began to reverse as monetary policy started to lean in the other direction. From cryptocurrencies to commodities, things began to come down almost in perfect reverse sequence to the way they went up. Even the economy seems headed for a return to “2 plus 2”: 2% real growth and 2% inflation. The latter has been in full retreat for 17 months, and core inflation is well below 2% if the owners’ equivalent rent (OER) component of the Consumer Price Index (CPI) is replaced with more accurate market-based measures of rent.

So, what is left to regularize? As we approach what may be the final chapter of this normalization story, the investment outlook for 2024 comes down to only a handful of the most crucial macro and financial variables yet to return to something more normal: Monetary policy needs to ease, fiscal policy needs to tighten, and interest rates need to proceed lower.

The inverted yield curve remains anomalous. The market expects the Federal Reserve (Fed) to cut rates. Recession is the normal catalyst for this outcome but since this is not a standard business cycle, a different outcome seems possible – if not likely this time. Our base case has been that normalization does not necessarily imply a recession, assuming the Fed reacts soon enough to falling inflation.

So far, the Fed has thrown cold water on any rate cut expectations. Inflation has melted faster and advance than the Fed has given due credit, but the establishment view holds that sustainably lower inflation can only be achieved through depressed economic conditions. Nevertheless, we may be fast approaching a tipping point where monetary policymakers could soon become believers in the sustainability of the retreat in inflation. There is a very good chance that inflation undershoots next year’s targets, a development that will be hard for the Fed to ignore, even absent a recession.

- First, looking around the world, there is no macroinflationary pressure coming from China as traded goods prices fall and the property sector struggles with deflation. Europe may be even more disinflationary than the U.S.; banking and monetary data point to a repressed 2024.

- Second, the remarkable resilience of the U.S. dollar in combination with these external deflationary forces has helped suppress domestic inflation even in the face of strong domestic growth.

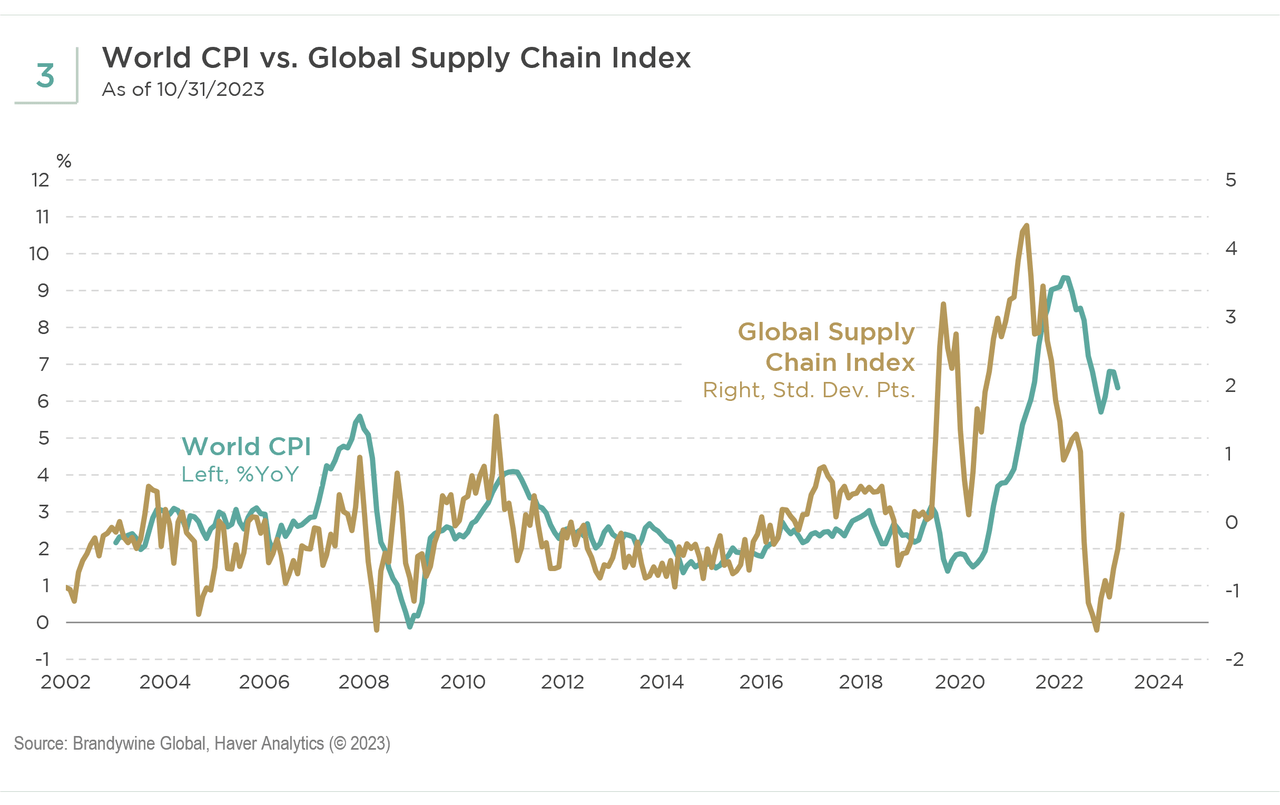

- Lastly, lagged effects from tight monetary policy on inflation are still in the pipeline; the retreat in inflation since mid-2022 is due mainly to supply chain improvements, a development that has provided the reverse of stagflation – a disinflationary expansion. Similarly, the retreat in the growth rate of the monetary data is exceptional. If short-term rates have peaked, in all probability so has the velocity of money. Nominal gross domestic product (GDP) activity seems set for a big slowdown absent any pick-up in money growth.

The longer the Fed ignores the retreat in inflation, the longer the Treasury curve stays inverted, and the higher the probability of a recession or some discontinuous event that increases recession risk. The odds of a recession are not trivial. However, it is not the most likely scenario given our constructive view on inflation. Timing is everything, but if the Fed begins to cut rates soon enough, next year could end with the economy accelerating.

We believe 2024 could be a strong year for investors in general once monetary policy passes the tipping point. From a valuation perspective, the bond market looks more attractive than the cap-weighted equity market, although there are clearly sectors trading at steep discounts to intrinsic value that also stand to benefit.

In addition to geopolitical upheaval and recession risk, the greatest domestic threats in the U.S. may be fiscal policy and the upcoming election. The current budget deficit is unsustainable given the level of interest rates relative to economic growth, yet political discord will likely make any significant fiscal consolidation difficult. While these risks may not be material issues in 2024, they could still be a significant source of instability in the U.S. macro outlook. At some point in the future, a big adjustment will be required, the consequences of which will be felt across the economy and markets.

Developed Markets Fixed Income Outlook: The Year of the Coupon+

By Jack P. McIntyre, CFA

As I put pen to paper for this outlook, we are anxiously waiting to see if, for the first time in history, the 10-year U.S. Treasury note records three consecutive years of negative returns. Either way, the broad theme for developed market (DM) bonds going into 2024 will be different from 2023, largely a function of time, including the long and variable lag of tight financial conditions, and fading fiscal preserve. These factors will be a cooling influence on the economy in 2024.

We expect 2024 to be the year of the “coupon+”, with the “+” representing potential boosts of price appreciation and currency appreciation from a weaker U.S. dollar. We always thought the uncertainty around this current economic cycle had more to do with timing. Interest rates will proceed higher until something breaks. Inflation has already broken but getting it the rest of the way down to target may demand some demand destruction, aided by advance housing deflation. That next leg lower will be led by service deflation, and that typically comes with economic pain in the form of labor market stress. So, for the first time in decades, inflation is not the critical variable for bond markets. It will be a weakness in the labor markets because of the concept of term premium embedded in real yields. The market is demanding a yield premium to take on duration. It is signaling that bond investors do not believe inflation will settle near the Federal Reserve’s (Fed’s) target. This view is true for most DM bond markets.

