gradyreese/iStock via Getty Images

Business Overview

Xponential Fitness (NYSE:XPOF) is a fitness company that has a franchise model and holds an umbrella of several brands such as Club Pilates, CycleBar, StretchLab, Pure Barre, YogaSix, AKT, and STRIDE (which is soon to be span off as a separate company). The company’s franchise model includes more than 3,000 studios owned and operated by franchisees while the company offers consulting to franchise owners in matters such as real estate, business management, marketing, branding, contracting, legal matters, financing and other aspects of owning a business for a fee. In addition, the company provides with an online platform where members can sign up and use a variety of services offered by the company and its franchised locations. Furthermore, the company offers extensive training support for its franchise owners many of which own multiple locations.

Fitness Programs (Xponential Fitness)

Even though this is a large corporation with more than 3,000 locations (which it calls studios) it calls itself a boutique company because each location has some unique aspects. Unlike many national gyms and fitness centers whose locations all look and feel alike, this company encourages its franchisees to have studios that have unique aspects and feel more like a local boutique fitness studio as long as they meet certain quality and consistency standards. This ensures that people who are looking for a unique experiences are more likely to become members and stay members. For example, the company’s studios tend to be on the smaller size (around 1,500 to 2,500 square feet as compared to most gyms and fitness centers that are about several times that size ranging from 3k to 30k in square footage).

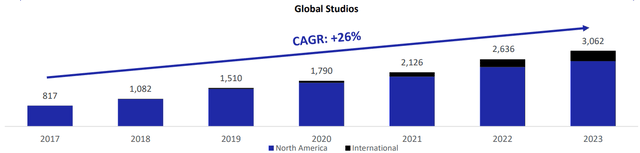

Out of the 3k studios operated by the company’s franchisees, 2600 are located in the US and 400 are located in international markets. Recently the company announced that it is expanding to Japan as it signed a master franchise agreement with Sunpark Company for its Pure Barre and YogaSix brands. Sunpark is a Japanese company that owns a suite of restaurants, entertainment centers and fitness studios and it is hoping to expand its market share by partnering with Xponential. Yoga is highly popular in Japan and this company’s Yoga related brands are likely to help its growth in the country.

Global Studio Count (Xponential Fitness)

In addition to fitness centers the company also owns a fitness clothing brand and its products can be seen in a number of stores that sell fitness clothes. The company also operates a number of fitness stores where it sells a variety of clothing brands including but not limited to its own. These stores serve two purposes. First, they generate additional revenues and profits. Second, they serve as a marketing device in order to increase the company’s brand awareness and brand name so that more people can become members of its main product (fitness club memberships and fitness classes).

By the way, the company is expected to report its earnings by the end of this month but it already announced some of its operating results ahead of time.

Operating Metrics

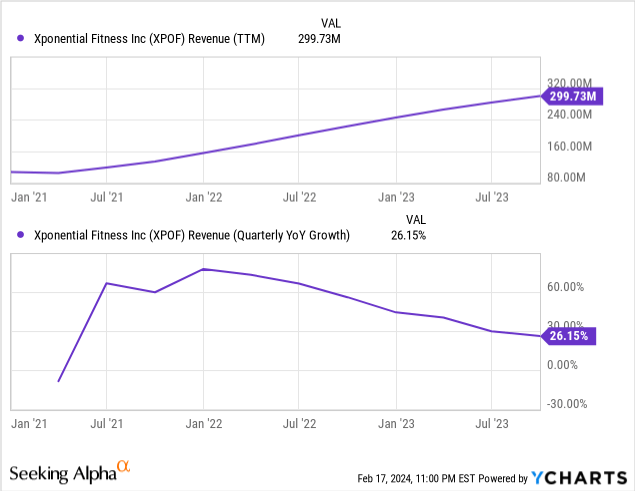

The company’s revenues have been growing at a pretty decent rate since its IPO, more than tripling in 3 years. Currently the company is enjoying a growth rate of 26%, which might look like a slowdown from 60% growth it enjoyed a couple years ago but keep in mind that the earlier growth was partially driven by pent-up demand since the economy was reopening from COVID restrictions. The current growth rate does not mean a significant slowdown but rather a return to normalized growth for the company. The advantage of the business model of fitness centers is that they make money regardless of whether people are showing up to their gyms or not. Historically speaking, most people (about two thirds to be exact) who sign up for gym memberships will not be coming to gym regularly after the novelty wears off but they will continue to make payments month after month for a long time.

