Leonid Eremeychuk

We present our note on Yara International (OTCPK:YARIY) (OTCPK:YRAIF), a leading global fertilizer company. We are drawn by the robust market backdrop, the company’s significant cash generation and capital returns, as well as the valuation upside. We will provide an overview of the firm, discuss nitrogen market fundamentals and Yara’s green opportunities, value the equity, and provide an investment recommendation.

A brief overview of Yara

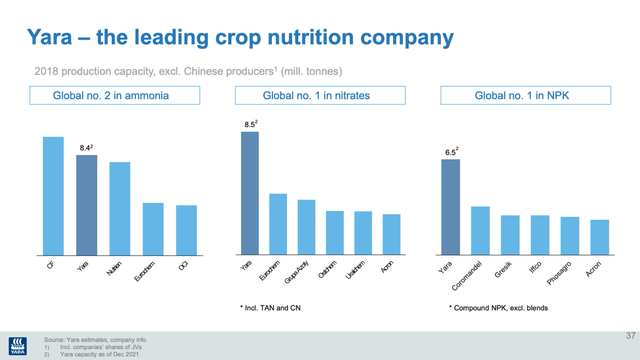

Yara is a Norway-based global fertilizer company. It produces, distributes, and sells nitrogen-based mineral fertilizers and related industrial products. Excluding Chinese producers, Yara is the largest global player in nitrates and NPK and the second largest in ammonia. The company operates an integrated business model. It has 26 production plants and sells its products in more than 140 countries. The company’s main production footprint is in Europe. The Norwegian Government owns approximately 36% of Yara’s shares and is the company’s largest shareholder. The company is listed on the Oslo Stock Exchange and has a current market capitalization of NOK84 billion or ca. $8 billion.

The nitrogen industry explained

Fertilizers are plant nutrients required for plants to grow. Nitrogen is the most important and commonly lacking nutrient; regular nitrogen application is required to maintain crop yields. The investment in hydrogen is highly profitable for growers, yielding on average a net return of 5x. The most common process in nitrogen fertilizer manufacturing is creating ammonia from a mixture of nitrogen from the air and hydrogen from natural gas. Most of the global ammonia production is upgraded to urea and other finished products. The nitrogen industry is highly fragmented despite consolidation trends. The world’s largest producers include CF, Yara, Nutrien, Ostchem, OCI, Koch, Eurochem, etc.

Supportive backdrop

Fertilizer consumption is mainly driven by food demand which is supported by population growth, economic growth, and diet changes (e.g., more fruits and vegetables and more protein-rich diets). In addition, industrial consumption is driven by economic growth and environmental limits.

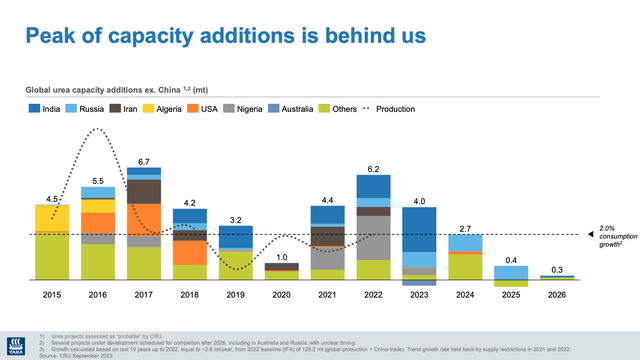

In our first note on OCI, we highlighted the nitrogen market’s positive outlook after a challenging period and attractive fundamentals over the mid-term. Strong demand for nitrogen is supported by increased crop prices driving higher fertilizer affordability and farmer profitability. In addition, purchasing activity is being supported by pent-up demand. Moreover, falling gas prices are highly supportive of margins (i.e., higher nitrogen-gas spread). Supply over the mid-term (up to 2027) will remain constrained providing further support for pricing. Peak additional capacity is already behind us and export volumes from China are limited.