Valuation

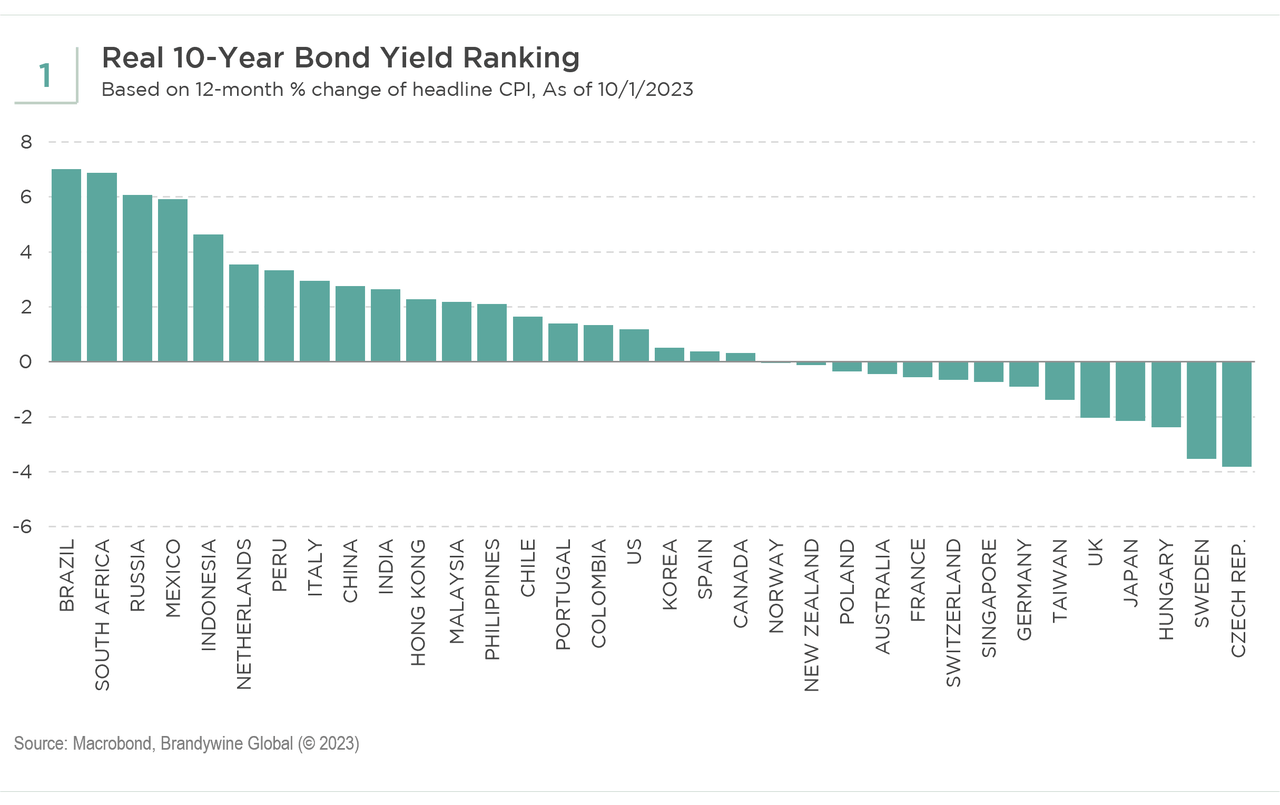

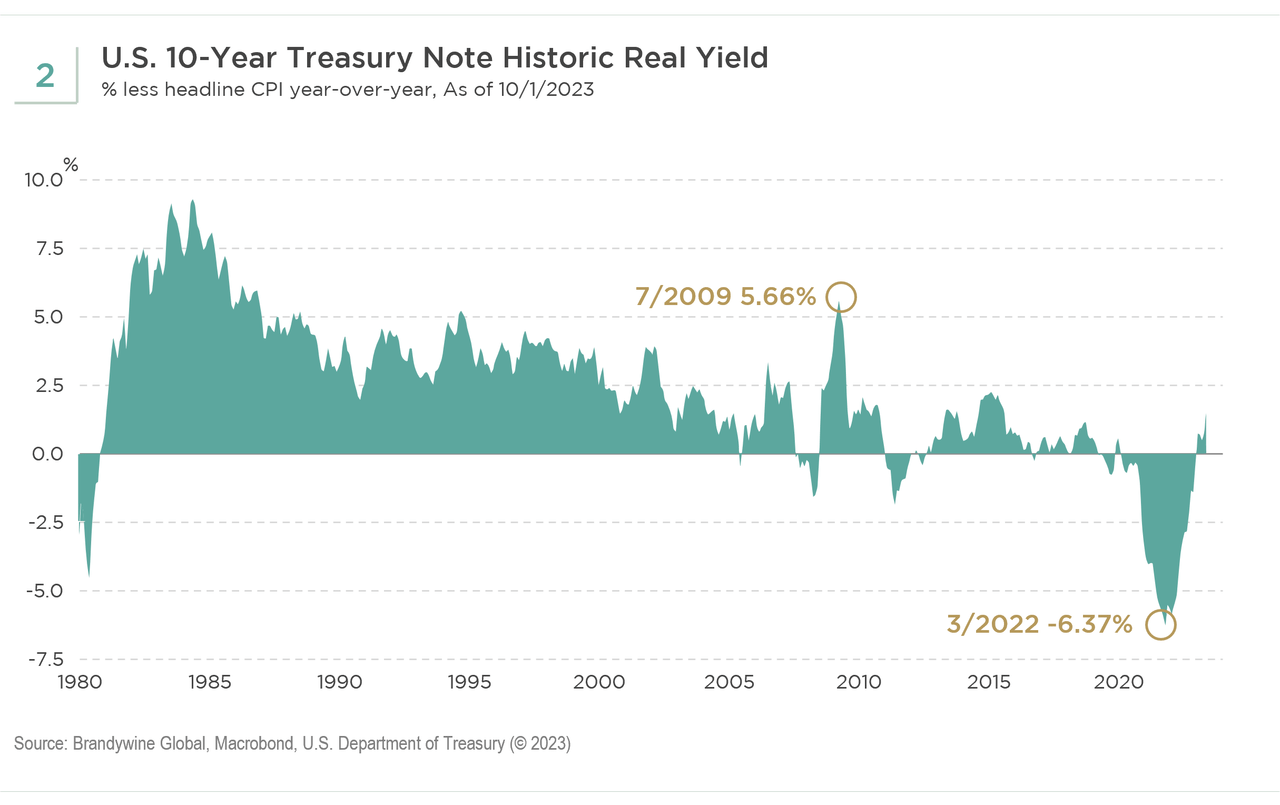

There is a combination of both outright and relative valuations across developed market bonds for 2024. The outright is versus inflation expectations, or the term premia phenomenon (see Exhibit 1). The relative is versus both equities and some credit-oriented fixed-income markets. For the first time in a long time, bond yields are above earnings yields, another measure indicating bonds being inexpensive relative to equities.

We expect U.S. Treasuries to set the tone for broader DMs. Treasuries should outperform due to the large “information” opportunity, which revolves around the domestic economy slowing more than expected and relative to other regions. A key driver of this view is that China should be a source of economic stability in 2024. Based on real yields, U.S. Treasuries are a buy as we do not expect real yields to proceed significantly higher from current levels (see Exhibit 2). If we are right about China aiding the world economy, extending to Asia and Europe while excluding the U.S., and about U.S. growth slowing more while domestic inflation falls advance than expected, we believe Treasuries will be the best-performing developed market bond market in 2024.

Inflation

Our confidence remains high around the view that inflation will head lower toward DM central bank targets. Supply chain deflation eventually will turn to demand deflation (see Exhibit 3). The path and timing are still uncertain, which will set up whether the economy sticks a soft landing or tumbles into recession. The key is having exposure to bonds that will do well in either scenario.

Investment Implications

Overall, we are constructive on DM bonds, although the path and timing of the drivers behind this view remain uncertain. Lagged tightening of financial conditions should fully hit during 2024. We expect Fed rhetoric will change in early 2024, followed by weak labor data. Rates will stay high until something breaks, that something being inflation, financial markets, or the economy.

We expect to see more economic pressures in the U.S. in 2024. China is in a different cycle, and economic stabilization should dominate, which in turn should help broader Asian and European economies. One exception is Japanese government bond (JGB) markets. We find no value there as the Bank of Japan (BOJ) tries to minimize financial repression in JGBs. BOJ policy means that JGB prices will be even more sensitive to Japanese inflation, which is persisting going into the new year. When it comes to DM bonds in 2024, investors should think of coupon return plus a total return boost.

Global Currencies Outlook: Policy and Growth Differences Drive Currency Performance

By Anujeet Sareen, CFA

The U.S. dollar appreciated modestly in 2023 against its broad trading partners. However, there was significant dispersion in performance. The dollar weakened against emerging market currencies and the British pound but strengthened against most developed currencies and the Chinese renminbi. Performance was largely driven by cyclical growth developments and monetary policy differences.

The dollar’s weakness against emerging market currencies mostly reflected monetary policy differences. Policy rates were elevated in a number of developing countries, notably Mexico, Brazil, Colombia, Hungary, and Poland. With modest but resilient global growth, and stable or improving external balances, higher-yielding emerging market currencies benefitted from higher capital inflows.

On the other hand, the U.S. economy was clearly an outperformer in 2023. While real gross domestic product (GDP) sequentially slowed to a below-trend growth rate in China and a number of developed countries, including Europe, the UK, Sweden, and Canada, U.S. real GDP accelerated, punctuated by a 5% real GDP performance in the third quarter. This divergence in growth led to a widening in interest rate differentials and supported dollar strength against these countries.