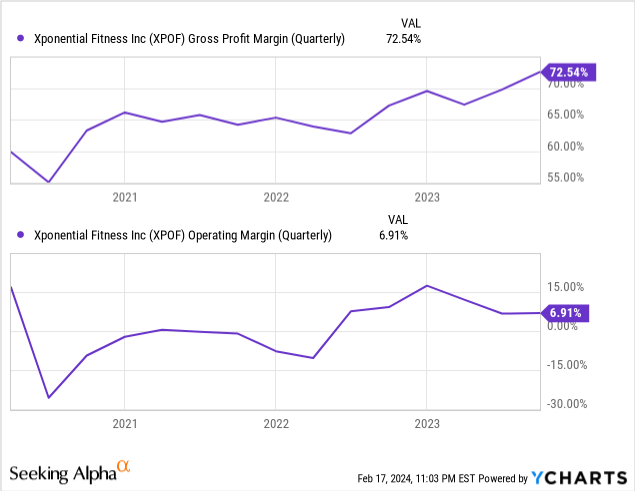

The company’s margins have been improving nicely in the last couple years. Its gross margin grew from mid 50s to low 70s and its operating margin grew from negative 20s to positive mid-single digits in the last 3 years. Margins have been increasing probably because its volume has been growing as the company’s fixed costs are more likely to be covered by incoming revenues. Because it operates a franchise business and it doesn’t actually operate any studios by itself, the company’s operating costs themselves will be limited to corporate costs such as marketing, administration and legal costs.

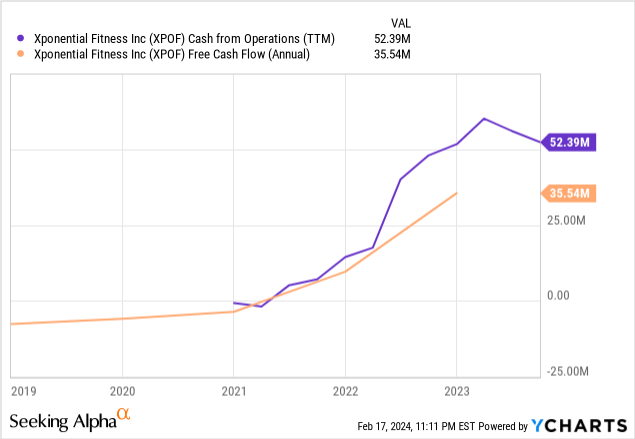

As a result of higher revenues and improving margins, the company’s cash flow generation has been improving over the years both in terms of operating cash flow (also known as cash from operations) as well as free cash flow which accounts for a company’s total cash flow generation after capital expenditures and debt payments. Just a couple years ago the company was looking at flat cash flow but now it achieved about $52 million in operating cash flow and about $35 million in free cash flow. If these trends continue, we could see operating cash flow approaching $75-80 million by the end of next year which would be pretty strong for a company of this size.

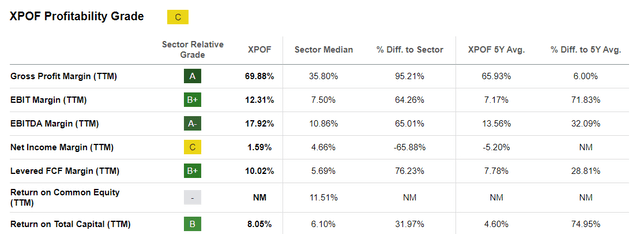

The company’s profitability metrics do a bit better than its sector median in terms of gross margins (70% vs 35%), EBIT margin (12% vs 7%), EBITDA margin (18% vs 11%) and levered free cash flow margin (10% vs 5%) but worse in net income margin (1.59% vs 4.66%) but the company is also improving in this particular metric as its 5-year average was -5.20% so it is on track to meet or beat its peers in a few years if it continues the current trend. It also performs slightly better than sector peers at return on total capital as it posts about 8% as compared to sector average of 6%. The company is doing not only better than its peers but also better than its 5-year average in most metrics regarding profitability which is generally considered a good sign.