Navigating the green transition

Yara aims to be the top midstream player across blue, green, and gray ammonia production both for decarbonized fertilizers and Yara Clean Ammonia customers including the shipping and energy industries.

Yara brought attention to its commitment to a Blue Ammonia Strategy (producing ammonia from gas but removing carbon dioxide) on its Capital Markets Day in 2023. Yara will benefit from the Inflation Reduction Act by building a production facility in Texas (YaREN – 50% stake) with a capacity between 1.2 and 1.4 million tons. Yara is expected to invest more than $1.3 billion and production will commence in 2027. In addition, the company expects to build a second plant in the US (there are no details on the location yet). Yara expects more than half of ammonia production to be used in applications other than fertilizer (vs. <20% now). Ammonia is the main cost-effective way of transporting hydrogen, and we believe ammonia producers will be major beneficiaries of the new hydrogen economy. Ammonia can also be used as an alternative shipping fuel. In November 2023, Yara Clean Ammonia, North Sea Container Line, and Yara International announced plans to realize the world’s first container ship (Yara Eyde – sailing emission-free between Norway and Germany) that will use clean ammonia as fuel.

We expect the green transition to be a major value-creation driver for Yara.

Valuation, capital returns, and investment case

Our investment case on Yara relies on an attractive outlook for fertilizers, green transition opportunities, and significant capital returns.

We value Yara on the basis of free cash flow yields and PE multiples. Our forecasts are largely in line with sell-side analyst consensus estimates (available on the firm’s website). We forecast $15.4 billion of sales in FY2024 and $15.9 billion of sales in FY2025 (respectively -1% and +3% growth YoY). Moreover, we forecast an EBITDA of $2.2 billion in FY2024 and $2.4 billion in FY2025, implying an EBITDA margin of 14.3% and 14.9% respectively. The more than 300 basis points margin improvement in 2024 is attributable to a higher nitrogen-gas spread and operating leverage.

We forecast $720 million and $830 million of net income in FY2024 and FY2025 respectively. This implies an EPS of $2.8 (NOK29) and $3.3 (NOK35) per share.

We moreover estimate an FCFF of $750 million and ca. $1 billion in FY2024 and FY2025 respectively. We expect the FCF to lead to a deleveraging of the balance sheet and higher capital returns. In line with sell-side consensus, we forecast a DPS of $1.7 (NOK17) and $2.1 (NOK22) per share in FY2024 and FY2025 respectively, implying a 5.2% and 6.7% dividend yield.

With an enterprise value of ~NOK117 billion or $11.2 billion, our forecast implies a forward EV/EBITDA of 5.1x; and a 1-year and 2-year forward FCF yield of ~7% and 9% respectively. Moreover, we estimate a 1-year and 2-year forward PE ratio of 11x and 9.4x respectively. Yara has historically traded at a forward PE ratio of 11.5x and a forward FCF yield of 7%. We value Yara at a target 2-year forward PE ratio of 11.5x implying a share price of NOK402. Discounted 1 year that leads to a target share price of NOK373 (using an 8% discount rate). This implies a 13% valuation upside.

Alternatively, applying the NOK402 share price target in 1 year, and considering the capital returns we forecast a more than 30% total return over two years or ca. 15% annualized return. We find the current risk/reward attractive and we recommend buying Yara shares. While we see no immediate catalysts, we believe the continued positive performance, the execution of ammonia initiatives, and capital returns will help unlock Yara’s value.

Risks

Downside risks include but are not limited to weakness in agricultural markets and lower crop prices, demand destruction, increased supply from new capacity additions given the low barriers to entry (e.g., Chinese oversupply), sourcing problems leading to lower volumes, lower utilization rates, lower nitrogen prices, higher than expected natural gas prices, unfavorable weather events, foreign exchange risk, etc.

Conclusion

Given the attractive risk/reward, we recommend buying Yara shares. We believe the stock can generate a high-teens IRR over the mid-term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.