Looking forward, the key question for currencies centers around the prospects of continued U.S. growth outperformance. In our estimation, stronger U.S. growth in 2023 was significantly explained by the stance of fiscal policy. Through the third quarter, government consumption and investment rose nearly 5% year-over-year in real terms – a rate of growth we do not typically see outside of U.S. recessions when counter-cyclical fiscal policy preserve is far more appropriate. In addition, some of the policy packages passed by the Biden administration in 2021 and late 2022 offered material investment incentives in key sectors of the economy, evidenced by the strong growth in private structures investment earlier this year. Finally, some of the fiscal policies introduced following the start of the pandemic in 2020 continued to offer preserve to economic growth in 2023.

Essentially, the negative effects of monetary tightening in the U.S. were more than offset by fiscal easing, leading to the market’s focus on “higher-for-longer” policies from the Federal Reserve (Fed). Most other countries around the world did not seek expansionary fiscal policies in 2023, and consequently, the cumulative effect of large monetary tightening cycles from 2021 – 2023 was more apparent in weak real GDP performance. The U.S. policy combination of easy fiscal/tight money was reminiscent of the early 1980s when the same combination of policies drove a U.S. dollar overshoot at the time.

In 2024, we foresee a deceleration in U.S. fiscal preserve. While some policies will continue to offer some advance preserve to certain sectors of the economy, we expect fiscal policy will shift to a modest overall headwind next year. Additional fiscal policy preserve from Washington is unlikely given a split Congress in an election year. Consequently, the downward pressure on growth and inflation from a very restrictive monetary policy stance will become more apparent, leading to a much slower nominal growth profile in the U.S., both in absolute and relative terms.

The attendant implications for lower interest rates will likely place downward pressure on the U.S. dollar as the year progresses. It is worth noting that the sustainability of U.S. government debt dynamics is a longer-term headwind for the U.S. dollar as well.

Despite these potential headwinds, there is still some risk that the U.S. dollar will remain resilient through the early part of 2024 before weakening more visibly in the second half of the year. Weaker non-U.S. growth is already driving an earlier start to monetary easing cycles away from the Fed. European central banks, in particular, appear poised to lower rates ahead of the Fed, likely widening the interest rate gap initially. Moreover, U.S. fiscal policy preserve, while diminishing, might still preserve growth over the next one to two quarters before clearer signs of sustained below-trend U.S. growth become apparent.

Emerging Markets Outlook: Opportunities in Local Markets with High Nominal and Real Yields

By Michael Arno, CFA

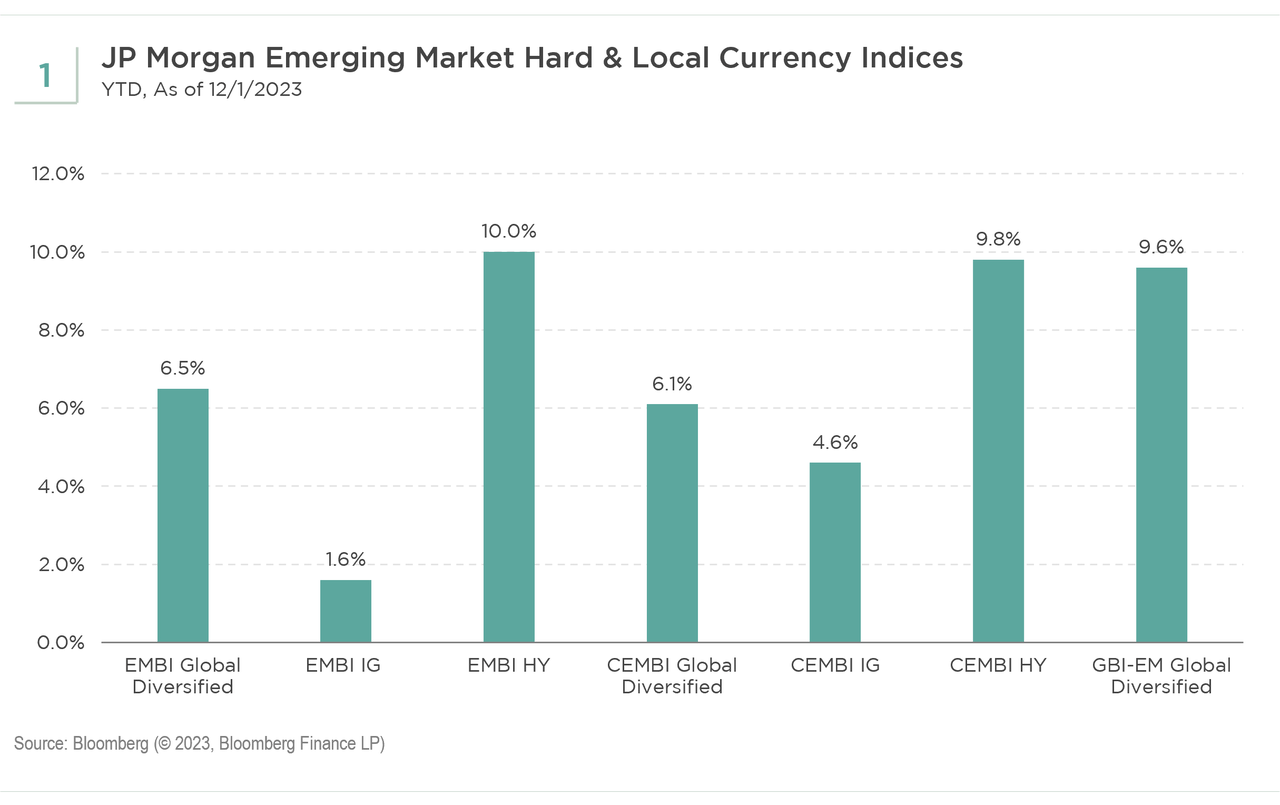

Local currency emerging markets led the way throughout 2023, across the emerging market (EM) universe. The JP Morgan Government Bond Index-Emerging Market Global Diversified Index (GBI-EM) has returned 9.6% year to date versus 6.5% for the JP Morgan Emerging Market Bond Index Global Diversified (EMBI) and 4.6% for the JP Morgan Corporate Emerging Market Bond Index (CEMBI) (see Exhibit 1). As we have been writing for a little over a year now, we saw a significant valuation opportunity in local currency emerging markets, driven by high nominal yields, peaking inflation following aggressive rate-hiking cycles, and elevated political risk premia in several markets.