Profitability Metrics (Seeking Alpha)

Stock Performance

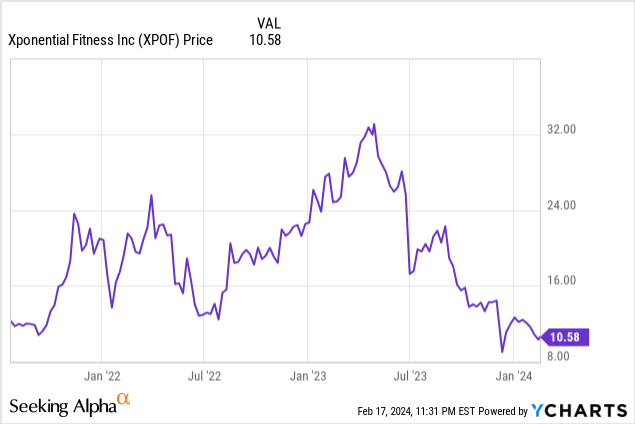

I must admit that while the company’s financial performance in the last few years have been impressive, I can’t say the same about its stock performance. The stock had its IPO just a few years ago and had a strong performance from late 2021 to mid-2023 as it climbed from $10 to $33 but since then its performance has been pretty poor as the stock gave back virtually all of its gains and its back to IPO price despite the fact that the company’s revenues and profits have grown nicely since then. It appears that investors are not very happy with the company’s performance but it is also possible that investors are worried about its future performance since markets tend to be forward looking.

Valuations

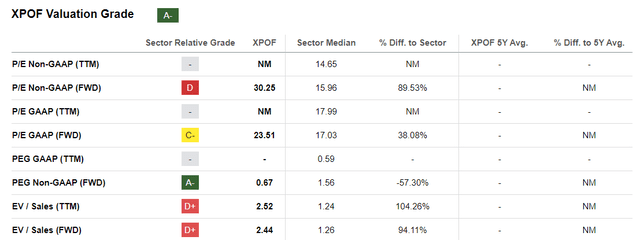

To be fair and honest, the company’s current valuation is not exactly cheap despite its stock selling off in recent months. The company’s trailing P/E ratio of 30 is about twice its sector median and its forward P/E of 23 is still significantly higher than sector median of 17 even though the difference seems to be smaller in forward metrics as the company is projected to continue growing aggressively. Still, the company’s PEG ratio of 0.67 indicates that it may still not be that expensive after adjusting for its growth rate. Typically PEG ratios below 1 are considered cheap when a company’s P/E is adjusted for its growth rate.

Valuation Metrics (Seeking Alpha)

Analyst Estimates

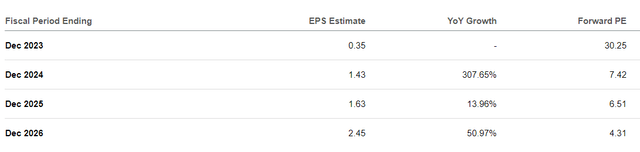

On a positive front, analysts seem to believe that this company’s growth will not only continue on its current path but perhaps even accelerate a bit as its revenues further pass its fixed costs and it becomes more profitable. Analysts expect the company to triple its net income this year to $1.43 and keep growing in double digits in 2025 and 2026. If the company can keep up with analyst estimates, it will be looking at a forward P/E of 6.5 based on 2025 earnings and 4.3 based on 2026 earnings. This also explains why the company’s forward PEG ratio is so low despite its P/E being so high because analysts expect explosive earnings growth. Keep in mind that analysts aren’t expecting the company to triple its revenues. They are expecting it to simply become more profitable as its revenues comfortably pass its fixed costs.

Analyst Estimates (Seeking Alpha)

Risks

There are a few risks to be aware of though. First, analyst estimates seem to be very optimistic. The company might meet or beat these estimates (as it has done several times in the past) but there is no guarantee of it. We will have to wait and see how next quarter’s results come out to see if these lofty expectations can be met.

Second, this is a highly cyclical industry that depends on discretionary spending. In general people tend to cut back on extra spending when they feel that their economic situation needs them to cut costs and this usually happens during or near recessions. If the economy were to enter a recession or slowdown, this company’s growth rate might take a hit but its long-term secular growth should be still intact.

Third, fitness industry also tends to have a lot of fads in it. Throughout the history, many fitness programs became popular just to fall out of favor later on such as Tae Bo, Jazzersize and Bowflex. It is also possible that this company’s fitness programs may fall out of favor at some time but the fact that it owns more than one fitness program should help reduce this risk by the way of diversification.

Fourth, the stock has been selling off in recent months which tells me that the sentiment around this stock is pretty negative right now. While the IPO price seems to have offered a support level for now, it may not hold for long and the stock might drop further before the sentiment eventually shifts.

Conclusion

This is an interesting company that has seen strong growth and improving margins. While the company’s current valuation is not cheap, its forward metrics indicate that it may be quite cheap if it can meet or beat analyst estimates. The stock sold off from $33 to $10 in recent months, falling back to IPO levels which may create a buying opportunity for some growth investors who don’t mind some risk. Currently the sentiment around this stock is very weak which means the stock price may continue to fall for a while but its current price provides a nice risk-reward profile for the long term.