Prostock-Studio

WW International (NASDAQ:WW) has struggled for years with its core Weight Watchers business, facing falling revenues and subscribers in a highly competitive market. While the company’s recent acquisition of Sequence Health looks like a bold strategic play to pivot into weight loss medications, this high-risk move is unlikely to turn around WW’s weak fundamentals.

With the core Weight Watchers business continuing to deteriorate, an already overstretched balance sheet, and extremely poor customer satisfaction, WW faces substantial challenges. Its expensive acquisition of Sequence at over 5x revenue adds further risk. While the stock may look cheap based on forward multiples, WW is a clear SELL.

Investment Thesis

WW International’s core business continues to struggle with falling revenues and subscribers, facing stiff competition in the diet and weight loss industry. Customer reviews are overwhelmingly negative, pointing to poor customer service and retention.

The company’s expensive acquisition of Sequence Health is a risky attempt to pivot into much-hyped weight loss medications to revive growth. However, successfully scaling Sequence will be very difficult given WW’s cash constraints and urgent need to fix core business issues.

With high debt, WW has limited financial flexibility. The stock may appear inexpensive based on forward EBITDA multiples, but the business fundamentals are deteriorating.

Dying Core Business

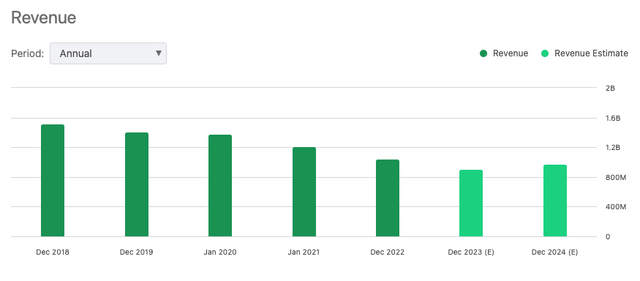

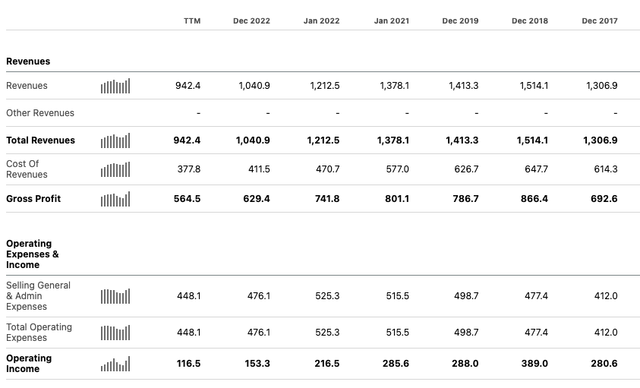

WW’s core Weight Watchers business has faced consistent revenue declines over the past decade. From 2018 to 2022, total revenues fell 39% from $1.51 billion to just $1 billion. The downward trend reflects the rise of new competing weight loss apps and digital platforms.

Operating income has shrunk in line with the decline in top line numbers.

WW has struggled to retain customers, with its subscriber base shrinking from over 4 million in 2013 to just 2.5 million in 2022. Heightened competition from more modern and personalized weight loss programs has eroded WW’s competitive position.

The company even rebranded itself from Weight Watchers to WW in 2018 to signal a shift towards wellness. But this has failed to resuscitate growth, with first half 2023 revenues still down ~15% year-over-year. The core business deterioration continues unabated.

Disastrous Customer Reviews

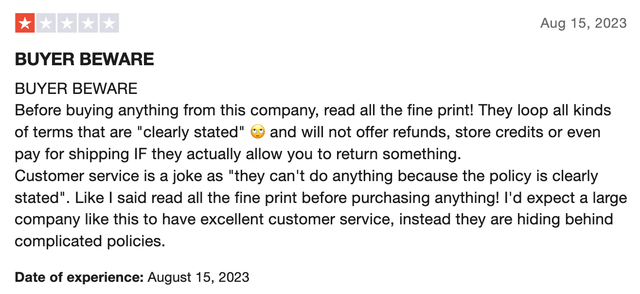

WW customers have expressed scathing criticism about the company’s services and business practices. Reviews on Trustpilot give the company an abysmal 1.4 out of 5 stars based on 116 reviews.

The most common complaints include difficulty canceling subscriptions, hidden fees, terrible customer service, defective products, and the program not working.

Another wrote:

“If I could I’d give them a zero. Their online program offers no support unless you are willing to pay a high price for it. What is worse is that it’s almost impossible to cancel your membership. When I finally got to speak to a program the person misled me and the charges continued. Noom is a much better program. At least they are truthful.”

Risky Sequence Acquisition

In April 2023, WW acquired Sequence Health, a telehealth platform focused on weight loss medications, for $132 million in cash. This is a bold strategic move to tap into the high-growth prescription weight loss drug market.

However, WW paid a rich premium of over 5x estimated Sequence 2022 revenues. And it’s unclear if Sequence’s early traction is sustainable or will translate to real profits for WW. Ramping up Sequence while managing cash burn and decline in its own core business will be extremely difficult for WW.

Stretched Balance Sheet

WW’s balance sheet is already dangerously stretched, with long-term debt of $1.4 billion compared to just $100m in cash & equivalents. Paying 5x revenues for Sequence has depleted WW’s cash position.

As of Q2 2022, WW had just $91 million of cash against its massive debt load. With 2023 projected to be free cash flow negative due to restructuring costs, WW has very limited financial flexibility.

Servicing and refinancing its huge debt burden while scaling Sequence’s unproven business model will be nearly impossible without massive dilution. The current leverage ratio of 7.7x EBITDA is unsustainable.

Expensive Valuation

WW may appear inexpensive based on its 2024 P/E of 15x, which is below the S&P 500’s forward multiple of 19. However, these multiples do not properly account for the risks facing the business. Ongoing revenue declines in the core business, disastrous customer satisfaction levels, a failed rebranding, and excessive leverage all argue against an investment in the company. Based on these realities, I believe WW’s fair value on 2024 earnings should be around 10x earnings, representing a downside of ~40% from today’s prices. Paying any earnings multiple for a company with WW’s financial profile is imprudent when its core business is falling apart. This is a value trap.

Bull Case Hinges on Successful Execution

The bull case would require flawless execution of the Sequence integration while simultaneously reviving the core Weight Watchers business. This is an extremely challenging dual mandate.

Upside relies on WW driving strong synergies between its legacy subscribers and Sequence’s offerings to unlock cross-selling potential. But the unproven Sequence business model and WW’s long history of missed targets makes this an unlikely outcome.

Conclusion: Stay Away from WW

WW International’s desperate pivot into weight loss medications via its Sequence acquisition is unlikely to succeed given the company’s weak fundamentals, declining core business, awful customer reviews, limited financial flexibility, and premium acquisition cost.

The core Weight Watchers business continues to lose subscribers and revenue. Customer satisfaction levels are among the worst. And the balance sheet is dangerously overleveraged.

While the stock may seem inexpensive based on forward multiples, the underlying business is deteriorating. Based on these facts, I rate WW International a clear SELL.