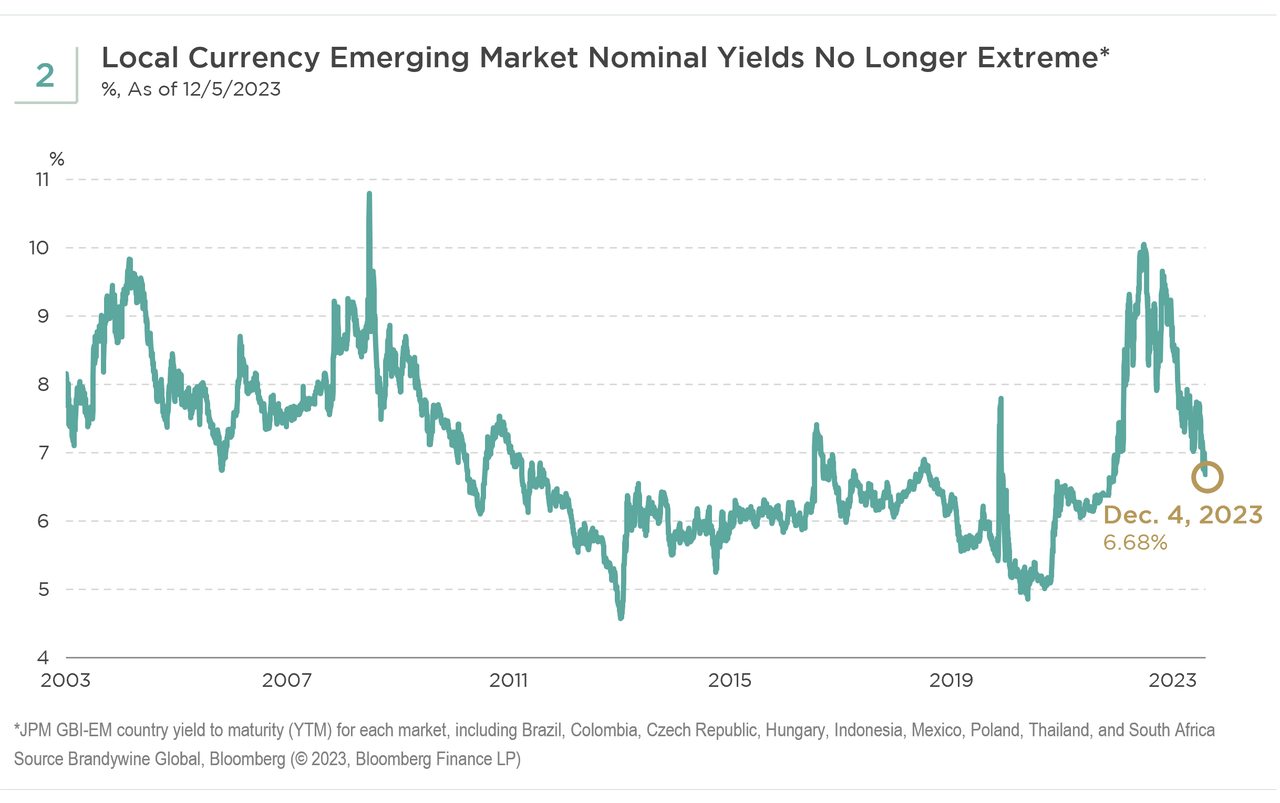

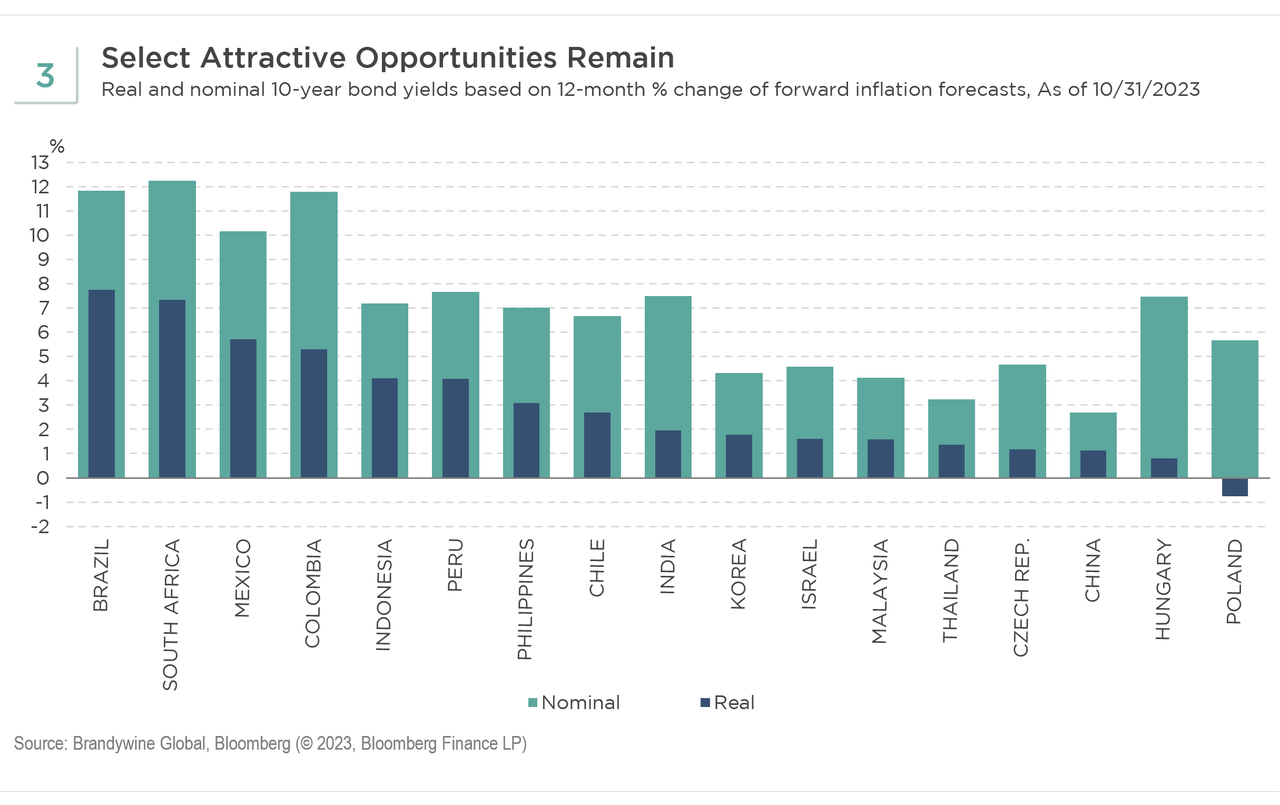

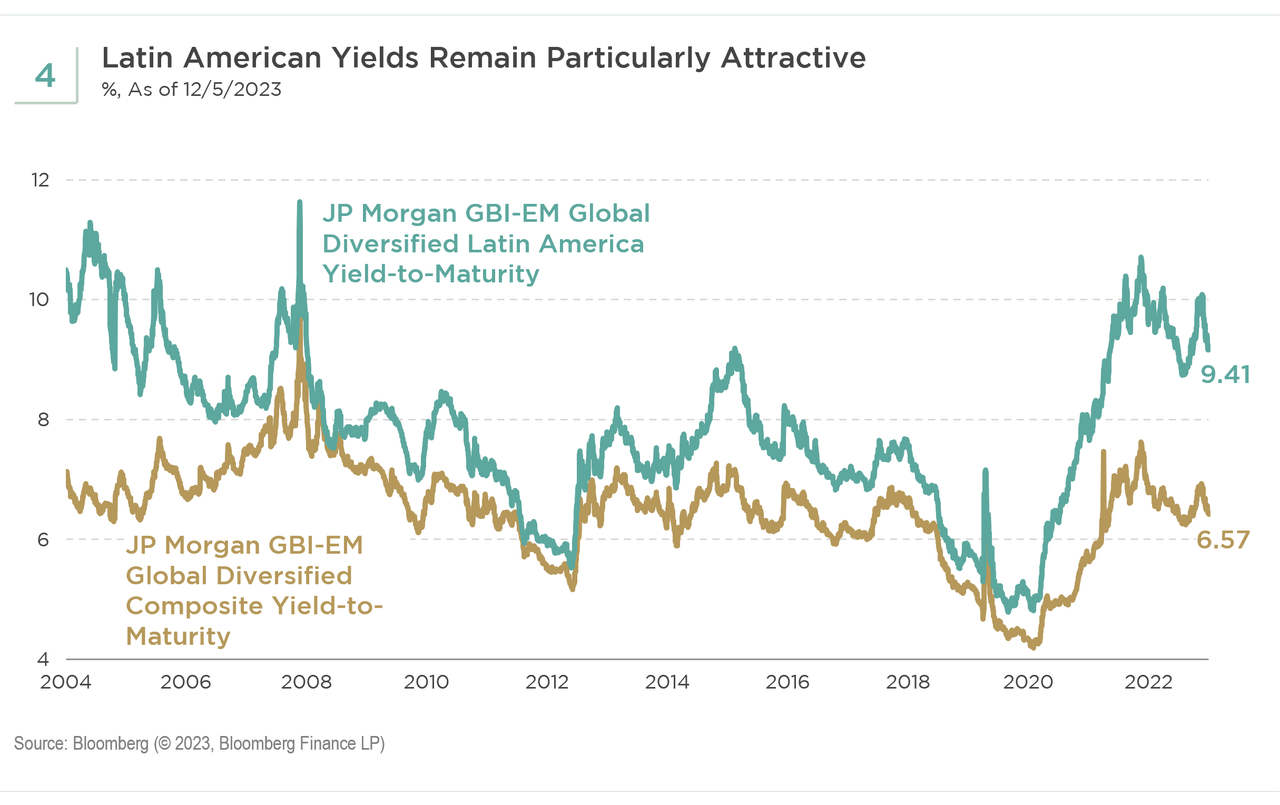

So, where to from here? While the valuation gap is not as extreme as it was in the fourth quarter of 2022 (see Exhibit 2), we believe attractive opportunities remain in local markets offering both high nominal yields and real yields (see Exhibit 3). This combination is particularly evident in Latin America where yields remain historically wide to the overall index (see Exhibit 4).

