PhanuwatNandee

Dear readers/followers,

In this article, I’ll update the thesis on Yara International (OTCPK:YRAIF). This has been a solid investment of mine for several years thanks to a very attractive entry point coupled with a very solid dividend payout and yield. Even though we’re now down to levels I didn’t expect we’d see until 2024, I’m still firmly in the green.

And while the company is facing challenges, these challenges haven’t impacted what is a fortress-type balance sheet. Even with a cut dividend – which you frankly should be expecting, this company still has an attractive long-term upside.

Why is this?

That’s what I mean to show you in this article, where we’ll digest 3Q23 results. As I’ve said before, I wouldn’t touch my position for a sale unless the price was above the 500 Mark, or at the very least had a “5” as the first number. That’s not something we see at this time, but that’s where I would be looking at the company with the intention of trimming my position. This is of course a very high valuation level – and we might not see it for several years.

This doesn’t bother me – let’s take a look at what sort of indications we see from the 3Q23 results.

Yara International – Looking at the 3Q23 results

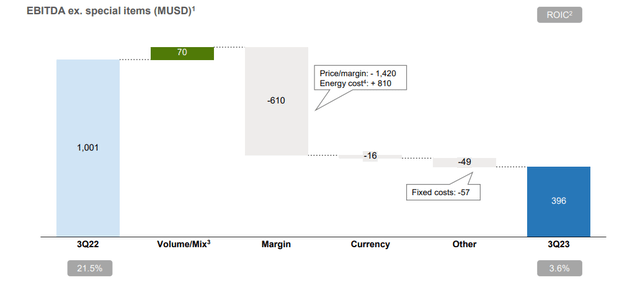

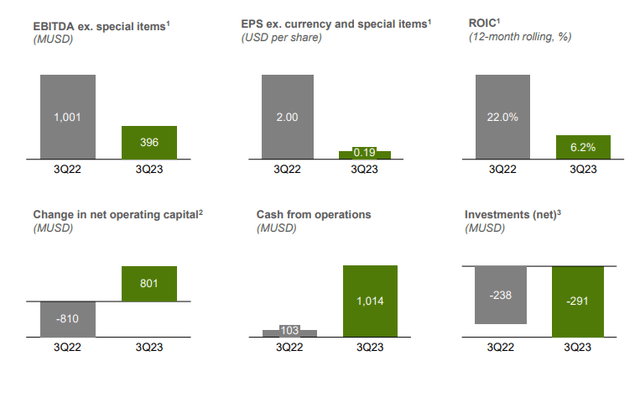

3Q23 started to see some of the downtrends that I’ve been talking about for the last year or so. What we’re seeing here is an EBITDA reject of 62%, mostly due to significantly reduced margins. At the same time, Yara had an operational cash flow of over a billion USD, but mostly due to an operating capital release.

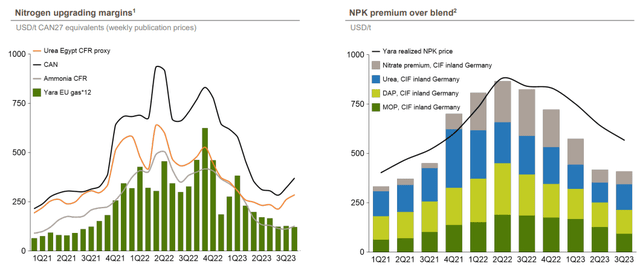

Yara remains primarily exposed to commodity prices and trends – nitrate prices being one of the largest impacts here. In this case, the company’s long order book is not in its favor – the nitrate prices are negatively impacted here. There are overall supportive fundamentals for the company here, but there is an uncertainty in terms of delivery phasing.

This coupled with current profit and EBITDA margins is what is dropping the company down here at the moment. You can see that despite a better volume and mix, margins are now really coming home to roost.

What you see is also inclusive of positive trends, such as overall lower gas prices, higher deliveries, and so forth. The fact that the company’s cash flow is positive doesn’t really count given it’s a capital release, meaning it released available capital from daily operations.

Instead of certain curtailments in the energy space we saw in 2022, we’re not seeing the risk of nitrogen curtailments if things don’t better in the company’s core areas, Europe. Despite improvement in farmer incentives compared to last year, it has been a very slow start so far to the season in Europe.

While I usually say that I would rotate Yara at above 500 NOK, the more sensible option, if you’re looking to take home profits, would be to look at the 475 NOK level or above, given that this is how high the company has typically managed during its peaks.

The company’s financial performance relates very clearly to just how much of a downturn we’re seeing here.

Yara International IR (Yara International IR)

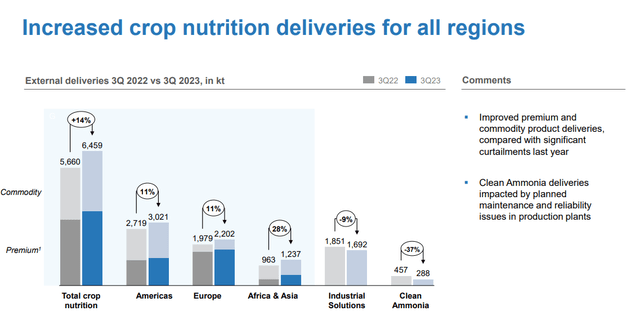

On a geographical basis, the company saw the most positive results from its Global plants segment, which went from negative to positive, but this is a very small segment. Out of legacy, the Americas did the best, with around a 60% reject YoY.

This comes at the same time as the company is seeing record, or increased levels of deliveries of crop nutrition for all geographical regions.