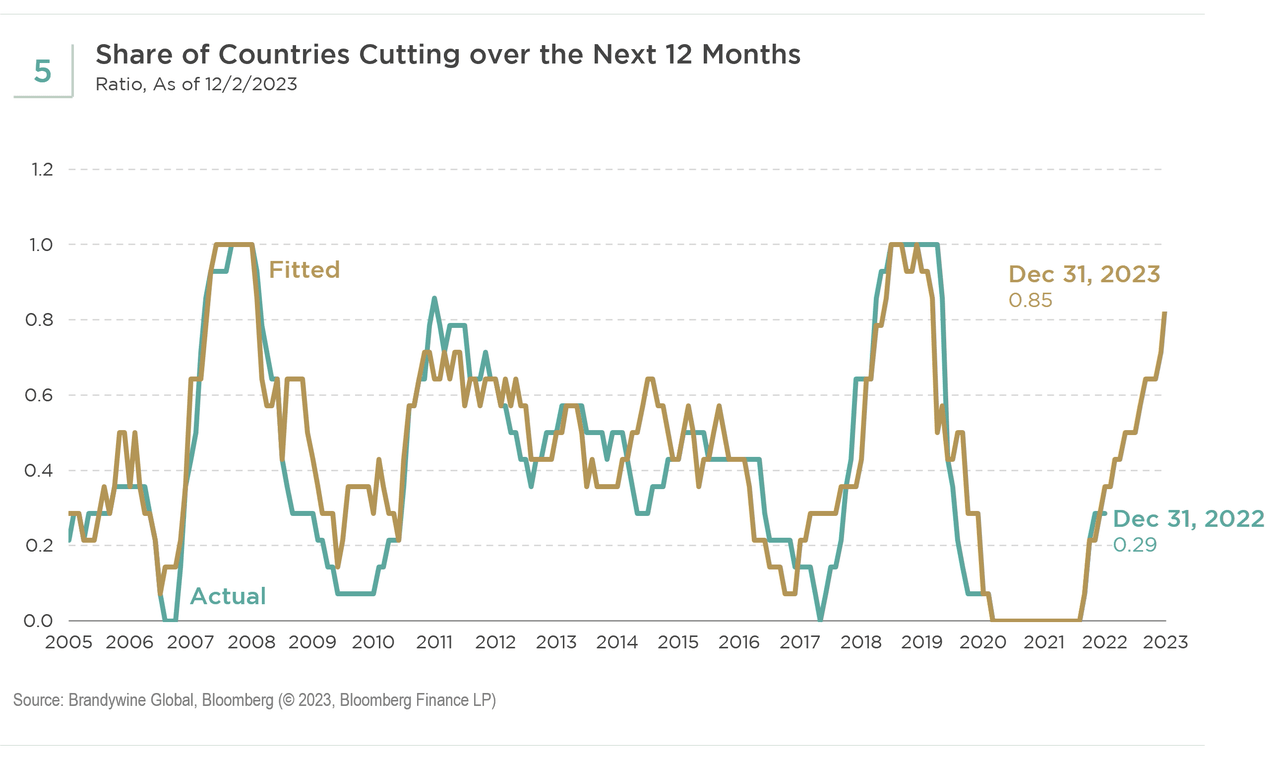

Central banks will be embarking on rate-cutting cycles over the coming months, responding to easing headline inflation pressures and improving inflation expectations. Our diffusion index forecasts a pickup in the share of countries cutting rates over the next 12 months (see Exhibit 5). We will be keeping an eye on the pace of cuts and assessing the impact on currency performance. The Chilean peso saw some significant weakness as the market priced in an aggressive rate-cutting cycle in addition to a reserve-building program, which the central bank halted in October. We could see some currency stability among the countries with central banks cutting rates at a more measured pace.

As we head into 2024, we will continue to monitor the policy responses from developed market central banks. As it stands today, the Federal Reserve appears to be done with its hiking cycle, and the debate is now focused on the pace of cuts in 2024. The other area of focus will be China, where growth underwhelmed in 2023 despite expectations of a reopening-led boost to the economy. This slowdown was driven by tightening policy on the property sector. However, recent signs that Chinese policymakers could be reducing some policy restrictions on the property market may stabilize growth going forward and boost consumer confidence as we head into 2024. Stabilizing or improving Chinese growth would be constructive for EM.

Investment Grade Credit Outlook: Constructive Entry Point for Total Return

By Brian L. Kloss, JD, CPA

After a reasonable year for investment-grade corporate credit, given the volatility of the underlying risk-free U.S. Treasury market, we look ahead to 2024 from a starting point where spreads have narrowed and yields have come in from their highs of 2023. Albeit not as attractive a starting point as 2023, the setup is still quite constructive for investors, especially those who are actively managing their portfolios. For the balance of 2023, one would expect new issuance to lighten up, driving spreads tighter in the short term as global investors look to deploy cash. Meanwhile, all investors will remain subject to the swings of the U.S. Treasury market.

Looking into 2024, a slowing U.S. economy and the continued normalization of supply chains should allow Federal Reserve Chair Jay Powell and his fellow policymakers to extend the pause on their monetary tightening path while still being mindful of any potential resurgence in inflation. Bearing this in mind, one would expect a pickup in new issuance during the first quarter while CEOs and CFOs contemplate the outlook for the balance of 2024. It is that contemplation around the path of economic growth that will drive much of the pricing of investment-grade credit for 2024. We would foresee a continued shortening up of positions given the flatness of many of the large, liquid credit curves across the world. In addition, we continue to foresee the opportunity to take advantage of lower-quality investment-grade bonds with a view that any potential economic slowdown will not be deep and prolonged. There is still an expectation that large multinationals will continue to consolidate their respective industries as organic growth will be more muted.

When all is said and done, we believe investment-grade corporate credit should offer investors an attractive yield and total return for 2024.

High Yield Credit Outlook: Favorable Dynamics Persist

By Bill Zox, CFA & John McClain, CFA

The high-yield market has been in a high carry or high absolute yield, and low dollar price environment since the middle of 2022. The difficult valuation adjustment for high yield took place in the first half of 2022 when the yield increased from the low 4% range and the dollar price declined from above 100 cents. That dramatic shift in 2022 positioned the U.S. high yield to enter 2023 with a yield of about 9% and a dollar price below 90 cents. The valuation metrics for the global high-yield market were similar. We believed those metrics were attractive, and we expected long-term returns to be strong from that starting point. Returns have been strong in 2023, and the yield is still about 8.5% while the dollar price remains around 90 cents. The strong high-yield returns stand in marked contrast to the returns in core fixed income, which were under pressure until the last two months of 2023 due to rising interest rates and elevated interest rate volatility.

The bear case for high yield has been based on credit spreads, which have been well below the range that tactical allocators have looked for since the early tech-telecom bubble in the early 2000s and the Global Financial Crisis in 2008. Credit spreads have largely been in a range of 400-600 basis points since the middle of 2022. The yield has been more stable while credit spreads have fluctuated more based on Treasury yields and interest rate volatility than on the outlook for default losses, which continues to be contained.

We have maintained that a 400-600 basis points spread range in this cycle is comparable to 600-800 basis points in previous cycles. High-yield issuers are now bigger companies, more often publicly listed, with higher credit quality, seniority, and credit ratings. The smaller, more aggressive financings and leveraged buyouts are more often found in the leveraged loan and private credit markets. The management teams of leveraged businesses have, in many cases, been working more for bondholders than stockholders for over a year. And – except for a small percentage of stressed or distressed borrowers – they have had and continue to have access to capital in a variety of markets. The longer dramatic spread widening is delayed, the less likely it becomes if management teams are focusing their capital allocation on deleveraging, debt reduction, and bond buybacks rather than stock buybacks, dividends, and debt-financed mergers and acquisitions.

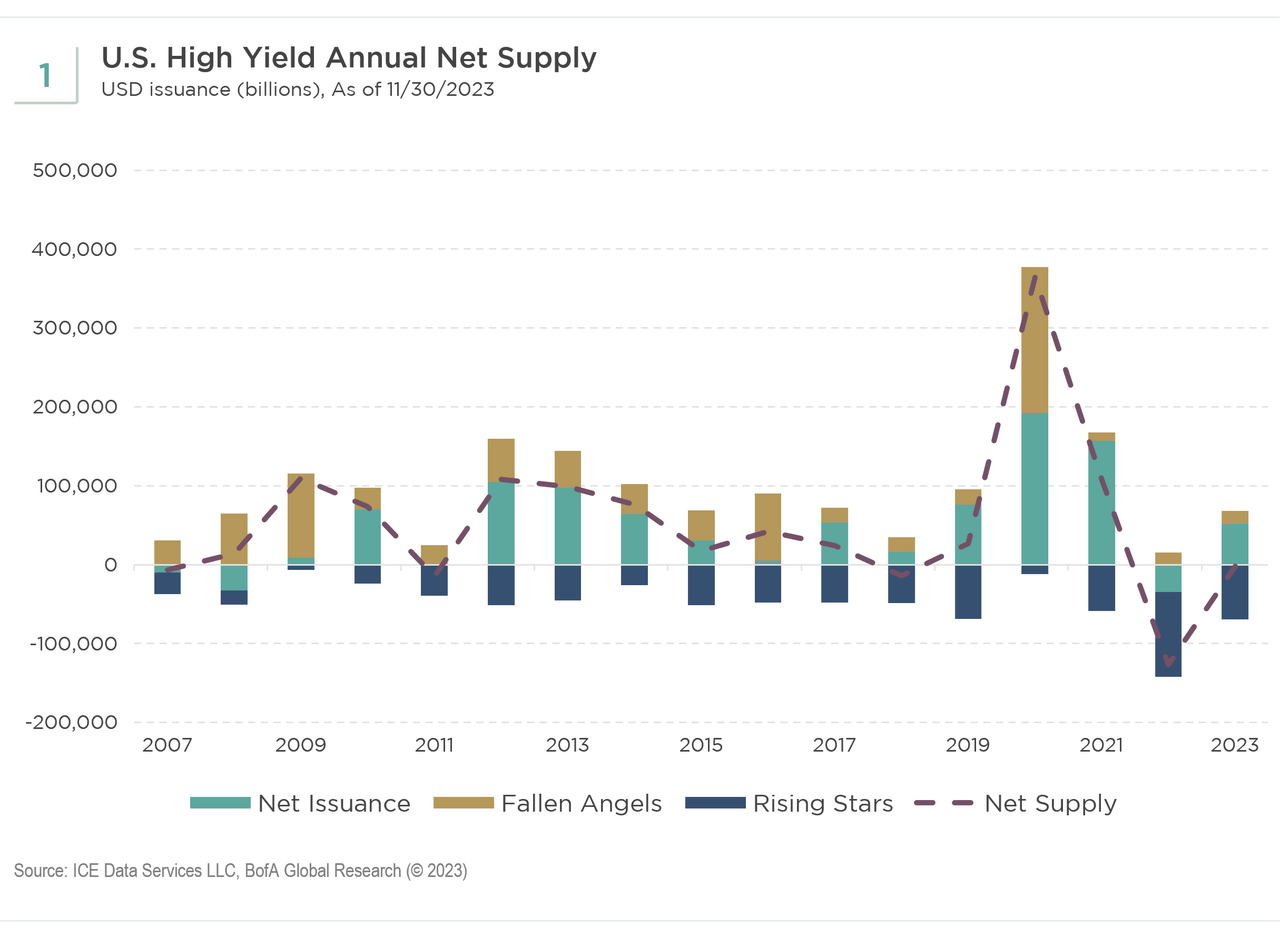

Finally, as the exhibit below shows, the U.S. high-yield market has benefitted from negative net supply for the last two years, and we expect a similar dynamic in 2024 if interest rates remain near these levels. In fact, all of the favorable dynamics that have led to strong high-yield returns since the middle of 2022 are still in place for both the U.S. and global high-yield markets. While tight monetary policy may become more problematic for the economy over time, many high-yield issuers are intensely focused on improving credit quality, which will put them in a better position to withstand an economic downturn.

Structured Credit Outlook: A Tale of Three Sectors

By Tracy Chen, CFA, CAIA

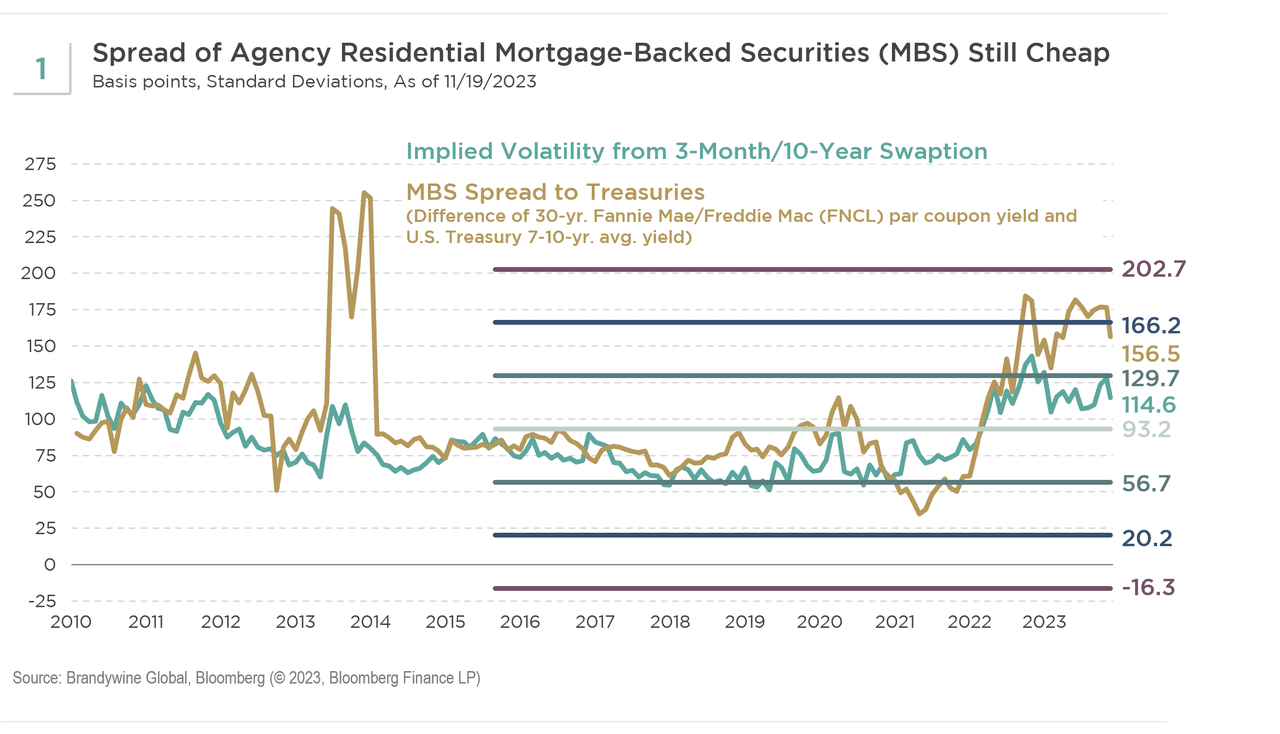

Valuations have cheapened significantly in most sectors of the structured credit market due to recession fears and idiosyncratic fundamental reasons. The spread of agency residential mortgage-backed securities (RMBS) to 7- to 10-year Treasuries is still cheap, trading at two-standard-deviations above the mean and pricing in the elevated interest rate volatility, the Federal Reserve’s (Fed’s) quantitative tightening (QT), and weaker bank demand (see Exhibit 1). Fundamentally, the convexity profile has never been better with the lion’s share of borrowers out of the money to refinance.