Yara International IR (Yara International IR)

The company continues to apply very strict financial discipline. Improvements are made in operating capital, with operating capital at a 98-day cycle, down from 113 in 2020 but up from 87 in 2022. And recollect, nothing about company fundamentals has changed materially here. Yes, it’s volatile – but anyone who invests in Yara should know, or already knew that very clearly.

Investing in food production combined with some of the most ESG and climate-friendly products makes perfect sense in this segment. That’s why this company continues to be among the largest singular positions in both of my portfolios, though it’s no longer the biggest as it once was when the price was higher.

I forecasted a change in nitrate/NPK premiums in early summer this year. I also said clearly that this does not lend itself to another “spike” in valuation for this company, if you go back and read this particular article on the company.

Instead, I forecasted some stabilization here – and Yara currently trades between 355 400 NOK. Even with energy costs down, the current nitrate prices and commodity trends will, I believe, not lend themselves to significant earnings improvements for the company.

But at the same time, I view it unlikely that we’ll see the significant negative situation we saw in 2010 and around that time. This is because there aren’t many new capacities coming online here, meaning that the company will have a better situation in terms of the macro.

With Belarus and Russia still out of the game, I continue to believe in the upside for fertilizer in the long term here.

The Yara improvement program, or YIP, is continuing to deliver solid results here, including production, emission intensity cuts, operating capital days, ammonia production, and other KPIs.

Yara has over 60 years of fertilizer fundamental science going for it. It works on a global scale to balance and incorporate crop nutrition and do this between organic matter, or farmyard manure, as well as mineral fertilizer, which the company sees as key to optimizing food production. As odd as it may seem, this is perhaps one of the “greenest” companies that I view myself investing in, combining the appeal of mineral fertilizers appreciate Nitrogen, Phosphorus, Potassium, and Magnesium, contributing not only to solid production but to enhanced water quality and soil health.

A quick glance at this, so you can see what’s “coming” and where we are coming from. None of this is a surprise.

Going forward, I forecast an earnings normalization as well as a dividend moderation – but because my entry is below 300 NOK and because I believe I know this company quite well, this is not an uncomfortable position in the least for me.

Risks & Upside

The risk to Yara here is continued weakness in product pricing and potential spikes in energy pricing due to an unfavorable energy market. If this comes at a time when product prices are low already – not appreciate it was before – then this will provoke a double sort of reject, where earnings may trough even advance and go down to levels from 5-7 years ago. Macro operational long-term risks to this company are extremely few. While this year is expected to be the absolute bottom, the current forecasts call for a dividend level of 16.2 NOK/share (Source: FactSet) which would imply a yield for Yara of 4.5% at today’s level – but this is expected to once again rise to over 20-25 NOK and 5-6% once the earnings go back up in 2024-2025E.

So the trick with Yara is expecting and accepting the volatility.

The company does not cycle quickly. This is part of the upside. If you look at the history, it has been many years since we saw a price consistently below 300 NOK, despite the company’s earnings-related uncertainty and volatility. recollect, for years the company generated less than 30 NOK/share in earnings per year.

The upside here is a long-term investment in the food production industry, and this continues to be the core of my thesis.

Valuation

My biggest change here is not calling Yara “cheap” at a valuation that I once did any longer. I continue to view the company at a PT of above 400, but I’m lowering it to 425 NOK/share which I better believe reflects its through-cyclic potential – and also what else is available on the market because 4.4% yield isn’t that great.

It’s decent, just not great, even if the company that generates it comes in with an above-average credit rating and above-average fundamentals.

The current analyst averages are much reduced, even more than mine. Going from an average PT of 490 NOK from a low of 350 and a high of 590 NOK a year ago, the analysts, 16 of them, following the company now consider it a “BUY” with 400 NOK PT, from a 300-475 NOK price range. My lowering to 425 represents my own recalculations, and I still say “BUY” here. Only 5 analysts out of 16 are a “BUY” here despite very few considering it too expensive at 365 NOK per share.

If we consider the historical multiples, meaning a P/E of 15x P/E holding, then this company has an upside of almost 40% annually to 2025 due to a high EPS – though I would consider this a bit high. I would go for the 20-year average of 13x that really flattens out the high we’ve seen the past few years, and where you “only” see a 28% annualized upside, or almost 70% in 3 years, implying a share price of over 550 NOK.

While I have a hard time seeing this now, the combination of usually beating estimates (over 30% of the time according to FactSet), coupled with quality, yield, operations, and balance sheet strength, give me enough confidence to remain at a very solid position at this time and makes me confident in my holding of the company

Because of that, here is my thesis for Yara as it stands.

Thesis

- Yara is one of the best/most appealing fertilizer businesses on earth and by far the most attractive with a combination of quality/fundamentals and upside that I see. The company combines legacy appeal with future-proofing, and I see only limited downside at any sort of conservative valuation.

- That is why Yara remains one of the biggest single positions in my entire portfolio, both commercial and private.

- This goes for both my private investment account, as well as my commercial/corporate account where I invest proceeds and profits from my business dealings.

- Yara is a “BUY” here, though every investor, of course, needs to look at their own targets, goals, and strategies. I would also always consult with a finance professional before making investment decisions such as this.

- I give the company a PT of 425 NOK for the common, which as of December of 2023 marks a reduction.

recollect, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to regularize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I will no longer call Yara cheap for what it offers at these levels. It’s an attractive “BUY”, but the upside now is a bit more muddled, and after the dividend is paid out, I now forecast only a 4-5% yield here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.