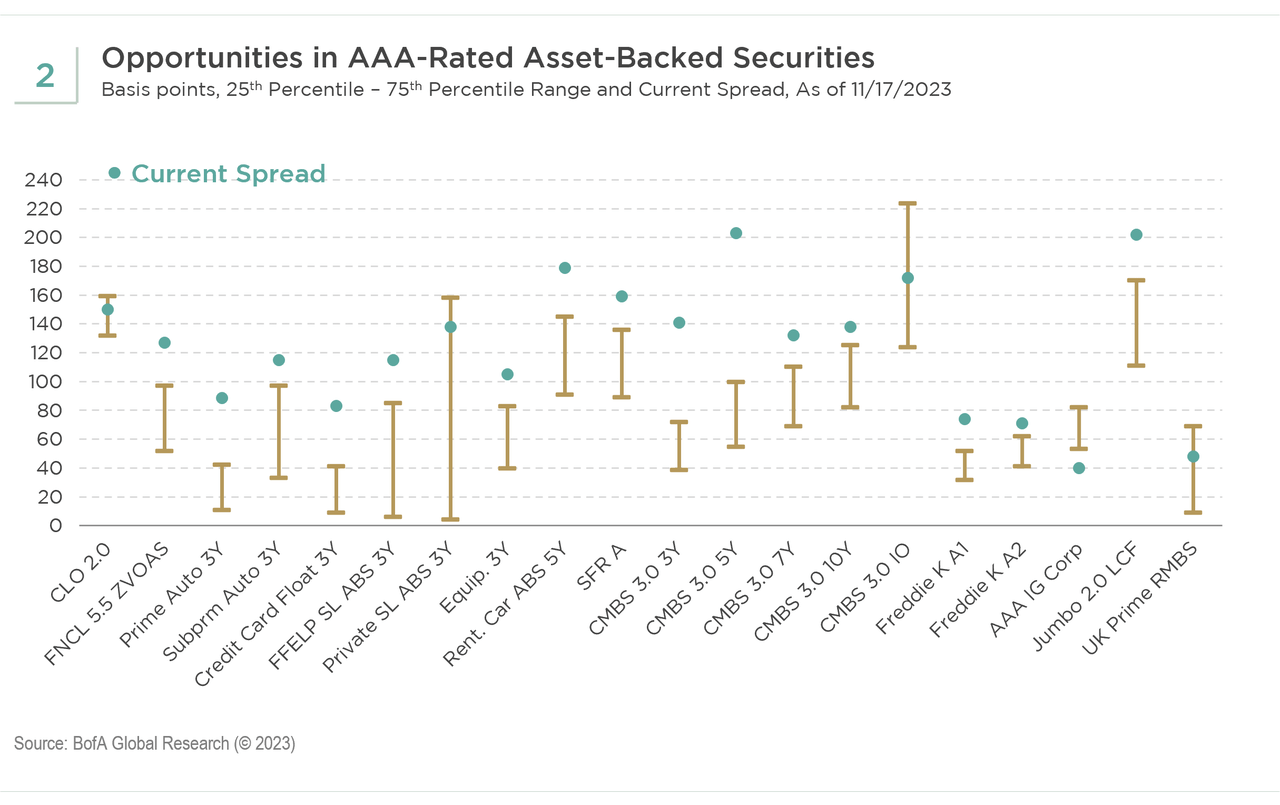

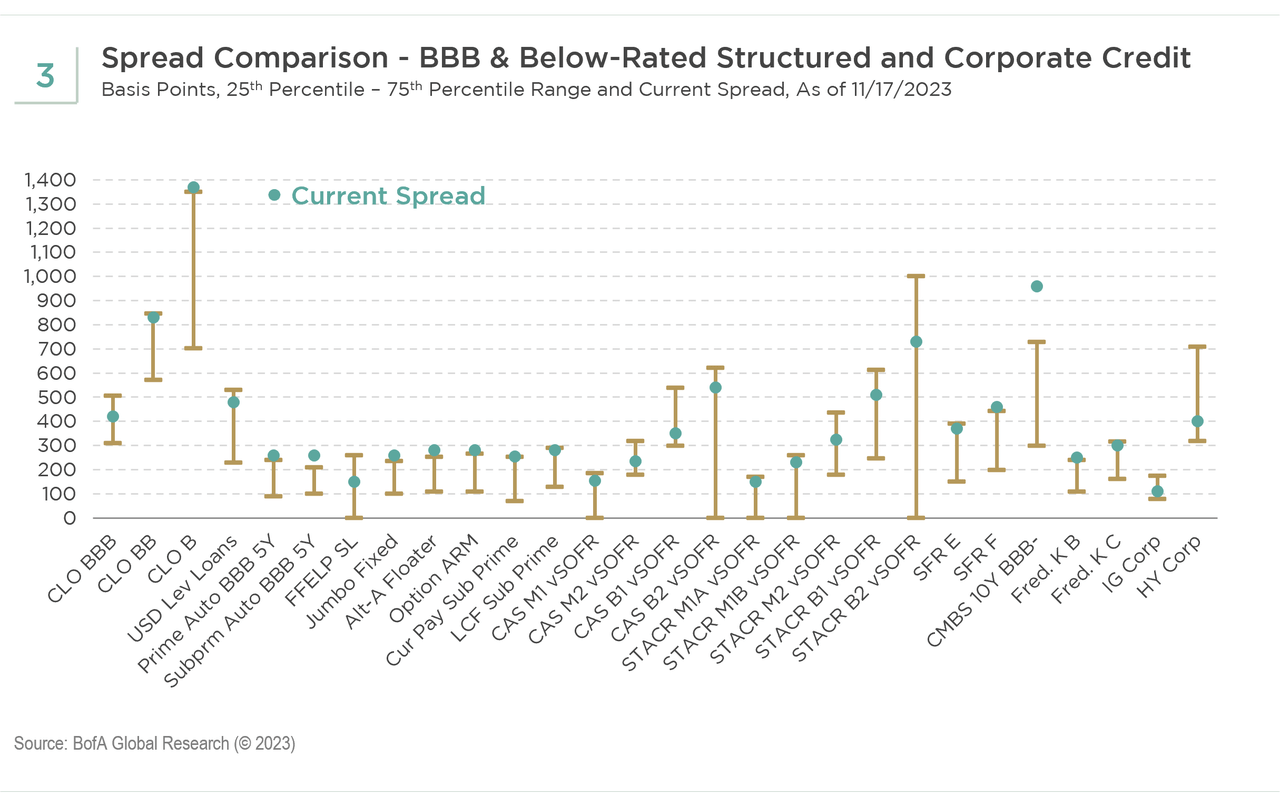

On the non-agency front, we see several opportunities, including: AAA-rated asset-backed securities (ABS) in the auto, student loan, and rental car segments; AAA-rated commercial mortgage-backed securities (CMBS); and BBB & below-rated CMBS, collateralized loan obligations (CLO), subprime auto ABS, and certain pockets of credit risk transfers (CRT). Several of these areas are cheap by multiple standard deviations, presenting attractive valuations relative to their trading history and to comparable corporate bonds (see Exhibits 2 and 3).

Still solid: Housing fundamentals and household balance sheets

Mortgage rates have moderated at the low-to-mid 7% level, constrained by the ongoing housing shortage and homeowners’ lock-in effect from low historical rates. As a result, housing prices have remained resilient, although housing market activities are lackluster. Compared to the housing boom that led to the Global Financial Crisis (GFC), we believe housing prices currently are well supported in this cycle. Furthermore, post-banking crisis, advance tightening of lending standards will preserve the future performance of RMBS collaterals.

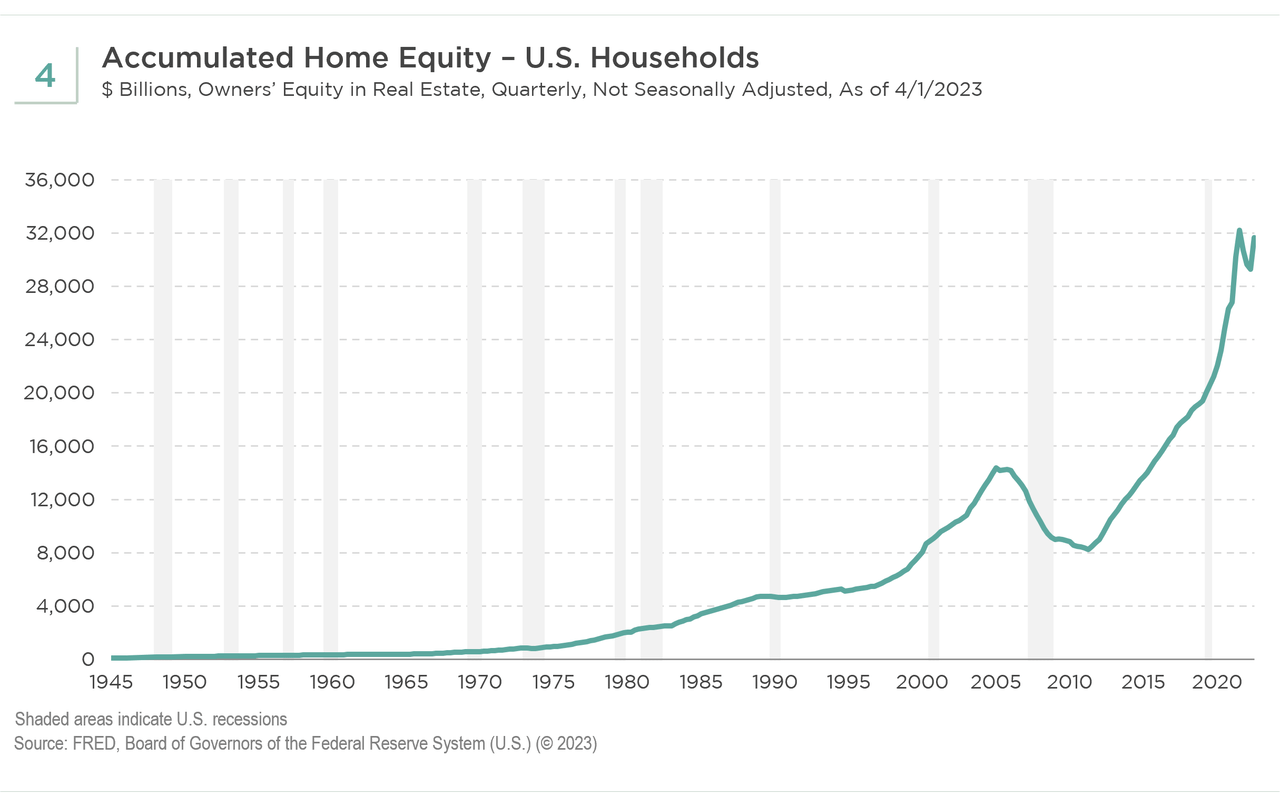

Credit fundamentals started to return to pre-COVID levels as consumers spent the savings they amassed from generous stimulus packages and large wealth effects due to rising asset prices. Now, accumulated home equity of over $31 trillion (see Exhibit 4) and remaining excess savings still supply buffers. However, we are starting to see some stress in the lower income and younger age group cohorts as delinquency levels in subprime auto ABS are rising for borrowers with lower FICO scores. The elimination of federal student loan forbearance will potentially impact other consumer debt payments as well.

CRE (commercial real estate) market: The long reckoning

There is no question that the secular shift to working from home and hybrid work arrangements poses tremendous challenges to the office sector within the CRE market. However, the prevalence of improved underwriting standards and other mitigating factors, including a decade of embedded price appreciation, along with the likelihood of loan extensions and modifications guide us to expect a prolonged reckoning for the sector, which could span across several years. In addition, there are other CRE sectors, including industrials and multi-family, that have been performing well. Credit curve steepening has turned drastic since 2022 with plenty of bad news and extension scenarios priced in. Price discovery and transaction volume in CRE remain very low, particularly in the office sector, making value assessment very challenging and the ability to create high conviction difficult. Within offices, cap rates need to widen more from here to complete the valuation adjustment in the sector’s spread to Treasuries. However, we speculate that we may be near the peak CMBS credit curve steepening, which would herald the entry of distressed investors as a welcome source of demand. We see interesting opportunities in new issue CMBS deals as a result of advance tightening of underwriting standards and the sharp reject of new issue volumes, especially up-in-quality in senior tranches.

Higher corporate/CLO tail risks

We believe leveraged loans should underperform high-yield and investment-grade corporate credit as higher funding costs, lower earnings, and higher tail risk of credit distress become more dominant. This trend would likely guide to lower coverage ratios for lower quality and junior parts of the CLO capital structure. We already are starting to see rating downgrades exceeding upgrades. However, we do see opportunities in AAA tranches of middle-market CLOs of quality issuers, which offer a high-risk premium over broad-syndicated AAA CLOs.

Favorable market technical

Reduced net new issuance and still-high demand are buoying the market technical of most securitized products.

Where we see the best value in 2024

Given cheapening valuations and the potential for more uncertain fundamentals due to the aftereffects of Fed tightening, credit tightening, reduced appetite from banks for long-duration assets, and slower economic growth, we believe structured credit valuations will likely have more downside. We will continue to be defensive and cautious by pivoting our investments up in quality, up in the capital structure, and short in duration within various sectors. We currently believe the most attractive opportunities include: up-in-coupon agency MBS; seasoned CRT securities rated BBB and BB; seasoned subprime auto ABS rated AAA to BBB; middle-market AAA CLOs; seasoned and new issue CMBS rated AAA to A, among others.

Global Equities Outlook: Different Rate Cycles Create Opportunities

By James J. Clarke & Sorin Roibu, CFA

Inflation remains the critical near-term driver of macroeconomic conditions, impacting interest rates, currencies, corporate profits, and stocks. Predicting the path of inflation has proven difficult due to massive fiscal and monetary shifts and both the disruption and renormalization of supply chains. Our macro investment framework at Brandywine Global sees yield and currency swings spurring mean-reverting cycles. However, the unusual combination of enormous fiscal and monetary policy, lingering COVID pandemic-related impacts, supply dislocations, and commodity shocks makes it challenging to calculate lags – both for the delayed impact of cumulative, record monetary tightening and for when macro conditions revert back to their norms.

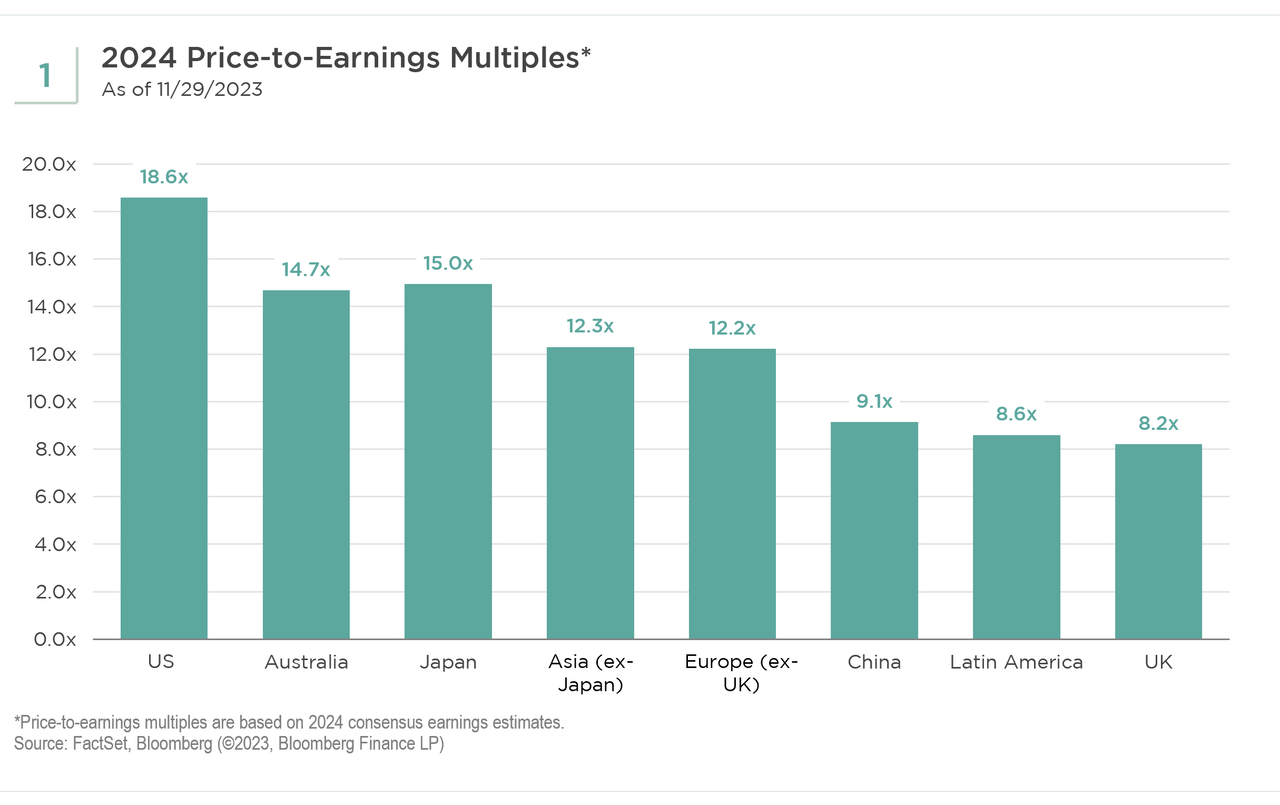

The high price for taming inflation is significantly higher interest rates. Higher rates and concerns about lagged economic damage from rate hikes, fading fiscal policy preserve, and rising oil prices make the U.S. growth outlook challenging and U.S. stock valuations unattractive (see Exhibit 1). We remain cautious about the U.S. and underweight versus benchmarks. Valuations outside the U.S. are more appealing, and we prefer geographies appreciate China, Brazil, Japan, and Europe. We would remind our investors that not every country is on the same interest rate cycle, which provides opportunities across global equity markets. Brazil has already begun to cut rates, which is a signal of the start of the next business cycle, something on which we appreciate to capitalize. Japan has not raised rates yet, which presents us with a currency opportunity in the yen. China faces its share of headwinds, but inflation is not one of them. We think being able to diversify among different interest rates and business cycles around the world is important.

We remain vigilant for new opportunities amid many global uncertainties, ready to act nimbly if fear creates investing opportunities. Our disciplined process and long-term perspective position us well to steer unpredictable markets ahead.

U.S. Equities Outlook: Market Weakness and Patience Point to Opportunities

By Patrick S. Kaser, CFA

Predicting a potential recession is never easy, as we discovered in 2023. Resilient growth and a meaningful drop in inflation have convinced many to return to the soft-landing camp. Looking at equity markets, we remain unconvinced. Because price levels are still painfully high for consumers and are likely to stay elevated, our base case remains that a recession is very likely given the fiscal and monetary backdrop. Of the 13 Federal Reserve (Fed) tightening cycles since the 1950s, 12 resulted in earnings-per-share (EPS) declines for the market, and 10 resulted in gross domestic product (GDP) recessions, according to analysis from Trahan Macro Research. The challenge has generally been figuring out how much of a lag there is between the tightening cycle and the eventual recession. When we layer on peak profit margins, labor strength – demonstrated by union strikes and the resulting wage gains, and shrinking money supply, the concerns for a recession grow. We also cannot ignore current political dysfunction and equity valuations that are not cheap.

The market seems to think the Fed is done hiking, but the hitch is that rate cuts generally come after problems emerge. These problems, generally in the form of economic or market weakness, do not portend great returns for U.S. equities. While investors have been hiding in the so-called “Magnificent Seven” large stocks, these companies are unlikely to be immune from the coming weakness, especially given the potential overordering of AI-related products near term. On the positive side for investors, the strength of these stocks has masked weakness in many other stocks if one only looks at the index levels. However, we believe many stocks are already pricing in a recession, and certain groups are likely to be very defensive in a recession. Health care, in particular, seems to be a sector that combines low valuations and a lack of economic sensitivity; some financials and auto exposures seem to be pricing in worse economic outcomes than we believe are likely.

The bottom line is that 2024 is likely to have meaningful chances for opportunistic investors to buy quality companies at attractive valuations. We believe staying patient seems wise until those price movements occur.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.